Gold Key Takeaways

- There are early signs that Trump 2.0 tariff policies may be less aggressive than feared.

- Gold is benefiting more from the dollar’s decline than a fading desire for safe haven assets.

- Gold buyers may now be turning their eyes upward for a retest of the record highs near $2790 in the coming days, if not a breakout to $2800+.

We’re just over 24 hours into President Donald Trump’s second term as US president, and traders are still trying to remember how to navigate the relentless stream of headlines that drive markets under the real-estate-mogul-turned-politician.

To boil it down simply, traders are focused on the potential for aggressive tariffs and a potential trade war first and foremost, and on that front, there are early signs that Trump 2.0 trade policies may be less aggressive than feared.

The President refrained from issuing new tariffs on “Day 1” despite campaign promises, and the wording of today’s much-ballyhooed threat of 25% tariffs on Mexico and Canada starting February 1 was less emphatic than many had come to expect from Trump (“We are thinking in terms of 25 percent on Mexico and Canada…”).

In any event, the mere fact that he’s singling out a couple countries for targeted threats suggests that a universal, across-the-board tariff on all imports to the US is still a way off, if even on the table at all. The apparently gradual approach to tariffs has weighed on the US dollar (the weakest major currency so far this week) and boosted risk assets, with US indices making another run toward record highs.

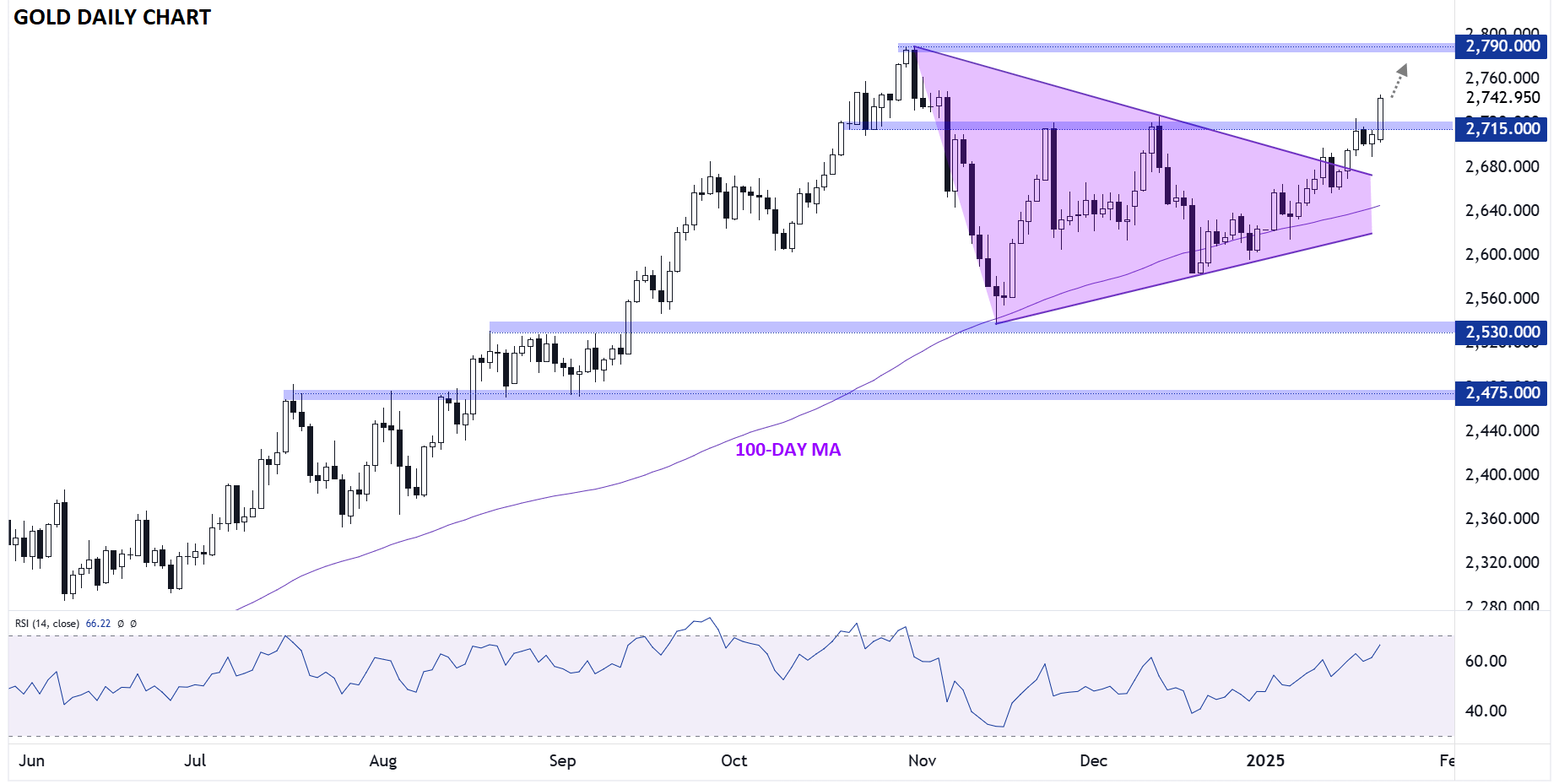

Gold Technical Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX.

Meanwhile, gold appears to be benefiting more from the dollar’s decline than the fading desire for safe haven assets. As the chart above shows, the yellow metal has broken definitively above horizontal resistance in the $2715-20 area to hit its highest level in 2.5 months.

Following the bullish breakout from the November-December symmetrical triangle pattern, gold buyers may now be turning their eyes upward for a retest of the record highs near $2790 in the coming days, if not a breakout to $2800+.

Conversely, a reversal back below the key $2715 would call the near-term bullish bias into question and potentially open the door for a move back down toward the 100-day MA near $2650.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX