Key Events:

- GBPUSD records a fresh 2024 high at 1.3450

- UK Flash Manufacturing and Services PMIs decline in August

- US Dollar Index retests July 2023 lows

- Technical Analysis: GBPUSD

UK Economic Metrics:

- UK CPI y/y stabilized at 2.2% in August, close to the BOE’s target

- UK GDP m/m recorded 0% growth, signaling concerns over the country’s economic growth trajectory.

- UK Claimant Count Change dropped from 2024 highs in August but remains up 0.4% for the year.

- UK Flash Manufacturing PMI fell from 52.5 to 51.5, while Services PMI dropped from 53.7 to 52.8, suggesting cooling inflationary pressures.

According to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, the latest PMI data hints at a potential "soft landing" for the UK economy. With services inflation declining to its lowest point since February 2021, the Bank of England may be more inclined towards further rate cuts before the end of 2024.

Technical Outlook

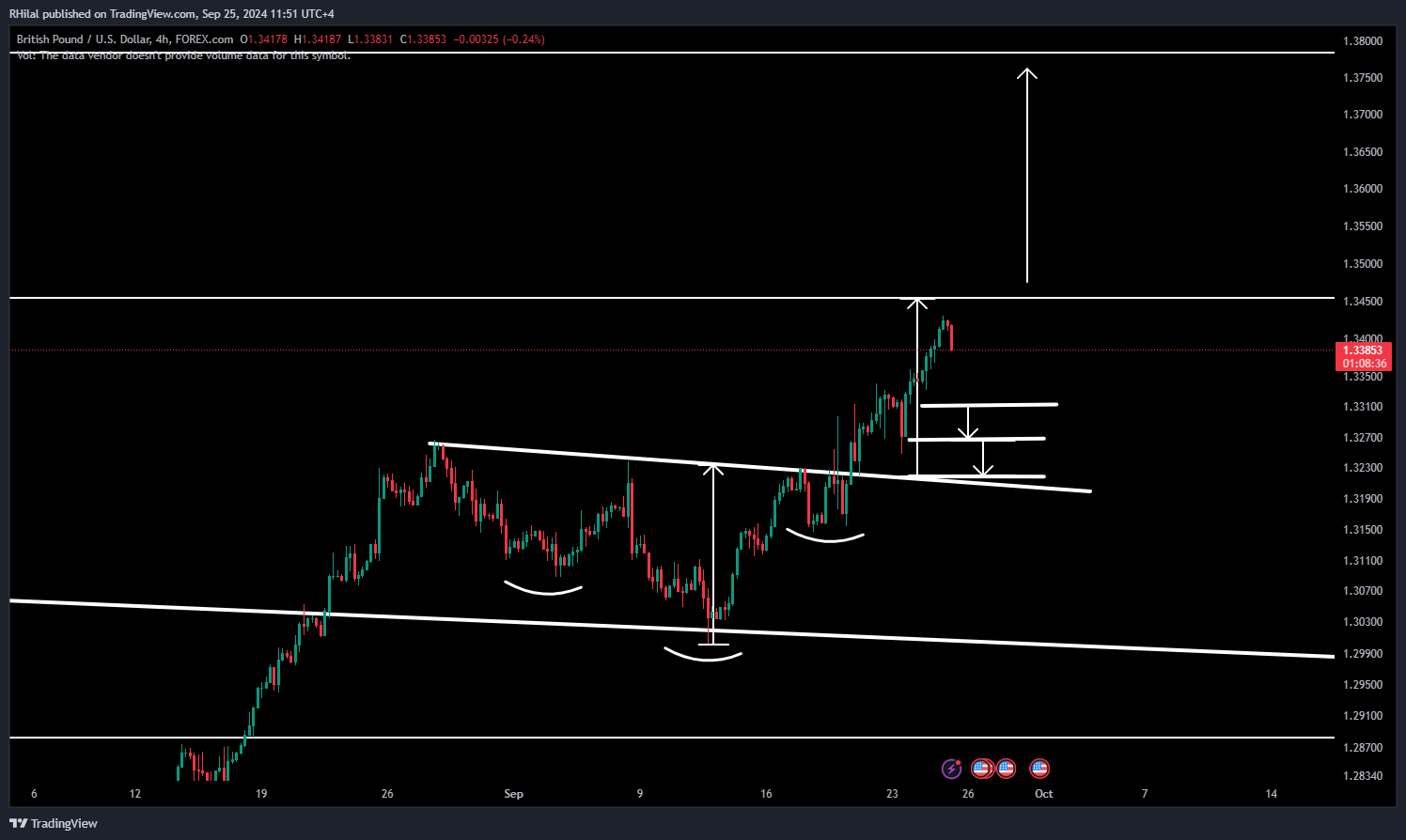

GBPUSD Outlook: 4H Time Frame – Log Scale

Source: Tradingview

On the 4-hour chart, GBPUSD formed a bullish continuation pattern (inverted head and shoulders) below the 1.3260 high between August and September. The breakout beyond the pattern led the GBPUSD towards the 1.3430 high, supported by a weak US dollar.

Potential pullbacks could see support at levels 1.33, 1.3260, and 1.32.

From the upside:

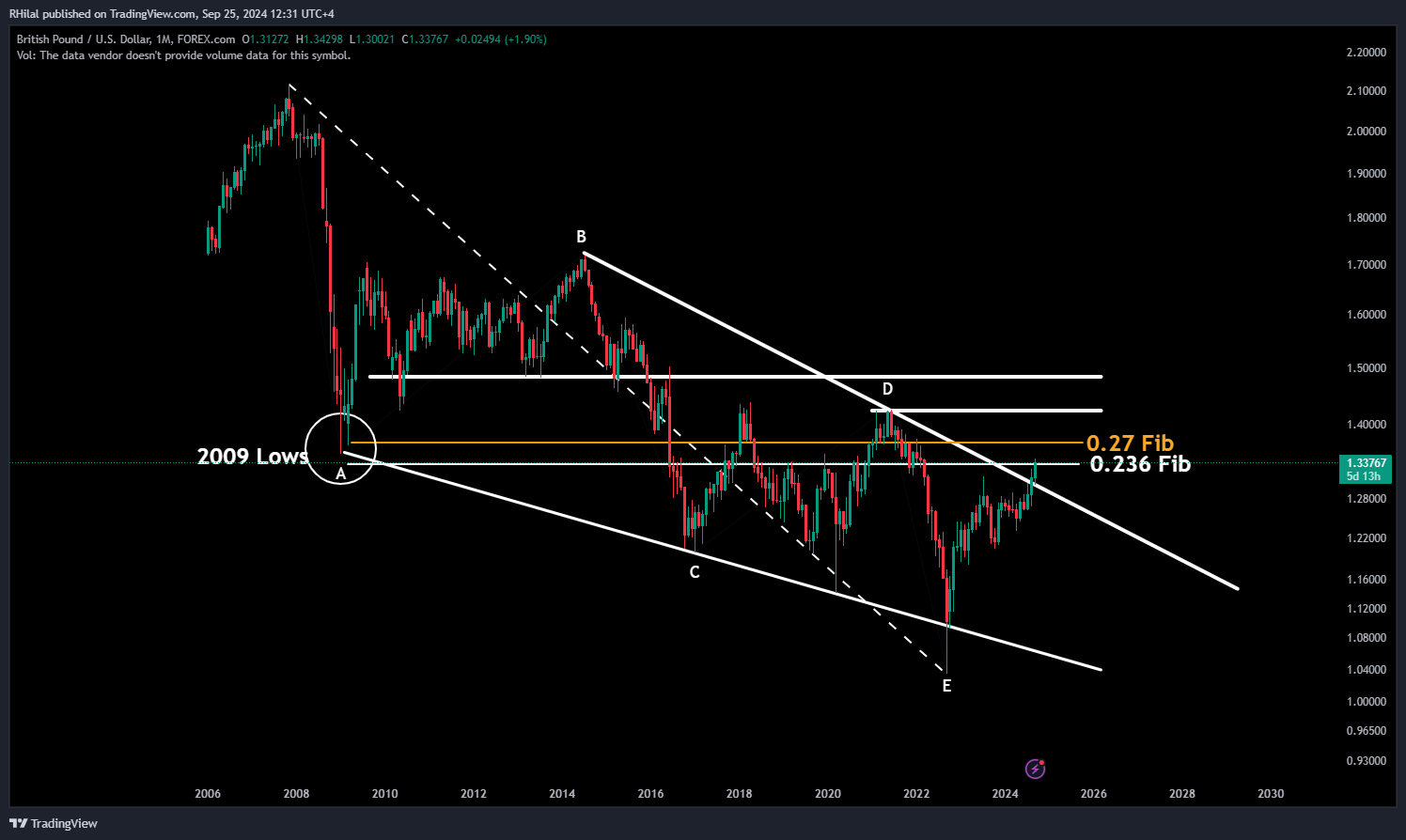

GBPUSD Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

On the monthly time frame, GBPUSD has broken out above its 15-year consolidation and is now nearing the 2009 lows, which coincide with key Fibonacci retracement levels (0.236 and 0.272) of the downtrend from the 2007 high (2.11) to the 2022 low (1.10), around the 1.34 zone.

Further resistance is expected between the 1.37-1.38 range, followed by the 2021 highs near 1.4250.

--- Written by Razan Hilal, CMT – on X: @Rh_waves