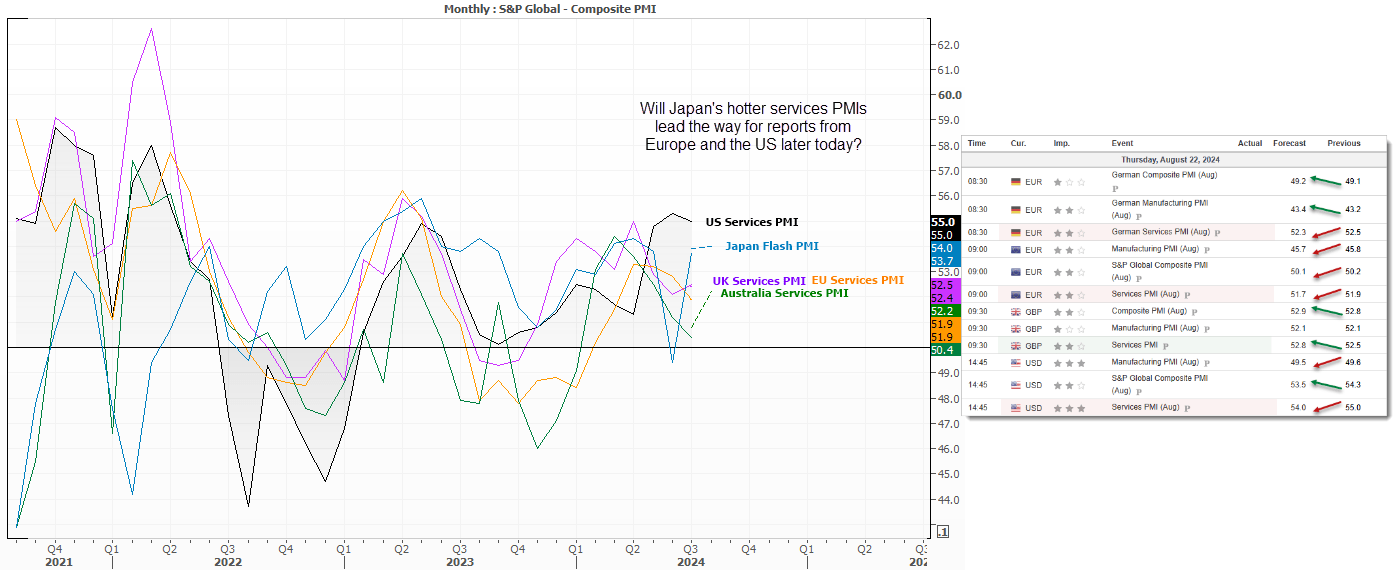

PMIs in focus today (times on GMT+1)

- 08:30 – DE flash PMIs

- 09:00 – EU flash PMIs

- 09:30 – UK PMIs

- 14:45 – US jobless claims

- 14:45 – US flash PMIs

Early PMIs from Asia shows a pickup in services activity for both Australia and Japan. Australia’s service sector expanded at its fastest pace in three months, with new orders, business confidence and employment also perking up. Selling price inflation also eased, despite a pickup of input costs. Overall, it points to a soft landing and is yet another report that neither warrants RBA cut nor hikes. Japan’s business activity expanded at its fastest pace since 2023 at 54, up from 53.7.

While this is unlikely to result in policy action from the RBA or BOJ, it serves as a reminder to central banks to remain vigilant to the potential pickup of services inflation. It could also tip us off to hotter services PMIs across Europe and the US later today. So it is interesting to see services, Europe and the US expected to come in lower. And with the US dollar remaining under heavy selling pressure, a hot services PMI report from the US has the greatest potential to spoil market trends.

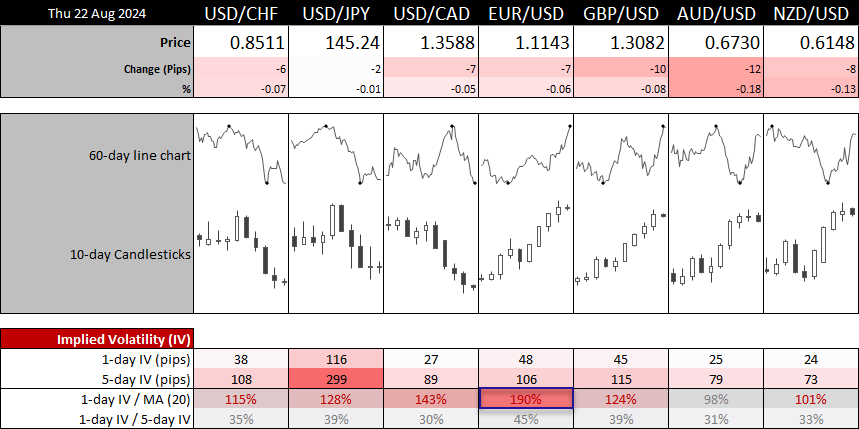

The US dollar selloff has certainly picked up pace once more although, as mentioned in previous analysis, US bond yields have remained supported on a relative basis. And if Powell is not as dovish as many expect, it could result in a rebound for the US dollar (or limited downside). And that means we could see a reversal on many of the FX majors which have benefited from the weaker USD.

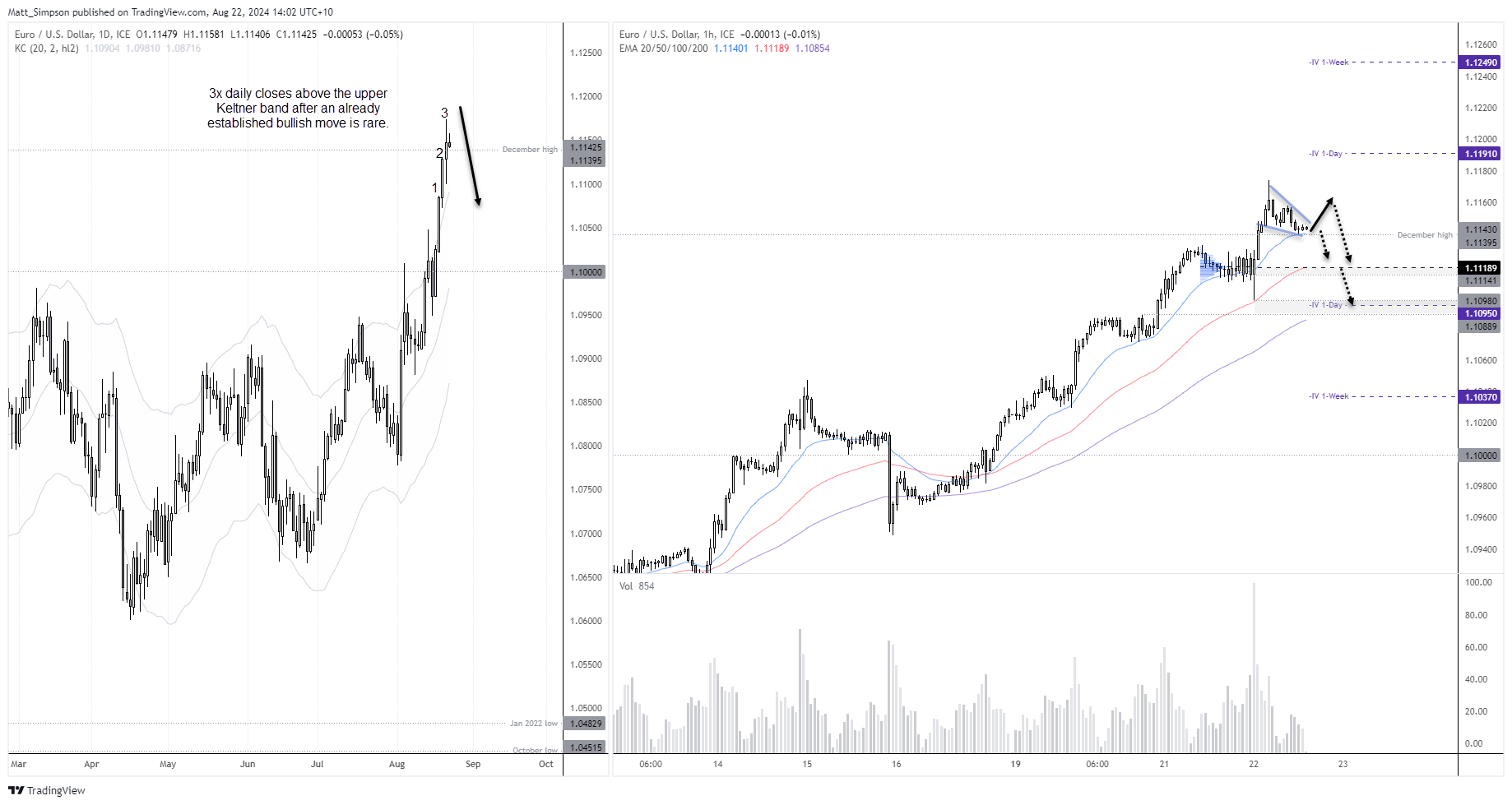

EUR/USD technical analysis:

The parabolic nature of the EUR/USD rally becomes clearer when we see that it’s closed above the upper keltner band for three consecutive days. And now working on a fourth. I’ll stand my ground that this looks like a market that wants to be toppled, but as always timing is key. Besides, there is no immediate threat to the strong bullish trend on the 1-hour chart.

Prices have retraced to the December high (1.1140) which likely be a pivotal level today. An break lower brings the 1.1114/18 support zone into focus which includes a high-volume node from the prior consolidation. Take note of the strong volume bar which coincides with the 1.1098 low, which suggests strong support in that area.

Should prices initially rally, I will continue to monitor price action for signs of a top, given the overextended nature of the rally on the daily timeframe.

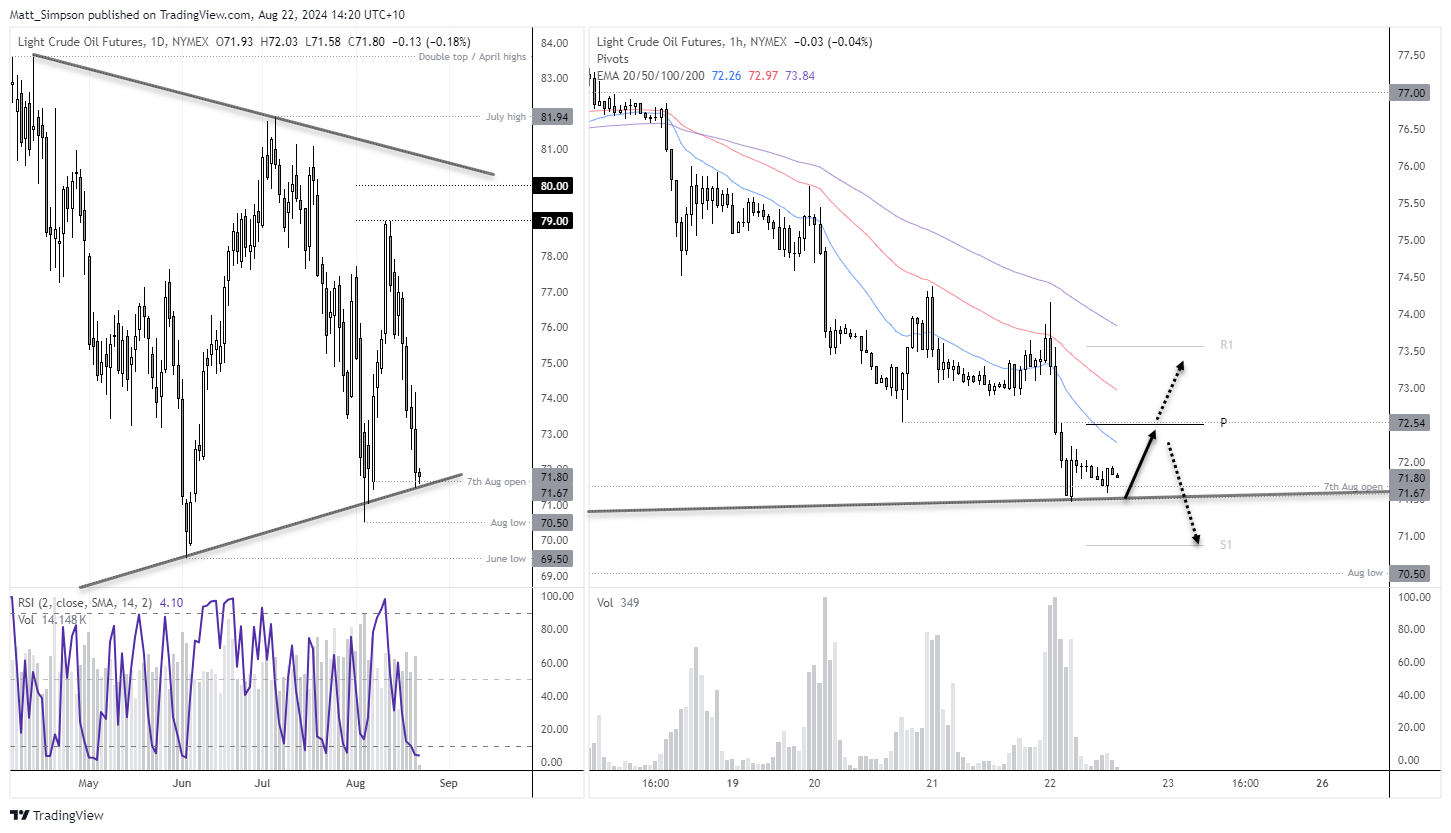

WSTI crude oil analysis:

If US services PMI surprises to the upside, it could support WTI crude oil. And it is a market that could do with a break from bearish forces, given it has fallen -9.5% over the past six days. The daily RSI (2) is heavily oversold, and prices are holding above trend support and the 7th August open. At the very least, I suspect a bounce within yesterday’s range could be due.

The daily pivot point sits near the 72.54 low, making it a potential near-term target for countertrend bulls. a break above which brings $73 into focus.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge