- EUR/USD analysis: key levels to watch include December’s low at 1.0723

- US dollar analysis: Powell, FOMC and data all paint a bullish US dollar story

- Dollar Index now cleanly above, and EUR/USD below, the 200-day average

Welcome to another edition of Technical Tuesday. In this shortened edition, we will get technical on the EUR/USD analysis as the pair continues to show bearish price characteristics, while the Dollar Index is continuing to push higher following robust data and hawkish Fed signals.

The US dollar extended its gains on Monday after a strong ISM services PMI report merely contributed to the perception that the Federal Reserve wouldn't rush to ease policy, following Friday’s robust jobs data. The economic calendar will be a bit light this week, but as the markets continue to reprice US interest rates, this should keep the greenback supported on any short-term dips until something changes fundamentally.

This week, the EUR/USD is among the major currency pairs to watch. As well as a rising US dollar, the EUR/USD has been held back by consistently weak data from the Eurozone. This time, retail sales came in at -1.1% vs. -0.9% eyed. That said, we had surprising strength in German Factory Orders, which rose a solid 8.9% m/m compared to a small decline expected.

US dollar analysis: Powell, FOMC and data all paint a bullish US dollar story

There is little justification for investors to start selling the US dollar at this early stage following a robust jobs report on Friday and a stronger-than-expected ISM services PMI report on Monday, and not to mention hawkish signals coming out of the FOMC meeting last week and now Powell acknowledging that the Fed is wary of cutting interest rates too soon. The employment report, in particular, has effectively quashed talks of an imminent interest rate reduction.

Powell said that the “danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading.” He added that “the prudent thing to do is to, is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way.”

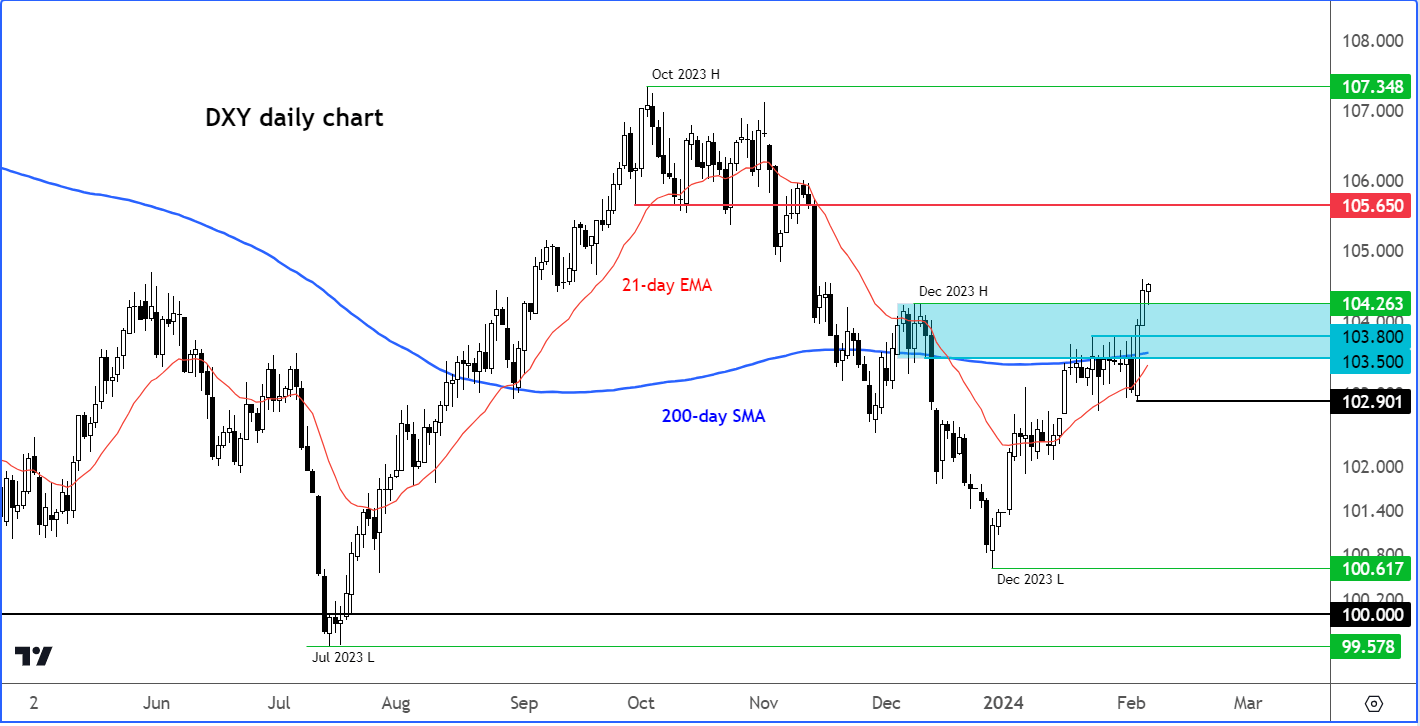

So, fundamentally, there is little reason to stand in the way of the US dollar rally. The Dollar Index has now broken cleanly above 103.50-103.80 key resistance area, which is now likely to turn into support.

For as long as we now don’t see a break back below 102.90 now, i.e., Friday’s low, the path of least resistance on the Dollar Index would remain to the upside. The next potential resistance area is seen around 105.65, which is the base of the previous breakdown that took place in mid-November.

EUR/USD analysis: key levels to watch

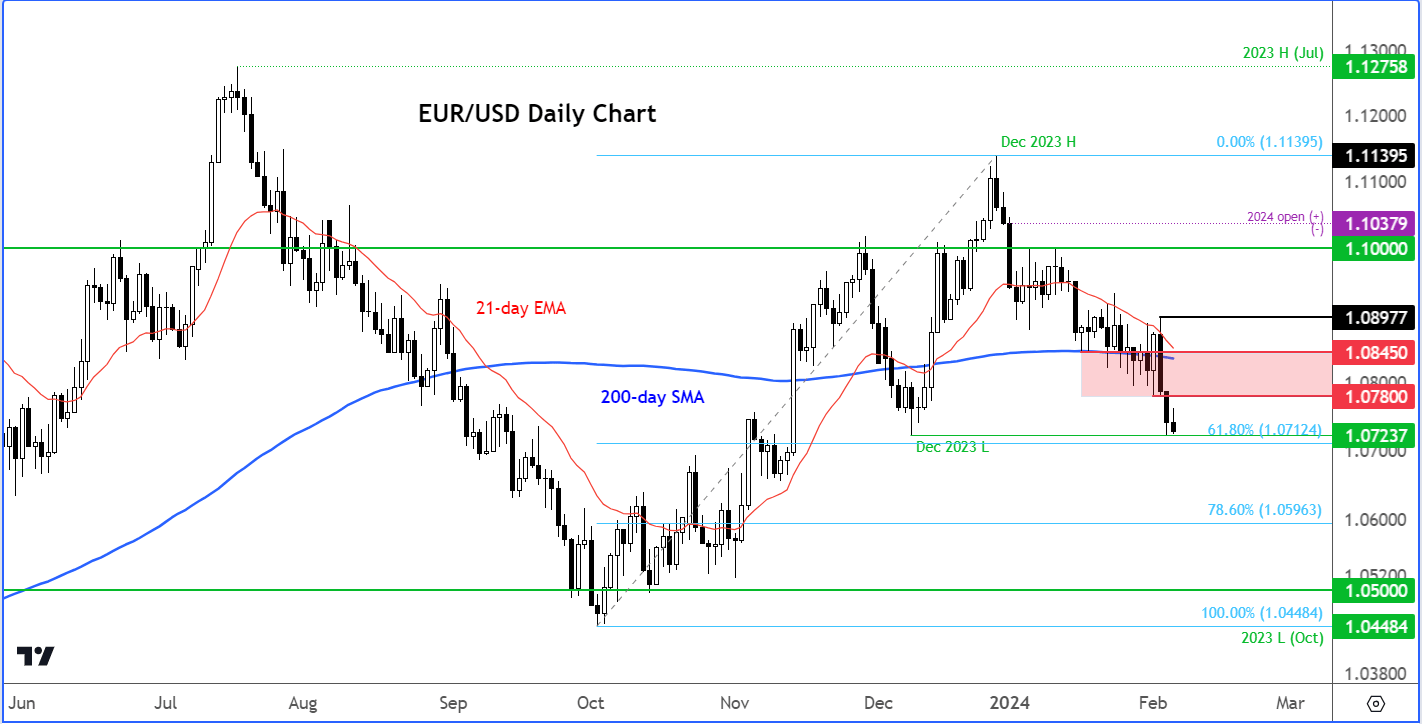

With the DXY also above December’s high of 104.26, the EUR/USD is thus likely to take out its December low of 1.0723 in due course.

The EUR/USD analysis will remain bearish until such a time it creates a bullish reversal signal. Key resistance is now seen in the area between 1.0780 to 1.0845. Within this zone, we also have the 200-day moving average coming into play.

On the downside, the next immediate target for the bears is the liquidity resting below the December low at 1.0723, with the 61.8% Fibonacci retracement level at 1.0712 likely to be in the bears’ radars.

Below these levels, 1.0600 could be the next key level to watch, for the 78.6% Fibonacci retracement also converges there too.

As things stand, only a break back above the most recent high just below the 1.09 handle would invalidate this bearish EUR/USD analysis.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R