When will Lloyds release Q3 earnings?

Lloyds is scheduled to report Q3 results on Thursday, 27th October, before the market opens.

Lloyds Q3 earnings consensus

Lloyds is expected to report an 8% fall in pre-tax profit to £1.86 billion from £203 billion the previous year.

Lloyds Q3 earnings preview

Lloyds is set to release Q3 results as the share price continues to underperform, down 15% so far this year, below the FTSE 100 7% fall.

There has been a lot of change since Lloyds last reported, including two prime ministers, three Chancellors, the chaos of the min-budget, and its impact on the gilt market before Chancellor Hunt rolled back most of the measures. Meanwhile, the Bank of England has continued to hike rates at a steady pace, which will benefit Lloyds’ net interest income. After years of struggling with low rates, the rapid rise in borrowing costs could buoy core earnings, especially as banks haven’t been so forthcoming to pass on the high-interest rates on deposits. Lloyd’s net interest income is expected to rise 15.4% to £3.29 billion.

The bank is a very domestic-focused and traditional bank, meaning that it is more exposed to an economic downturn in the UK than peers such as HSBC and Barclays. Day-to-day loans and mortgage lending are core businesses, meanwhile, Lloyds has less exposure to trading and investment bank activities. As a result, there will be more focus on bad loan provisions. Last year the release of provisions set aside in the pandemic helped boost earnings. In Q3 2021 Lloyds released 84 million. However, with a recession in the UK looking unavoidable, Lloyds could expect more people to default on loan repayments. In Q2 the bank set aside £200 million to cover bad loans, this is expected to rise further in Q3 to £253.9 million.

Mortgage demand could also be in focus, as well as the bank’s willingness to lend, particularly in light of the volatility in the gilt market and mortgage rates. The bank’s mortgage book rose to £296.6 billion in H1, up by £3 billion.

Where next for Lloyd’s share price?

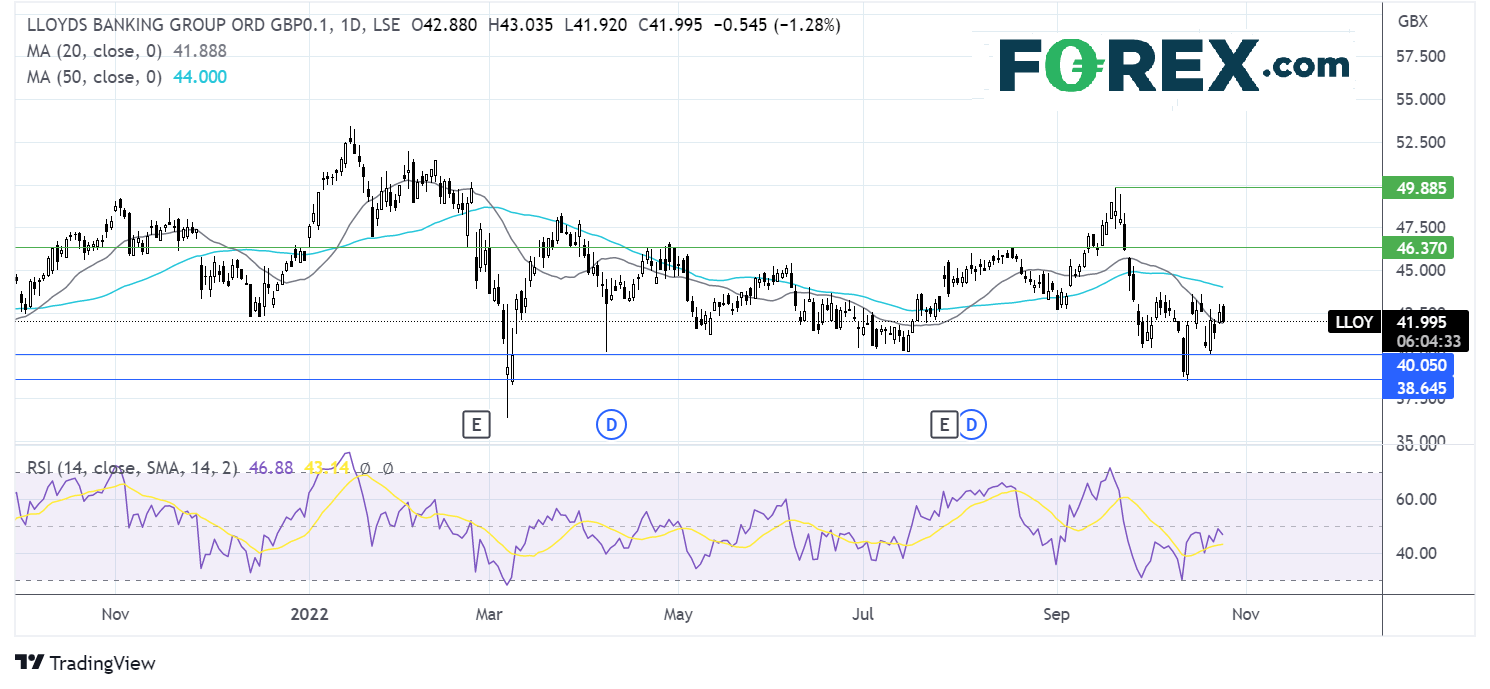

Since April, Lloyds has been traded relatively range-bound, capped on the upper band by 46.4p and on the lower band by 40p. There have only been a few occasions over the past 6 months when the price had broken out of these bands, the most recent being a fall to 38.5p on October 13th.

The price has rebounded from 38.5p, retaking the 20 sma but is lacking the momentum to rise above 42p the weekly high. Buyers need to push over 42p to expose the 50 sma at 44p, before bringing 46p back into target.

Should sellers successfully defend the 42p level, bears could look to test the 20 sma at 41.8 and a break below here opens the door to 40p. Should sellers successfully clear this hurdle 38.5p will come back into focus.