EUR/USD holds close to 2024 lows ahead of ECB Lagarde’s speech

- USD eases from 2024 highs amid a quieter economic calendar

- Hotter inflation & hawkish Fed comments boosted USD

- EUR/USD consolidates around 1.0550

EUR/USD is holding steady after steep losses last week, which saw the pair fall to an early low of 1.05, as the USD reached a 2024 high.

The US dollar has eased lower at the start of the new week but remains close to its yearly high, boosted by hotter inflation data last week and hawkish Federal Reserve speakers, including chair Jerome Powell.

Fed chair Powell warned the market that the Fed was in no rush to cut interest rates, resulting in a repricing of expectations for a December rate cut down to 60/40 odds from over 80% a few weeks ago.

This week is quieter for U.S. economic data; however, plenty of Fed speakers will provide clues about the central banks' future path for interest rates in light of Trump's win.

The euro trades under pressure on expectations that the ECB will cut interest rates at a faster pace than the Federal Reserve, given the cooler inflation and weaker growth outlook. ECB president Christine Lagarde will speak later today, and the market will be watching closely for clues over whether the ECB will cut rates by 50 or 25 basis points in the December meeting

Concerns over the region's growth outlook have also ramped up following Trump's victory in the US election, which has raised worries about trade tariffs on the euro region.

Looking out across the week, eurozone inflation is due tomorrow, although this is the second reading for October. PMI data on Friday will be the first major data release since Trump won.

EUR/USD forecast – technical analysis

EUR/USD broke out of its falling channel, dropping to a low of 1.05. The price has edged higher and consolidated around 1.0550, bringing the RSI out of the overbought territory.

Sellers will look to take out 1.05 to extend the bearish trend towards 1.0450.

Meanwhile, recovery needs to rise above 1.0640, the April low, to bring 1.0670, the June low, into focus ahead of 1.07.

Oil inches higher but gains re limited by supply surplus & China demand worries

- Russia – Ukraine tensions escalate lifting oil prices

- IEA forecast a supply surplus next year

- Oil tests 67.50 support

After falling last week, oil prices are ticking higher amid concerns over intensifying tensions between Russia and Ukraine. However, gains are being limited by concerns over the demand outlook in China and forecasts of a global oil surplus.

Tensions between Russia and Ukraine have escalated, with further attacks raising some concerns that supply may be impacted. So far, the Russian oil supply has seen little impact from the escalation of tensions, but if Ukraine targeted oil infrastructure, the oil price could rise sharply.

For now, concerns over heightened tensions in Russia are being offset by worries over the demand outlook in China. Oil prices fell 3% last week after weak data from China, the world's second-largest oil consumer. Chinese refinery throughput fell 4.6% in October from last year as factory output growth slowed, according to government data.

The International Energy Agency also forecasts that global oil supply will exceed demand by more than a million barrels a day in 2025, even if OPEC cuts remain in place. The prospect of a supply surplus could keep pressure on oil prices.

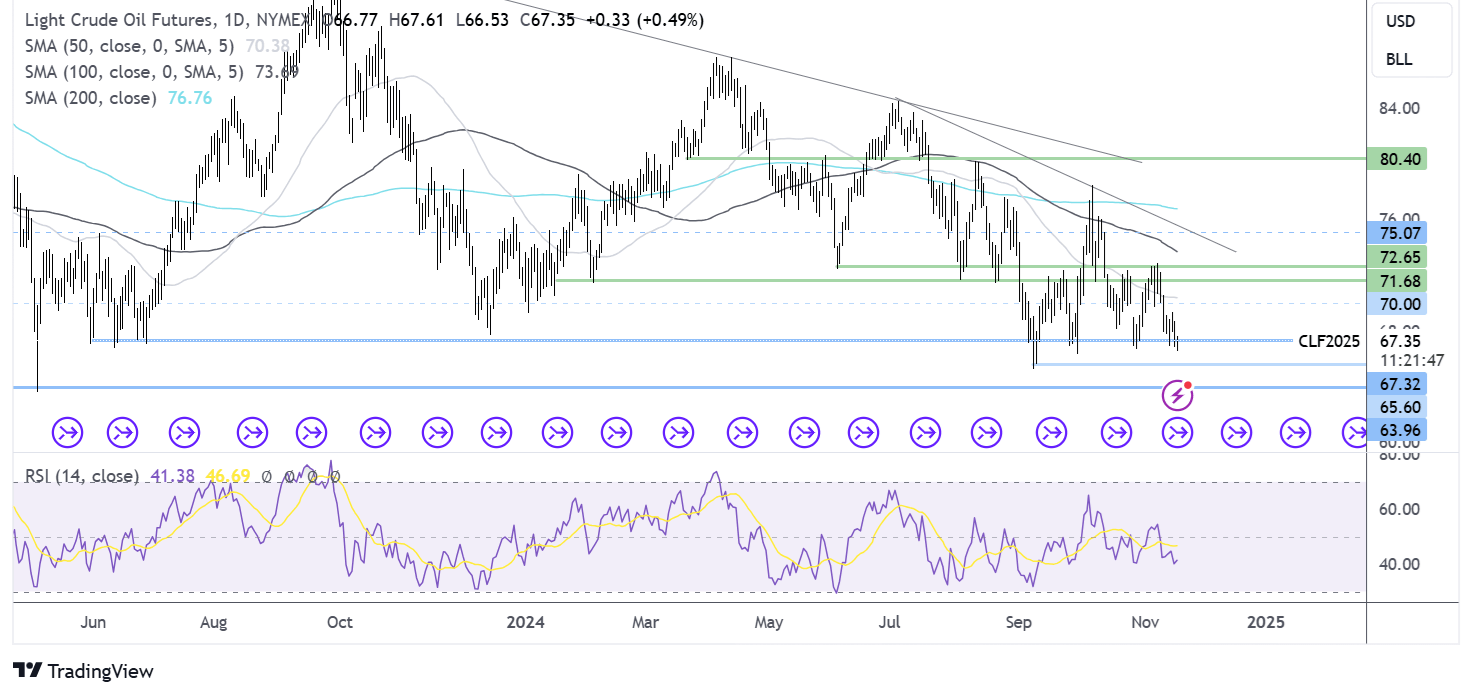

Oil forecast - technical analysis

Having failed to take the 71.50 – 72.50 resistance zone, oil fell lower and is testing the 67.50 support level. A break below here opens the door to 65.25, the September low. Should sellers break below here, 63.60 the May 2023 low.

Should the 67.50 support hold, buyers could look to rise towards 70.00, the round number, before bringing the 71.50- 72.50 resistance into play.