US Dollar Outlook: AUD/USD

AUD/USD extends the recent series of higher highs and lows to register a fresh weekly high (0.6545), and the exchange rate may further retrace the decline from the monthly high (0.6688) to hold within the yearly range.

US Dollar Forecast: AUD/USD Recovery Keeps Yearly Range Intact

Keep in mind, the recent recovery in AUD/USD has kept the Relative Strength Index (RSI) out of oversold territory, and the bullish price series may persist as Federal Reserve Governor Lisa Cook emphasizes that ‘it likely will be appropriate to move the policy rate toward a more neutral stance over time.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Governor Cook acknowledged that ‘I still see the direction of the appropriate policy rate path to be downward’ while speaking at the University of Virginia, with the permanent voting-member on the Federal Open Market Committee (FOMC) going onto say that ‘the magnitude and timing of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.’

Source: CME

The comments suggest the FOMC will further unwind its restrictive policy in an effort to avoid a recession, but speculation surrounding US monetary policy may continue to shift ahead of the Fed’s last meeting for 2024 as the CME FedWatch Tool now reflects a 56% chance for a 25bp rate-cut in December.

With that said, the recent series of higher highs and lows may keep AUD/USD within the yearly range, but failure to defend the monthly low (0.6441) may lead to a test the August low (0.6349).

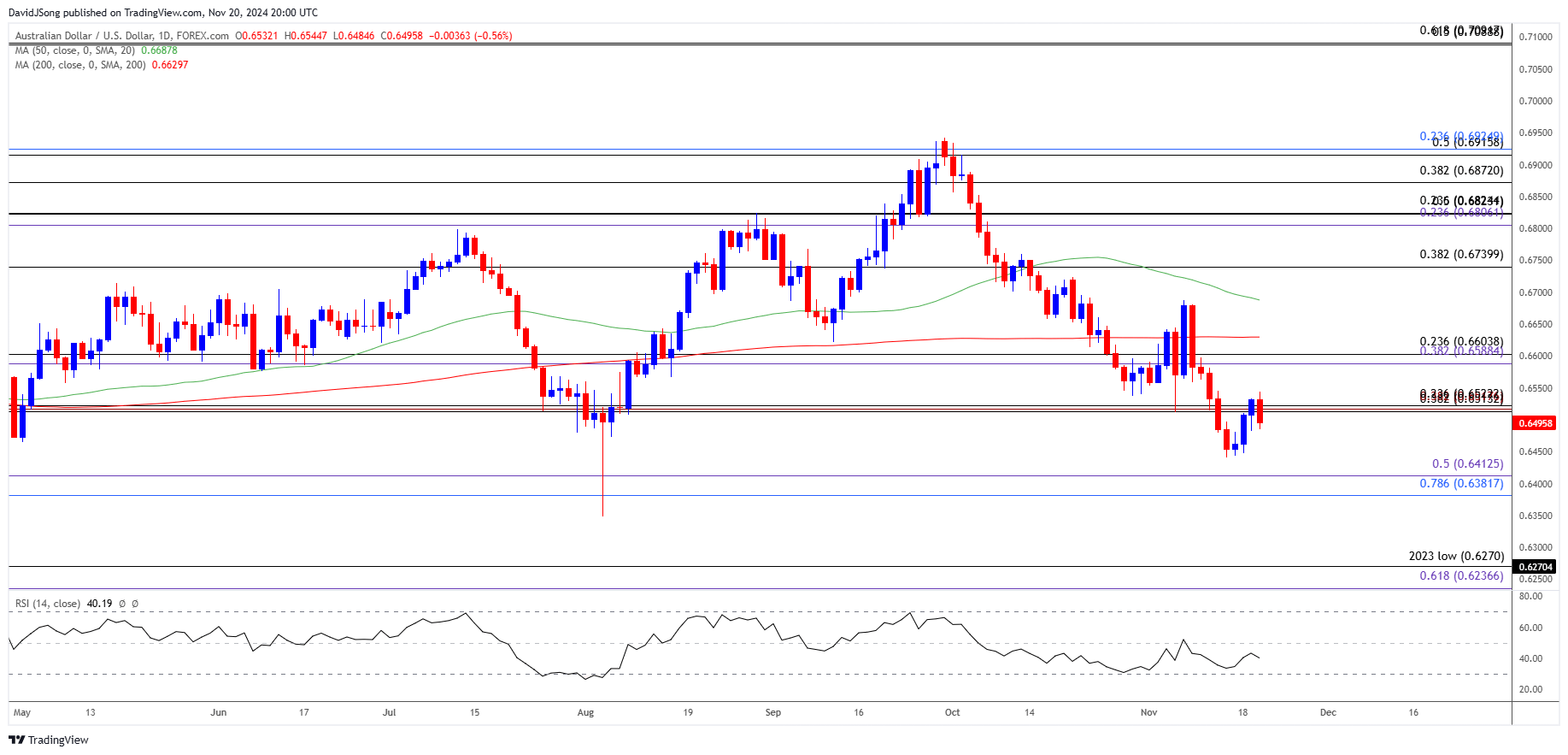

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD may stage a larger recovery as it registers a fresh weekly high (0.6545), with a break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) zone to bring the monthly high (0.6688) on the radar.

- Next area of interest comes in around 0.6740 (38.2% Fibonacci retracement) but AUD/USD may snap the bullish price series as it struggles to hold above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region.

- Failure to defend the monthly low (0.6441) may push AUD/USD towards the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone, with the next region of interest coming in around the August low (0.6349).

Additional Market Outlooks

GBP/USD Struggles as BoE Bailey Sees Faster Disinflation

Gold Price Recovery Keeps RSI Above Oversold Zone

US Dollar Forecast: EUR/USD Rebound Pulls RSI Out of Oversold Zone

USD/JPY Rebounds as BoJ Ueda Pledges to Support Economic Activity

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong