SPX, Yields Talking Points:

- U.S. markets are putting in big moves on the morning after the release of U.S. CPI data for the month of December.

- Headline CPI printed at the expectation of 2.9% YoY but Core CPI came in a touch below the expectation, printing at 3.2% v/s the 3.3% that was expected. But – that did go in the direction of the PPI miss yesterday that gives hope for FOMC rate cuts later in the year.

- The move across markets has been intense so far, with 10-year yields dropping by 14 bps and SPX catching a strong bid to extend the rally from the election gap that finished earlier this week.

- The question now is whether the pullback in stocks is over or whether sellers come in ahead of a 6k re-test. I look into this below.

Bulls are back in a big way for U.S. equities, and this stands in stark contrast to the sell-off from last week.

This Monday saw SPX gap down to finish off the election gap and that’s around where support started to play-in at 5782. While yesterday’s daily candle finished red for the index, it also finished higher than the Monday close after that daily bar had gapped-higher, and that move was driven by the softer PPI readings that came out ahead of the bell yesterday.

But tension remained as can be seen by the intra-day pullback yesterday, and the wait was for CPI data that released this morning. While the data didn’t come in below the expectation as much as the PPI data a day prior, it also didn’t beat expectations and this fueled hope that we may, in fact, get rate cuts in at some point this year.

It’s still early, however, and the CPI data from this morning wasn’t exactly a major positive for rate cut hopes, as headline CPI printed at 2.9% on a year-over-year basis and that’s against last month’s 2.7% reading and the 2.4% level that printed in September. So, inflation is still pushing higher, even if the actual print didn’t come out above the expectation.

And Core CPI did come out softer than the expectation, but the delta was slight, with year-over-year CPI printing at 3.2% against the 3.3% expected and that was the same level that printed in Core CPI in August and September releases of last year. That then led to three consecutive months at 3.3% and then this month showed a slight decline.

To sum, the CPI release wasn’t a clear sign that inflation is slowing to the point where the Fed can push another cut in March and given the massive response that’s shown in both bonds and stocks, it seems as though there’s a short-cover move taking place. This, of course, can turn into the initial seeds of a rally but the big question now is whether buyers come in to defend higher-low supports to allow for that next test of the 6k handle that bulls haven’t been able to do much above yet.

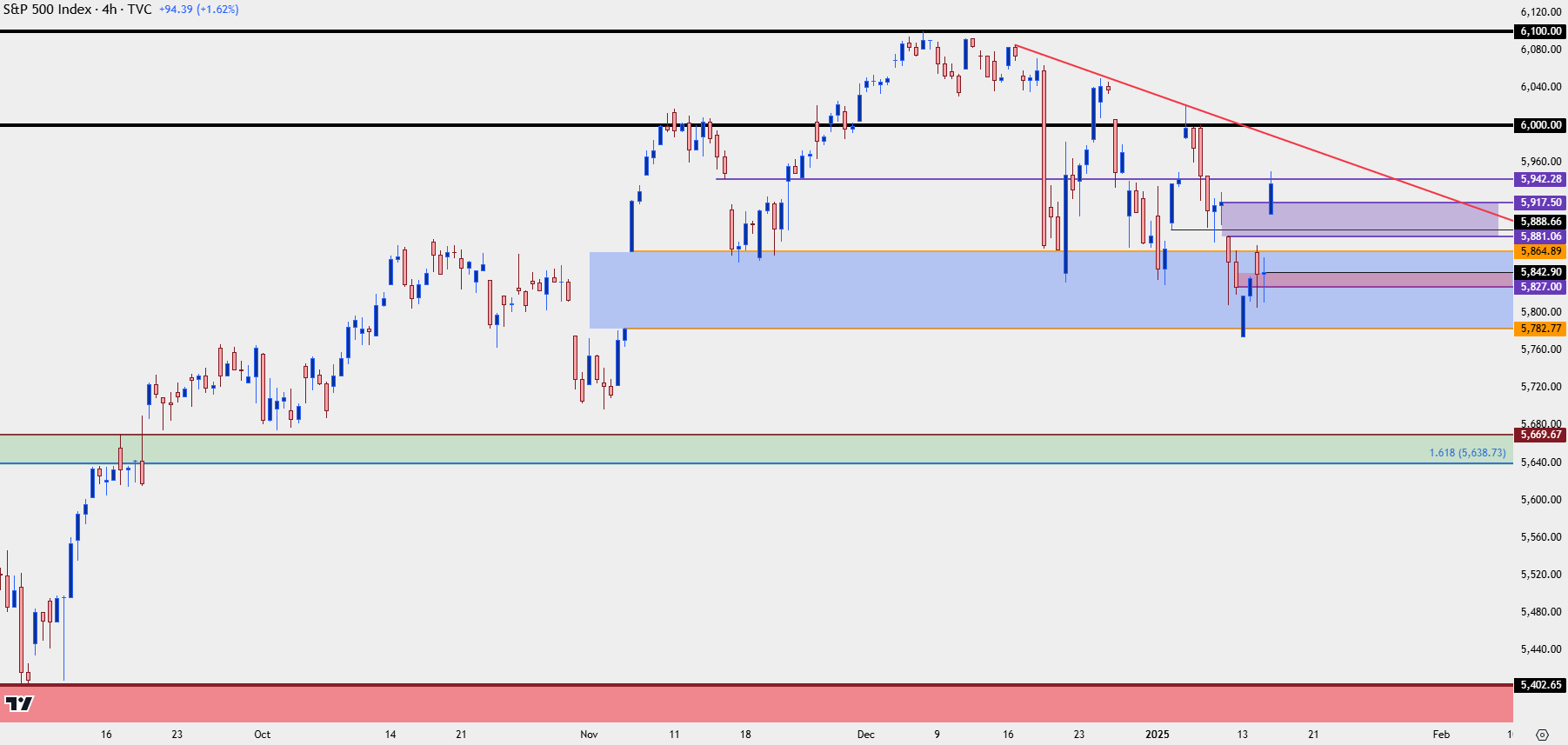

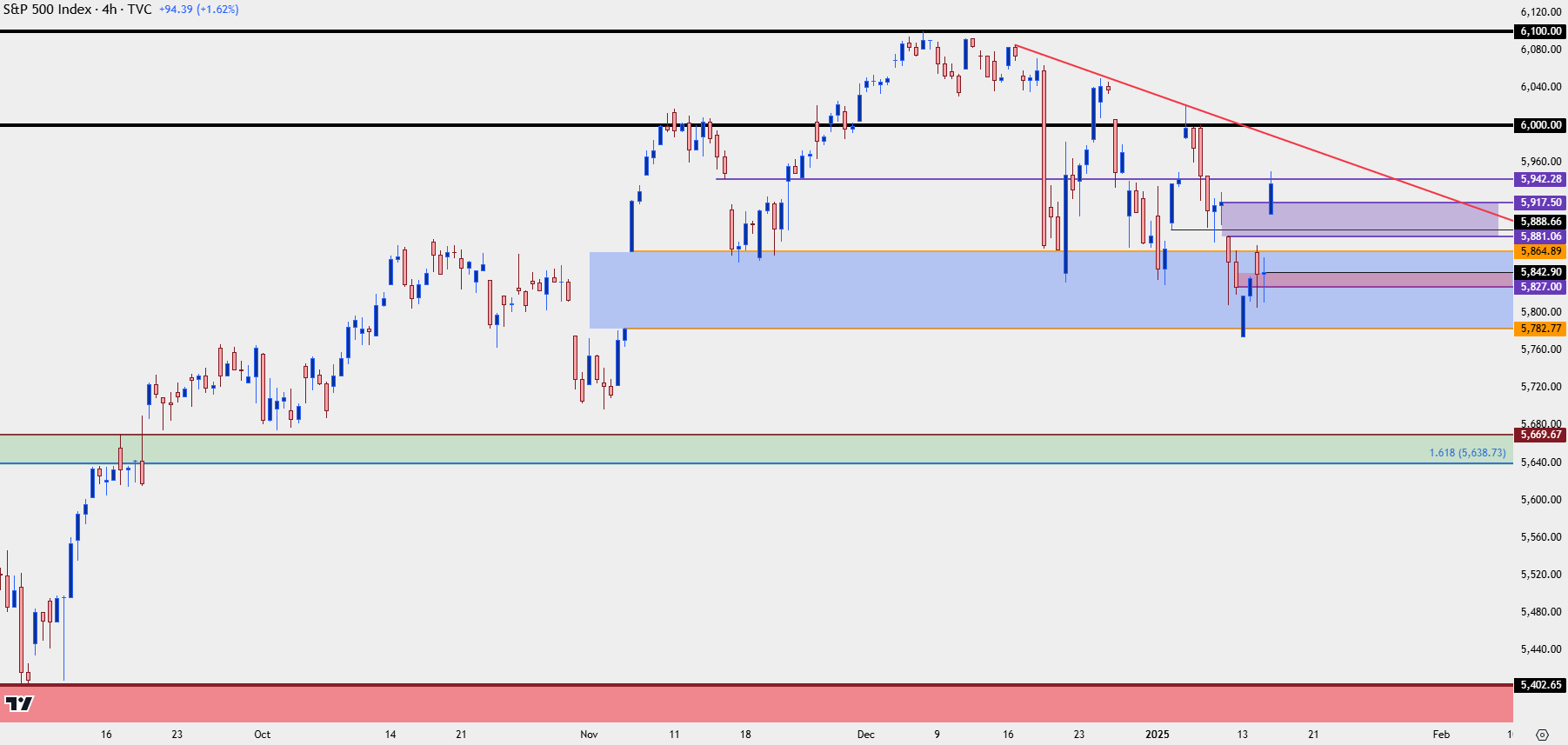

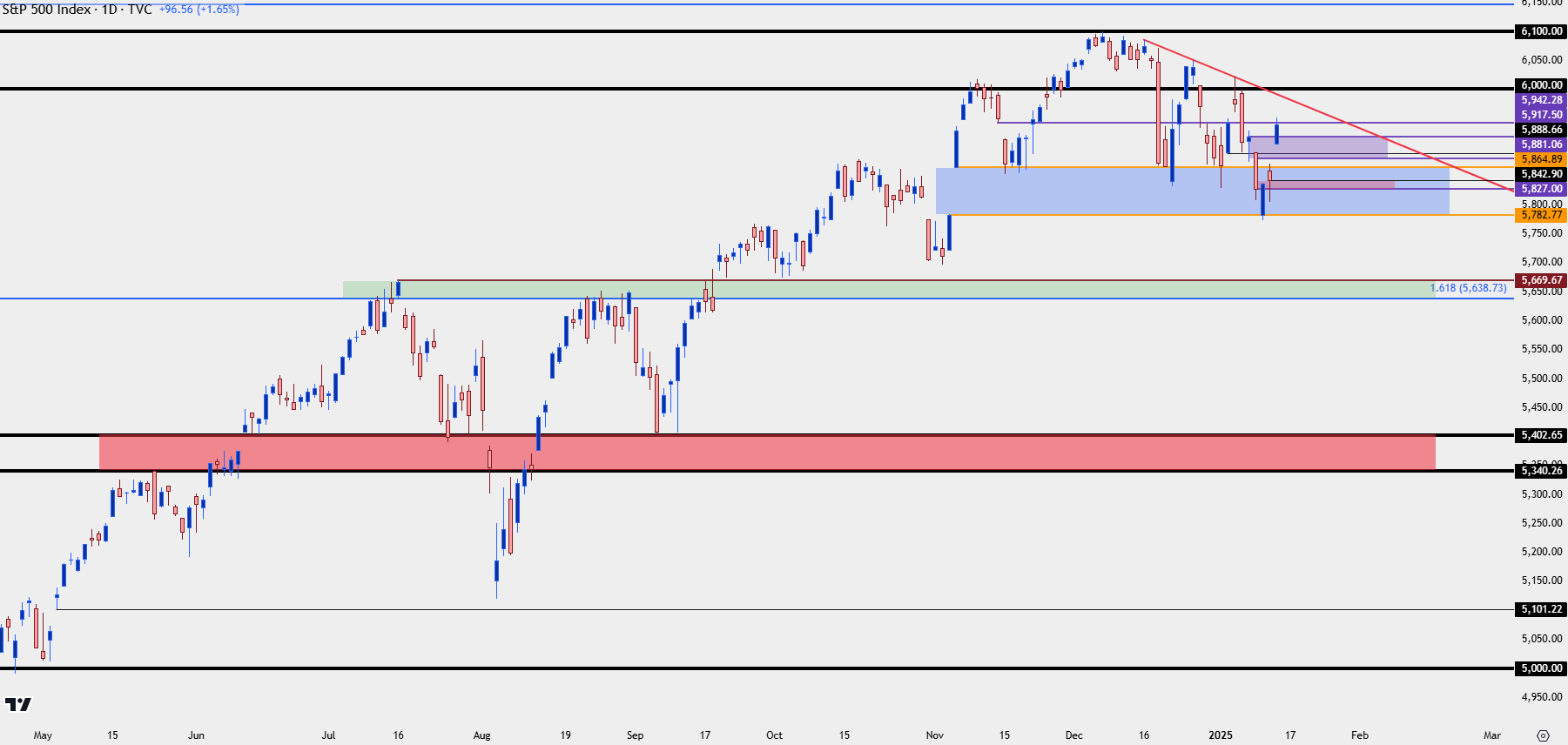

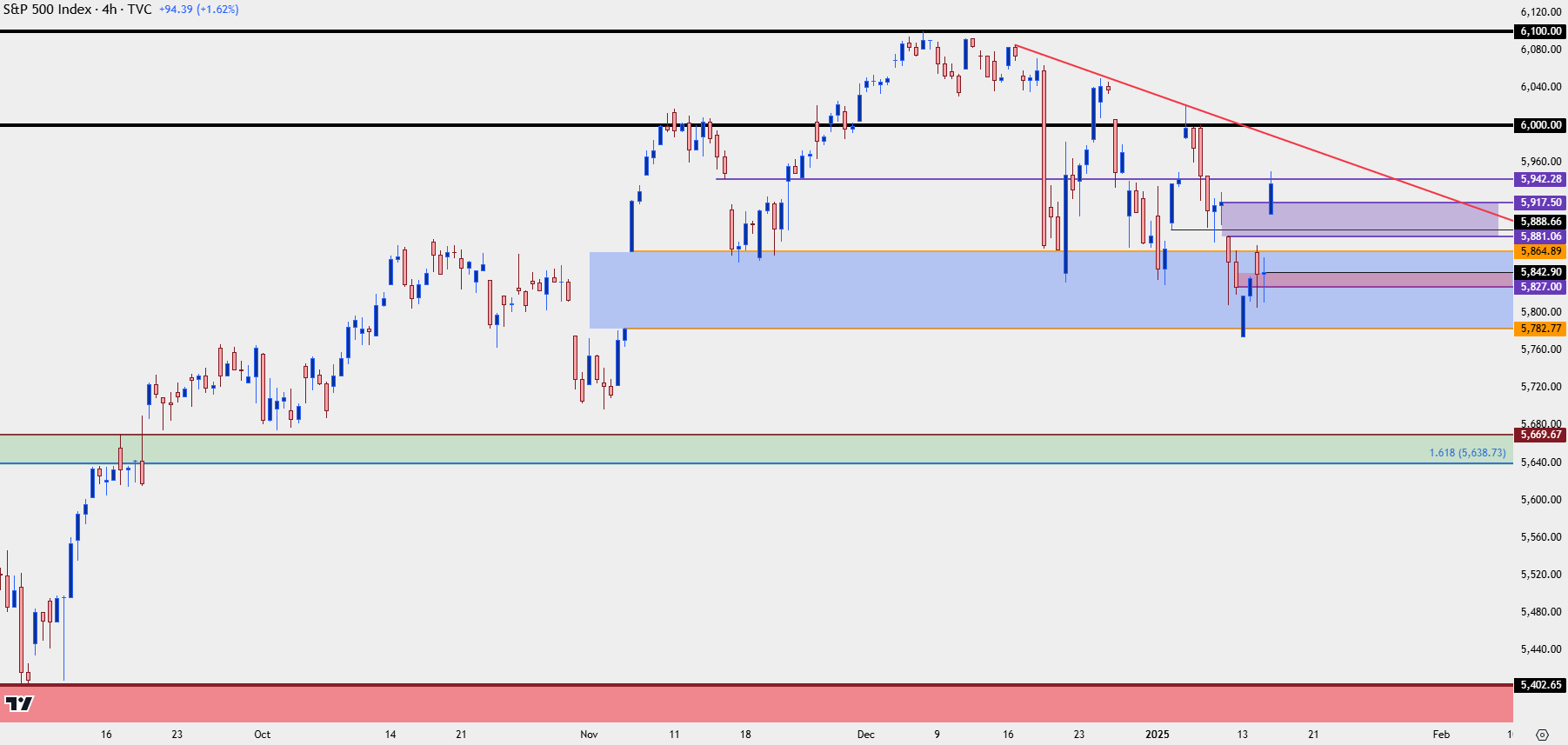

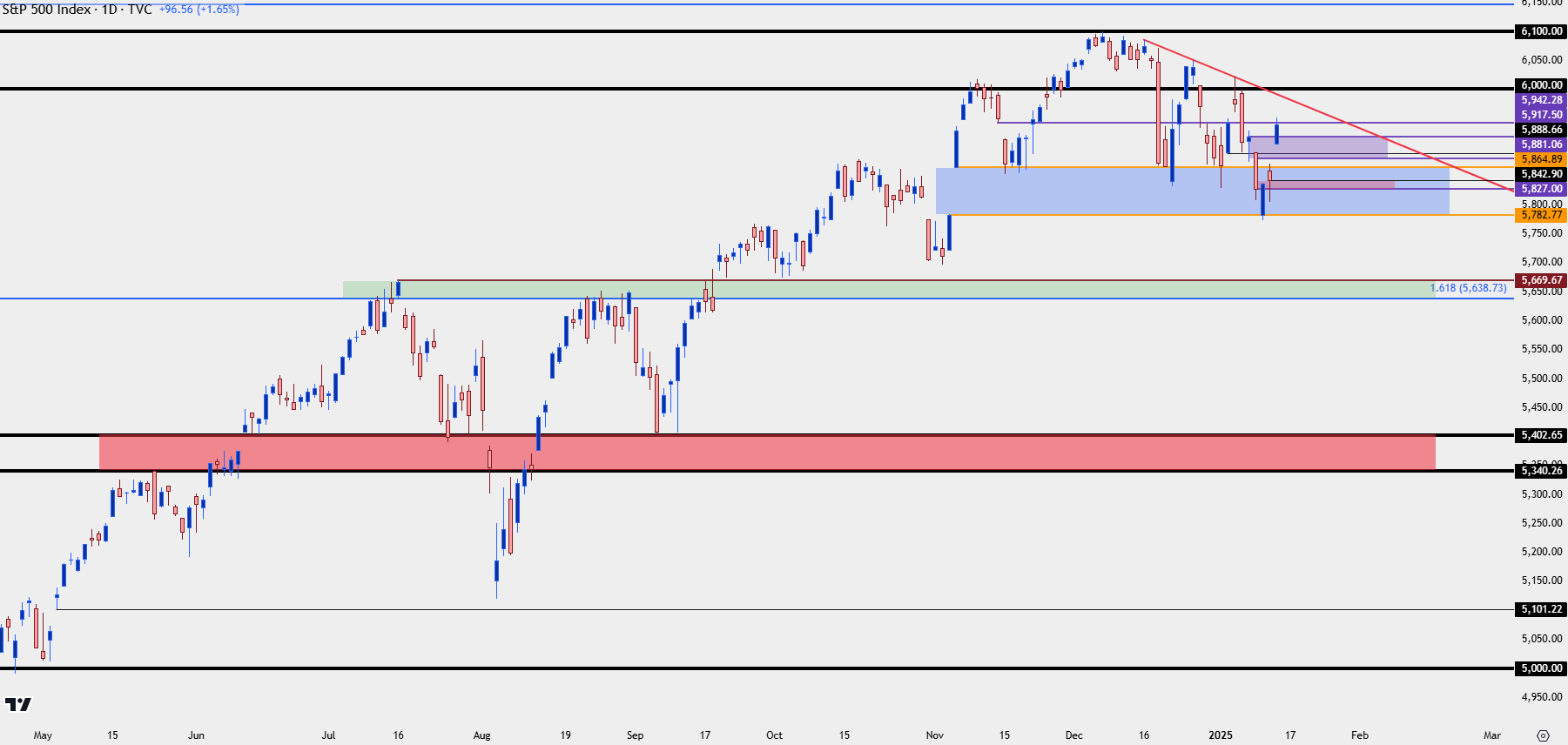

The daily chart of SPX below is updated from yesterday’s webinar and there’s a couple levels of note for buyers to defend. A support hold in the 5881-5888 level would be construed as bullish, as buyers would not allow for a fill of today’s opening gap. Below that, 5827, or the top of the election gap, is another level where support holds would bring a bullish bias. And then below that, it’s the 5827-5842 zone that’s of note, as this goes from last week’s close to the bottom of today’s opening gap.

SPX, S&P 500 Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

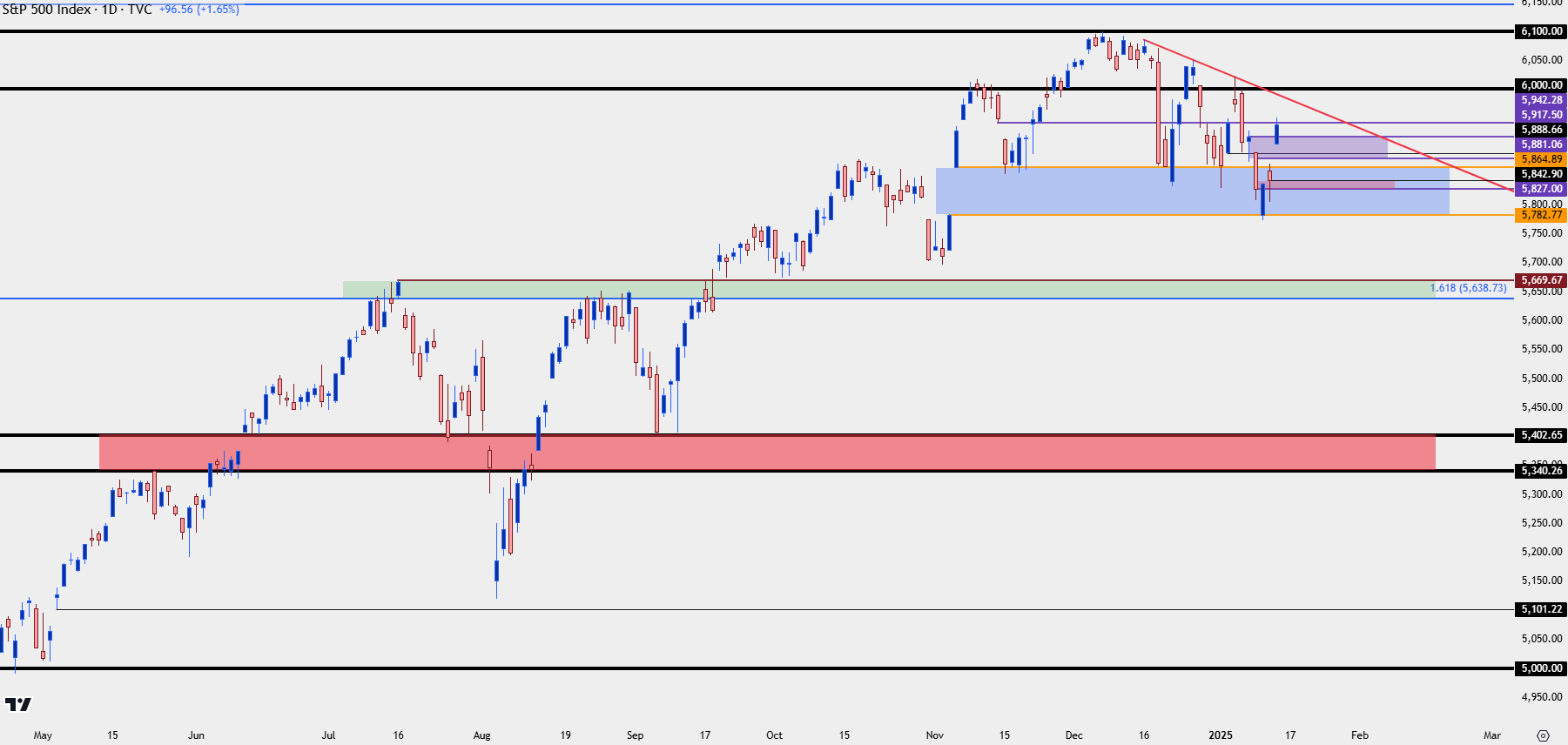

SPX Bigger Picture

Bullish equities after a pullback was my top trade idea for 2025, and the election gap was the first zone of support that I was tracking which has already come into play.

But the big question now is whether that can last and I think the answer for that derives back to bonds, which I’ll look at in a moment. But – from the daily chart of SPX we had a fresh lower-low print to start this week and it’s not until we take out the prior lower-high, around the 6k level, that we can say that the trend on the daily has started to shift. Until then, this is a possible lower-high and bulls should remain cautious of possible reversal setups, unless one of the above support zones come into play.

SPX Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

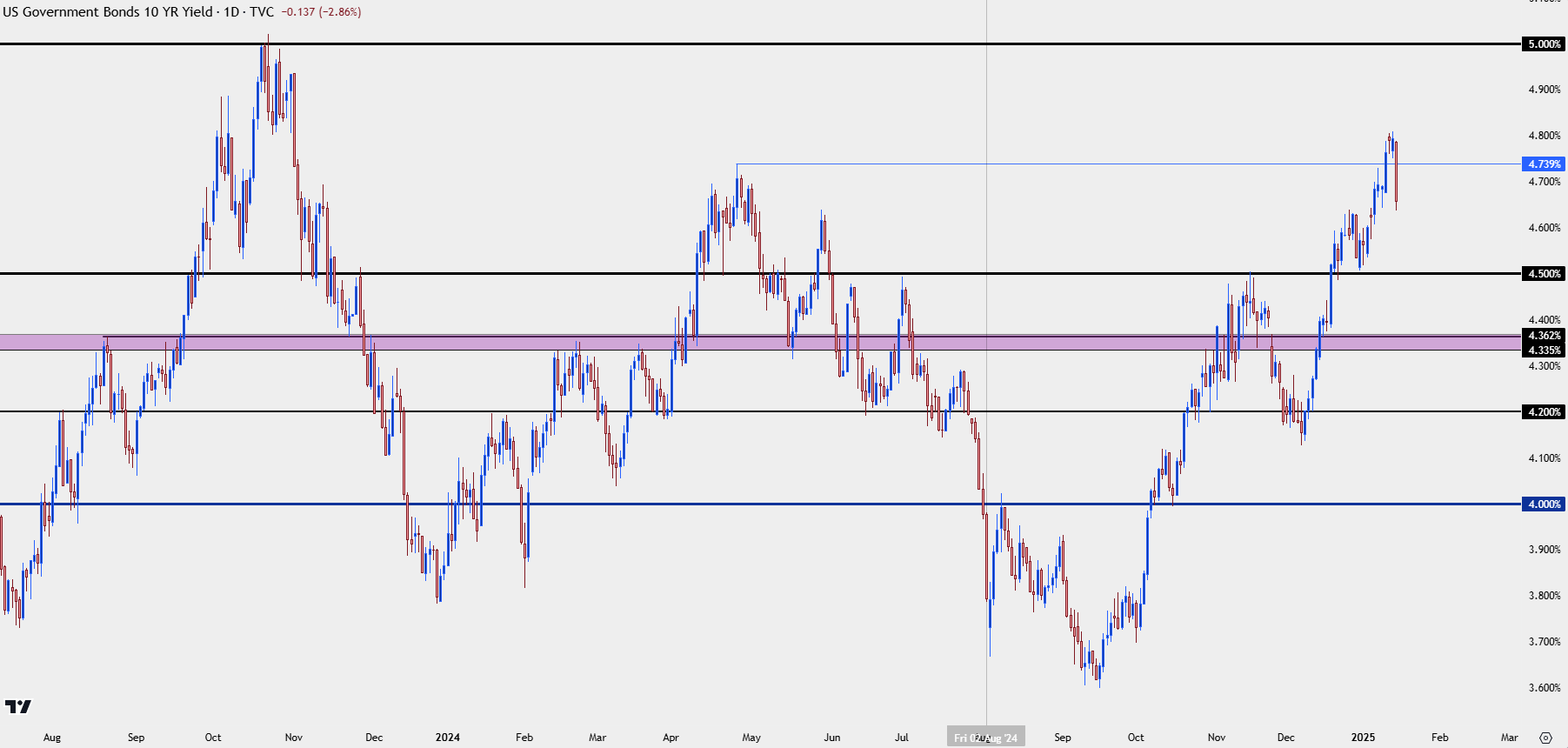

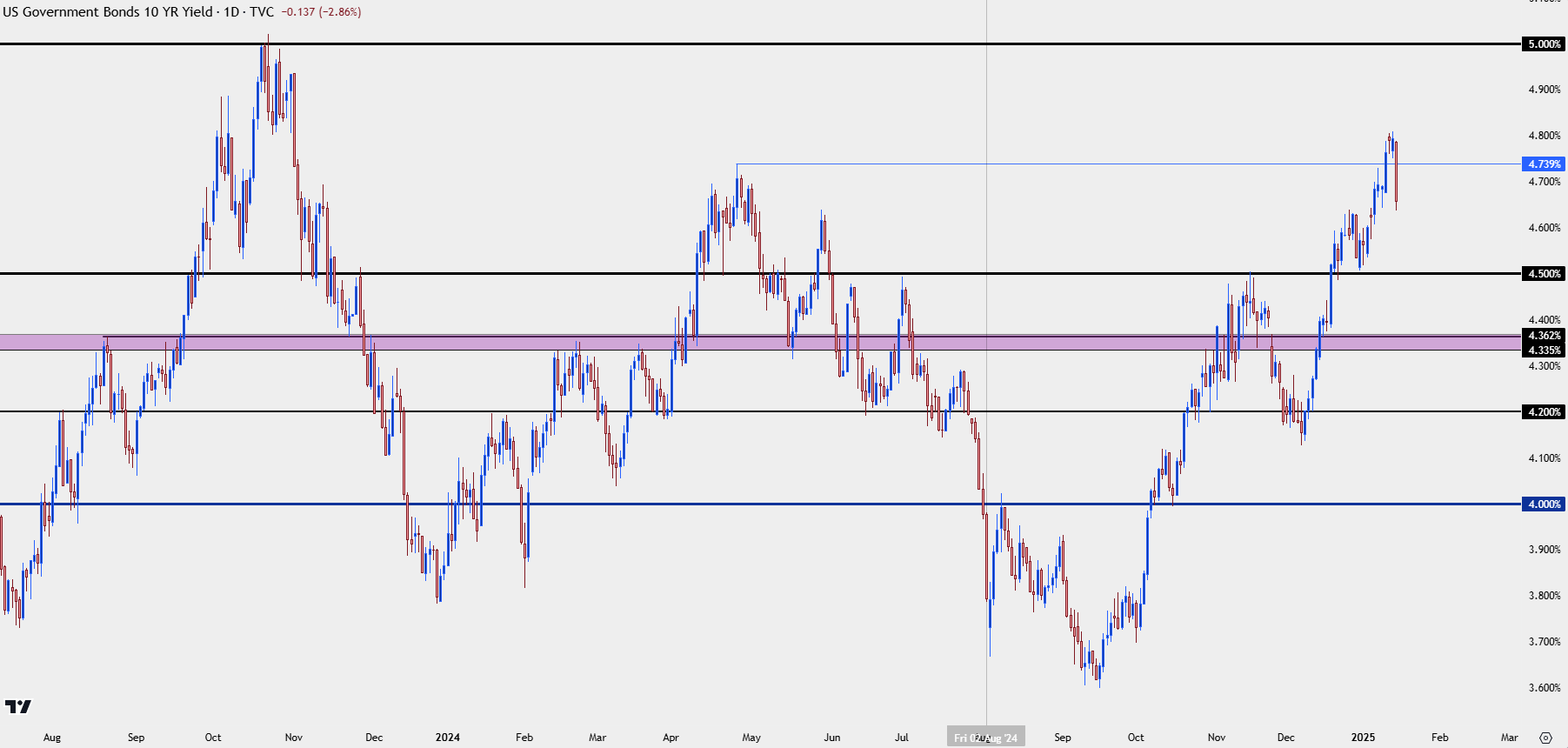

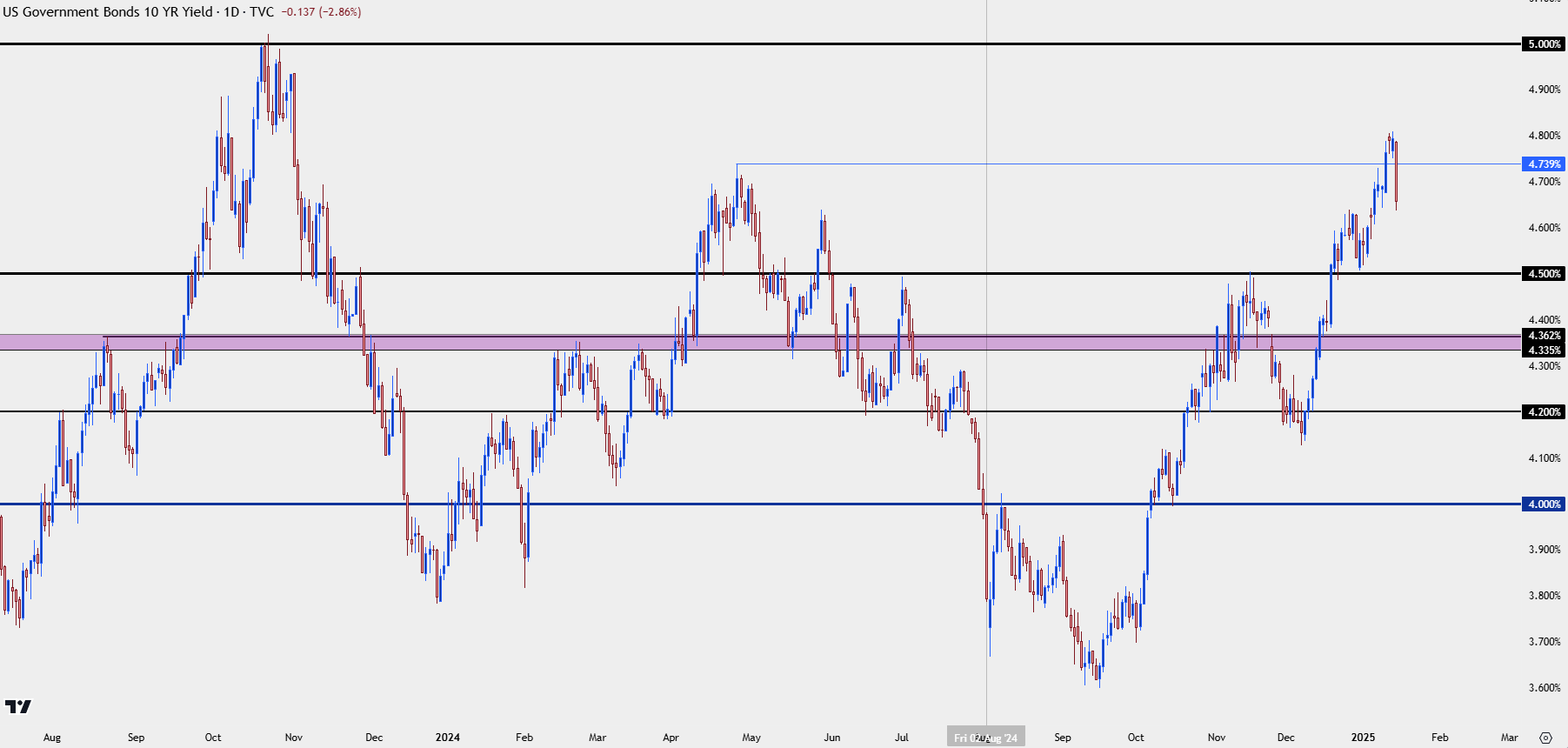

Bonds

U.S. Treasury yields have been on a steep incline since the election. And I’ve read a number of possible reasons for that and perhaps some of them are true. But, what’s notable is the context with which this has taken place, as 10-year yields have risen by as much as 120 basis points since just before the Fed kicked off a rate cut cycle.

That’s helped to normalize the yield curve, and while many have already dismissed the traditional signaling of yield curve inversion to imply recession potential, it’s often after the curve has normalized that economic hardship may show.

Nonetheless, as the Fed has continued to cut rates, 10-year yields have continued their incline and last week saw yields tilt above 4.74%, which has been a waymark of sorts over the past year-and-change. There were retracements in equities in April of last year and leading into October of the year before, in both instances as 10-year yields were rising fast and to that level.

So far today we’re seeing a bit of pullback in that theme, but the big question is whether this morning’s CPI data, which, again, was pretty high with headline at 2.9% YoY – is fueling a rush of buying activity into Treasury notes? It seems more likely that this is a short-cover type of scenario after CPI didn’t increase at a blistering pace. And this seems tied to the move that’s showed in stocks.

So, whether either move can continue, the sell-off in bonds and stocks and the related rise in yields, will need to see follow-through confirmation.

Yield on 10-Year Treasury Notes

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

SPX, Yields Talking Points:

- U.S. markets are putting in big moves on the morning after the release of U.S. CPI data for the month of December.

- Headline CPI printed at the expectation of 2.9% YoY but Core CPI came in a touch below the expectation, printing at 3.2% v/s the 3.3% that was expected. But – that did go in the direction of the PPI miss yesterday that gives hope for FOMC rate cuts later in the year.

- The move across markets has been intense so far, with 10-year yields dropping by 14 bps and SPX catching a strong bid to extend the rally from the election gap that finished earlier this week.

- The question now is whether the pullback in stocks is over or whether sellers come in ahead of a 6k re-test. I look into this below.

Indices Forecast

Bulls are back in a big way for U.S. equities, and this stands in stark contrast to the sell-off from last week.

This Monday saw SPX gap down to finish off the election gap and that’s around where support started to play-in at 5782. While yesterday’s daily candle finished red for the index, it also finished higher than the Monday close after that daily bar had gapped-higher, and that move was driven by the softer PPI readings that came out ahead of the bell yesterday.

But tension remained as can be seen by the intra-day pullback yesterday, and the wait was for CPI data that released this morning. While the data didn’t come in below the expectation as much as the PPI data a day prior, it also didn’t beat expectations and this fueled hope that we may, in fact, get rate cuts in at some point this year.

It’s still early, however, and the CPI data from this morning wasn’t exactly a major positive for rate cut hopes, as headline CPI printed at 2.9% on a year-over-year basis and that’s against last month’s 2.7% reading and the 2.4% level that printed in September. So, inflation is still pushing higher, even if the actual print didn’t come out above the expectation.

And Core CPI did come out softer than the expectation, but the delta was slight, with year-over-year CPI printing at 3.2% against the 3.3% expected and that was the same level that printed in Core CPI in August and September releases of last year. That then led to three consecutive months at 3.3% and then this month showed a slight decline.

To sum, the CPI release wasn’t a clear sign that inflation is slowing to the point where the Fed can push another cut in March and given the massive response that’s shown in both bonds and stocks, it seems as though there’s a short-cover move taking place. This, of course, can turn into the initial seeds of a rally but the big question now is whether buyers come in to defend higher-low supports to allow for that next test of the 6k handle that bulls haven’t been able to do much above yet.

The daily chart of SPX below is updated from yesterday’s webinar and there’s a couple levels of note for buyers to defend. A support hold in the 5881-5888 level would be construed as bullish, as buyers would not allow for a fill of today’s opening gap. Below that, 5827, or the top of the election gap, is another level where support holds would bring a bullish bias. And then below that, it’s the 5827-5842 zone that’s of note, as this goes from last week’s close to the bottom of today’s opening gap.

SPX, S&P 500 Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

SPX Bigger Picture

Bullish equities after a pullback was my top trade idea for 2025, and the election gap was the first zone of support that I was tracking which has already come into play.

But the big question now is whether that can last and I think the answer for that derives back to bonds, which I’ll look at in a moment. But – from the daily chart of SPX we had a fresh lower-low print to start this week and it’s not until we take out the prior lower-high, around the 6k level, that we can say that the trend on the daily has started to shift. Until then, this is a possible lower-high and bulls should remain cautious of possible reversal setups, unless one of the above support zones come into play.

SPX Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Bonds

U.S. Treasury yields have been on a steep incline since the election. And I’ve read a number of possible reasons for that and perhaps some of them are true. But, what’s notable is the context with which this has taken place, as 10-year yields have risen by as much as 120 basis points since just before the Fed kicked off a rate cut cycle.

That’s helped to normalize the yield curve, and while many have already dismissed the traditional signaling of yield curve inversion to imply recession potential, it’s often after the curve has normalized that economic hardship may show.

Nonetheless, as the Fed has continued to cut rates, 10-year yields have continued their incline and last week saw yields tilt above 4.74%, which has been a waymark of sorts over the past year-and-change. There were retracements in equities in April of last year and leading into October of the year before, in both instances as 10-year yields were rising fast and to that level.

So far today we’re seeing a bit of pullback in that theme, but the big question is whether this morning’s CPI data, which, again, was pretty high with headline at 2.9% YoY – is fueling a rush of buying activity into Treasury notes? It seems more likely that this is a short-cover type of scenario after CPI didn’t increase at a blistering pace. And this seems tied to the move that’s showed in stocks.

So, whether either move can continue, the sell-off in bonds and stocks and the related rise in yields, will need to see follow-through confirmation.

Yield on 10-Year Treasury Notes

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview