Key Events

- GBPUSD Breaks 10-Year Trendline: Amplifying bullish sentiment

- Gold Nears Record Highs: Awaiting the next push for further gains

- Cautious BOE Outlook: Concerns over the UK labor market

- Dovish Fed Outlook: US labor market seen as needing support

Recap from the Jackson Hole Symposium:

- Fed's Perspective: A weak US labor market is prompting the need for easing monetary policies, with no preference for further weakening

- BOE's Perspective: Despite shocks to the labor market, more restrictive policies may still be necessary

A cautious BOE and a dovish Fed are supporting GBPUSD's upward momentum beyond key chart levels.

Technical Outlook

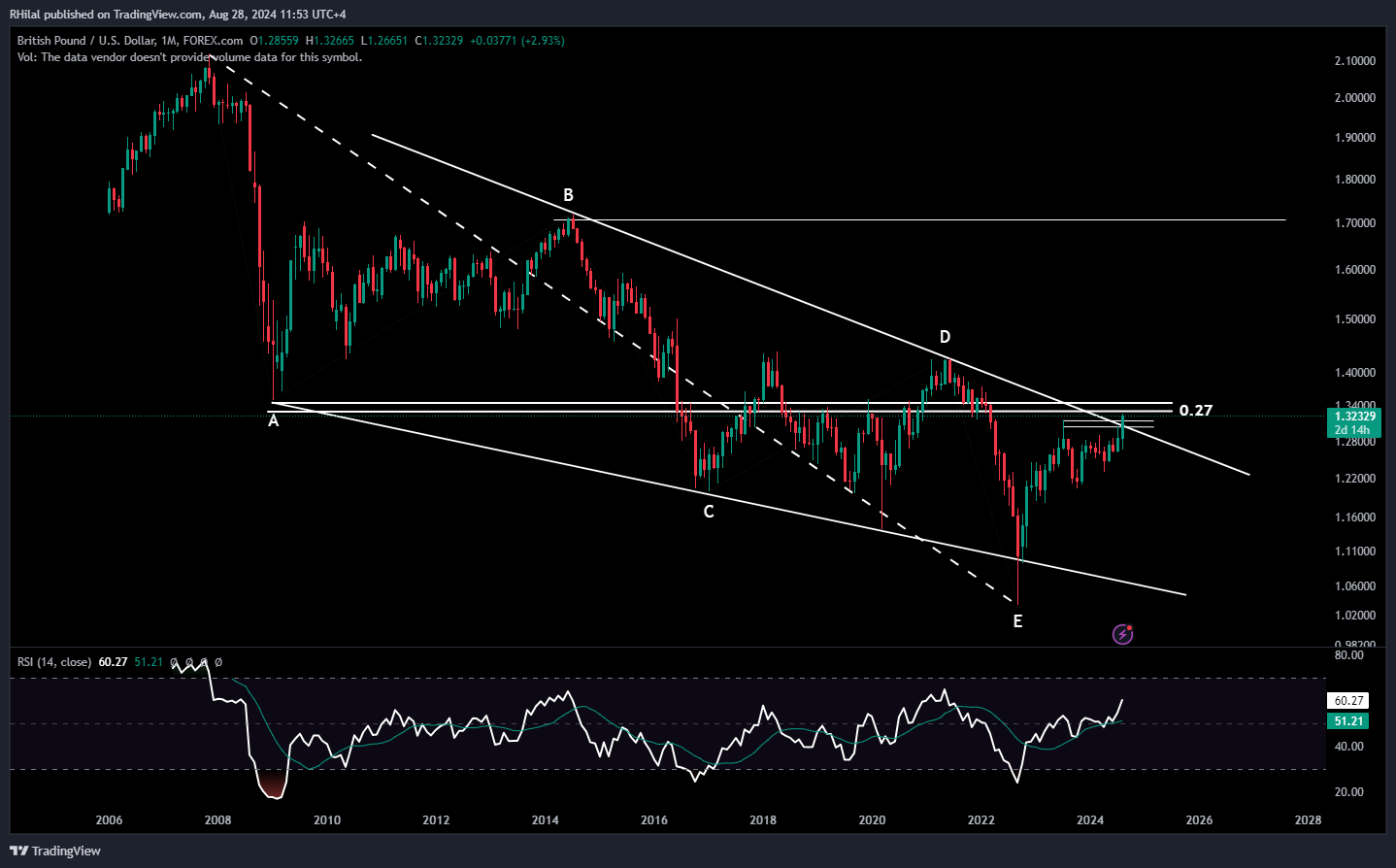

GBPUSD Outlook: GBPUSD – Monthly Time Frame – Log Scale

Source: Tradingview

The GBPUSD has broken through a long-term consolidation range that extended from 2009 to 2024, surpassing the trendline connecting the lower highs of July 2014 and May 2021.

From a Fibonacci retracement perspective, based on the 2007 high and 2022 low, the pair is currently hovering near the first Fibonacci level of 0.236 at the 1.33 resistance, with the next target at the 0.272 level, aligning with the 2009 low at the 1.35 barrier.

Any pullbacks from these resistance levels may find support at the 1.31 and 1.30 zones before continuing the bullish breakout, potentially turning the 10-year resistance into a supportive ground for the pound's uptrend.

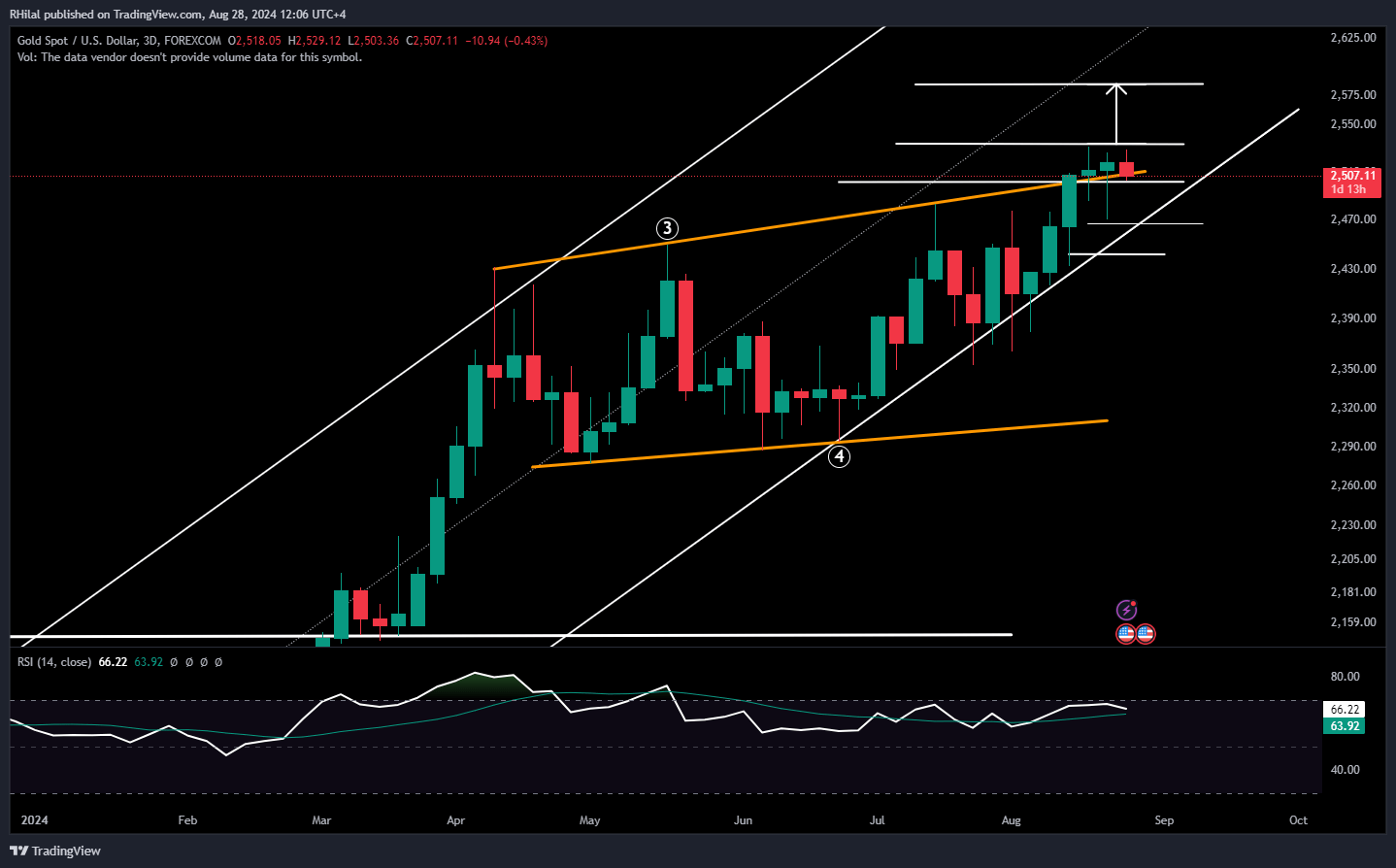

Gold Outlook: XAUUSD – 3 Day Time Frame – Log Scale

Source: Tradingview

Gold is respecting the borders of its primary uptrend, with the 2530 resistance level in focus. Recent price action has shown bullish momentum, with the previous 3 day candle forming a lower wick, indicating the bears’ inability to control the trend, while the close remained near the candle's upper end.

Amid ongoing geopolitical tensions, the haven demand continues to underpin gold's bullish trend. The 2530 level serves as a key barrier before a potential breakout towards the next target at 2580.

Corrections are likely to be supported near August 2024 lows around the 2470 zone, and in more extreme cases, near May 2024 highs at the 2440 zone.

--- Written by Razan Hilal, CMT – on X: @Rh_waves