US Dollar Forecast: EUR/USD Attempts to Halt Five-Day Selloff

US Dollar Outlook: EUR/USD

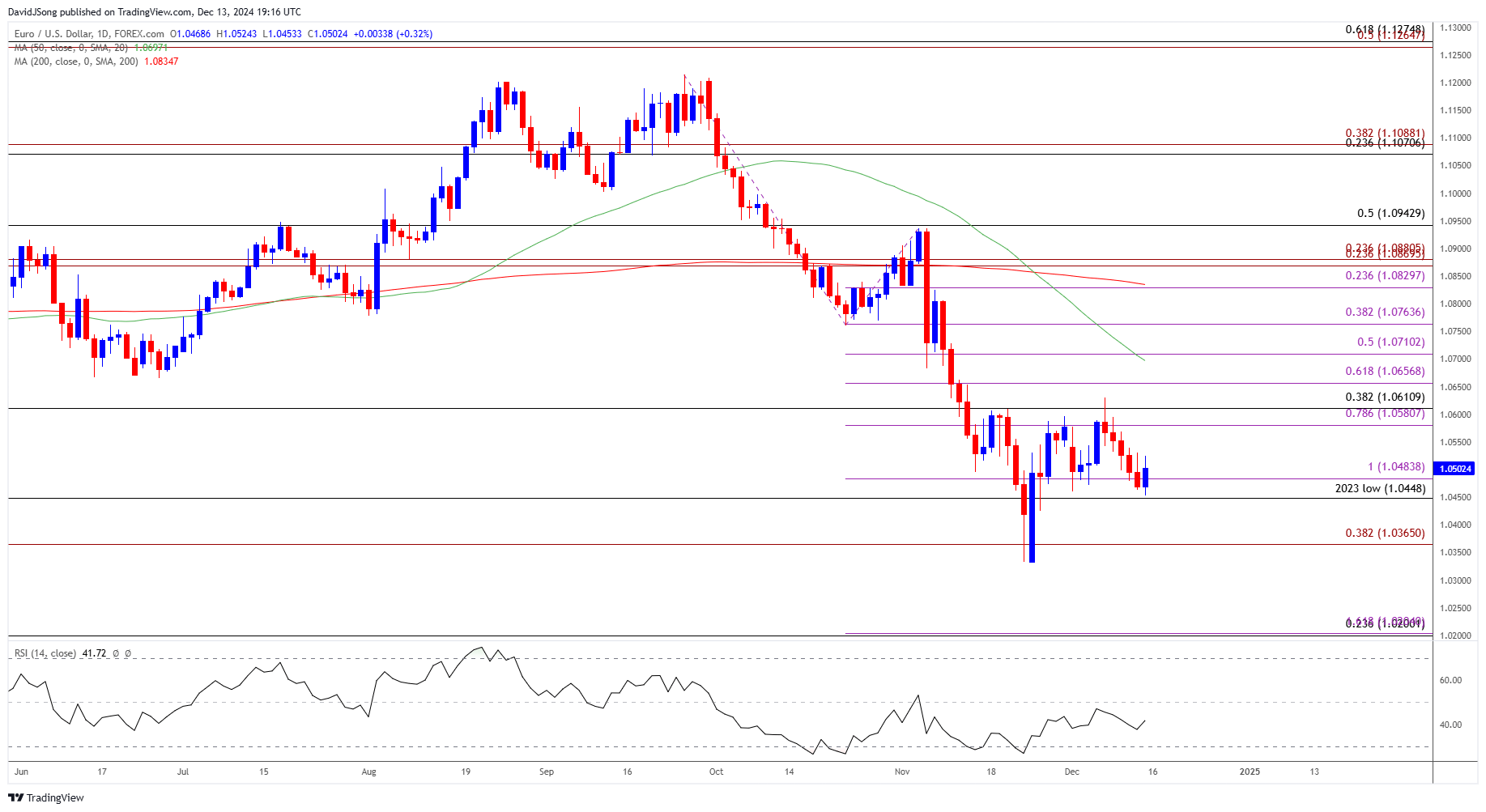

EUR/USD attempts to halt a five-day selloff as it recovers from a fresh monthly low (1.0453), but the exchange rate may struggle to retain the rebound from the yearly low (1.0333) as it continues to carve a series of lower highs and lows.

US Dollar Forecast: EUR/USD Attempts to Halt Five-Day Selloff

EUR/USD may track the negative slope in the 50-Day SMA (1.0697) as it no longer trades within the opening range for December, and the weakness following the US election may persist as the exchange rate holds below the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Nevertheless, the Federal Reserve rate decision may sway EUR/USD as the central bank is expected to cut US interest rates by another 25bp at its last meeting for 2024, and more of the same from the Federal Open Market Committee (FOMC) may drag on the US Dollar as Chairman Jerome Powell and Co. pursue a netural stance.

With that said, EUR/USD may trade within the November range should the FOMC stay on track to further unwind its restricitve policy in 2025, but the Fed’s Summary of Economic Projections (SEP) may generate a bullish reaction in the Greenback if the update reveals an upward revision in the interest rate dot-plot.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD fails to hold within the opening range for December as it carves a series of lower highs and lows, with a break/close below the 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension) zone raising the scope for a move towards 1.0370 (38.2% Fibonacci extension).

- A breach below the yearly low (1.0333) opens up 1.0200 (23.6% Fibonacci retracement), but lack of momentum to break/close below the 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension) zone may keep EUR/USD within the November range.

- Need a close above the 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement) region to bring 1.0660 (61.8% Fibonacci extension) back on the radar, with the next area of interest coming in around 1.0710 (50% Fibonacci extension).

Additional Market Outlooks

USD/JPY Stages Five-Day Rally for First Time Since June

Gold Price Forecast: Bullion Remains Below Pre-US Election Prices

Canadian Dollar Forecast: USD/CAD Climbs to Fresh Yearly High

GBP/USD Outlook Hinges on Break of December Opening Range

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong

StoneX Financial Ltd (trading as "FOREX.com") is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, FOREX.com does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date.

This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it. No opinion given in this material constitutes a recommendation by FOREX.com or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although FOREX.com is not specifically prevented from dealing before providing this material, FOREX.com does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. For further details see our full non-independent research disclaimer and quarterly summary.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFD and Forex Trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.com is a trading name of StoneX Financial Ltd. StoneX Financial Ltd is a company incorporated in England and Wales with UK Companies House number 05616586 and with its registered office at 1st Floor, Moor House, 120 London Wall, London, EC2Y 5ET. StoneX Financial Ltd is authorised and regulated by the Financial Conduct Authority in the UK, with FCA Register Number: 446717.

FOREX.com is a trademark of StoneX Financial Ltd. This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Privacy Policy. FOREX.com products and services are not intended for Belgium residents.

© FOREX.COM 2024