- Chinese regulators announce swathe of stimulus measures to boost growth and inflation

- Interest rates and RRR cut, continuing moves which have failed to boost demand to date

- Measures to boost Chinese stock market flagged, specifics to arrive later

- China A50, Hang Seng, SGX iron ore pushing higher

Overview

Chinese regulators will slash wholesale and mortgage interest rates, free up cash for banks to lend and implement measures to support the stock market, designed to help address flagging economic activity which is weighing on inflation. However, none of the moves directly boost demand, raising questions about just how effective they may be in delivering a sustainable improvement in economic sentiment.

China delivers swathe of stimulus measures

In a joint press conference with leaders from the People’s Bank of China (PBOC), National Financial Regulatory Administration and China Securities Regulatory Commission, regulators announced they will cut the reserve requirement ratio for Chinese lenders by 50 basis points, releasing additional financial liquidity that can be used in the economy.

Wholesale interest rates such as the seven-day reverse repo and one-year medium-term (MLF) rate will be reduced by 0.2% and 0.3% respectively, with loan prime rates also cut by 0.25%.

Reductions to mortgage and deposit rates were also flagged along with the potential for further cuts to the RRR. Down payments for second home purchases were also reduced.

Regarding China’s spluttering share market, the regulator flagged moves to promote mergers, acquisitions and corporate reorganisations, along with guidance to promote medium and longer-term funds to enter the market.

But is it enough to boost economic activity?

While plenty for traders to digest, none of the moves should be deemed as unexpected. Perhaps them arriving simultaneously, yes, but further cuts to rates and the RRR were already expected. And while the initial market reaction has been positive, what stands out is that it’s just a continuation of policies we’ve seen previously: providing ever lower financing rates to borrowers. To date, that strategy has not delivered a meaningful improvement in demand, nor addressed glaring supply-side overcapacity across several key sectors.

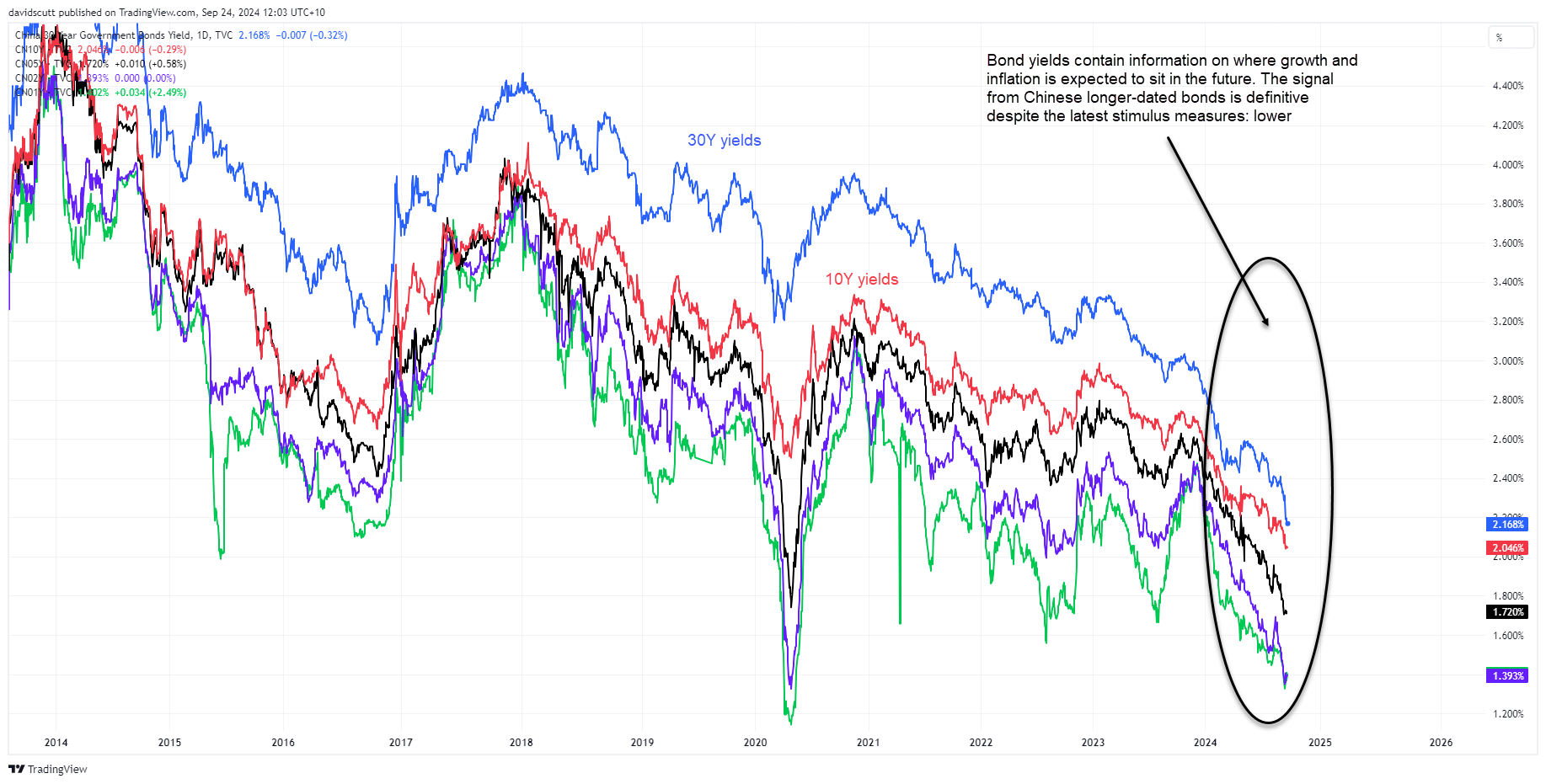

Rather than looking at the immediate reaction in more liquid Chinese markets, one of the best indicators as to whether markets think these measures will work is the shape of China’s yield curve. As seen in the following chart, despite all the monetary easing seen so far, including today, longer-term yields continue to collapse towards shorter-dated yields, delivering a clear signal on where investors see growth and inflation in the future: lower.

If traders thought the policy measures would work, you’d expect longer-date yields would be moving in the opposite direction. It’s telling they aren’t.

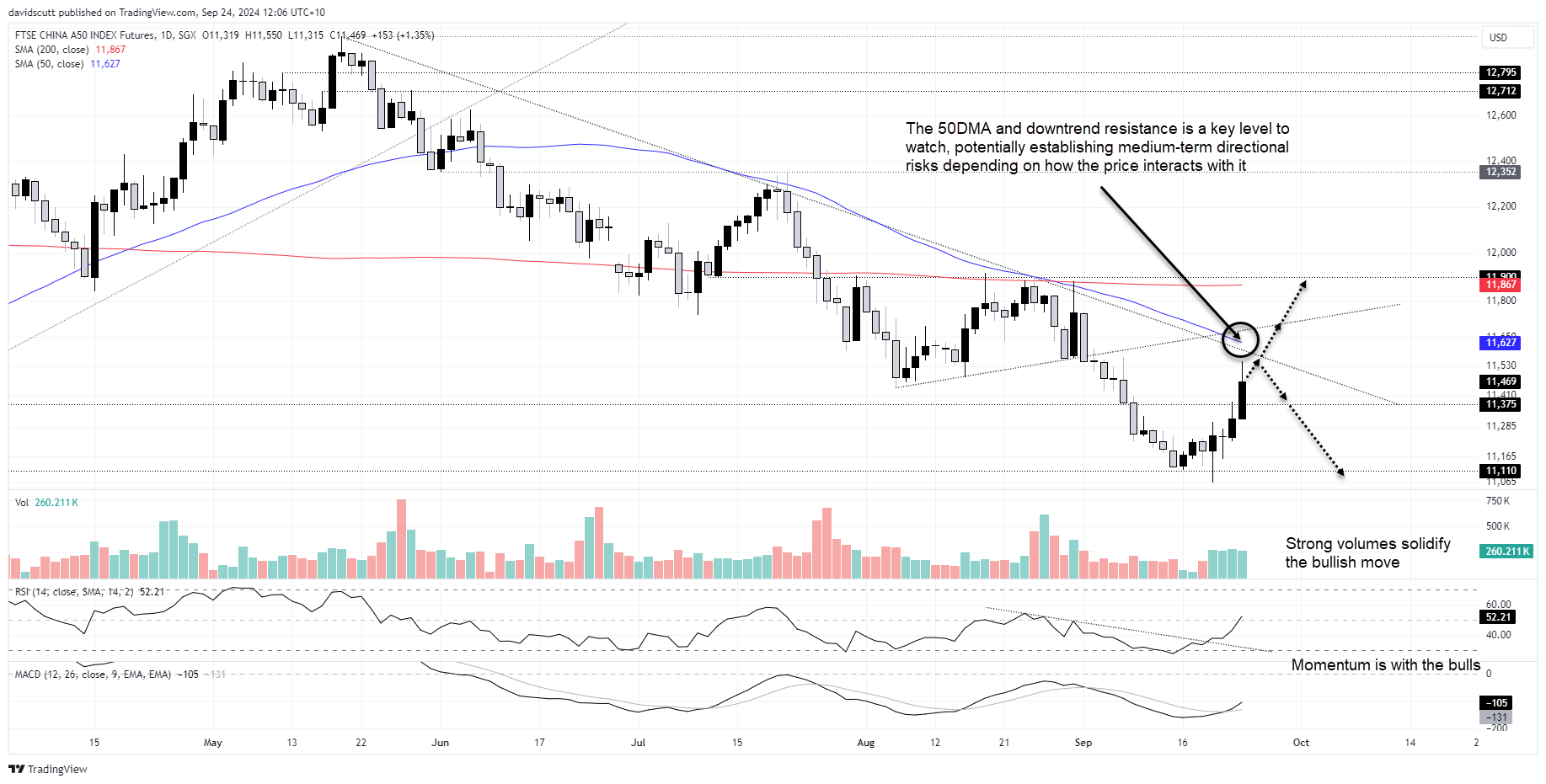

China A50 bulls eyeing downtrend retest

Looking at China A50 futures, momentum has swung around to the upside with big volume accompanying the recent bounce. MACD and RSI (14) have confirmed the bullish price signal, pointing to a possible near-term test of key downtrend resistance and the 50-day moving average.

If that zone were to be broken, it may facilitate a push towards the 200-day moving average and horizontal resistance around 11900. But if the downtrend and 50DMA hold, the price may reverse back towards the recent lows with only minor support at 11375 located in between.

Risks look biased higher in the near-term given the threat that state support may be called upon if the initial bullish reaction falters.

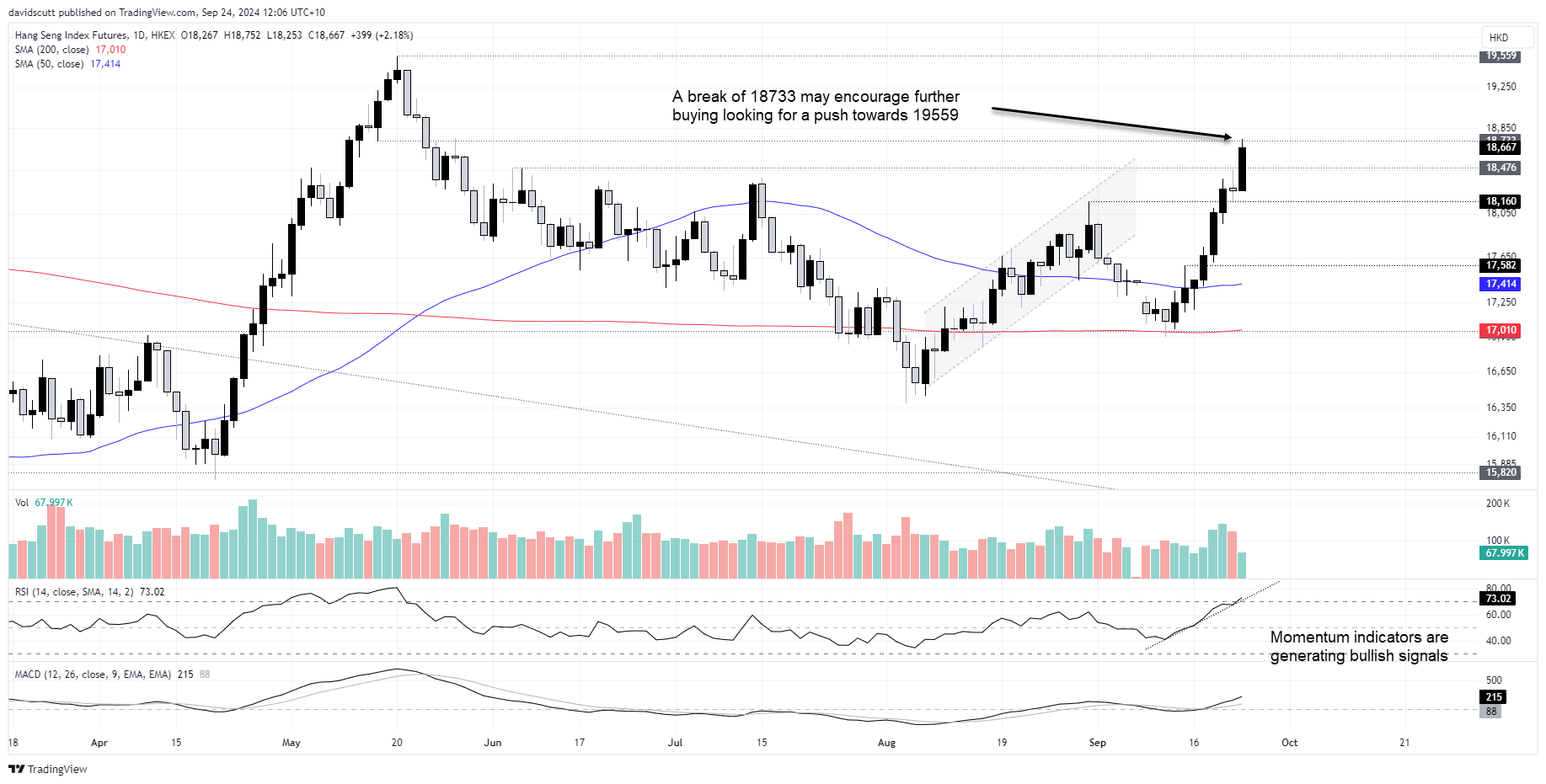

Hang Seng extends bullish run

Hong Kong’s Hang Seng has extended its bullish run on Tuesday, rallying briefly above resistance at 18733 before revering lower. With MACD and RSI (14) providing bullish signals on momentum, the bias is to buy dips near-term.

Support is located at 14476, 18160 and 17582. A clean break above 18733 may open the door for a push towards 19559.

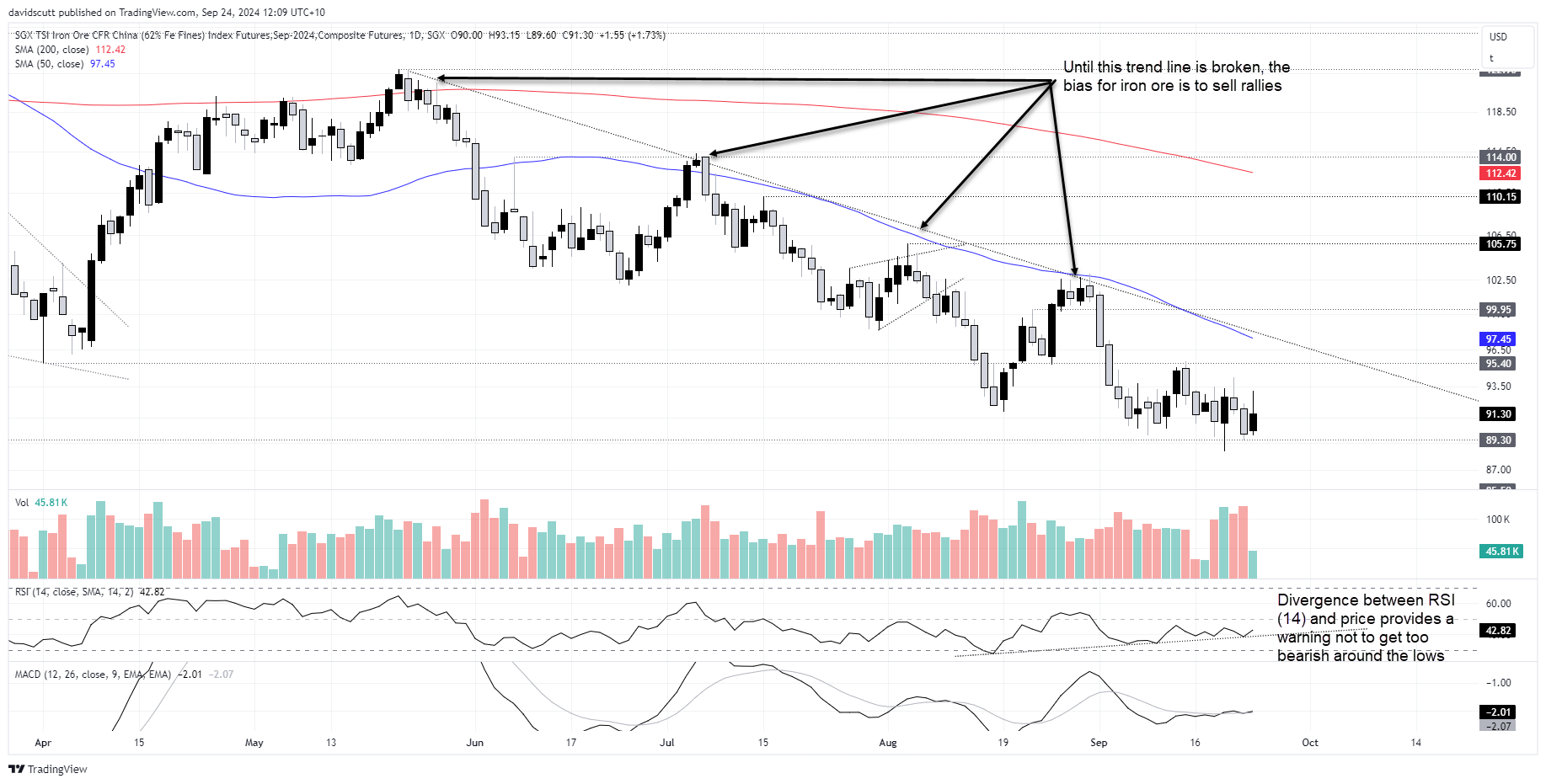

SGX iron ore remains heavy

Turning to the industrial metals space, SGX iron ore tried to rally on the announcements but has since reversed towards long-running support at $89.30. A decisive break below this level may bring a flush towards $85.50. On the topside, resistance is located at $95.40 with a far tougher test located just above with downtrend resistance accompanied by the 50-day moving average. If that zone were to be broken, the contract could squeeze up towards $99.95 or even $105.75.

Even though RSI (14) remains in an uptrend and is diverging from price, the bias remains to sell rallies until the downtrend is broken.

-- Written by David Scutt

Follow David on Twitter @scutty