Nikkei 225 trading guide: constituents, market hours and how to trade

Looking for something specific? Jump ahead using these links.

- What is the Nikkei 225?

- About Nikkei 225 constituents

- How often do Nikkei 225 companies change?

- How is the Nikkei 225 calculated?

- What does the Nikkei 225 price mean?

- What moves the Nikkei 225 price?

- Average annual returns of the Nikkei 225

- Nikkei 225 market hours

- How to trade the Nikkei 225

- How to short the Nikkei 225

- Can you invest in the Nikkei 225 in the UK?

- Nikkei 225 companies ranked by market capitalisation

What is the Nikkei 225?

The Nikkei 225 is a stock index that tracks the performance of 225 of the largest Japanese companies listed on the wider Tokyo Stock Exchange. As such, it is a key gauge of market strength and a major Asian equity benchmark with global consultation.

Launched in 1950 with a value set at 250, the Nikkei 225 is a price weighted index, as opposed to a market capitalisation index. This means that, like the Dow Jones, the value of the index is derived from the per-share price of its constituents, as opposed to the German Dax or the FTSE 100, whose constituents are ranked by market cap.

About Nikkei 225 constituents

The largest Nikkei 225 constituents of the index by weighting feature Fast Retailing, the holding company of fashion brand Uniqlo, SoftBank Group, encompassing the investment institution, and electronics giant Tokyo Electron.

A newer addition to the index is NGK Spark Plug Co, included in October 2020.

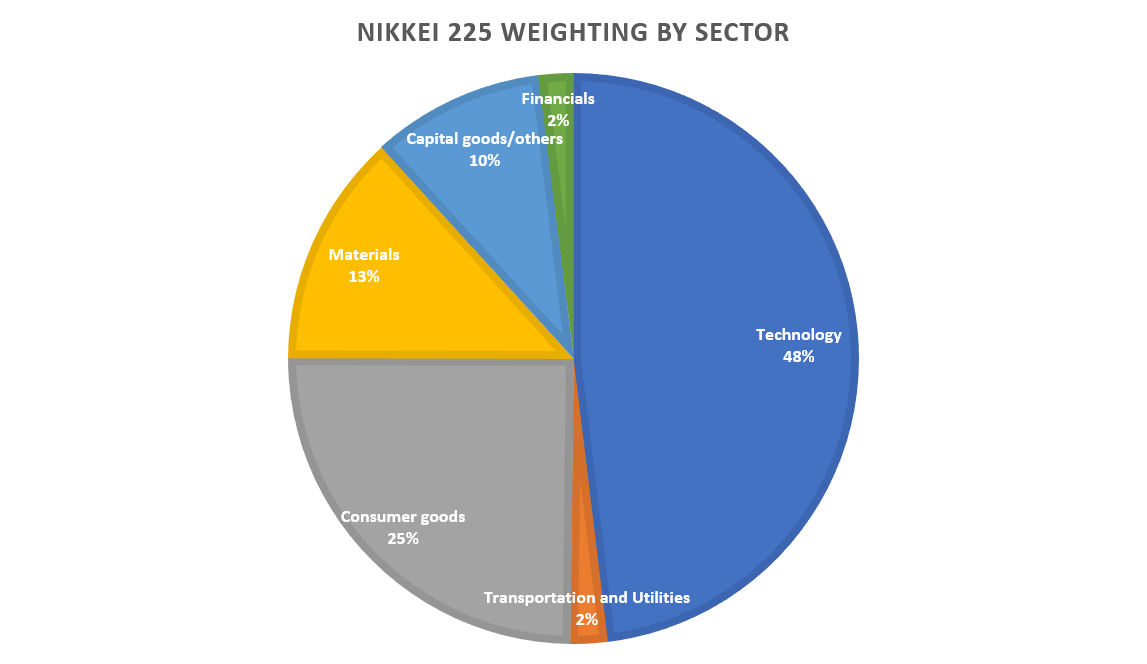

Here’s how the Nikkei 225 sector weighting looked as of May 14 2021, correct as of the October annual review. Percentages are rounded to the nearest whole number.

How often do Nikkei 225 companies change?

The Nikkei 225 index is reviewed in the Annual Review every October and constituents may change accordingly. Qualifying criteria is based on considerations of liquidity and ‘sector balance’, with six sector categories, as seen in the pie chart above, consolidated from the 36 Nikkei industrial classifications.

When a component is delisted due to its bankruptcy, or the reorganisation of its company group etc, the stock would be deleted from the index and a new component would be added.

How is the Nikkei 225 calculated?

The Nikkei 225 is calculated by dividing the sum of the adjusted prices by a divisor. The purpose of the divisor is to eliminate the effect of external factors not directly related to the market movement in calculating the price-weighted index – a method known as ‘Dow adjustment’ – and therefore maintain the continuity of the index.

What does the Nikkei 225 price mean?

The price of the Nikkei 225 indicates whether the share prices of the companies on the index are rising or falling. If the price of the Nikkei 225 is increasing, it means that a specific company or group of companies are experiencing gains, which is reflected in the price of the overall index. Conversely, if the Nikkei 225 price is falling, it means that companies on the index are experiencing a decline in price.

The Nikkei 225 ranking is based on a weighted average of share prices. This means companies with a larger weighting will often see their share price fluctuations have a correspondingly outsized impact on the wider index.

What moves the Nikkei 225 price?

The Nikkei 225 price is affected by a range of fundamental drivers associated with the performance of the Japanese economy and industries within it, as well as technical factors. Yen strength can have an affect on price, as well as economic data releases, commodity prices, and even natural disasters.

While such drivers may be expected to move the index in a certain direction, there is no guarantee that the move will play out, so traders should consider how determining factors work together rather than simply isolate any one factor. That said, here are a few of the key things to consider when trading the Nikkei 225.

Strength of the Yen

The strength of Japan’s currency is one potential influence on the Nikkei 225 price. Japan is an export-heavy economy, and so much of its goods and services will be bought in international currency. When the Yen is weaker, Japan’s exports are more competitive, and increased international demand caused in part by a weaker Yen can buoy the Nikkei 225.

However, since the Yen is often seen as a safe haven currency, in risk-off times money can flow into the currency, strengthening it against other pairs and making exports less competitive again, which can push stocks lower and potentially compound business concerns in a shrinking economy.

Monetary policy/economic data

Theoretically, aggressive monetary policy from the Bank of Japan (BOJ) can weaken the Yen and in turn provide favourable conditions for exporters that may impact the Nikkei 225 price. However, the efficacy of Japan’s extensive quantitative easing program and low interest rates has been questioned, with critics suggesting the measures have failed to improve a stagnant economy.

The fact that Japan’s interest and inflation rates have been historically low makes BOJ perspective different from the US, for example, where the Federal Reserve is more likely to be in a position to consider rate hikes as inflation picks up.

Accordingly, whereas traders interested in US indices might look to assist their trading by following a measure such as CPI, which is linked to inflation, those following the Nikkei 225 may prefer the Tankan survey, an economic report issued by the BOJ of thousands of Japanese companies of a specific size and considered a useful measure of business sentiment.

The quarterly research gives an insight into commercial trends and conditions per industry. One example of how it can move the index is during the coronavirus outbreak in 2020, when the Tankan showed business mood at the lowest point for 11 years, with the report’s release pushing the Nikkei 225 down by 0.75% that day.

Individual company performance

Since the Nikkei 225 is weighted by price, companies with a larger weighted share price in the index are more capable of moving the index than smaller constituents. For example, Fast Retailing is considerably more capable of causing changes in the Nikkei 225 price than Toyota.

Socio-political events

As with other global indices, events such as the Great Recession and the coronavirus pandemic are all capable of hitting market demand in one way or another. For example, the pandemic in 2020 caused a sharp deterioration in manufacturing activity and market demand, seeing the Nikkei 225 plummet more than 38% in March 2020 from its February mark that year.

Average annual returns of the Nikkei 225

Over the last ten years, the Nikkei 225 has produced an average annual return of 12% although the returns year-on-year during that timeframe fluctuated wildly. A remarkable 2013 boost of 56.7% followed aggressive monetary policy that weakened the Yen and boosted export-focused companies. Conversely, 2011 saw the index plunge -17.34% as fundamental factors conspired to strengthen the currency.

You can see the yearly returns from 2011-2020 below. Remember, past returns are no guarantee of future performance.

Nikkei 225 market hours

The main trading hours for the Nikkei 225 are between 9:00 – 11.30, and 12:30 – 15:00 local time (GMT+09:00) five trading days a week.

How to trade the Nikkei 225

There are a number of ways that you can trade the Nikkei 225; the most common are derivatives such as CFDs, futures and options, as well as ETFs. All of these instruments enable you to get exposure to all 50 companies from a single position.

Nikkei 225 CFDs

Contracts for difference (CFDs) are derivatives that take their price from the underlying market, in this case the Nikkei 225. As you’ll never be taking ownership of an asset, you can speculate on whether the index is going to rise or fall in value.

Learn more about CFDs.

Nikkei 225 futures

Futures contracts are agreements to exchange an asset at a set price on a set expiry date. Unlike most futures, Nikkei 225 contracts don’t have an underlying physical asset to exchange, as an index is nothing more than a number representing a group of stocks.

Nikkei 225 options

Nikkei 225 options are contracts that give you the right, but not the obligation, to buy or sell the index at a set price on a set date.

Where Nikkei 225 options are available with us, you’d be doing so via CFDs.

Nikkei 225 stocks and ETFs

You can also trade the Nikkei 225 through ETFs, or investment instruments that hold a group of stocks – in this case, the shares of constituents on the index.

Alternatively, stocks on the S&P 500 can naturally be traded individually, offering an opportunity to focus on particular sectors of interest.

Find out more about share trading with us.

How to short the Nikkei 225

Shorting the Nikkei 225 involves taking a position that the index will fall. This can be done by selling short a Nikkei 225 contract or shorting constituent stocks. Alternatively, traders may be interested in shorting a Nikkei 225 ETF. For options, you can buy Put options on Nikkei 225 stocks if you believe them to be overvalued, or buy a Put option on a Nikkei 225 ETF.

Read more about shorting a market.

Can you invest in the Nikkei 225 in the UK?

You can invest in the Nikkei 225 in the UK, albeit indirectly, through a combination of ETF, mutual funds or index funds, or of course trade the security through derivatives in the methods outlined above.

Nikkei 225 companies ranked by share weighting

Here are the top ten-ranked companies on the Nikkei 225 ranked by share price, correct as of June 2021 (Source: Nikkei).

|

Rank |

Code |

Company name |

Weighting |

|

1 |

9983 |

Fast Retailing |

11.13 |

|

2 |

9984 |

Softbank Group |

6.18 |

|

3 |

8035 |

Tokyo Electron |

6.07 |

|

4 |

6954 |

FANUC Corp |

3.28 |

|

5 |

9433 |

KDDI Corp |

2.78 |

|

6 |

6367 |

Daikin Industries |

2.70 |

|

7 |

6857 |

Advantest Corp |

2.47 |

|

8 |

4063 |

Shin-Etsu Chemical Co |

2.35 |

|

9 |

2413 |

M3 |

2.22 |

|

10 |

4543 |

Terumo |

2.10 |