Despite over 200,000 new confirmed coronavirus cases reported in the UK yesterday, PM Boris Johnson said that there is a good chance there won’t be a need to increase restrictions or force lockdowns. Johnson said that the measures created under Plan B should be enough to carry the UK through the Omicron variant wave of the coronavirus, which includes working from home, wearing masks and using vaccine cards. However, Johnson did warn that it may take a while to get past this phase and that the UK is not out of the woods yet. He also noted that the booster program is helping to keep things from getting worse. With less restrictions and no lockdowns, the Great British Pound is on fire, primarily vs the Euro!

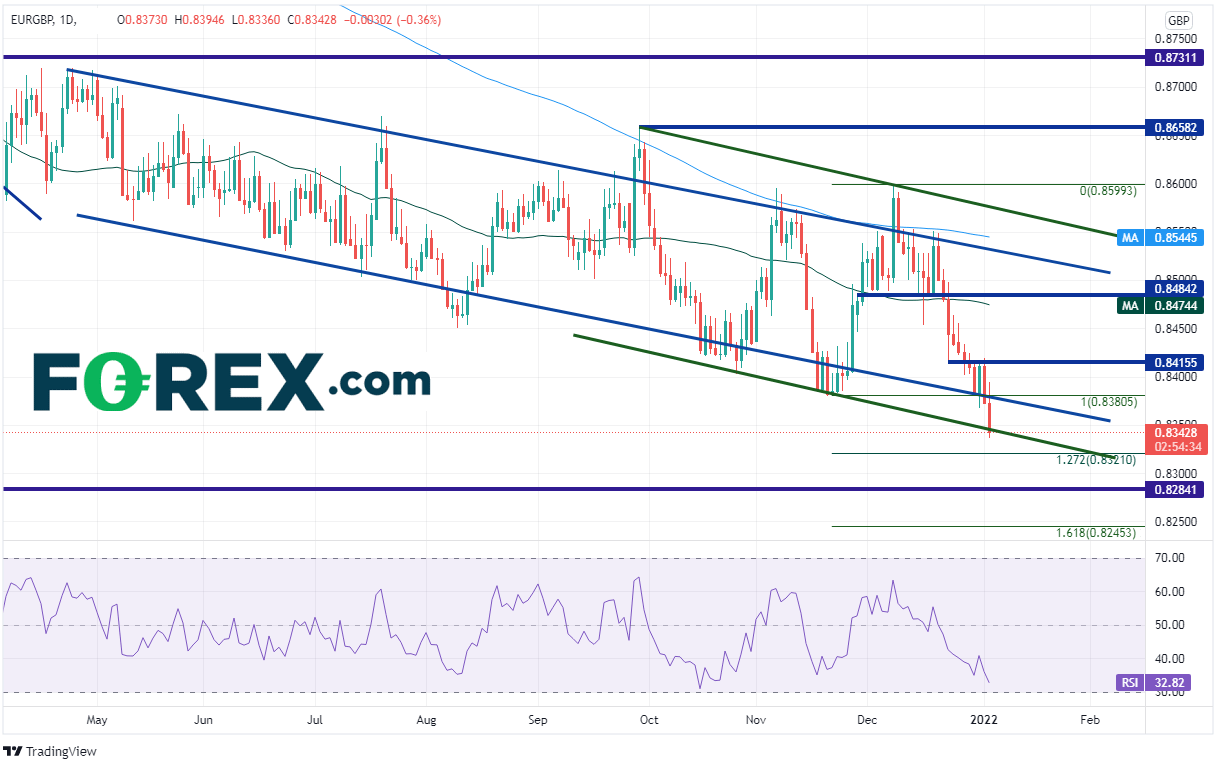

EUR/GBP has been moving lower in a channel (blue) since mid-April 2021 from a high of 0.8917 to today’s current low of 0.8336. In late September, the pair broke higher out of the top of the channel to the 200 Day Moving Average near 0.8658 but was rejected. Price moved back inside the channel and moved to test the bottom trendline near 0.8403. This was the beginning of a wider channel (green) which EUR/GBP has been trading in since. Today, the pair tested the bottom trendline near 0.8350.

Source: Tradingview, Stone X

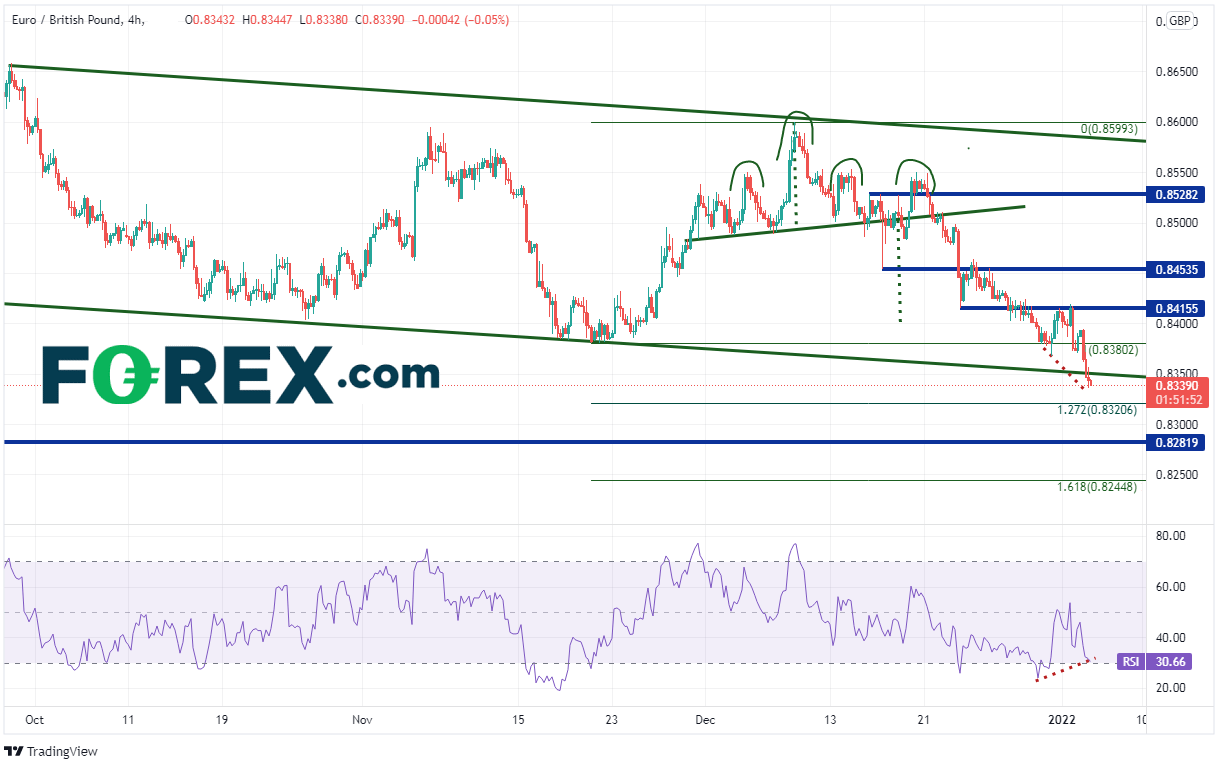

On a 240-mintue timeframe, within the larger (green) channel, price completed a Head and Shoulders formation (with 2 right shoulders) and reached its target near previous lows at 0.8400. Price continued lower, and today, broke below the bottom trendline of the channel near 0.8350. Support below is at the 127.2% Fibonacci extension from the lows of November 21st, 2021 to the highs of December 8th, 2021 near 0.8321, then the February 18th, 2020 lows near 0.8282. Below there, price can fall to the 161.8% Fibonacci extension from the recently mentioned timeframe near 0.8245. However, notice that the RSI is diverging with price, an indication that the pair may be ready for a bounce. Resistance above is at the previous lows near 0.8380. Above there is horizontal resistance at 0.8415 and 0.8454.

Source: Tradingview, Stone X

If it is true, as Boris Johnson predicts, that the Omicron variant can be contained and there won’t be further restrictions or lockdowns, it should make for a bullish Pound. Therefore, EUR/GBP may continue lower. However, with EU CPI on Friday and an RSI diverging with price, watch for the pair to possibly bounce in the near-term.