Asian Indices:

- Australia's ASX 200 index rose by 4.7 points (0.07%) and currently trades at 6,652.20

- Japan's Nikkei 225 index has fallen by -129.87 points (-0.49%) and currently trades at 26,266.96

- Hong Kong's Hang Seng index has fallen by -166.88 points (-1%) and currently trades at 16,534.15

- China's A50 Index has fallen by -124.61 points (-0.98%) and currently trades at 12,581.17

UK and Europe:

- UK's FTSE 100 futures are currently down -14.5 points (-0.21%), the cash market is currently estimated to open at 6,811.65

- Euro STOXX 50 futures are currently down -15 points (-0.45%), the cash market is currently estimated to open at 3,316.53

- Germany's DAX futures are currently down -46 points (-0.38%), the cash market is currently estimated to open at 12,126.26

US Futures:

- DJI futures are currently up 21 points (0.07%)

- S&P 500 futures are currently down -0.5 points (0%)

- Nasdaq 100 futures are currently up 3 points (0.08%)

A cautious tone was present across equity markets overnight, with Chinese equities once again taking the lead lower but volatility was on the lower side. The ASX 200 was flat whilst most other indices were in the red across Asia.

Today is clearly all about the US inflation report, where another hot print is expected. Core CPI is expected to rise to 6.5% and match its 40-year high set in June, whilst CPI is expected to soften to 8.1% y/y – thanks to lower energy prices which OPEC are doing their best to support.

With markets fully braced for another hot CPI – which will no doubt prompt a bullish response for the dollar if true, there is little talk of it missing expectations. And that could arguably prompt a more volatile response should it come in slightly softer. And speaking of volatility, implied vols for forex are screaming higher whilst USD/JPY trades within a miniscule range around its 24-year high.

How CPI impacts forex

There are two tell tale signs that an important event is looming; realised volatility has died a quiet death whilst implied volatility has sprung alive. For all FX majors, 1-day implied volatility is currently higher than 1-week implied volatility, which means options traders estimate volatility over the next 24-hours to be greater than the next five days.

Over the past week, 1-day IV has more of less risen by around 50% - whilst IV for USD/JPY has more than doubled. GBP/USD is currently the highest level of anticipated volatility of around 150 pips, but we also need factor in headline risk from the BOE (Bank of England) – who insist they’ll wrap up their emergency QE program tomorrow, despite reports suggesting otherwise.

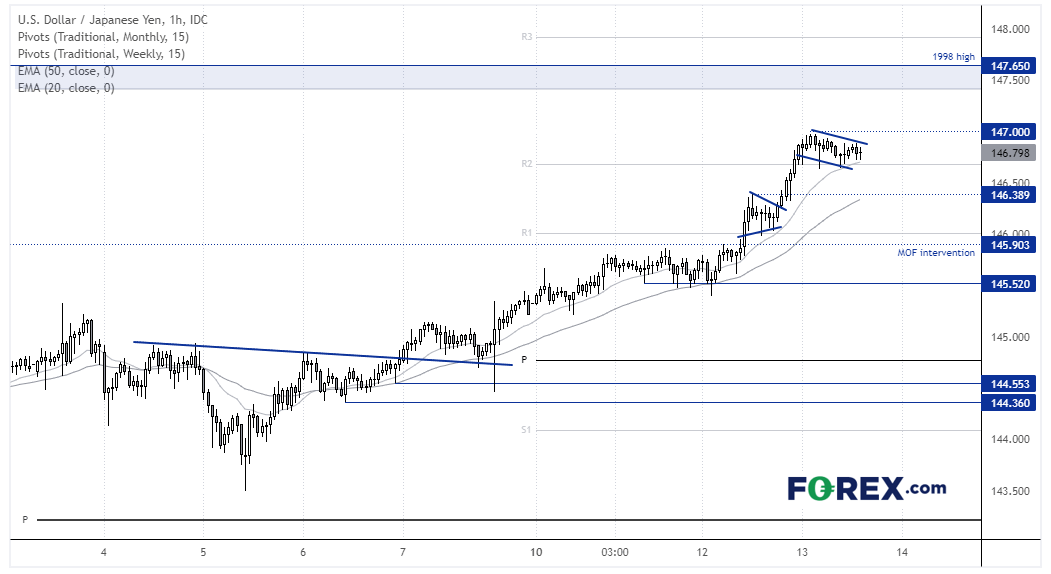

USD/JPY 1-hour chart

USD/JPY remains within a strong uptrend on the 1-hour chart, and trades within a tight consolidation just off its 24-yer high. There’s been little in the way of jawboning from the MOF since prices broke above the previous intervention high, and the BOJ’s Kuroda has once again given a weak yen the thumbs-up – so long as its demise is not too volatile.

A break above 147 confirms a bull-flag breakout and assumes trend continuation toward the 147..65 high – but given the historical significance of this level, it could prompt a shakeout has traders book profits or even fade the move.

Should prices move initially lower then bulls could consider dips, but if CPI is to come in softer than expected then bears would likely drive this pair much lower.

FTSE 350 – Market Internals:

FTSE 350: 3747.48 (-0.86%) 12 October 2022

- 46 (13.14%) stocks advanced and 299 (85.43%) declined

- 1 stocks rose to a new 52-week high, 88 fell to new lows

- 12.29% of stocks closed above their 200-day average

- 98.57% of stocks closed above their 50-day average

- 0.57% of stocks closed above their 20-day average

Outperformers:

- + 6.21% - Carnival PLC (CCL.L)

- + 3.61% - Indivior PLC (INDV.L)

- + 3.38% - Vietnam Enterprise Investments Limited (VEILV.L)

Underperformers:

- -11.63% - John Wood Group PLC (WG.L)

- -10.32% - JD Sports Fashion PLC (JD.L)

- -9.05% - Paragon Banking Group PLC (PAGPA.L)

Economic events up next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.