- The $70 per barrel floor remains solid, and WTI has resisted breakouts below this level in recent months.

- OPEC+ anticipates lower global economic growth for 2025 and has reduced the production ceiling for its members and allied countries, which could exert upward pressure on WTI prices.

During the final part of Q4 2024, WTI has remained within the $70 per barrel zone, fiercely resisting movements below this critical support. This behavior is influenced by OPEC+'s continuous announcements regarding production cuts and their extension into 2025.

What Does OPEC Expect for Next Year?

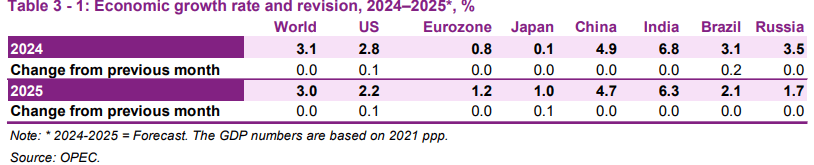

The global economic growth projected by the organization has been revised downward from 3.1% in 2024 to 3.0% in 2025, primarily due to several factors including: Negative geopolitical events, high debt levels and elevated interest rates.

Although global inflation has started to decline, it has not dropped sufficiently in regions such as America, Asia, and Europe to justify minimum interest rates in 2025. Aggressive monetary policies by central banks could significantly impact global economic growth.

Global Economic Growth Table

Source: OPEC

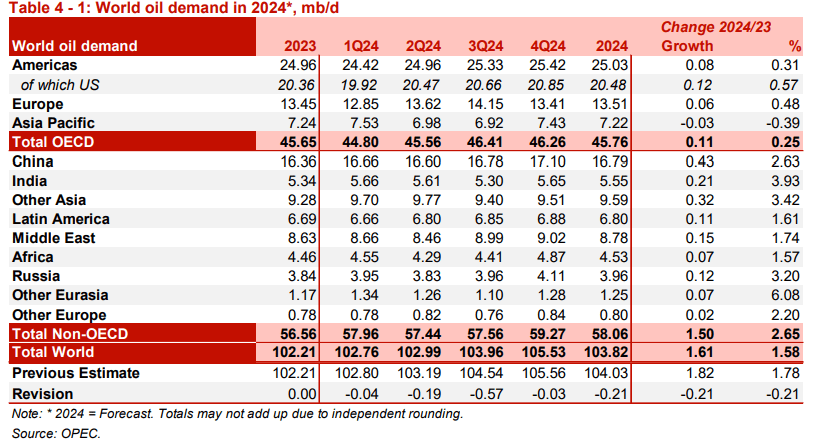

Demand projections for 2025 have also been reduced. By the end of 2024, total oil demand is estimated at 103.82 million barrels per day, an increase of 1.61 million barrels compared to 2023. However, for 2025, the projection indicates a more moderate increase of 1.4 million barrels per day, reflecting slower growth respect to the current year. This is attributed to limited economic growth in some key regions, potentially restricting demand expansion.

Oil Demand by Country Table

Source: OPEC

OPEC+ has emphasized that due to expectations of lower economic growth and demand in 2025, extraction reduction policies will need to remain in place for much of the year. Currently, the cuts have been extended until December 31, 2025, with a production ceiling set at 39.72 million barrels per day. This represents a decrease compared to 43.5 mbd in 2022 and 41.1 mbd in 2024.

These limits do not include additional voluntary cuts by some countries, such as Saudi Arabia, which has repeatedly highlighted the necessity of reducing production to stabilize oil prices.

With lower economic growth in consumer countries, demand expectations have diminished, prompting the bloc to adopt a production-limiting stance. These restrictions could exert upward pressure on WTI prices in 2025, as current measures and cuts remain in place.

WTI Forecast for 2025

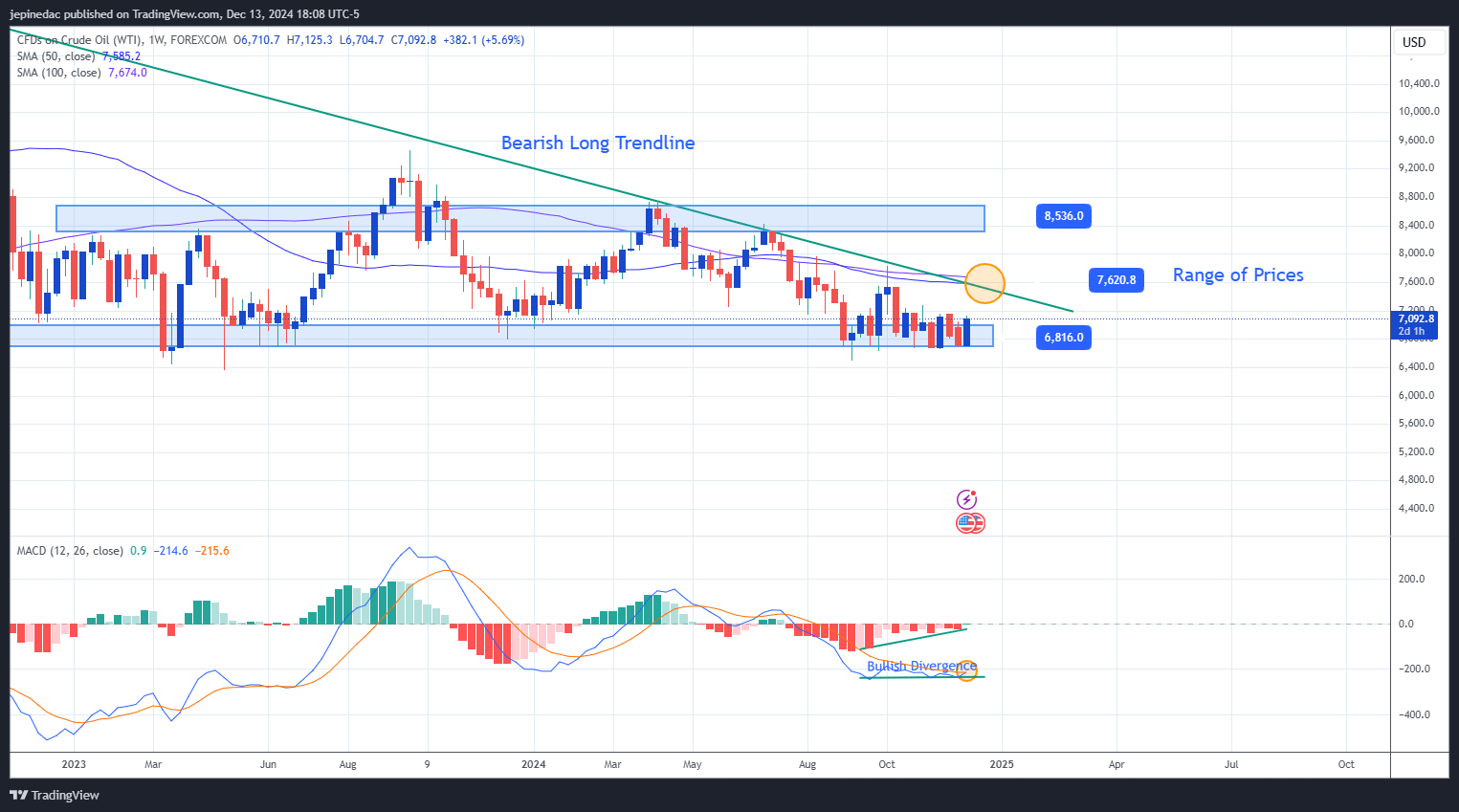

WTI has maintained a downward trend since its impressive rise in 2022, when it exceeded $120 per barrel. However, the trend appears to have reached a key lateral range, where the $70 level has prevented further lows, opening the possibility of a significant upward movement in 2025.

Source: StoneX, Tradingview

- Lateral Range: The zone between the $85 ceiling and the $70 floor has defined the primary movements of 2024, and these levels could be crucial for determining the continuation of the downward trend or the beginning of a new upward trend. Currently, both barriers have proven strong enough to reverse price movements. In this context, the latest movements of 2024 are within a critical support zone that could halt the bearish outlook and generate movements above $70.

- MACD:

- Bullish Crossover: For the first time since June 2024, the MACD line shows a bullish crossover with the signal line, indicating reduced selling pressure and room for buyers to consolidate their strength.

- Positive Histogram: The MACD histogram is displaying positive values for the first time in months, signaling growing momentum among buyers and reinforcing a bullish outlook.

- Bullish Divergence: Lower lows in the MACD lines and higher lows in the histogram suggest that buying movements have gained sufficient strength to persist, potentially generating upward corrections from the current support zone.

Key Levels:

- $85: The main resistance within the current lateral range. Movements near or above this level could pave the way for a significant bullish trend in 2025.

- $76: Intermediate resistance associated with the midpoint of the lateral channel and aligned with the 50 and 100-period moving averages. Breaking above this level could challenge the bearish trend that has persisted since 2022.

- $70: This level has been respected on 8 occasions since 2021, solidifying its status as a tough barrier for sellers. It has the potential to change the bearish perspective. However, consistent movements below this level could reactivate the prior downward trend and break the current lateral range.