Crude Oil Technical Forecast: WTI Weekly, Daily & Intraday Trade Levels

- Oil prices surge nearly 11.1 off monthly / yearly low- WTI attempting third weekly-rally

- Crude now testing first major technical hurdle- weekly opening-range breakout imminent

- Resistance 71.33-72.45 (key), 73.61, 74.39/45- Support 69.71, 67.69-68.01 (key), 65.62-66.31

Oil prices surged more than 11% off the monthly low with a recovery off technical support now testing the first major resistance hurdle. The immediate focus is on a breakout of the weekly opening-range with the multi-week rally vulnerable while below this key pivot zone. Battle lines drawn on the weekly, daily, and 240min WTI technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this crude oil setup and more. Join live on Monday’s at 8:30am EST.Oil Price Chart – WTI Weekly

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

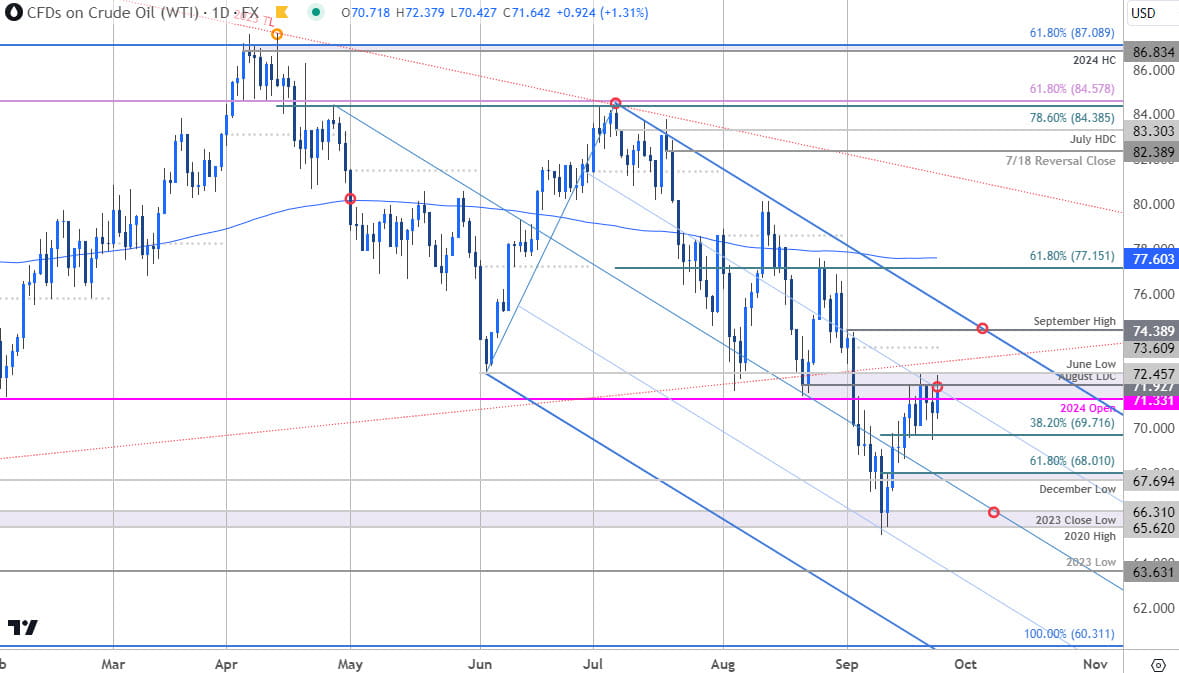

Technical Outlook: In my last Oil Price Forecast, we noted that WTI had, “plummeted through key support last week and cleared a multi-year consolidation pattern- the technical outlook remains weighted to the downside while in this formation. From a trading standpoint, look to reduce portions of short-exposure / lower protective stops on a stretch towards 65.62- rallies should be limited to the 71.92 IF price is heading lower on this stretch with a close below this pivot zone needed to mark downtrend resumption.”

WTI registered a low at 65.25 the following week before rebounding sharply with the subsequent recovery now testing former support as resistance. We’re looking for possible inflection off this zone over the next few days for guidance with the immediate rally vulnerable while below 71.33-72.45- a region defined by the objective 2024 yearly open, the August low-day close (LDC) and the June swing low.

Oil Price Chart – WTI Daily

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

A look at the daily chart shows WTI continuing to trace within the confines of a descending pitchfork formation with a rebound off the 25% parallel now testing the median-line. Note that this slope converges on the 71.33-72.45 resistance range over the next few days and further highlights the technical significance of this threshold.

Oil Price Chart – WTI 240min

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

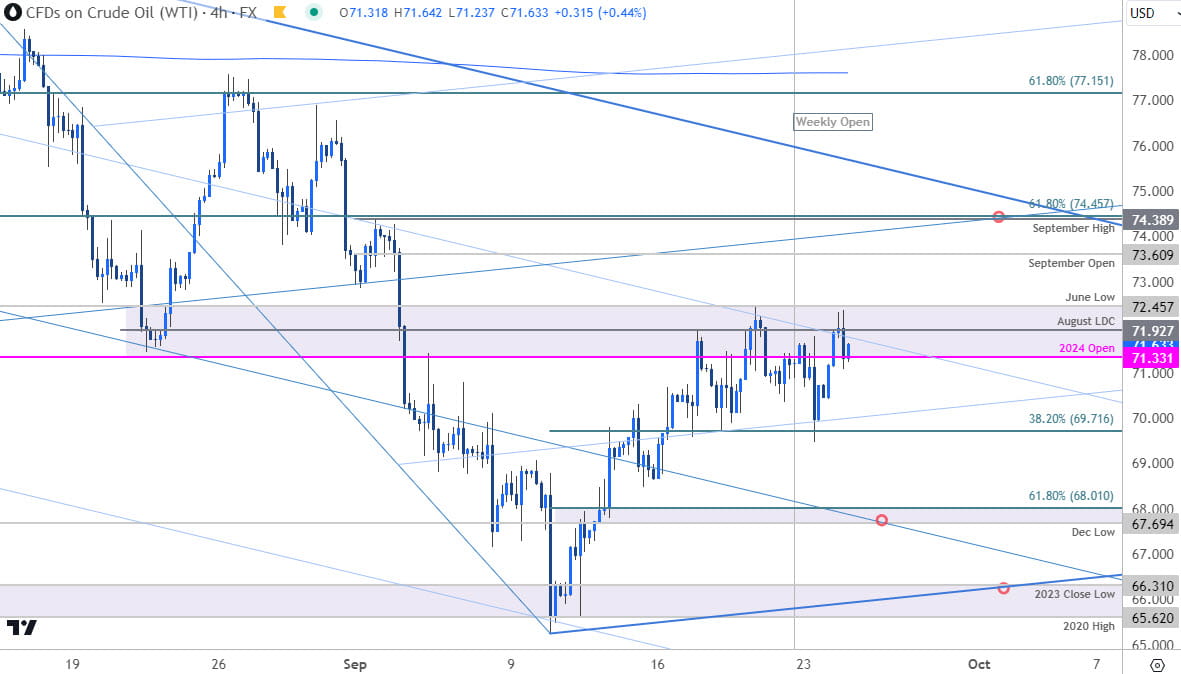

A closer look at oil price action highlights a newly identified upslope off the early-August / September lows with price setting the weekly opening-range just above the 25% parallel and just below key resistance- look for the breakout of the 69.71-72.45 range for guidance.

A topside breach / close above this key pivot zone exposes the monthly open at 73.60 and 74.39/46- a region defined by the 61.8% retracement of the August decline September swing high. Look for a larger reaction there IF reached with a weekly close above needed to suggest a more significant low was registered this month.

Initial support rests at 69.71 and is backed by the December low / 61.8% retracement of the September rally at 69.69-68.01. Key support remains at 65.62-66.31- a region defined by the 2020 swing high and the 2023 close low. Ultimately a break / close below this threshold would be needed to mark downtrend resumption.

Bottom line: A recovery off downtrend support takes oil prices into the first major test of downtrend resistance. The immediate focus is on a breakout to the weekly opening-range for guidance. From at trading standpoint, losses should be limited to 67.69 IF price is heading for a breakout with a close above 72.45 needed to fuel the next leg- watch the weekly closes here.

We’ll review these charts in-depth in the Weekly Technical Outlook Webinar on Monday morning.--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex