Gold and silver have been on the rise in the last couple of days, recovering from weakness earlier in the week. Once again, gold has risen alongside equity markets, suggesting the recovery is not entirely driven by haven flows amid uncertainty surrounding the upcoming French snap elections, which appears to have only impacted the local stock and bond, as well as regional, markets. That said, the election uncertainty has without a doubt helped to keep gold supported at least partially. In any event, our gold forecast remains bullish insofar as the long-term outlook is concerned.

French election uncertainty boost gold forecast

The first round of French parliamentary election is occurring this Sunday and the full extent of Marine Le Pen's National Rally party’s progress will likely be known after the run-offs on July 7. Recent polls indicate that the far-right RN party is still leading. French newspaper Les Echos on Friday revealed a poll that shows RN might win as much as 37% of the popular vote. It was up two percentage points from the last publication of the poll, compiled by OpinionWay a week ago. Meanwhile, Macron's centrist bloc, Together, was down 2 percentage points to 20%, while the New Popular Front leftwing alliance was seen reaching 28% of the vote. This election uncertainty has positively influenced the gold forecast.

Key US data on tap: Core PCE impact on XAUUSD forecast

Meanwhile, as far as today’s session is concerned, we have an important piece of data coming up, namely the May core PCE Price Index. This is expected to have risen by 0.1% month-on-month compared to a rise of 0.2% the month before. On a year-over-year basis, it is seen printing +2.6% for May, down from +2.8% y/y in April. If the actual data turns out to be weaker, then that could send bond yields lower, which in turn should help to boost the appeal of low- and zero-yielding assets like gold.

Upcoming US NFP and CPI: Gold forecast implications

More US economic data is to come in the next couple of weeks, with the June non-farm jobs report due on Friday of next week, followed by the CPI report on July 11.

Ahead of these data releases, the US dollar index was marginally higher on the week, on course to finish higher for the fourth consecutive week – unless the PCE data comes in weaker or otherwise the dollar falls later on in the day. It is worth pointing out that the greenback has become investors’ preferred FX hedge against political uncertainty in Europe. Currencies like the Japanese yen and Swiss franc, which have historically been the preference, have been hurt by dovish central banks in their respective countries. This dynamic also affects the gold forecast.

Gold forecast: XAUUSD technical analysis

Source: TradingView.com

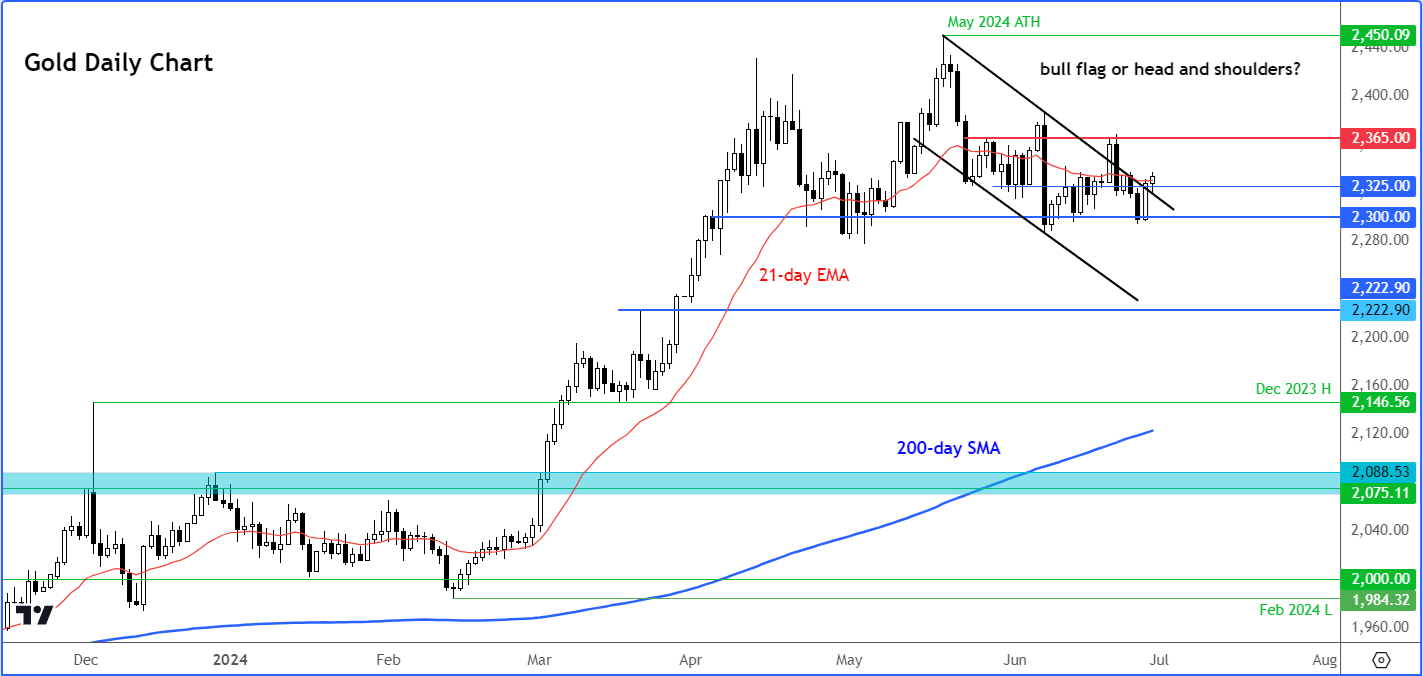

The higher highs and higher lows on gold chart remain intact, although there are some concerns about the recent loss of bullish momentum. But if the consolidation has done one thing is that it has allowed the Relative Strength Index (RSI) to work off its ‘overbought’ conditions on multiple time frames, including the long-term charts like the weekly and monthly. Given the minimal pullback from the all-time highs, this has been achieved mainly through time, than price action, which is always a bullish sign.

Therefore, the potential head and shoulders formation that you may be able to observe on the daily time frame could be a bear trap and, in any event, may not breakdown the pattern’s neckline around the key $2300 support area.

In fact, one could argue that gold is consolidating inside a bull flag continuation pattern and in the last couple of days it has started to threaten a breakout. So, the bears will have to exert significant pressure here to turn the tide meaningfully in their favour.

The bulls have pushed gold prices above short-term resistance at $2325. The next level of potential resistance comes in around the $2365 area. If we see a move above this level, then that would provide the clearest signal yet that the bull trend has indeed resumed.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R