The major currency pairs such as the GBP/USD, EUR/USD and USD/JPY could all be on the verge of a sharper dollar-driven move in the week ahead, even if economic data is on the lighter side. Rising US unemployment and cooling inflation has seen investors grow confident in pricing in at least a 25-basis point rate cut for September. At the upcoming Jackson Hole symposium, the Fed Chair could finally provide a clear signal that they will indeed cut rates. Meanwhile, the upcoming PMI data on Thursday could provide some volatility for the like of the pound and euro. Growth concerns, strong wages and high inflation in the services sector continue to pose a headache for the ECB, while a split BoE has left traders unsure about the UK central bank’s next steps, who like the ECB, are wary of services inflation not easing fast enough. The recent recovery means the medium-term GBP/USD forecast remains bullish after a 4-week decline had the bulls sweating a little.

GBP/USD forecast: Dollar eases back despite retail sales beat

In the week ahead, the economic calendar is quieter. Aside from the global PMIs on Thursday, we don’t have much else that could drastically move asset prices. So, it could be a long wait until we potentially hear something meaningful from the Fed and other central bank officials at the week’s marquee event: the Jackson Hole symposium on Friday. The latest US retail sales data released on Thursday was a fair bit stronger than expected, but this only provided a short-term boost to the dollar. By the mid-session on Friday, the greenback had lost those gains. This was partly because the market knows the Fed’s attention is turning to employment. The US central bank is no longer just focused on getting inflation back under control as it once was. As the disinflationary trend continues, the rising unemployment rate, now at 4.3%, is already well above the Fed's year-end target. Dollar traders are therefore more focused on employment data than other indicators, which explains the dollar's difficulty in sustaining its gains from strong retail sales.

Looking ahead: Jackson Hole Symposium is key event bar PMIs next week

As previously noted, the upcoming week looks relatively calm on the economic front. The spotlight, however, will be on Friday's Economic Policy Symposium in Jackson Hole, Wyoming.

The only other notable event is the global PMIs mid-week.

When it comes to US PMIs, all eyes will be on services inflation and any signs of ongoing deceleration. A gradual slowdown would bolster the soft-landing narrative, but weaker-than-expected data—whether it be in headline numbers, new orders, prices, or employment—could spark a sell-off in the dollar as markets begin speculating on potential Fed rate cuts.

Meanwhile for UK PMIs, the key concern is inflation in the services sector which remains strong, keeping the Bank of England’s rate setters split. If we see stronger inflation data from the UK again, this will complicate the MPC’s ability to cut rates further, which, on balance, would likely be bullish for the GBP/USD forecast.

Then, the focus will turn to the Jackson Hole Symposium on Friday. This event gathers central bankers, finance ministers, and market players from around the world, and has historically been a venue where the Fed signals major policy shifts. Could this be the moment the FOMC hints at a rate-cutting cycle beginning at their September 18 meeting? Recent data, including stronger retail sales and jobless claims, suggest that a 25-basis point cut is now more likely than the 50-basis point reduction anticipated just a few weeks ago. However, with the Fed increasingly focused on the labour market, the upcoming non-farm payrolls report on September 6 will be key to their final decision. Nonetheless, any strong indication of a September rate cut at Jackson Hole could push the dollar lower and lend support to our modestly bullish GBP/USD forecast.

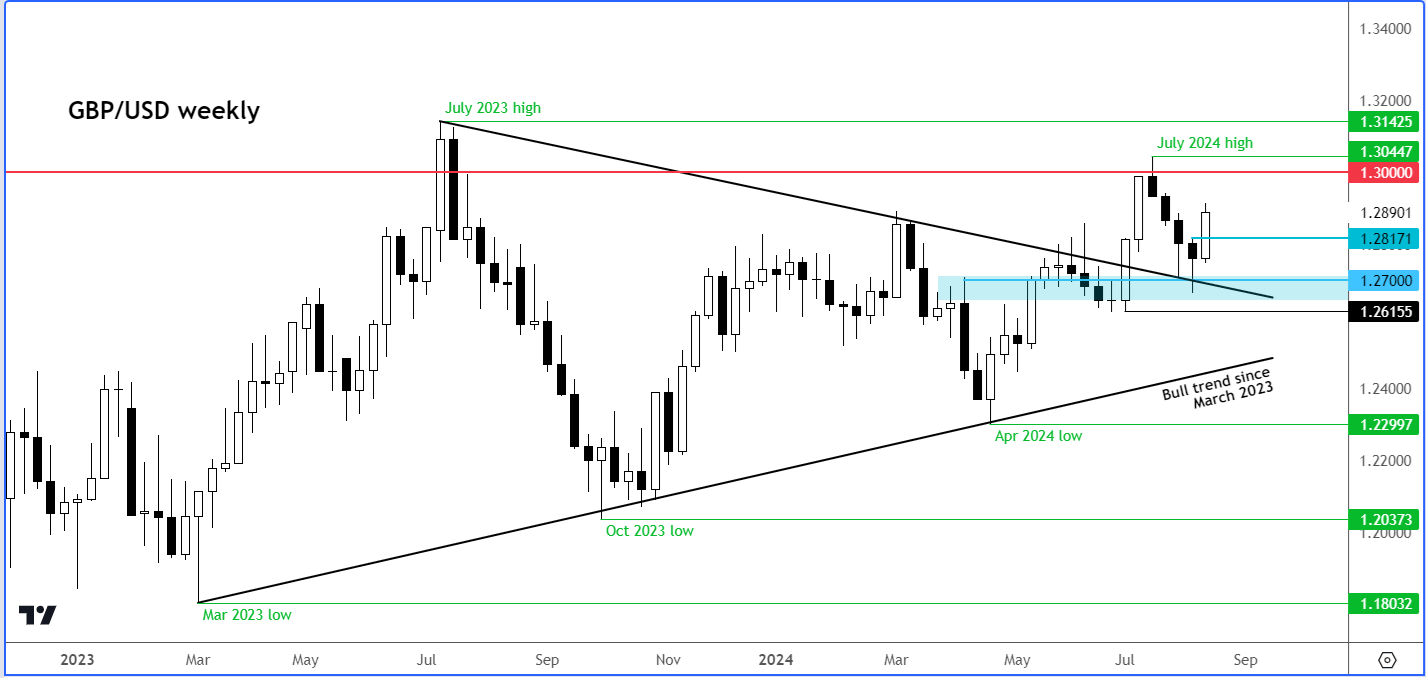

GBP/USD forecast: Technical analysis

Source: TradingView.com

At the time of writing on Friday afternoon, the GBP/USD was holding onto its weekly gains, and it looked set to end a run of 4-weekly losses. This is a positive technical development and points to some follow-up gains in the week ahead.

However, if instead, we see the pressure resume, say as a result of a hawkish Fed, then the technical GBP/USD forecast could turn if it goes on to break July’s low of 1.2615.

Ahead of this area are a few important support levels to watch for a bounce on any short-term weakness. These include the 1.2850 area, followed by longer-term support at around the 1.2700 – 1.2750 range.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R