Today’s release of the US PPI report was weaker than expected and we saw an immediate drop in the dollar in response. This helped to lift gold off its lows, with the metal having risen sharply in the previous day amid renewed weakness in bond yields. There is the potential for gold to move sharply in response to this week’s CPI inflation data from the US should we see a sharp deviation from expectations. We maintain a bullish gold forecast ahead of the CPI release.

Softer us PPI adds pressure to the dollar

The latest US Producer Price Index (PPI) numbers have come in softer than anticipated, with the headline figure inching up by just 0.1% month-on-month, below the expected 0.2%. Meanwhile, core PPI remained flat, undershooting the forecast of a 0.2% rise. On a year-over-year basis, PPI growth slowed to 2.2%, down from the revised 2.7% of the previous month and slightly below the expected 2.3%. This weaker-than-expected PPI report has contributed to a mild softening of the US dollar across the board, helping to lift gold off its earlier lows.

All eyes on us inflation and retail data

With the US economy already digesting a disappointing jobs report and lacklustre ISM manufacturing PMI a couple of weeks ago, today’s weaker PPI adds another layer of uncertainty for the dollar. The upcoming Consumer Price Index (CPI) measure of inflation on Wednesday could be a critical turning point. Should the CPI also come in weaker than expected, it could further erode the dollar's yield advantage, potentially giving a boost to assets like gold.

Economists are predicting a 0.2% month-on-month rise in both headline and core CPI figures. However, if the CPI figures exceed expectations, it could challenge the market's assumption of an accelerated pace of rate cuts by the Federal Reserve. On the other hand, if CPI aligns with the softer PPI trend, market confidence in the prospect of roughly 100 basis points of rate cuts in 2024 could grow, applying additional downward pressure on the dollar.

Beyond inflation, the focus will shift to US activity data later this week, including July retail sales figures on Thursday. Reports from major retailers like Walmart and Home Depot will also be closely watched for clues about the health of US consumer spending. Analysts are bracing for weak data, and if their forecasts prove accurate, the dollar could face further challenges as concerns mount over the impact of tight monetary policy on consumption.

Gold forecast: Technical analysis and trade ideas

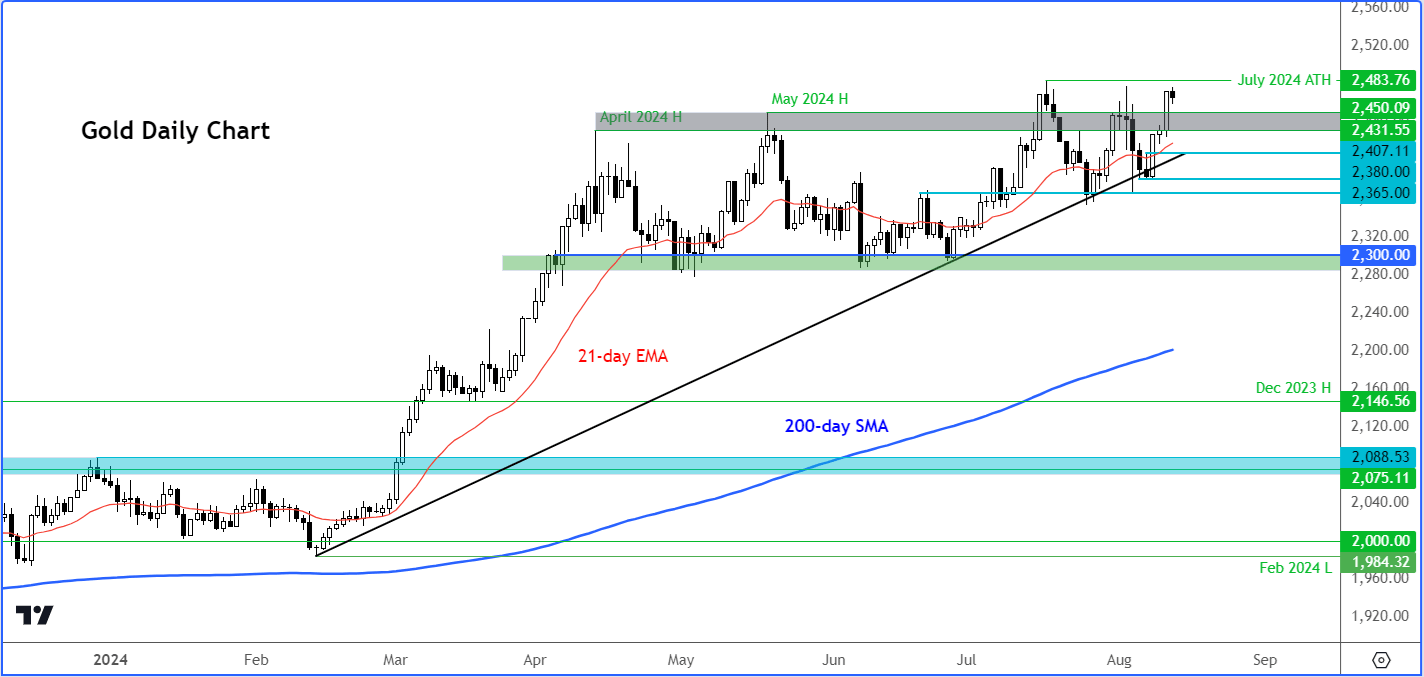

Source: TradingView.com

There is no doubt that the trend on gold chart is bullish. A quick glance at the daily chart of gold shows higher highs and higher lows, upward-sloping moving averages and bullish trend lines. Therefore, there is not much for the bears to work with yet. Indeed, with gold now breaking back above the shaded grey area on the chart, between $2431 to £2450, where it had found resistance back in April and May, there is an increased probability we could see a continuation to the upside from here. With July’s record high of $2483 within a spitting distance away from here, we could easily see gold surge to $2500 from here, if not higher. So, the technical gold forecast remains bullish.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R