US futures

Dow future -0.03% at 43083

S&P futures -0.01% at 5865

Nasdaq futures 0.01% at 20440

In Europe

FTSE -0.29% at 8263

Dax 0.35% at 19568

- Stocks steady after record highs

- Earnings in focus amid a quiet economic calendar

- BAC & GS beat forecasts

- Oil tumbles to $70 as the risk premium falls

Stocks steady after record highs

U.S. stocks are set for a subdued start as investors pause for breath after a stellar rally in the previous session, which saw stocks reach record highs.

Three major indices rose on Monday, with the S&P500 and the Dow Jones reaching record highs for a second straight session amid optimism over a strong Q3 earnings season and a rally in tech stocks.

Equities seem unfazed by expectations that the Federal Reserve could be cutting interest rates at a slower pace than initially expected. Yesterday, Fed governor Waller signaled that future interest rates will be less aggressive than the large move seen in September; he raised concerns that the economy could still be running at a hotter-than-desired pace.

Waller’s comments come after recent reports on employment inflation and GDP, which suggest that the economy may not be slowing as much as previously thought.

The market is pricing in about an 86% probability that the Fed will cut rates by 25 basis points in November and a slight chance it could leave rates unchanged. Today, the US economic calendar is quiet with speeches from Federal Reserve officials, including Mary Daly and Raphael Bostic, scheduled.

Amid a sparse economic calendar today, the focus is squarely on earnings with numbers from major banks, including Bank of America and Goldman Sachs, among others.

Corporate news

Goldman Sachs is set to open higher after the investment bank posted Q3 earnings that beat expectations. The global banking and markets division performed strongly, generating net quarterly revenues of $8.55 billion.

Bank of America will open higher after-earnings beat expectations, as higher investment banking fees helped offset the slight year-on-year decline in net interest income.

Walgreens Boots Alliance is set to open over 6% higher after the pharmacy chain said it would shut 1,200 stores over the next three years. It also beat Wall Street's estimates for fourth-quarter adjusted profit.

Oil majors such as Exxon Mobile and Chevron are falling, tracking a sharp decline in oil prices.

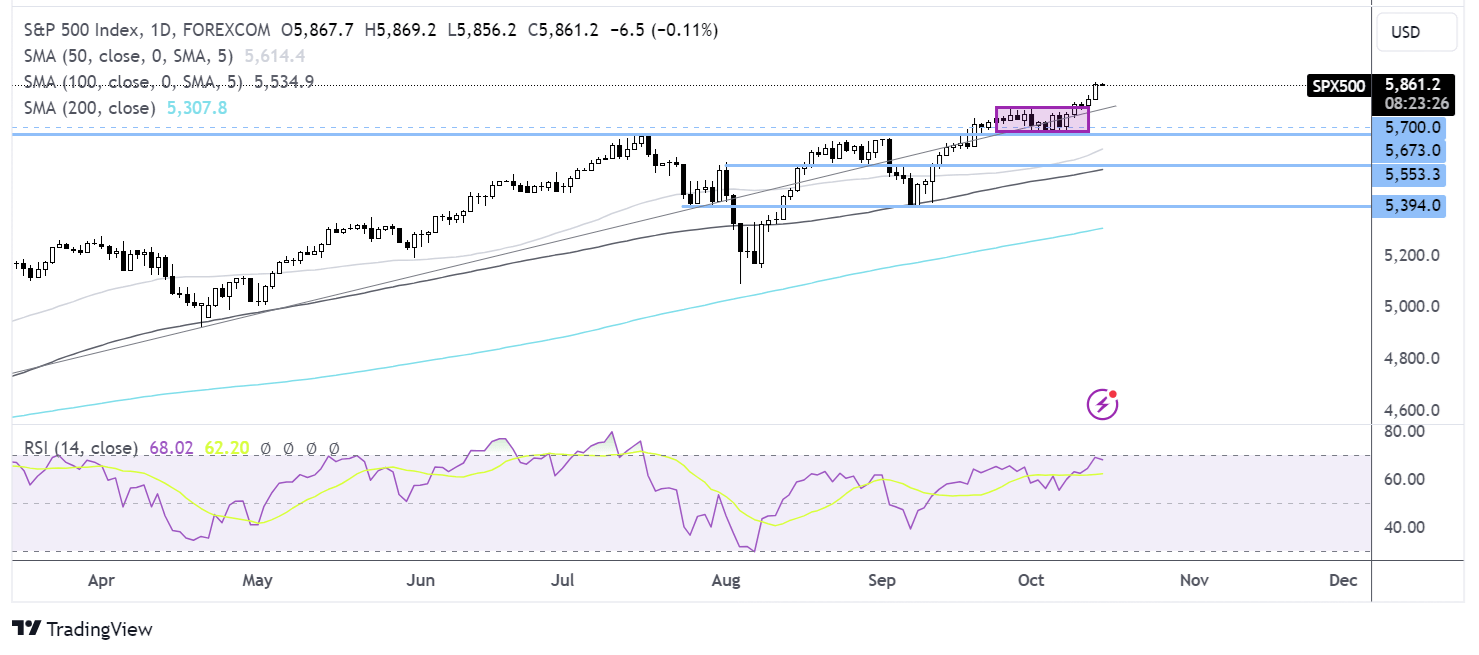

S&P500 forecast – technical analysis.

S&P 500 broke out of its recent range, rising to fresh all-time highs of 5800. Buyers will look to extend gains towards 6000. However, the RSI is on the brink of overbought territory, so buyers should be cautious. Support can be seen at 5775, the rising trendline support, and the upper band of the previous range. It would take a break below 5665 to create a lower low.

FX markets – USD falls, GBP/USD rises

USD is easing lower but continues to trade around a 2 1/2 month high supported by expectations that the Federal Reserve will cut interest rates gradually. The US economic calendar is quiet. The focus will be on three Fed speakers.

EUR/USD is unchanged after German zed EW economic sentiment improved by more than expected in October to 13.1 up from 3.6, owing to optimism on inflation and ECB interest rate cuts. The ECB is expected to cut rates again on Thursday.

GBP/USD is rising after UK unemployment unexpectedly ticked lower to 4%, down from 4.1%, highlighting the resilience of the UK labour market. Wage growth cooled to 4.9%, down from 5.1%, in line with expectations. UK inflation data is due tomorrow.

Oil tumbles as the risk premium falls

Oil prices are extending losses, dropping 4% today amid a weaker demand outlook and as the risk premium on oil falls.

Media reports have said that Israel is willing not to strike Iranian oil infrastructure targets, calming fears of a supply disruption in the Middle East. As the risk premium falls, oil prices have dropped lower.

Furthermore, the oil demand outlook is also deteriorating. Both OPEC and the IEA cut their forecasts for global demand growth in 2024, with China accounting for the bulk of those downgrades.

While China announced stimulus packages in recent weeks the market is unconvinced that this is enough to revive strong growth.