US futures

Dow future 0.03% at 42051

S&P futures 0.14% at 5734

Nasdaq futures 0.03% at 20031

In Europe

FTSE 0.48% at 8217

Dax -0.16% at 19222

- Stocks muted ahead of a big week for risk events

- US election polls show race is still too tight to call

- Nvidia rises after its inclusion into the S&P500

- Oil rises as OPEC+ delays production increase

US elections in focus ahead of voting tomorrow

U.S. stocks are rising very modestly, and trade is cautious ahead of this week's upcoming US elections and the Federal Reserve interest rate decision.

The polls remain incredibly close, with traditional polls pointing to a slight possibility of Kamala Harris's victory when the Polymarkets predicted a Trump victory. However, his odds of winning have narrowed. And predicted showed Harris edging past Trump. The closeness of these odds highlights the uncertainty surrounding this coin-toss presidential election.

There is also a possibility that the winner may not be known for days after voting, which could result in choppy trade while the market awaits clarity.

The VIX index, which is considered a measure of market fear, is at 22.38, considerably above its 30-day moving average, although it's still well below where it was the week before the 2020 election.

Beyond the elections, the market is pricing in a 25-basis-point rate cut from the Federal Reserve at the November meeting. The decision comes after data last week showed a much weaker-than-expected October nonfarm payroll report, but they did little to change market expectations for the Federal Reserve.

Last week, the three main indices fell as investors de-risked and digested a mix of earnings from the technology megacaps. While Alphabet and Amazon impressed, Apple, Microsoft, and Mesa fell and were concerned about the outlook and high AI spending.

Corporate news

Nvidia rose after it was announced that the stock would replace Intel on the Dow Jones Index.

Trump Media & Technology is set to open 7% lower as the market reassesses Trump’s chances of winning the election.

Robolox is set to rise 3.3% after Morgan Stanley upgraded its stance on the game platform to outperform from equal weight, saying the share price could double.

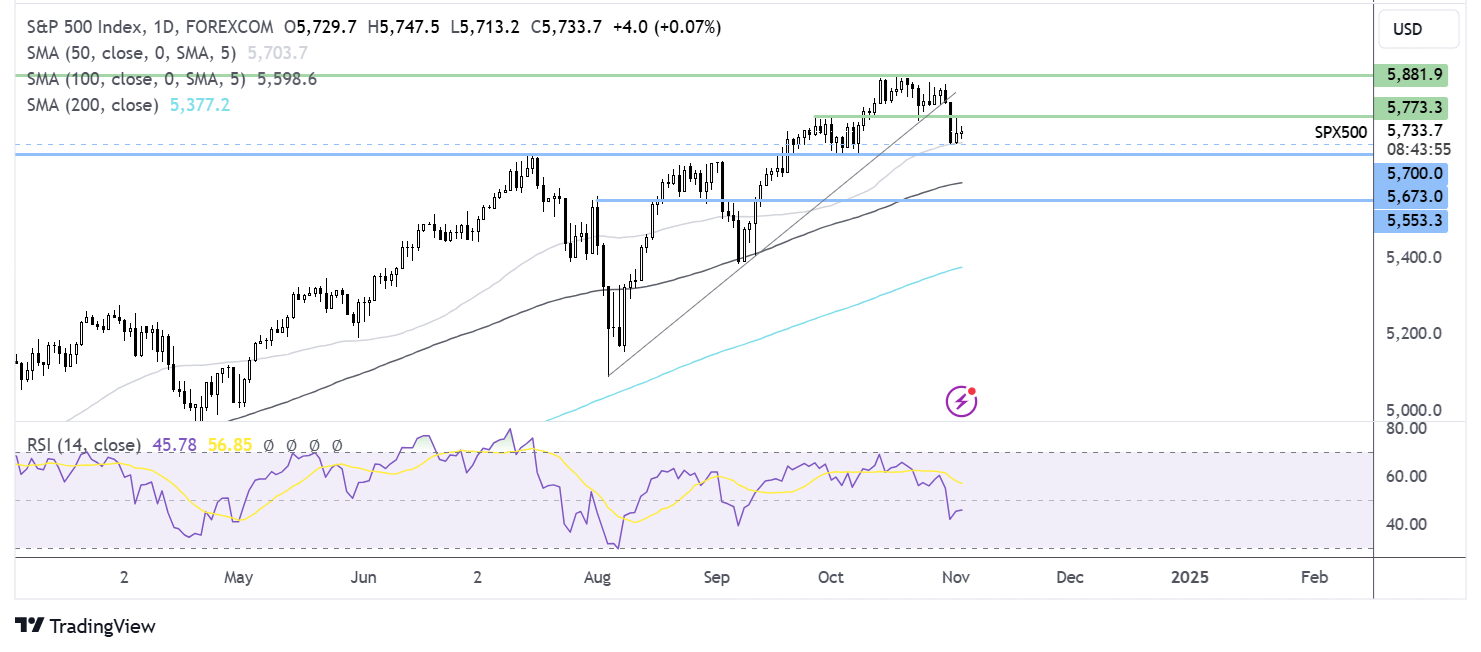

S&P 500 forecast – technical analysis.

After consolidating between 5882 and 5775 since early October, the S&P 500 broke below the lower band before finding support on the 50 SMA at 5700. The price is edging higher towards resistance at 5775, the September high. Buyers will need to retake this resistance to negate the near-term bearish move. Above 5775, 5882 comes back into play. Sellers will look to break down the 50 SMA at 5700 to create a lower low and expose the 100 SMA at 5600.

FX markets – USD falls, EUR/USD rises

The USD is falling after a flat finish last week as the market looks cautiously ahead to the US elections and the Federal Reserve interest rate decision on Thursday. The USD has fallen from three-month highs after five weeks of gains.

EUR/USD is rising, making a weaker U.S. dollar, and after manufacturing activity contracted by less than expected in October. The manufacturing PMI was revised to 46, up from 45 in September. Gains in the euro could be limited as the ECB is expected to continue cutting interest rates potentially at a faster pace than the Fed.

GBP/USD is rising, capitalizing on a weaker U.S. dollar and recovering from weakness following the Labour government’s budget last week. This week's attention will be on the Bank of England, which is expected to cut interest rates by 25 basis points but is not expected to signal another rate cut this year.

Oil rises as OPEC+ delays oil production increase.

Oil prices are rising over 2.5% after OPEC+ decided to delay production increases and as the market braces for the US presidential election results.

At the weekend, OPEC+ said it would extend its output cut of 2.2 million barrels per day for another month in December. The group had been planning on increasing production by 180k barrels per day starting next month. However, given the low oil prices, concerns over a supply glut, and weak demand, the oil cartel has kicked the can down the road. There should be more clarity after the US presidential election.

The Oil markets could also be volatile this week, with participants also awaiting Iran's response to recent Israel attacks.