Market update: It has been an overall risk-on day, with US indices rising and Nvidia hitting new record highs, before the latter eased off its best levels to turn lower, following its earnings release. Gold and oil rose further as geopolitical tensions remained in the spotlight, while Bitcoin hit fresh records as it closed in on $100K, boosted by optimism that Trump’s election victory will mean crypto-friendly policies. In the FX space, the yen was also bid, supported by some hawkish remarks from the BoJ governor, implying a rate hike was not off the table in December. Elsewhere, the EUR/USD broke below the 1.05 handle amid hawkish repricing of US rates and ongoing concerns over Eurozone economy, while the GBP/USD slipped near the 1.26 level, potentially on the verge of breaking further lower. The GBP/USD outlook thus remains bearish.

US dollar extends advance

US rates have continued to price in lower rate cuts, and the market is no longer fully expecting a cut in December. According to the CME FedWatch tool, traders are 60% sure a cut is on the way in December, before the Fed pauses until at least March, when the odds of another 25 bps cut has shrunk to less than 50% now. Those odds were boosted by the release of stronger jobs claims data today.

Against this backdrop, the US dollar has maintained its strength heading into the European close, despite a brief wobble in stock markets after the Wall Street open. The escalation in the Russia-Ukraine conflict has had a limited impact on FX markets, but the fact that the euro is weakening is perhaps a reflection of those risks.

GBP/USD: Pound remains on the back foot

Meanwhile, from the UK side of things, we haven’t had much in the way of fresh data, although the fact that public sector net borrowing surged to 17.4 billion from 16.1 billion, disappointed expectations for a smaller deficit last month. The GBP/USD outlook therefor remains bearish, and we would expect it to move below 1.26 handle.

Yesterday, UK's higher-than-expected inflation data likely ruled out a December rate cut by the Bank of England, but the GBP/USD fell anyway. It is always the market’s response to news that is more important than the news itself. And this couldn’t be truer for the cable.

The pound drew attention yesterday as UK CPI data exceeded expectations for October, rising to 2.3% from 1.7%, surpassing forecasts of +2.2% y/y. Core CPI was even hotter at 3.3%. However, traders quickly sold the initial GBP/USD rally, acknowledging that the Bank of England remains primarily focused on services inflation, where a modest rise to 5.0% y/y aligns with their forecasts.

After the latest CPI data, it seems unlikely that the BoE will take further action in December. However, additional easing could occur in early 2025, potentially in February, as economic conditions may warrant looser policy.

Thus, the GBP/USD outlook remains bearish, with modest selling pressure expected until the dollar tops out.

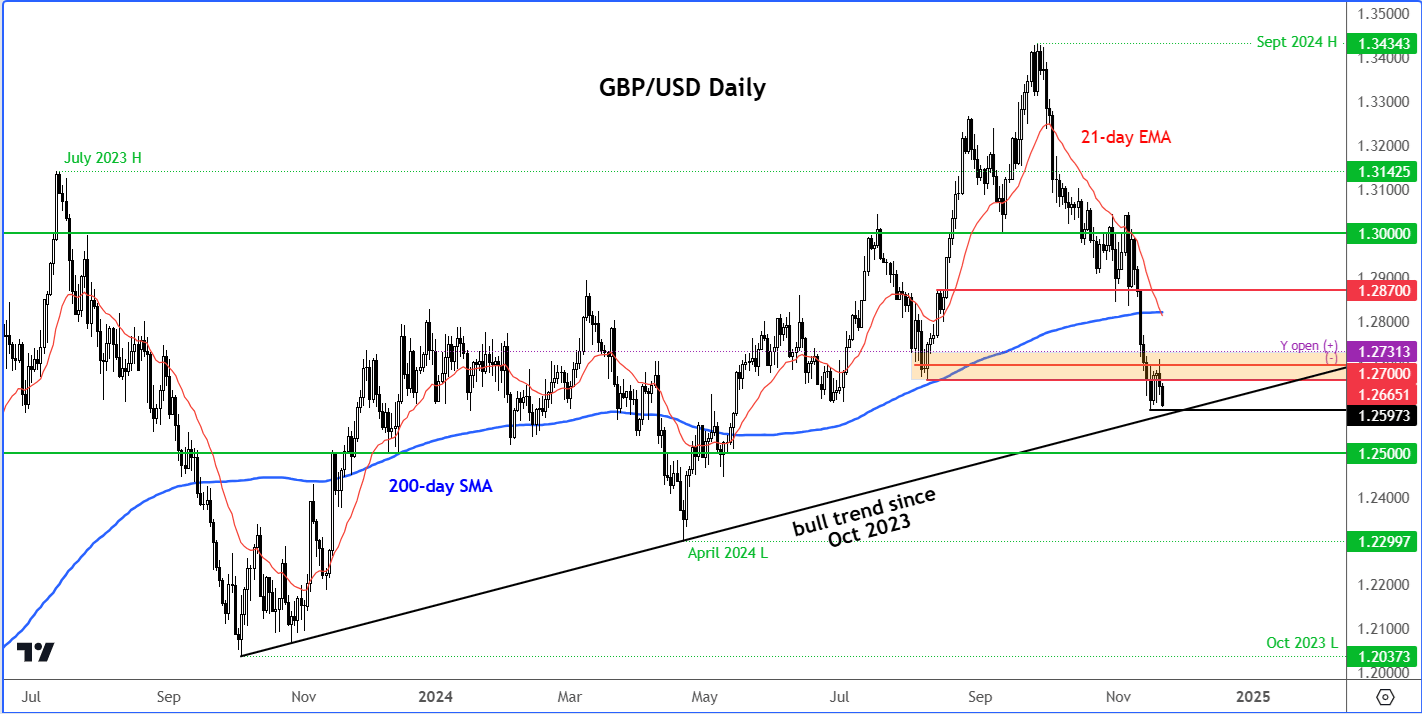

Technical GBP/USD outlook: key levels to watch

Source: TradingView.com

From a technical standpoint, the GBP/USD outlook remains unambiguously bearish. Resistance between 1.2665 and 1.2731 has been tested and held firm this week. A breakout above this range is required to tilt the balance in favour of the bulls, but we have seen the opposite.

Support has been evident around the 1.2580 to 1.2600 zone, where a trend line dating back to October 2023 intersects. However, given the nature of price action in recent days, a break below here appears increasingly likely. A breach of this trend line could pave the way for a decline to the $1.25 level.

Meanwhile, the RSI nearing oversold levels of 30.0 warrants attention. While this does not guarantee a rebound, it increases the likelihood of one occurring soon. But a reversal stick must be seen first before we start talking bullishly about the GBP/USD outlook.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R