Investors’ insatiable appetite for technology stocks have kept the stock market rally going for months now, keeping the likes of the Nasdaq 100 and S&P 500 supported, while we have seen cracks appear in other sectors of the market. But even technology stocks look fatigued at these levels and a long overdue correction may be upon us. From its peak of just over 40K, the Dow is now down around 4%. In contrast, from their intraday all-time highs, the Nasdaq 100 was down just 1%, while the S&P was faring a little worse, at the time of writing. Could we see a more pronounced drop on these outperforming indices? With a lack of any fresh bullish stimulus and following months of solid gains, we could see a bit of a correction. So, in my opinion, the S&P 500 outlook is not looking too great at current levels and without a sizeable correction.

Why are stocks falling today?

Stocks were trading lower by late afternoon London session, with Treasury yields and the dollar both on the rise. It looks like investors are growing concerned once again about the potential for US interest rates to remain high for longer.

The renewed bond yield sell-off has been triggered in part by a surprise rise in US consumer confidence for May and weak auctions of two- and five-year US Treasuries. The Fed’s ongoing hawkish tone has also been a supporting factor for the dollar and yields, with several officials talking down the prospects of an earlier than expected rate cut.

Such has been the strength of US dollar today that not even a higher-than-expected CPI report from Australia could help to provide lasting support for the AUD/USD pair. Here, CPI came in at 3.6% y/y, which has basically ended hopes for a Reserve Bank of Australia rate cut this year. In fact, this was another factor that held back Australia’s stocks overnight and provided additional bearish influence on the wider global markets.

Another factor that is unnerving stock investors is the ongoing depreciation of the yen and yuan. The USD/JPY is slowly grinding towards 158.00, nearing intervention territories. Meanwhile, the offshore USD/CNH is nearing the highs of the year circa 7.28. A potential rise to a new high for the year on the USD/CNH could negatively impact risk assets and benefit the dollar.

S&P 500 outlook: Core PCE could impact Fed rate cut timing

Looking ahead, the crucial data will be released on Friday when the Fed’s favourite gauge of inflation is published. The core PCE figures will come a week before the May jobs report. Until then, it is possible we could see some weakness come into the markets in light of the recent bearish price action and a lack of any fresh bullish stimulus. The PCE data could impact the timing of the first rate cut significantly and potentially the S&P 500 outlook too.

S&P 500 outlook: Key levels to watch

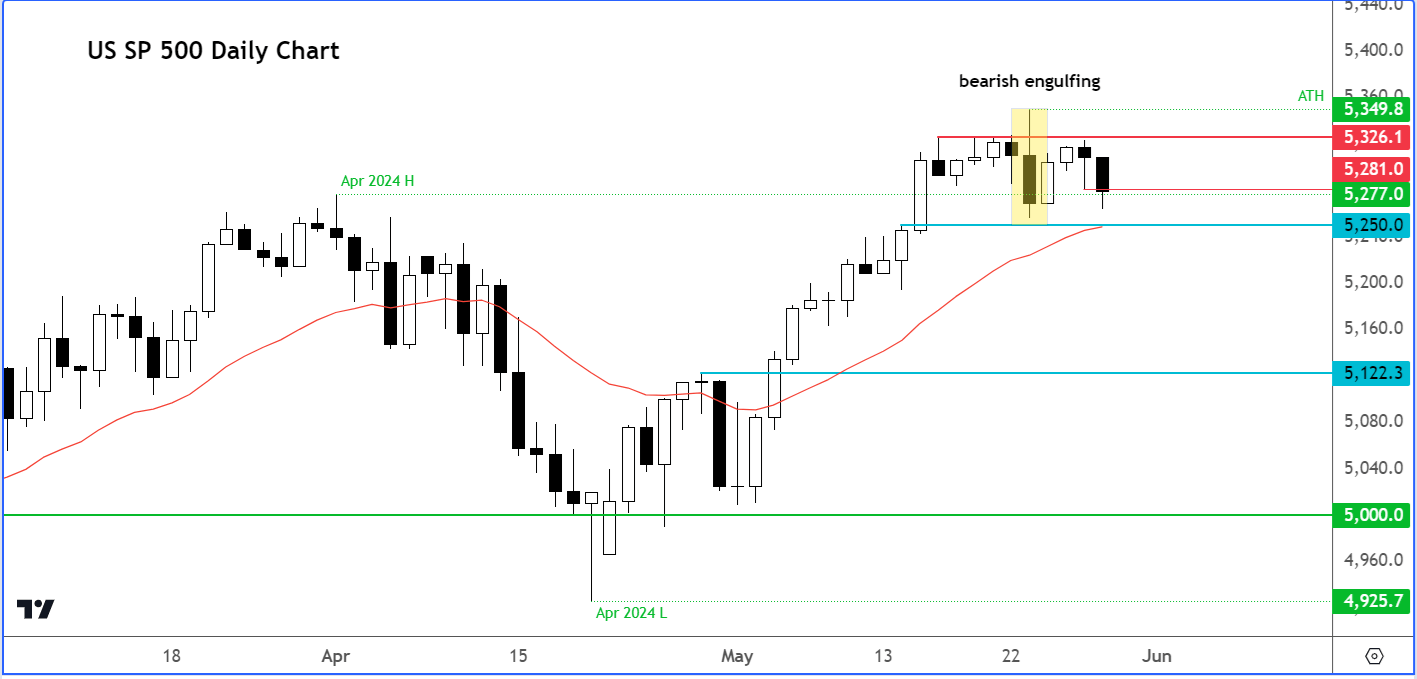

Source: TradingView.com

The big bearish engulfing reversal pattern on the S&P 500 that we saw on Thursday from an all-time high, means we may have seen at least a temporary top in the markets. But so far, we haven’t seen any downside follow-through. Could that change this week?

The bears still need to show a bit more conviction before things start to look more bearish. A potential break below 5250 support level, where the 21-day exponential average also comes into play, could be that trigger.

The bulls meanwhile will need to proceed with extreme care in light of Thursday’s reversal-looking price action, until we (1) either see evidence that Thursday’s reversal candle was in fact just another bear trap or (2) get a decent pullback to remove some froth from the market.

In terms of resistance levels to watch 5281 was Tuesday’s low, which needs to hold to maintain the bears’ newly found momentum. Above this level, 5326 is the next key resistance to watch, which was resistance until the brief breakout we saw on Thursday. The all-time high comes in just below the 5350 level.

If that 5250 support level gives way meaningfully, then we could see some follow-up technical selling towards the base of the breakout that took place early this month, around 5122.

While Thursday might mark a significant peak, it's important to note that we've observed similar price patterns before, and they consistently resulted in minimal additional downside. The market's trend has been very robust. For the bears to regain full control, this trend needs to weaken substantially first.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R