US futures

Dow future 0.44% at 44,949

S&P futures 0.01% at 6084

Nasdaq futures 0.4% at 21478

In Europe

FTSE -0.0% at 8335

Dax 0.89% at 20213

- US unchanged around record highs

- US jobless claims rise to 224k

- Fed Powell signals to a slower pace of rate cuts

- Oil inches higher as OPEC+ is set to postpone oil output hikes

Stocks hover a record high

U.S. stocks are set for a muted opening as investors digest the latest jobs data and look ahead to tomorrow's nonfarm payroll report.

Yesterday, the S&P 500, the NASDAQ 100, and the Dow Jones booked record closing highs thanks to a surging technology sector.

Federal Reserve chair Jerome Powell highlighted the strength of the US economy and signaled a slower pace for interest rate cuts, echoing Mary Daly's view that there was no urgency to cut rates further. The market is still pricing in a 75% chance word a December rate cut.

Today's jobless claims data showed that the number of Americans applying for unemployment benefits increased modestly compared to last week, up 224,000, implying that the labour market continues to cool.

Attention now turns to tomorrow's nonfarm payroll report, which is expected to show that 200,000 jobs were added in February after just 12,000 were added in October, following strike action and the impact of hurricanes.

Corporate news

Dollar General trades higher after the discount chain operator posted Q3 revenue ahead of forecasts whilst also trimming the upper end of its annual forecast owing to hurricane expenses.

Southwest Airlines is flying higher after revising its Q4 revenue per available seat mile forecast, thanks to stronger pricing and a resurgence in domestic demand.

MicroStatregty and other crypto stocks are surging after Bitcoin, the world's largest digital currency, shot above 100k to fresh record highs following Trump's selection of Paul Aitken for SEC chair. Paul is expected to bring pro-crypto regulation to Washington, replacing Gary Gensler, who adopted a tough stance on the crypto industry in recent years.

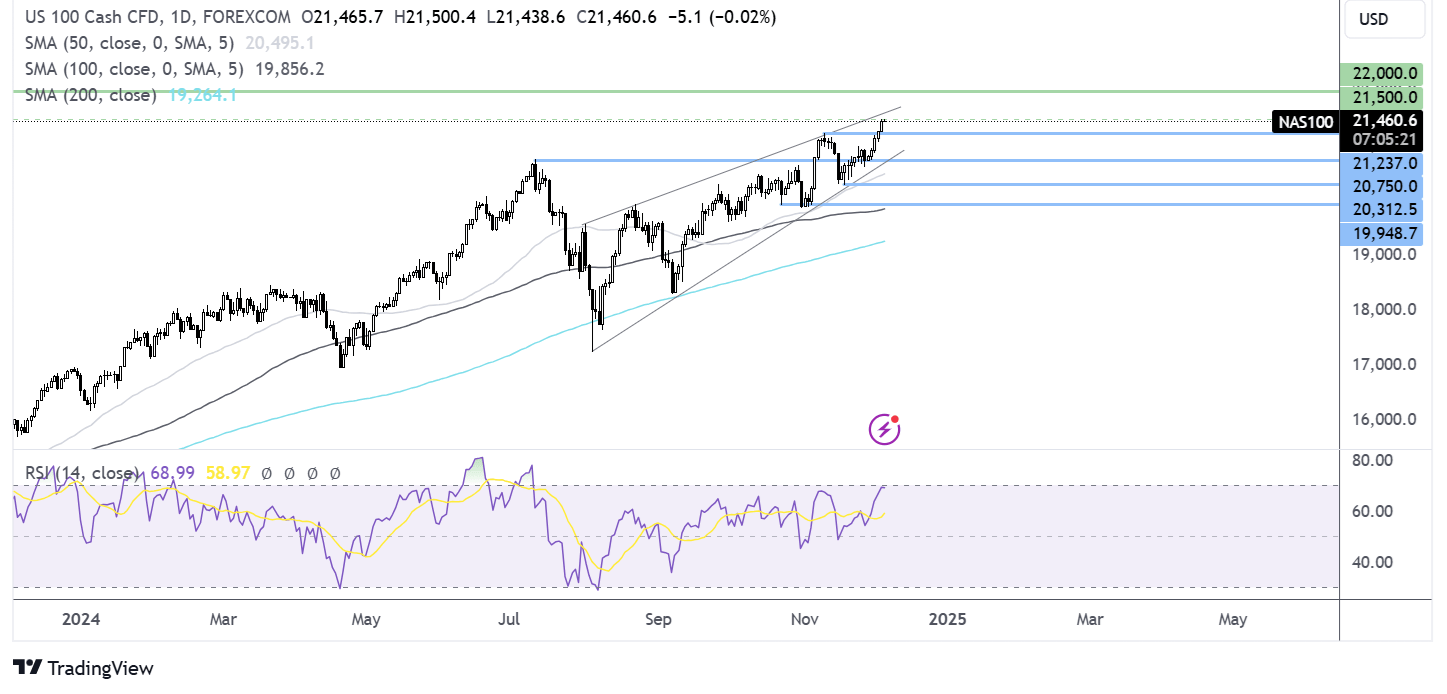

Nasdaq 100 forecast – technical analysis.

The Nasdaq 100 recovered from the 20,300 mid-November low, rising above 21,000 to 21,500, a fresh ATH. The RSI above 50 supports further upside while it remains out of the overbought territory. Buyers will look to extend gains to 21,600, the rising trendline resistance. On the downside, immediate support is at 21,300, the November 11 low, opening the door to 20,700. A break below 20,300 is needed to create a lower low.

FX markets – USD falls, EUR/USD rises

The USD is falling after weaker-than-expected jobs data and as attention turns to NFP data tomorrow. The US jobless claims rose to 224k and jo cuts were higher than expected.

EUR/USD is rising despite the collapse of the French government as Michel Barnier lost a vote of no-confidence, as expected. Eurozone retail sales were also weaker than expected. However, the EUR is gaining, taking advantage of the weaker USD.

GBP/USD is rising amid a weaker USD. The BoE’s DMP quarterly survey showed that UK companies' inflation expectations rose to 2.7% in the final quarter. This survey is closely watched by BoE policymakers, who have warned that they see a slower path to rate cuts following the budget.

Oil rises as OPEC is set to delay output increases to April

Oil prices are inching higher after yesterday's losses as the market weighs reports that OPEC+ is planning to delay planned oil output increases until April next year.

The delay comes as the oil group attempts to support prices amid weak demand notably from China and rising supply from outside OPEC. The group had been originally planning to unwind output cuts of 2.2 million barrels per day from October this year.

Meanwhile, US oil stockpiles showed a larger than expected draw al, frank some support to the price.