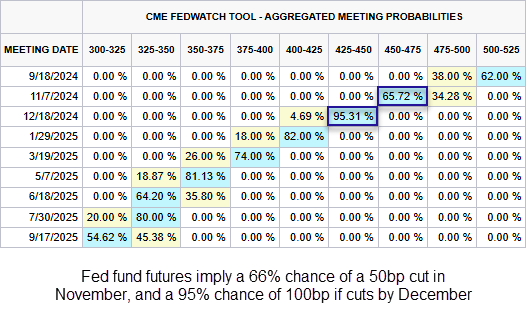

Bears are relishing any weakness from the US, looking at how markets responded to Tuesday’s data sets. Yet it is also making bullish investors increasingly concerned about a potential hard landing for the US economy. With ISM manufacturing, GDPnow and construction data all missing the mark, Fed fund futures are now implying a 95.3% chance of 100bp of cuts by December.

With just three meetings left this year, market pricing favours a 50bp cut to arrive in November, leaving the 25bp cuts for September and December. Incoming data remains all the more important for Fed expectations, and we have a decent amount of it to crunch through this week.

Job openings, job cuts and ADP payrolls provide a warm-up for Friday’s NFP. But the ISM services report also has the potential to reverse sentient (for the better) should it put in another surprise set of strong figures.

Key US economic data points to watch this week (times AEST)

Thursday:

- 00:00 - JOLTS job openings, durable goods, factory orders

- 02:00 - GDPnow (revised)

- 04:00 - Fed beige book

- 21:30 - Challenger job cuts

- 22:15 - ADP employment

- 22:30 - Jobless claims, nonfarm productivity, unit labour costs

- 23:45 – PMI composite, services (final)

Friday:

- 00:00 – ISM services

- 22:30 – Nonfarm payroll, unemployment, average earnings

With concerns of a hard landing on the rise, commodities and commodity FX are taking the hit alongside demand expectations. WTI crude fell to its lowest level since June 6, with its 2-day range spanning -8.5% and prices are now testing the $70 handle.

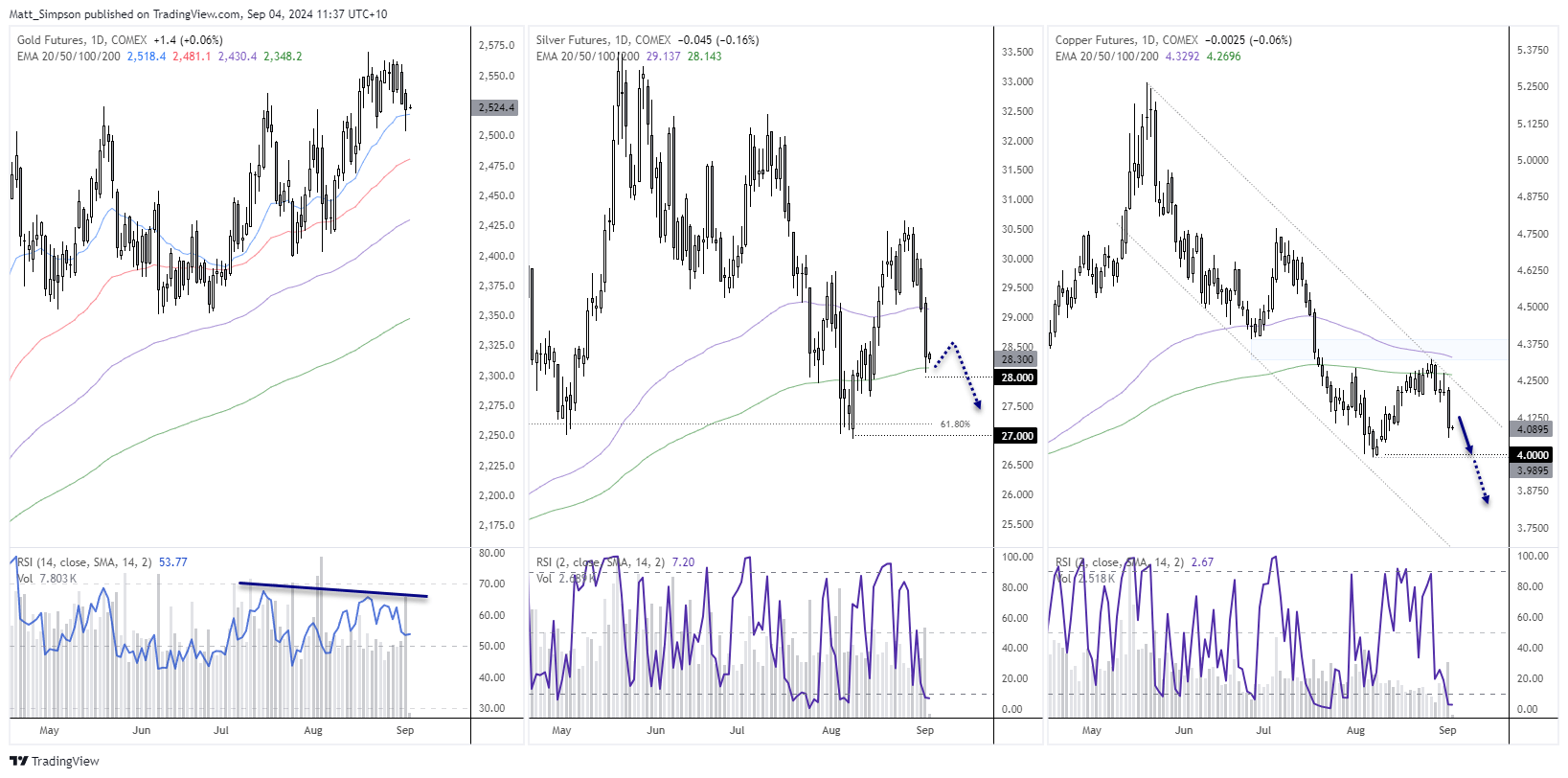

Gold, silver, copper technical analysis:

All three metals futures markets closed lower on increased trading volumes on Tuesday, which suggests bearish initiation. To see gold fall during a bout of risk-off suggests traders closed their holdings to nurse losses elsewhere (such as stocks).

Gold prices remain relatively well supported overall, and there is clearly some safe-haven aspect to factor in. But a bearish divergence is forming on the daily chart to suggest upside potential could be limited, even if safe-haven demand limits its downside. This may be a better market to seek intraday trades on.

Silver futures found support at their 200-day EMA and the $28handle. Beyond this, there is little going for bulls unless incoming US data picks up and fast. Silver therefore remains a pair for bears to consider fading into rallies in anticipation of a move back near the $27 lows.

Copper prices are in a clear downtrend on the daily chart, with a false break of the 200-day EMA marking an important swing high. Copper remains within a bearish channel on the daily chart and looks poised to head for $4. Whether it can break beneath it may come down to whether we see more headlines of ‘Chia buying’ to support the market. A break beneath the 3.98 low brings $3.75 into focus.

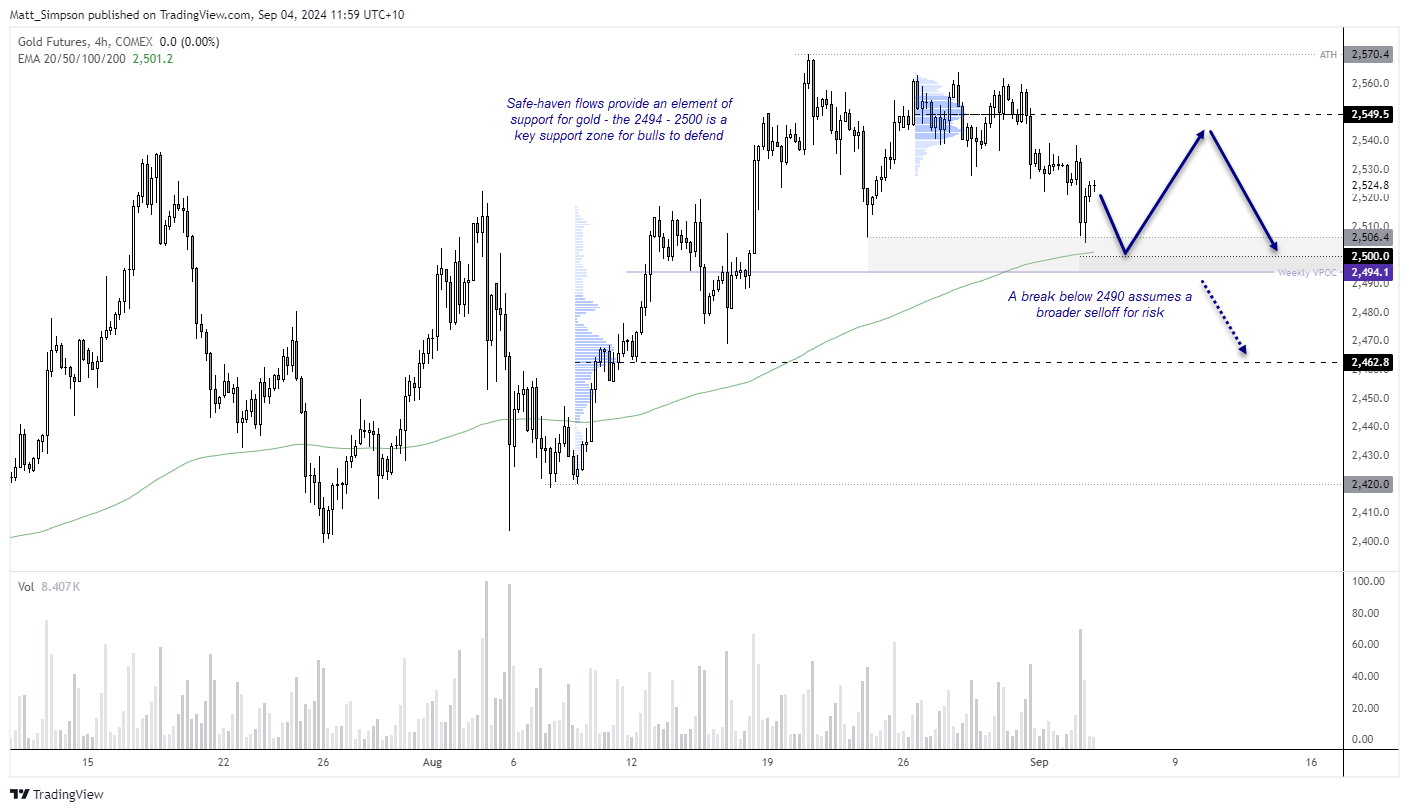

Gold technical analysis:

Gold may be down, it it does not seem to be out. Notice that prices tried but failed to drop all the way to $2500, and instead only managed a minor breach of the 2506.4 low. Even if prices do drop to 2500, the 200-bar average from on the 4-hour chart and weekly VPOC are nearby for potential support. And as gold is holding up relatively well compared with silver and copper, perhaps it is a market to consider buying the dip.

Yet as I suspect rallied will be capped, bulls could seek moves up to the 2540 to 2550 area. A break beneath 2490 assumes a deeper correction and a much broader selloff for risk.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge