Gold Key Points

- After a brief swoon back toward $2500 this morning, gold is once again trading near its record high at $2530.

- The latent risks of deficit spending in the world’s largest economy, even in times of relatively strong economic growth, has stoked interest in alternative stores of value like gold.

- A clean breakout to new record highs above $2530 would set the stage for a potentially strong continuation toward the upper-$2500s heading into the fall.

It’s been an interesting day amidst an interest month for gold.

The yellow metal briefly shed $20 on the release of this morning’s bigger-than-expected upward revision to Q2 GDP – ostensibly on the idea that the stronger US economy could keep the Fed from cutting interest rates as aggressively as some traders expected – but dip buyers have stepped in aggressively to push gold back toward its record high near $2530 as of writing.

One catalyst supporting gold prices is Fitch’s update to the US credit rating. The ratings agency affirmed the country’s AA+ credit rating, but also forecast that the US fiscal deficit would average 8% over the next three years. The latent risks of deficit spending in the world’s largest economy, even in times of relatively strong economic growth, has stoked interest in alternative stores of value like gold.

More broadly, the yellow metal has weathered the early-August panic well and continues to consolidate near record highs, potentially setting the stage for another leg higher if/when gold breaks out of its 2-week consolidation. Now, gold traders are looking ahead to Core PCE (tomorrow) and the Non-Farm Payrolls report (next Friday) to dial in the expected scale of Fed easing in the coming months.

Gold Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX

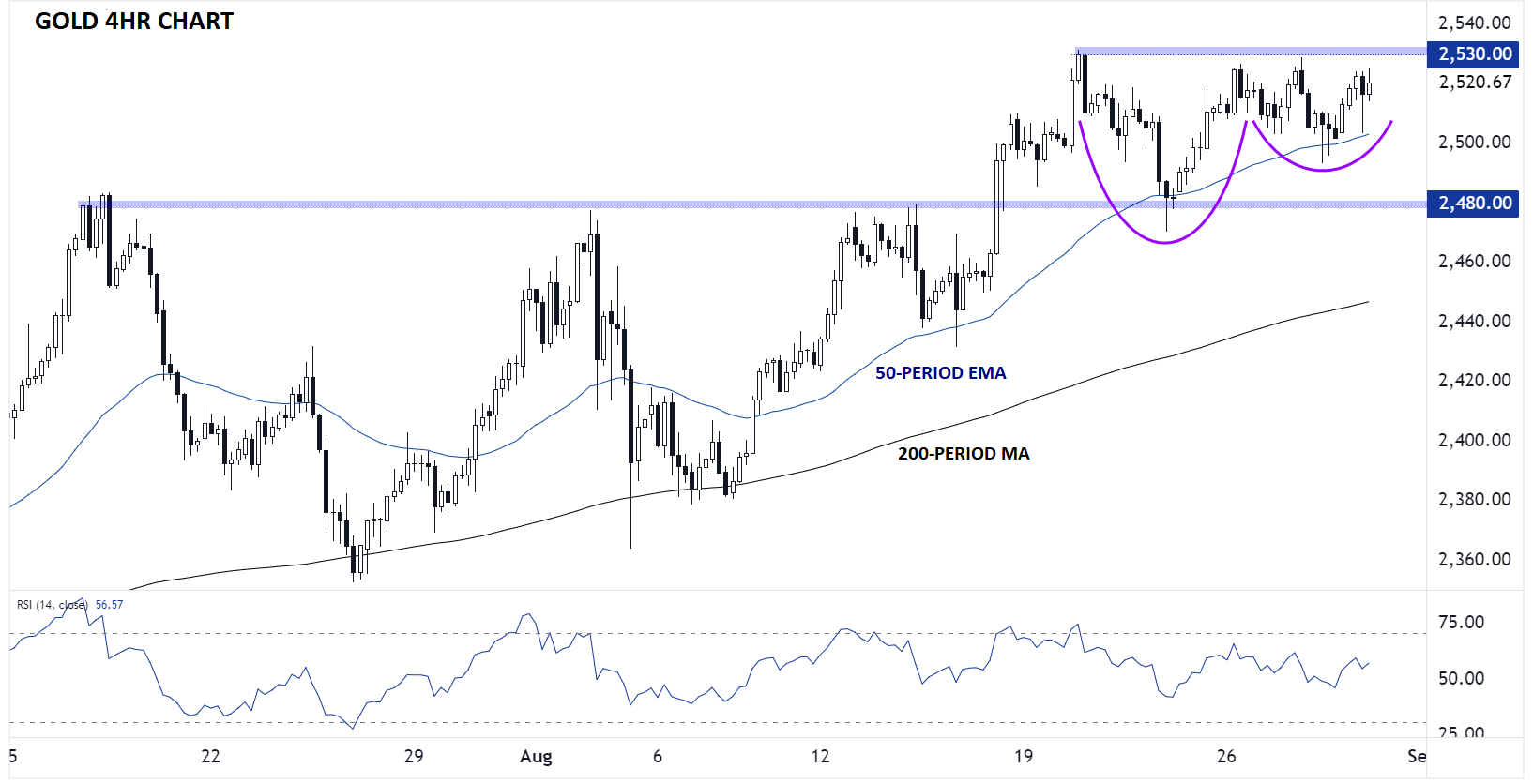

Looking at the 4-hour chart, Gold’s recent consolidation pattern comes into focus. The precious metal is forming a potential Cup-and-Handle pattern over the last two weeks, showing strong buying pressure on any near-term dips.

As noted above, a clean breakout to new record highs above $2530 would set the stage for a potentially strong continuation toward the upper-$2500s heading into the fall.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX