Oil trades at highest level since 2014 post OPEC+ meeting

Oil prices are bounding higher after OPEC+ agreed to stick with the current 400k barrel per day increase to production from November, as agreed in July.

Heading into the meeting there had been rising expectations that the oil cartel could look to raise production by a further 400k barrel per day amid growing pressure from the likes of the US and India for cheaper oil, particularly given the spreading energy crunch and rising inflationary pressures.

Oil prices have surged higher across the year as demand from economies reopening out-stripped supply and has remained elevated since. Demand is expected to continue out-stripping supply by around 1.5 million barrels per day for the next six months according to Citigroup.

In addition to reopening demand, surging natural gas prices are also under pinning oil demand. Amid the ongoing energy crunch in Asia and Europe oil is comparatively cheap next to gas now, which is prompting expectations of a large scale switch in energy supply to petroleum based fuels.

Meanwhile supply shocks have also supported the price of oil, after oil producers have struggled to get full production back online following hurricanes and tropical storms in the Gulf of Mexico. Furthermore, some OPEC countries such as Angola and Cambodia have struggled to ramp up output to the increased OPEC quota due to a lack of investment or maintenance issues.

The jump in oil prices will do little to ease concerns over persistently high inflation. Rising energy costs could quickly filter through economies lifting prices resulting in elevated inflation becoming entrenched. This comes at a time when growth is also showing signs of slowing, prompting stagflation fears.

Learn more about trading oilWhere next for WTI crude oil?

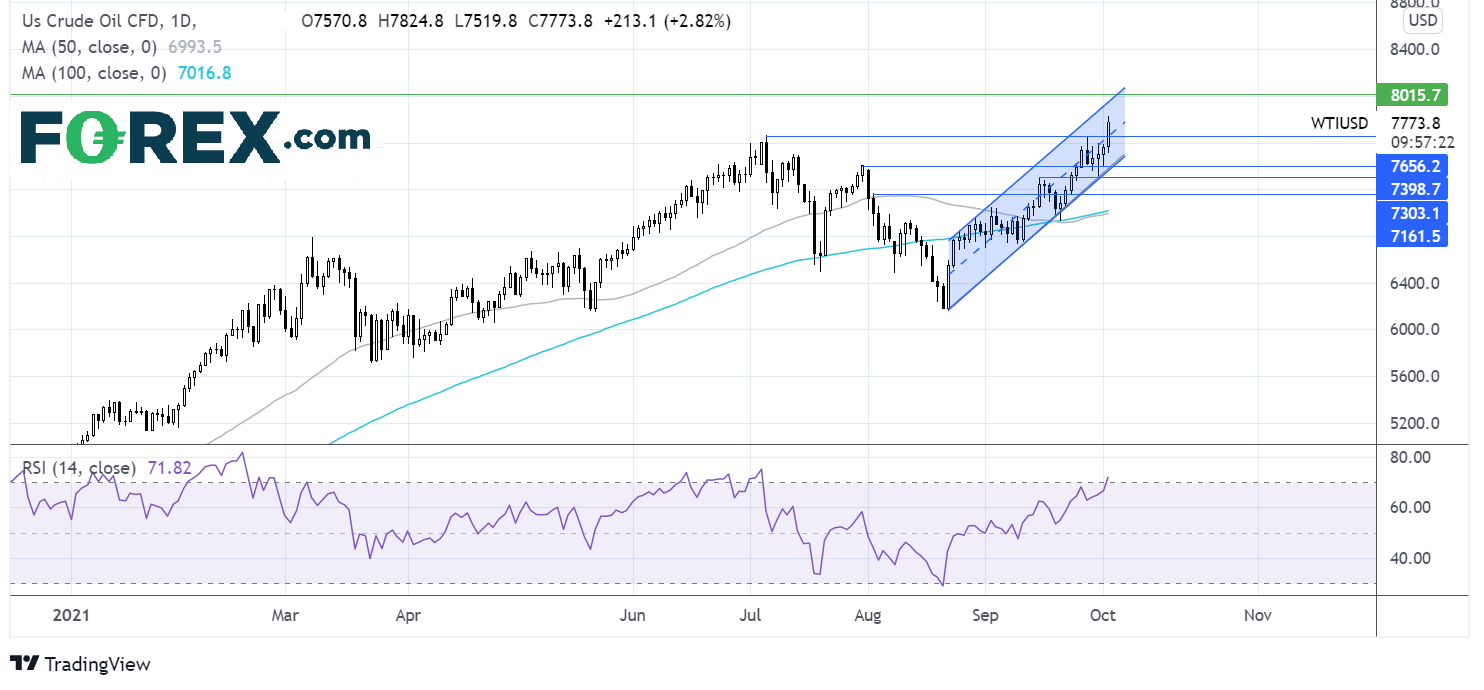

WTI crude oil trades within an ascending channel since late August. The price has broken above the previous high of 76.64 reaching 78.24. The RSI has tipped into overbought territory, so there could be some consolidation sat these levels of even a pull back. Bulls will be aiming for $80.00 the key psychological level and the upper band of the rising channel. On the flip side, support can be seen at 76.64 the previous high ahead of 74.10 the high 30 July and the lower band of the rising channel.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.