S&P 500 Talking Points:

- Stocks retained strength through the week with SPX rising to test the 6100 level on Friday.

- Ahead of the Thanksgiving holiday the index was still test the 6k level for support but that hasn’t traded since Black Friday. It remains as a possible spot of support should pullback themes develop.

- I tracked the bigger picture backdrop for stocks in the Q4 forecast and you can access that in its entirety from the link below:

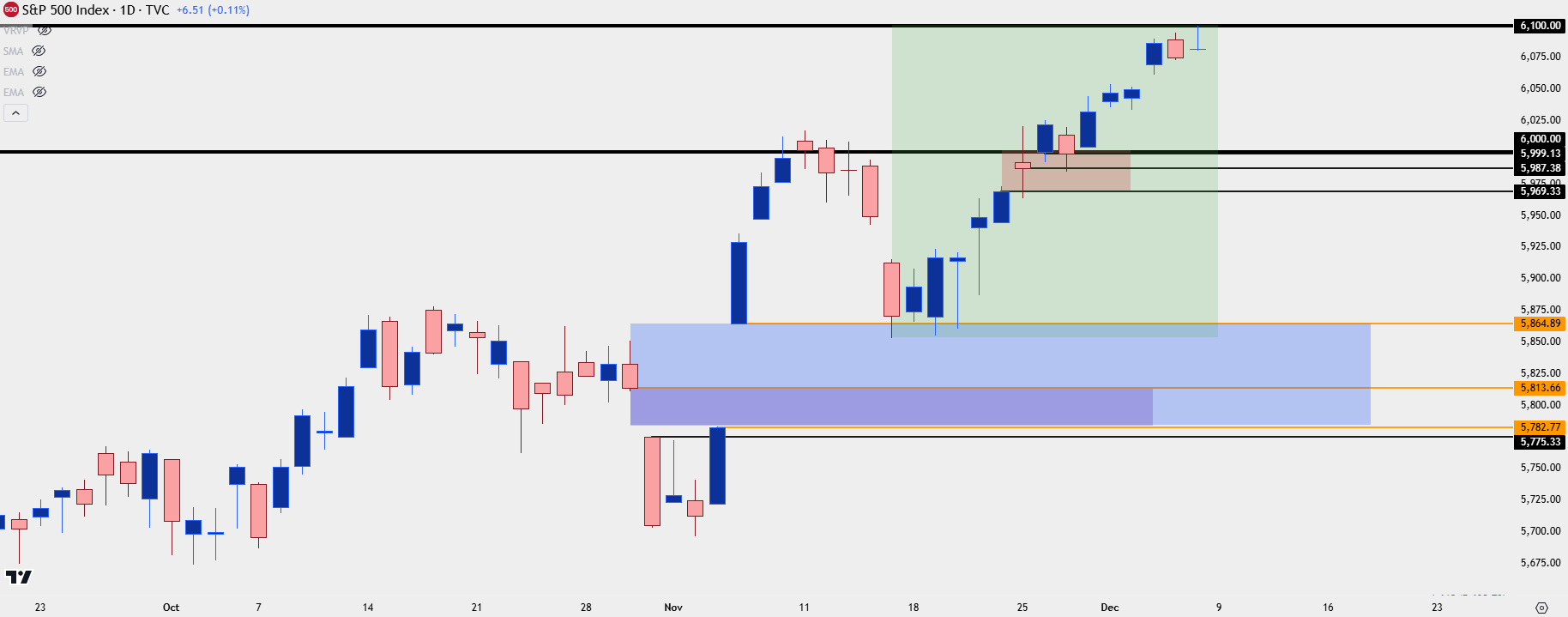

It’s been a slow and methodical move higher for US equities of late. There was a massive gap around the Presidential election last month; and then a pullback from that until support held at the top of that gap. But, since then, it’s pretty much been a straight-line higher with very little pullback along the way. There was a bit of resistance at the re-test of the 6k level a couple weeks ago, but that didn’t last for long as bulls grinded through that. And then this week saw buyers press up to the next psychological level at 6100, which set the high on Friday morning for SPX.

SPX Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

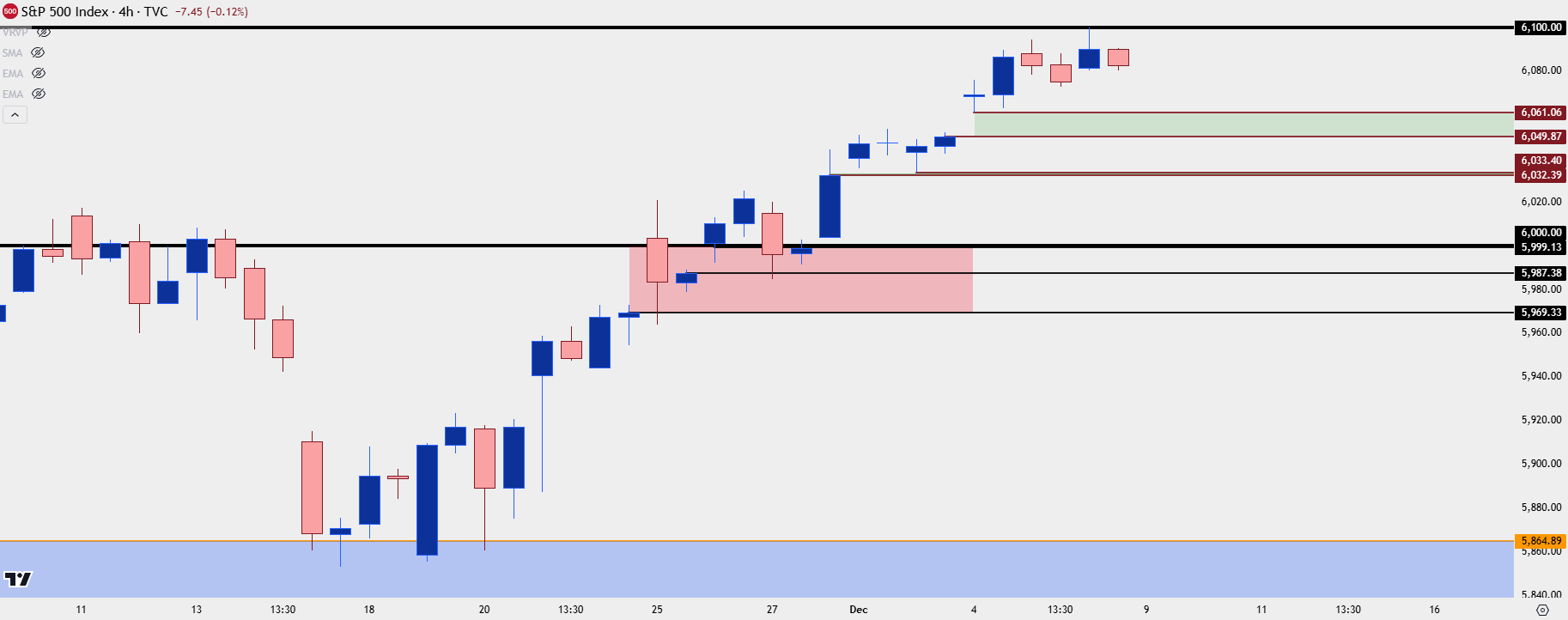

SPX Mind the Gap

For next week there’s support potential at a prior unfilled gap in SPX. That runs from the 6049 prior high up to the 6061 low from Wednesday morning. There’s been a tendency for those gaps to show as support of late, such as we can see in the red zone on the chart below from a couple weeks ago. But – there is still even about a point of unfilled gap left over from last week’s open, between 6032 and 6033.

SPX Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist