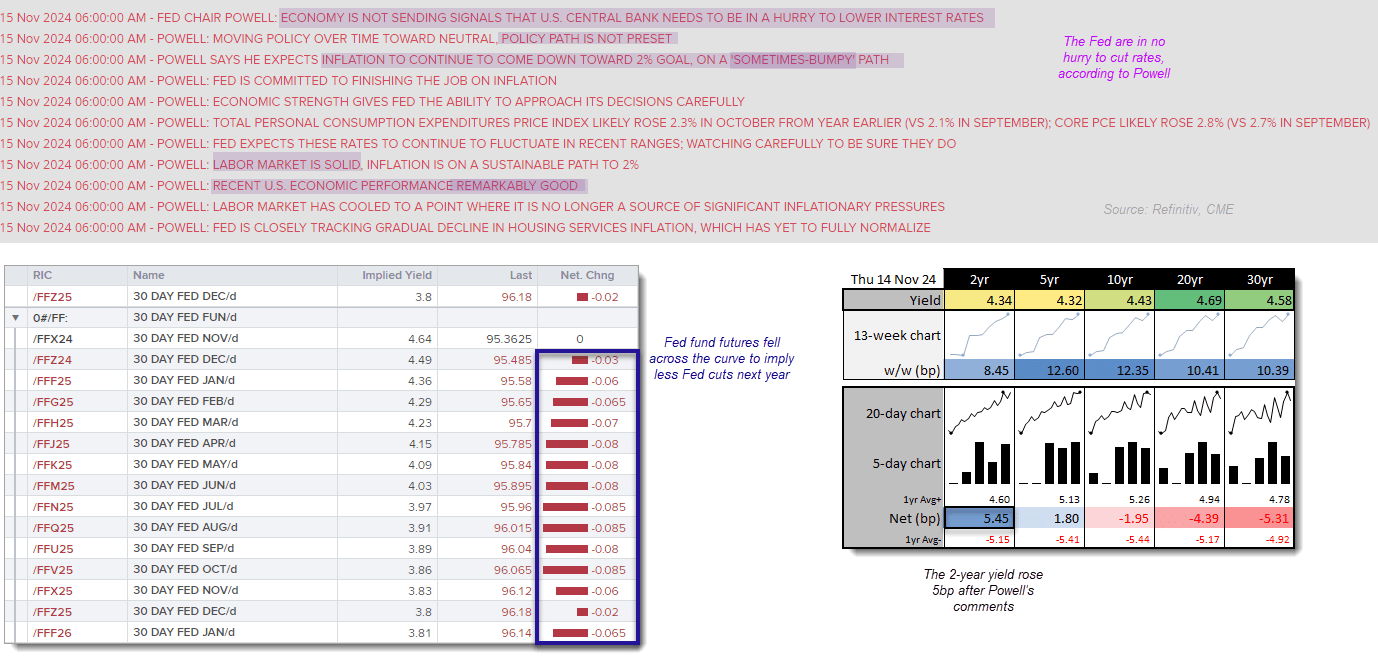

No sooner had I written today’s headline that “the USD rally was showing early signs of fatigue”, Jerome Powell hit the wires to force a quick edit. Citing a solid labour market and “remarkably good” recent economic performance, Powell bluntly said that “the economy is not sending signals that the US central bank needs to be in a hurry to lower interest rates”.

Not that it should need translating, but it diminishes odds of more rate cuts next year in the current climate. Especially when we’re all waiting to see just how inflationary Trump’s second term may be. The Fed funds futures curve was lower across the board, particularly in the second half of 2025 (lower prices imply higher yields).

Fed funds futures are still favouring a December cut with a 62.4% probability, but the potential for it to land in January instead also sits at 55.5%. The next cut could arrive in July according to the curve, but it is not particularly confident with just a 39% probability.

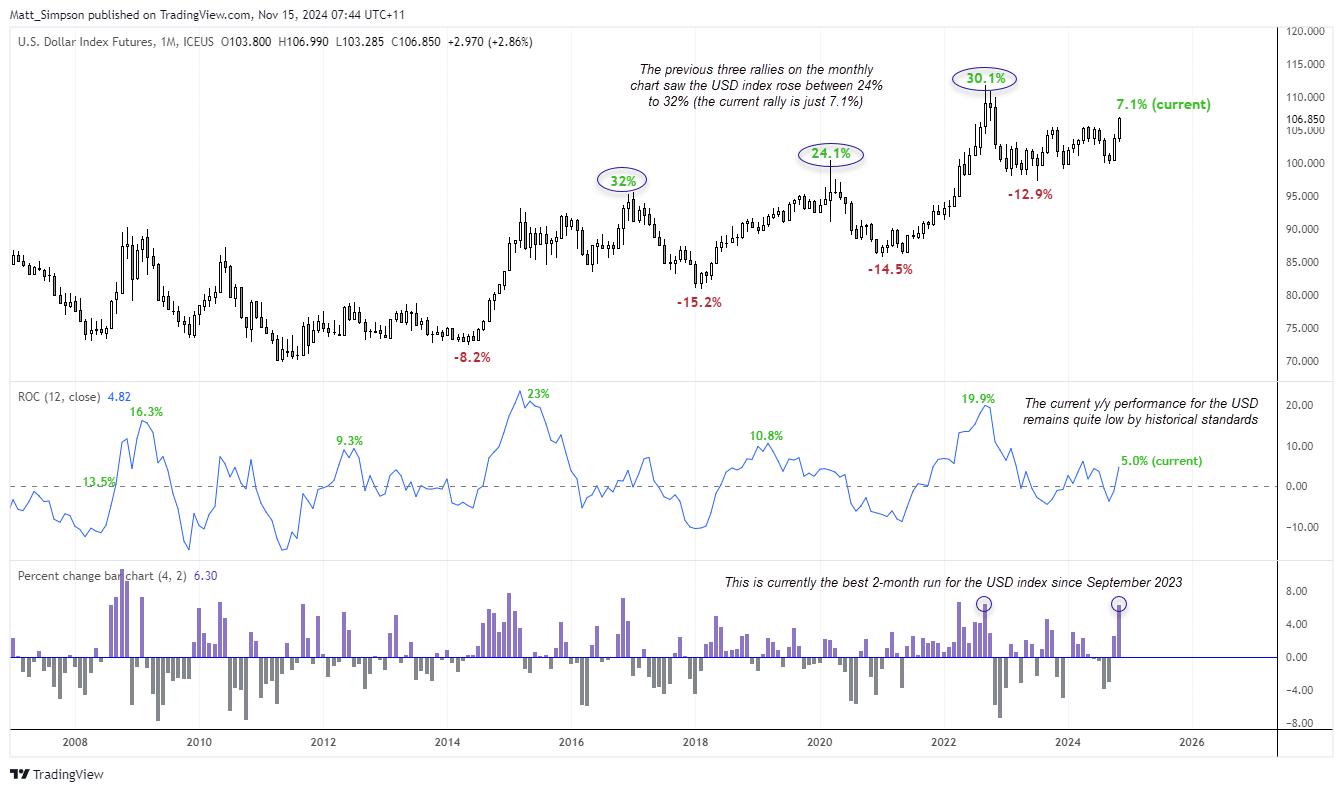

The USD rally could have a lot further to go

If we step back to admire the view, it is easier to appreciate that the USD rally could have a lot further to go. While the USD index is currently amid its best two-month performance in over a year, its year-on-year performance is just 5%—which is much lower than previous rate of change (12) peaks of approximately 9% to 23%. Trough to peak performance has reached between 24.1% to 32% over the prior three rallies, whereas the current rally from its lows is a modest 7.1%. Sure, there will be opportunities for pullbacks along the way, but if previous macro moves are to be repeated, then we could be looking at a USD index breaking to new highs above 112.

However, something to also factor in if the USD does continue to strengthen is whether Trump wants a strong dollar. While his policies may warrant a stronger dollar, he was vocal about not liking it during his first term.

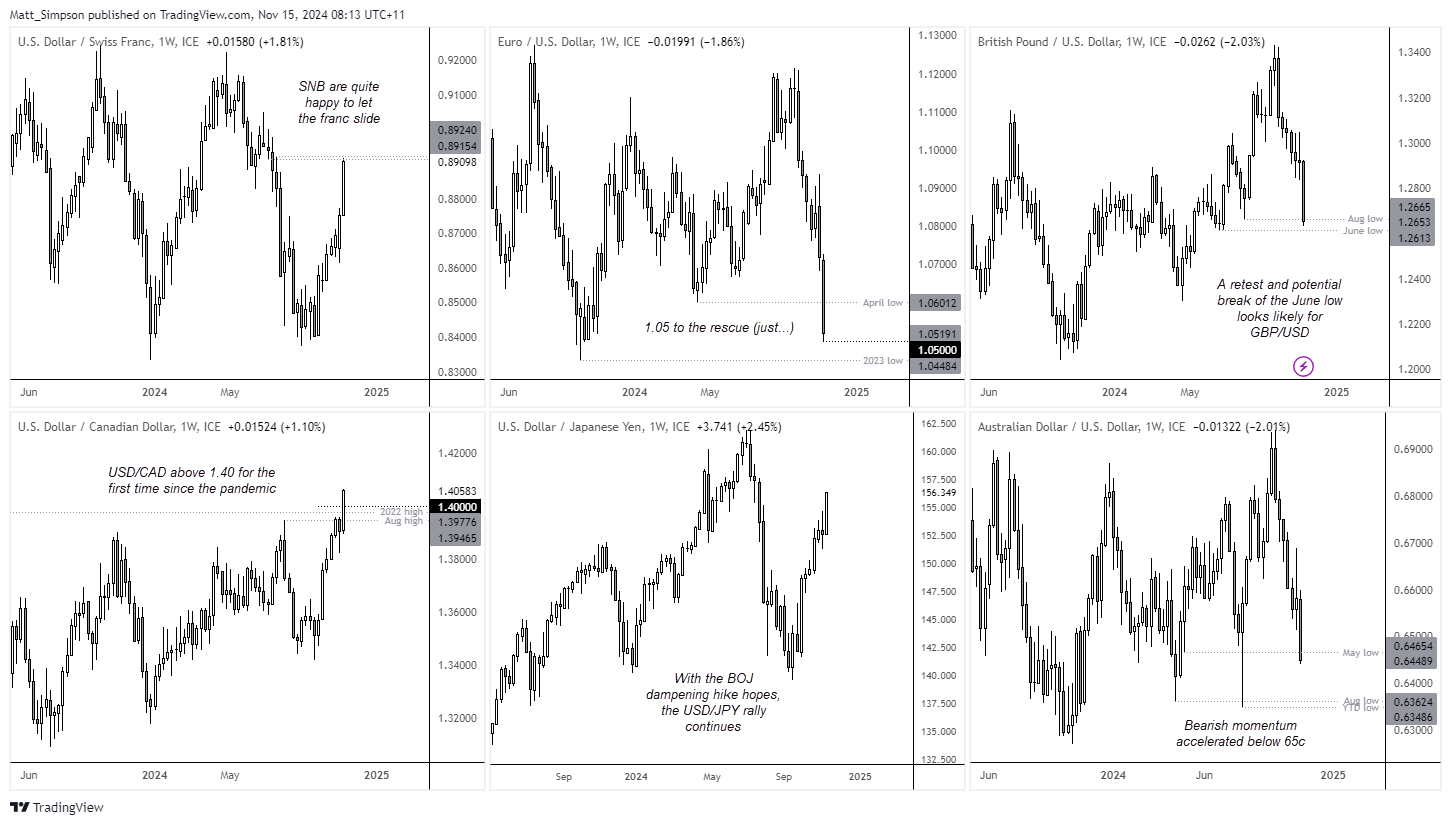

- USD/JPY reached a 4-month high (and reached my 126.20 target) ahead of Japan’s GDP figures released later today

- USD/CHF hit a 4-month high and tagged my 0.89 target

- USD/CAD closed above 1.40 for the first time since May 2020

- EUR/USD tagged the 1.05 handle for the first time since October 2023 (which for now is holding as support)

- AUD/USD saw its lowest daily close since April and is now less than 50-pips from the 64c handle

- GBP/USD fell to a 4-month low and closed beneath the 1.27 handle

Events in focus (AEDT):

- 08:30 – NZ business PMI

- 10:50 – JP GDP, capex, private consumption

- 12:30 – CN house prices

- 13:00 – CN fixed asset investment, industrial production, retail sales, unemployment, NBS press conference

- 15:30 – JP industrial production, capacity utilisation

- 18:00 – UK GQP (Q3), industrial production, index of services, manufacturing production, trade balance

- 21:00 – EU economic forecasts

- 22:30 – ECB McCaul speaks

- 00:30 – US core retail sales

- 01:15 – US industrial production, manufacturing production, business inventories

- 02:00 – ECB Lane speaks

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge