Summary of RBA’s Monetary Policy Decision (April 2019):

- Rates unchanged at 1.5%

- Growth in international trade has declined

- Long-term bond yields have declined further, consistent with the subdued outlook for inflation and lower expectations for future policy rates in a number of advanced economies.

- The Australian labour market remains strong

- GDP points to a softer picture for the economy

- Central scenario is for underlying inflation to be 2% this year and 2.25% in 2020

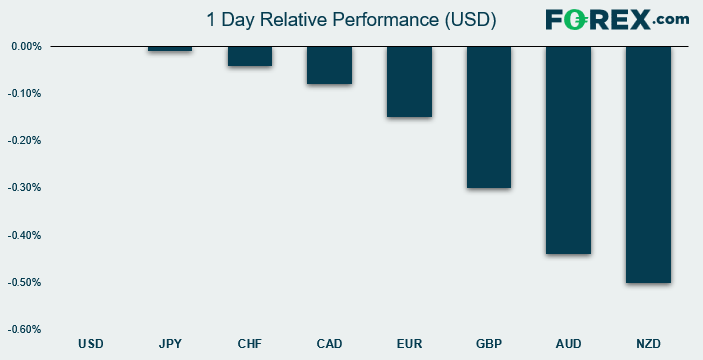

Overall the statement remains fairly-balanced, although it continues to appear that RBA’s confidence in the labour market is fending off a dovish stance. So, if we’re to see labour data soften, expect calls for a rate-cut to increase and AUD to face renewed pressure. AUD is currently the second weakest major behind NZD today, although volatility currently remains contained overall.

AUD/NZD has found resistance at 1.0500 following the meeting and the four-hour chart is trying to carve out a bearish outside candle. There’s potential for weakness over the near-term, although we remain bullish above 1.0400 due to the intraday trend structure.

Moreover, the cross is trying to carve out a bullish trend after confirming a bullish wedge reversal following RBNZ’s dovish meeting last week. Whilst the yield differential is favourable to NZD with a 25bps advantage over RBA’s cash rate, AUD/NZD moved higher as traders tried to adjust for the increased likelihood of an RBNZ cut whilst RBA remains neutral.

Ultimately, the bullish wedge projects an approximate target back around the 1.0670 highs, so bulls could consider setups following signs of consolidation or retracement towards key levels of support.