Key Events

- US ISM Manufacturing PMI

- JOLTS Job Opening (Wednesday)

- ADP Non-Farm Employment Change (Thursday)

- US Unemployment Claims (Thursday)

- US ISM Services PMI (Thursday)

- US Non-Farm Payrolls (Friday)

EURUSD Outlook

As we enter September, both the Fed rate cut, and ECB rate cut are looming on the horizon. The EURUSD is entering the month in a corrective mode as the US Dollar index respects the December 2023 support. The upcoming US employment indicators are set to fuel or reverse the current trends, providing further clarity on the upcoming direction of the Fed decision, and making room for an ECB rate cut effect on the chart respectively.

Gold Outlook:

Amid rising ceasefire pressures in the prolonged conflict between Israel and Hamas, gold remains sensitive to these developments as it trades near the 2500 mark. Despite monetary policy expectations and ongoing ceasefire discussions, gold has been unable to break above the 2530 level since August 20, forming a strong resistance barrier.

Technical Outlook

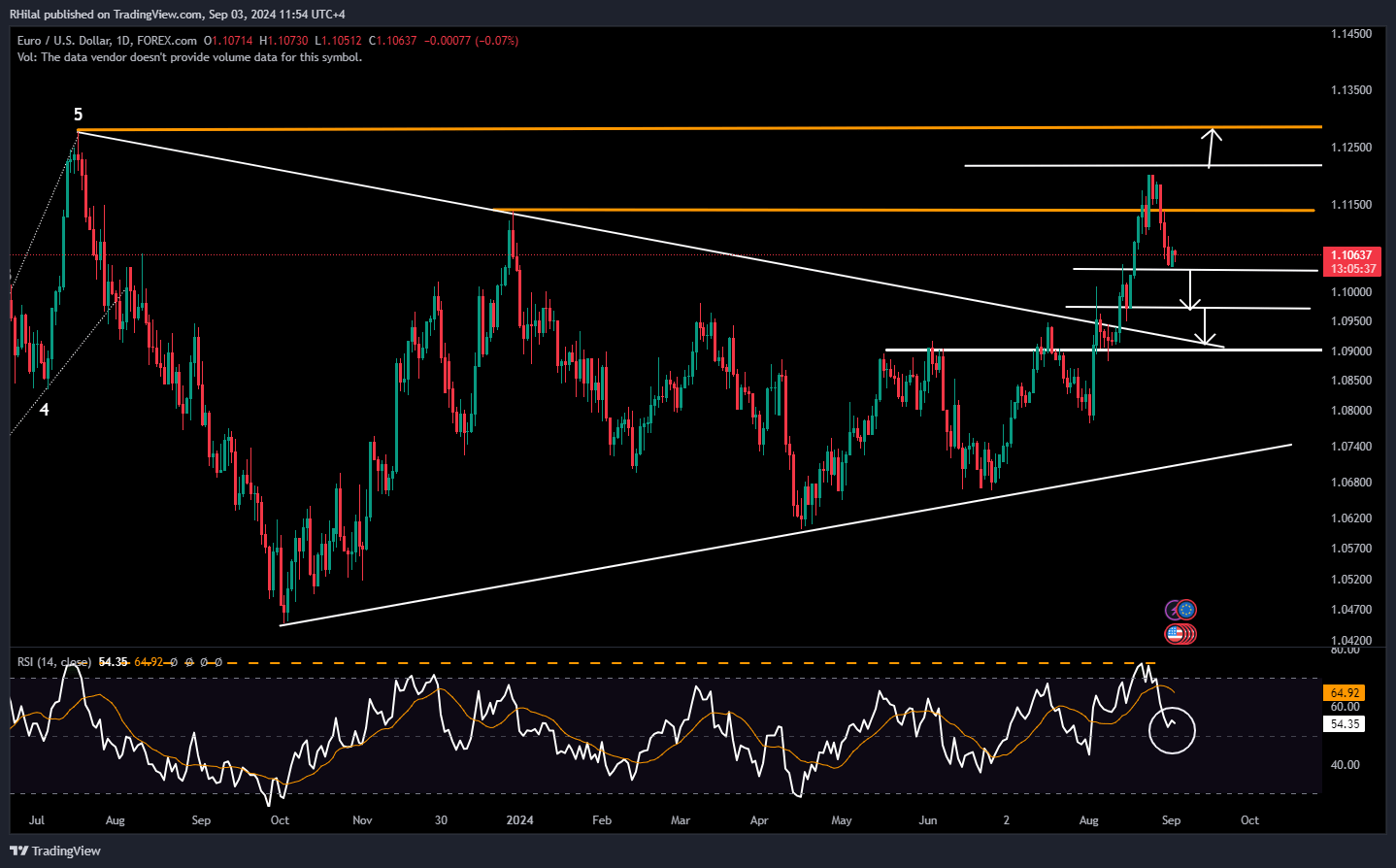

EURUSD, Gold Outlook: EURUSD – Daily Time Frame – Log Scale

Source: Tradingview

The EURUSD is nearing a support zone from both a price and Relative Strength Index (RSI) perspective. The daily RSI is approaching its neutral zone, while the chart approaches the lower end of the 1.10 range, with potential support at the 1.1040 level.

Key levels to watch on the upside include the 1.120 and 1.13 zones. On the downside, a break below the 1.10 barrier could pave the way for key support levels at 1.09 and 1.08. A definitive breakout for EURUSD would occur above the 1.13 mark, while a drop back into consolidation would signal further indecision before a clear trend emerges.

From the perspective of Gold

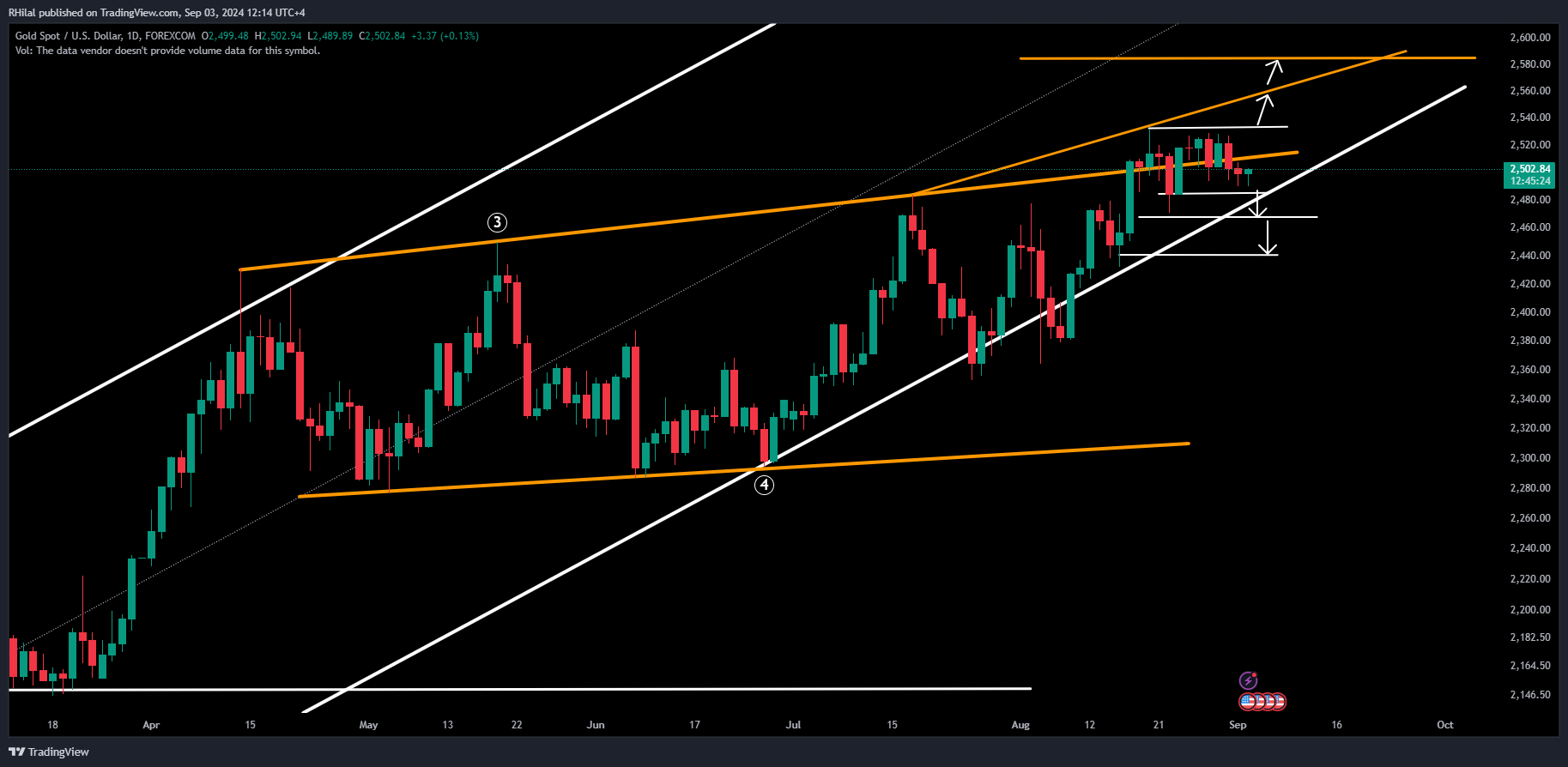

EURUSD, Gold Outlook: XAUUSD – Daily Time Frame – Log Scale

Source: Tradingview

Gold continues to trade above the 2500 mark, maintaining a bullish bias. Drops are viewed as buying opportunities, aligning with the lower boundary of its primary channel near the 2465 and 2440 levels. A further decline below 2440 could increase bearish pressures towards 2414 and 2380.

On the upside, a clear range is defined below the 2530 mark. A close above this level is needed to forecast a move toward the upper end of the 2500 range, with 2580 as the next resistance level.

The outlook for both Gold and EURUSD remains cautiously bullish, driven by sensitivity to inflation factors, haven demand between precious metals and the US Dollar, and ongoing monetary policies. Shifts in these factors are likely to have a significant impact on the charts' trajectories.

--- Written by Razan Hilal, CMT – on X: @Rh_waves