EUR/USD rises with ECB rate decision & US CPI data due this week

- ECB is expected to cut rates by 25 bps on Thursday

- US CPI is set to rise to 2.7% on Wednesday

- EUR/USD rises above the 20 SMA

Yeah, the U.S. dollar is moving higher towards the 10580 level as investors focus on Thursday's ECB interest rate decision and US inflation.

The market is fully pricing the ECB will cut rates by 25 basis points to 3% as many ECB policymakers have shown concerns over the risks of inflation undershooting the target owing to the weaker outlook for the region.

Recent data from the eurozone has highlighted the weaker outlook, with PMI data contracting and falling to a 10-month low.

Meanwhile, the French economy is also going through a tough moment, with the outlook becoming gloomier after the government collapsed at the end of last week.

Meanwhile, the US dollar is inching lower after strong gains last week. Following the US non-farm payroll report on Friday and comments from Federal Reserve chair Jerome Powell earlier last week, the market is pricing in an 80% probability of a 25 basis point rate cut next week, according to the CME Fed watch tool.

This week, the main focus will be U.S. consumer price index data, which is expected to show that CPI accelerated to 2.7% in November, up from 2.6% while core CPI is expected to hold steady at 3.3%

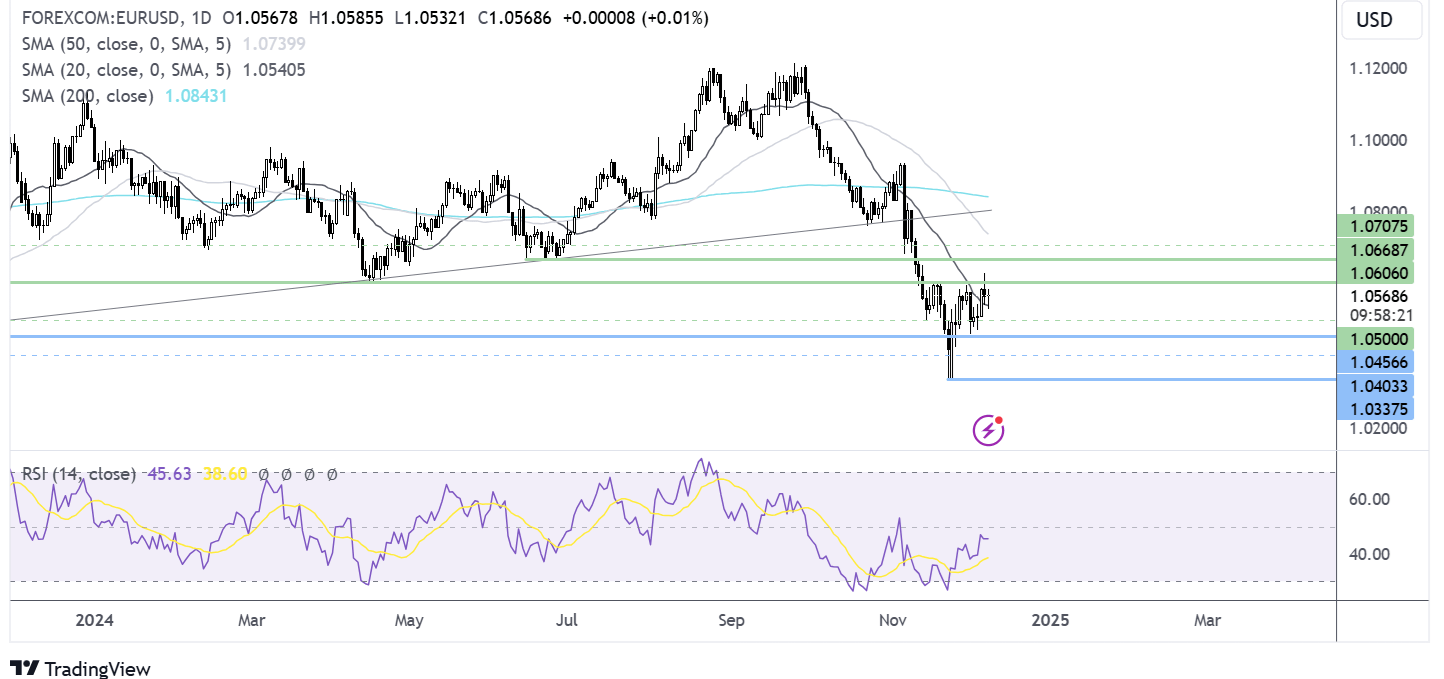

EUR/USD forecast – technical analysis

EUR/USD forecast – technical analysis

EUR/USD has recovered from the 1.0330 low reached last week, consolidating between 1.450 and 1.06.

A rise above 1.06 is needed to extend the recovery towards 1.07, .

Oil rises on geopolitical developments and China’s policy move

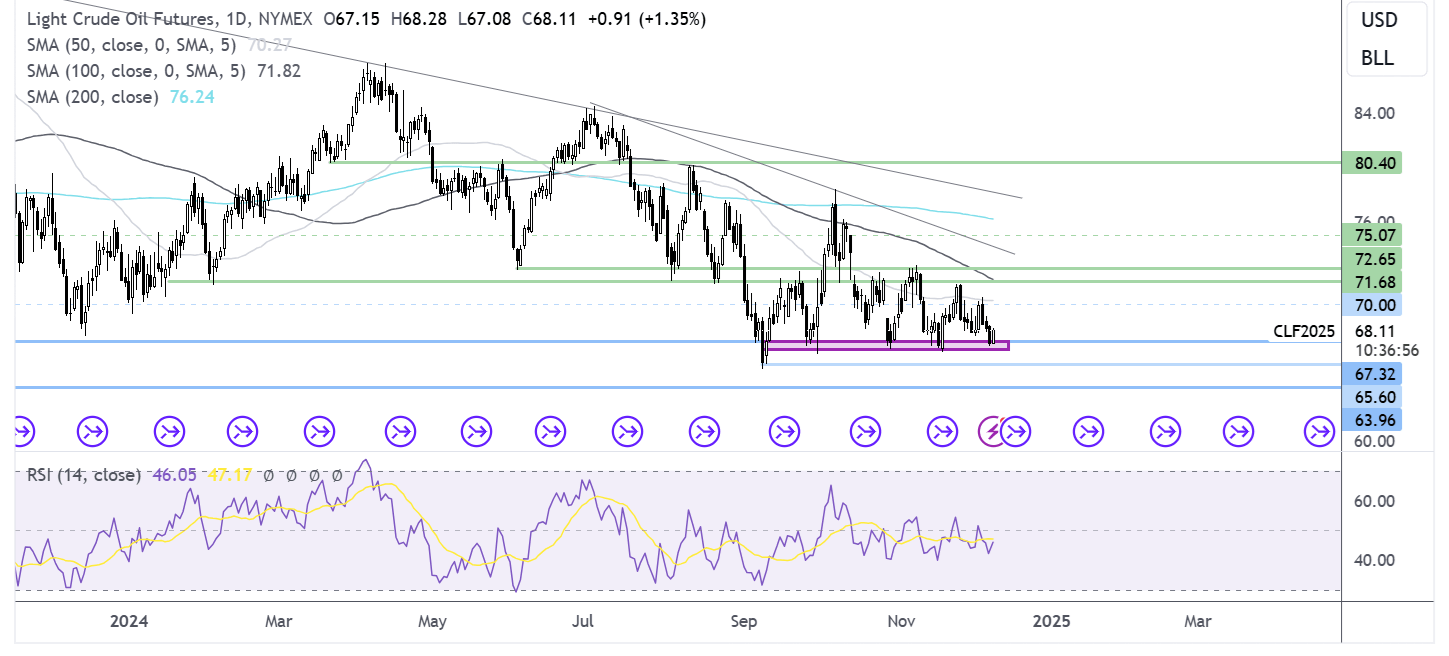

Oil forecast – technical analysis

Any recovery would need to retake the 50 SMA and the 71.50 zone to bring 75.00 into play.