Key Events

- The Trump rally pushed markets to overbought levels, signaling potential for a recharge or reversal by the end of 2025

- EURUSD risks sliding to 1.03 and 1.01 if a breakout occurs below 1.0480

- US Retail Sales could add DXY volatility ahead of the weekly close

- Eurozone and US Flash PMIs may drive volatility risks on EURUSD next week

Following this week’s positive CPI results and the ongoing Trump rally, the DXY reached a critical resistance level at 107, forming a potential bull flag pattern and pulling EURUSD down to retest one-year lows at 1.05. Market pullbacks on Friday were observed across Bitcoin, precious metals, the US Dollar Index, and EURUSD, with retail sales data adding volatility risk.

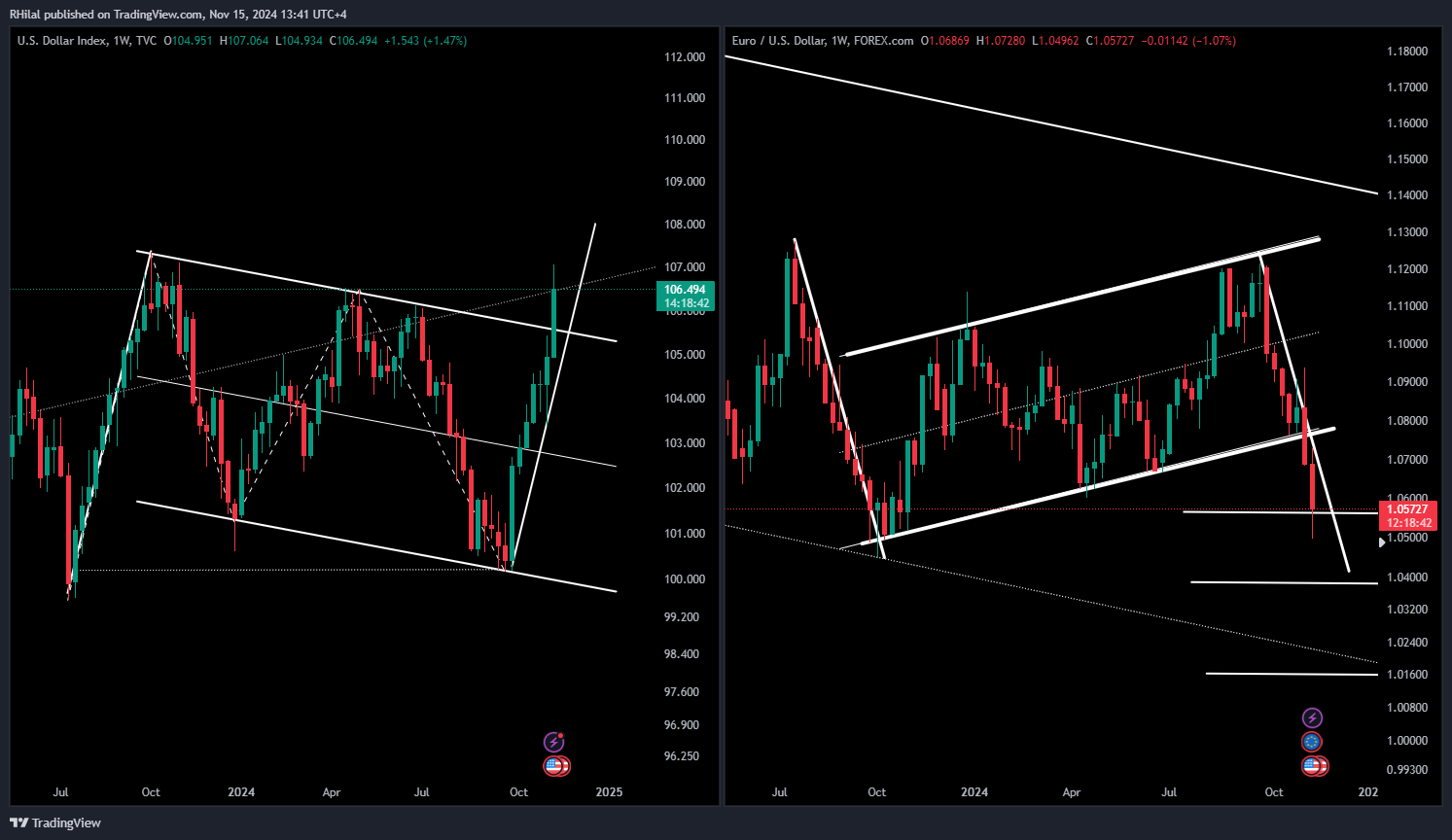

While the DXY traced a bull flag pattern this week, the EURUSD traced a bear flag pattern

DXY – EURUSD Weekly Time Frames – Log Scale

Source: Tradingview

The extreme target of the pattern has not yet been reached, as trends are holding at critical support and resistance levels that could fuel a sharp rally if momentum continues. Next week’s key catalyst for the EURUSD chart will be the PMI results.

Currently, Flash Manufacturing PMIs remain relatively weak, staying below the expansion threshold of 50, while Flash Services PMIs are strong, holding above the 50-expansion mark.

Technical Analysis: Quantifying Uncertainties

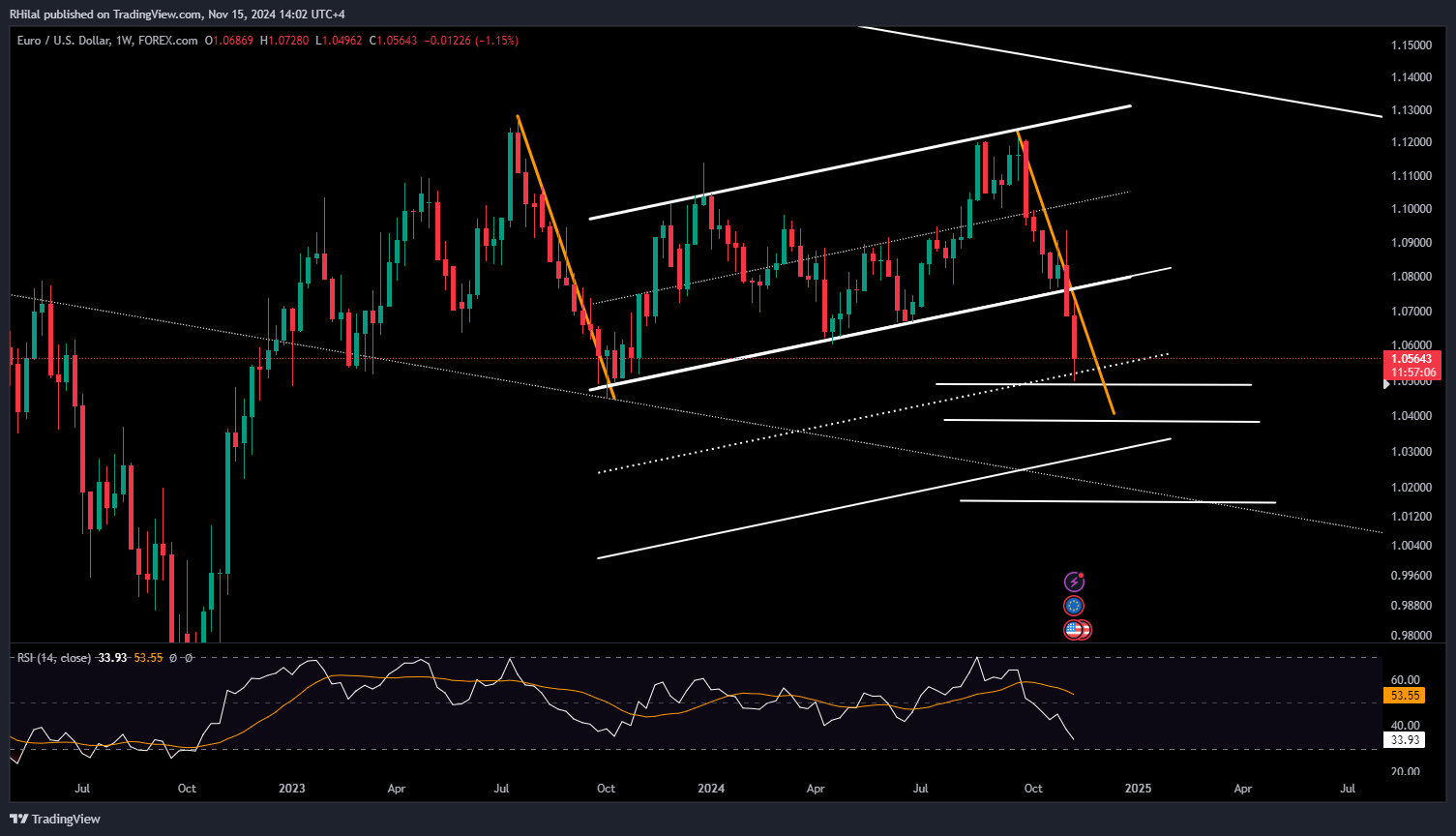

EURUSD Forecast: Weekly Time Frame – Log Scale

Source: Tradingview

Before extending the drop to the bear flag target, EURUSD’s breakout is currently rebounding from the mid-channel zone aligned with the 1.05 support level, situated within a one-year duplicated channel pattern.

Here’s how the scenarios may play out:

Bearish Scenario: A decisive close below 1.05 could drive EURUSD further down to 1.0380 and 1.0150

Bullish Scenario: If EURUSD rebounds, resistance may be encountered at the trendline connecting the lows of 2023 and 2024, the upper boundary of the duplicated channel, near 1.07 and 1.0770. A strong move above these levels could confirm a longer-term bullish trend for the Euro

--- Written by Razan Hilal, CMT on X: @Rh_waves