Gold prices retreated sharply after hitting a record high earlier. Did we just see a near-term top in gold prices, or was this yet another trap for gold traders speculating on lower prices? While uncertainty surrounding the upcoming US election should, in theory, be supportive of gold, we haven't seen many new bullish catalysts lately. If anything, the big rally in the US dollar is a massive bearish sign for gold, while rising bond yields should also be increasing the opportunity cost of holding zero-interest-bearing assets like precious metals. Yet gold has been able to climb to new all-time highs repeatedly in recent days. But did it just form a near-term top to turn the short-term gold forecast bearish?

Bond yields and US dollar undermine gold forecast

So much has been made of the recent upsurge in bond yields, yet gold traders were looking through it until now. The US 10-year bond yield is holding firm above 4% at 4.22%, while the dollar is once again on the rise against all major currencies, most notably the yen at 153.00. Both have been buoyed by expectations that the Federal Reserve will slow its pace of rate cuts. With no major US economic data on the docket today, don’t expect yields or the dollar to weaken significantly. If yields stay elevated, this could influence the short-term gold forecast negatively.

No further escalation in the Middle East conflict

We haven’t seen any significant escalation in the Middle East conflict. Oil prices tumbled last week after Israel said it isn’t planning to target Iran’s oil and nuclear facilities. This decline in oil prices has, in turn, reduced gold's haven appeal for now.

China’s disappointment also weighing on gold

Finally, there’s China, the world’s largest consumer of gold. Its latest stimulus measures initially provided some hope for commodity prices when they were announced in late September, but there’s growing uncertainty about whether they’ll be enough to get GDP growth back to the 5% target. Last week, China’s Finance Ministry didn't provide the key details, like the size or timing of these measures, leaving the market with more questions than answers. This has raised doubts about the stimulus’s potential impact, especially given China’s current economic challenges. As a result, Chinese stocks and China-linked asset prices, like copper, have fallen. And now gold is potentially showing some delayed response to this factor.

Technical gold forecast: XAU/USD retreating from severely overbought levels

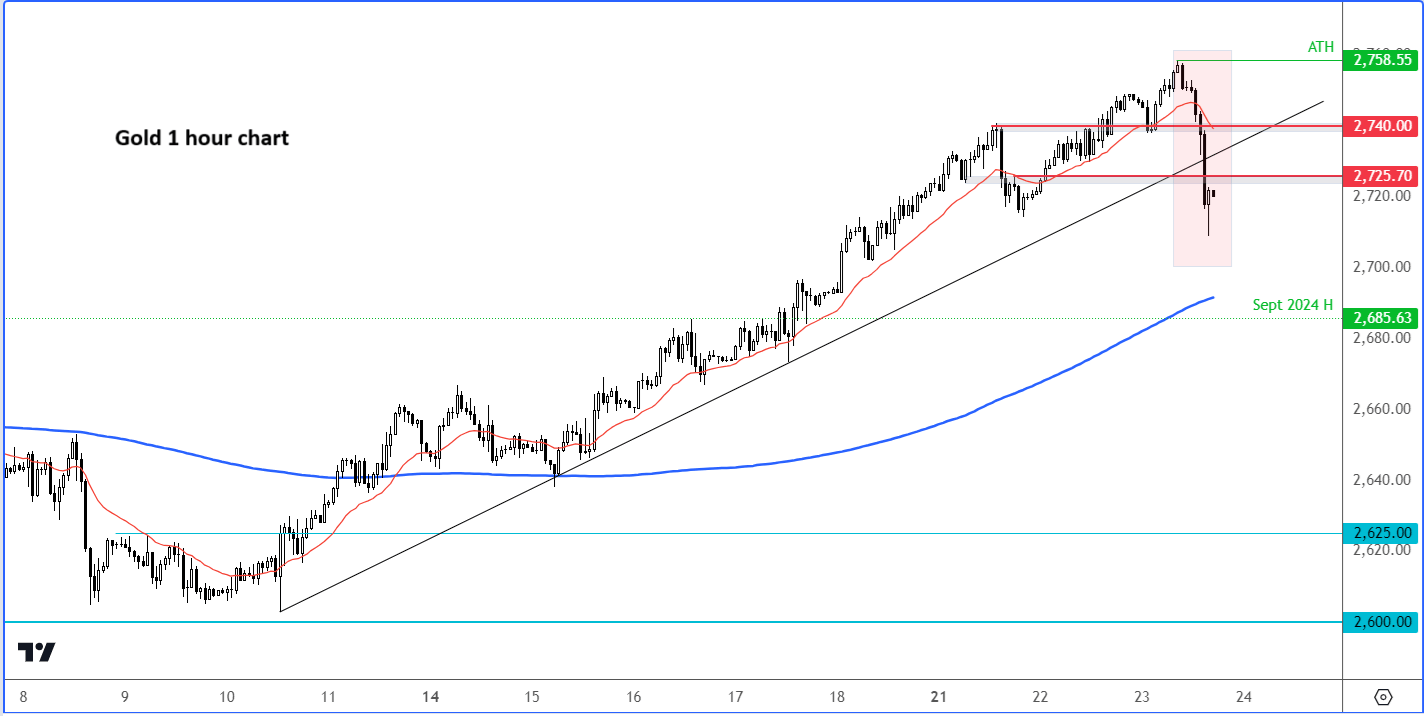

There's been some interesting price action on the gold chart today. After hitting a fresh record high, it lost its earlier momentum, before slumping. The selling was largely due to rising bond yields and a stronger US dollar. Despite those headwinds, gold had been pushing higher lately, but it's now running into some resistance. Could this be the top for gold? Well, we haven’t had confirmation yet.

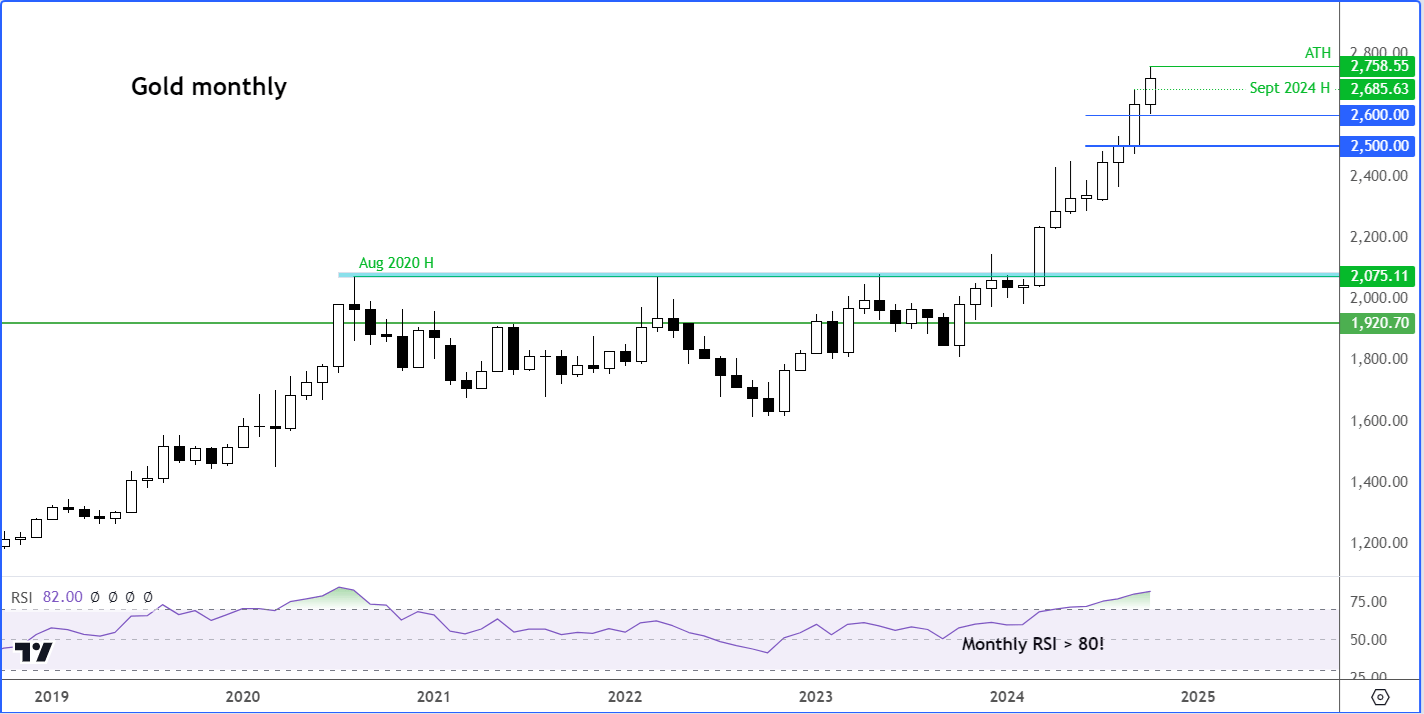

If you zoom out and look at the long-term charts, especially the monthly, it's been moving steadily upward. The RSI climbing to 80-85 area is definitely something to watch. When we do see a reversal on the daily or lower timeframes, we could be in for a sharp correction, similar to what happened back in August 2020, when an overbought RSI around similar levels signalled several months of price drops and consolidation before the gold price finally bottomed out.

Now, if you check the hourly chart, you’ll see gold has broken a bullish trendline that’s been holding since the rally started on October 10th. It's already made a lower low. Does this mean gold has turned? Maybe—but we’ll need a daily close to really know. As long as it stays below short-term resistance at $2725 and ideally yesterday’s low of $2719, the short-term outlook leans to the downside. But if it moves back above this area, we could be looking at yet another failed bearish attempt.

Watch today’s close to confirm whether we have seen a clear reversal in gold.

Source for all charts: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R