- EUR/USD remains a sell on rallies prospect

- Geopolitics and relative economic performance likely to dictate EUR/USD direction

- Most major events come from the United States calendar

- Watch for gap risk upon the resumption of trade on Monday, depending in geopolitical developments over the weekend

EUR/USD overview

With most major events scheduled outside the continent, EUR/USD direction looks set to be dictated by external influences next week.

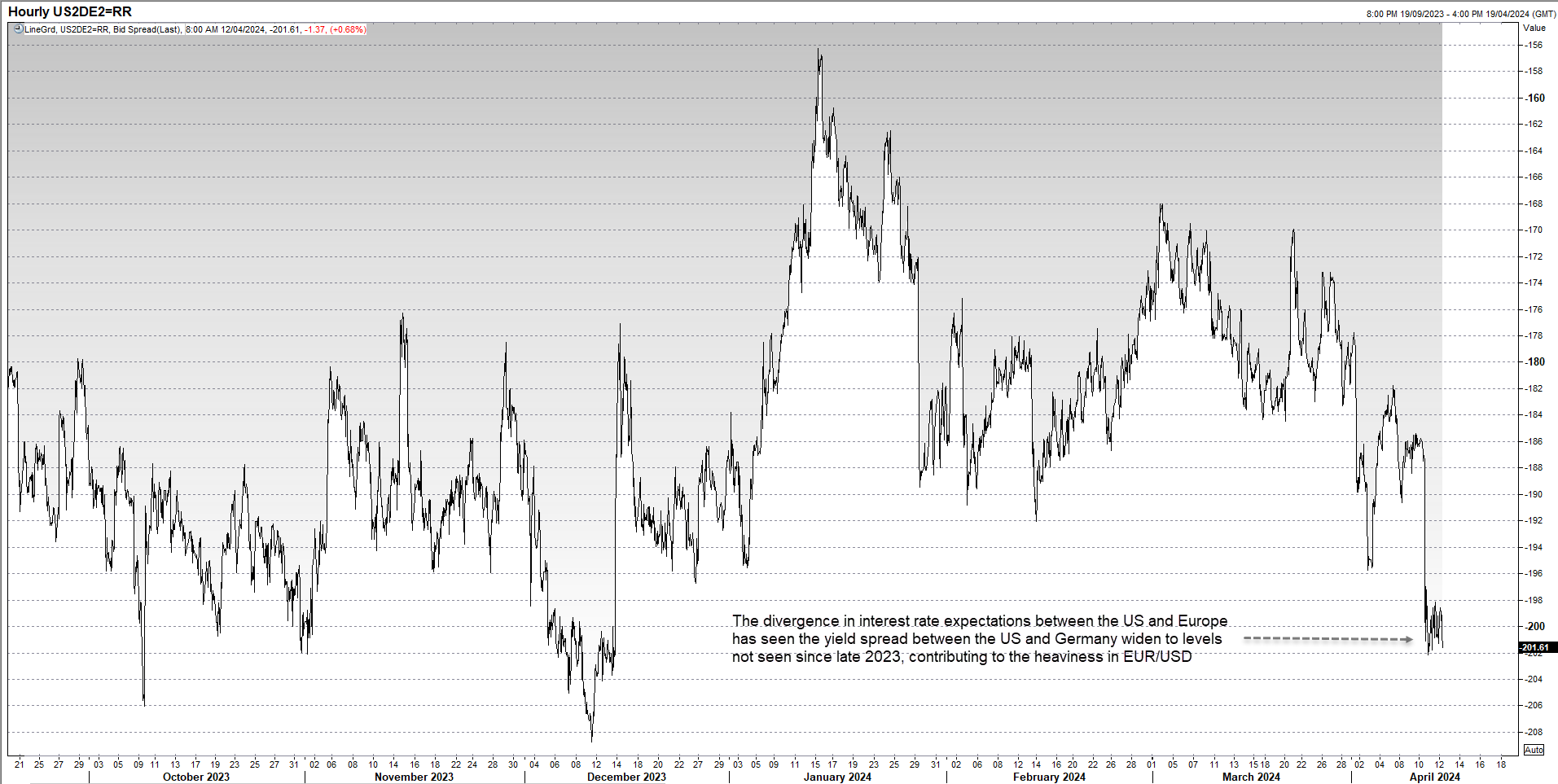

After several months of divergence in central bank expectations, with a cut from the ECB brought forward to June with the first move from the Federal Reserve pushed back to Q4, whether the US economy can sustain its momentum may go a log way to determining how the EUR/USD fares.

Geopolitics will also feature, creating the potential for significant volatility on safe haven flows, including gap risks upon the resumption of trade on Monday.

If the trajectory is sustained in both areas, we prefer to sell rallies given the technical breakdown in EUR/USD on Friday.

Source: Refintiiv

EUR/USD fundamental view

With the ECB April monetary policy meeting and US inflation updates in the rear-view mirror, attention this week turns to relative economic performance and how it’s being interpreted by central bankers.

Looking at the European calendar, several reports loom as market movers for EUR/USD.

On Monday, Eurozone industrial production may continue to paint a picture of weak internal and external demand. Tuesday brings the German ZEW survey, including the influential expectations measure.

Wednesday will see the final reading of euro area inflation for March. Unless there’s an unusual deviation from the preliminary estimate, it should come and go to little fanfare. The European data calendar is otherwise sparse.

In the States, retail sales for March will be scrutinised after two underwhelming reports to start the year. It prints on Monday. Housing starts, building permits and industrial production arrive Tuesday with jobless claims, existing home sale and Philadelphia Fed manufacturing index out Thursday.

Outside the States and euro area, other events that may generate volatility include China’s March data dump on Tuesday, accompanied by March quarter GDP.

With US inflation uncomfortably elevated, traders will be given a further opportunity to see whether that is a unique phenomenon when its neighbour to the north, Canada, releases inflation data on Wednesday. Japan will do the same on Friday.

Given the strong positive correlation that exists between EUR/USD and GBP/USD, UK wages and unemployment figures out Tuesday, and inflation data Wednesday, have potential to move EUR/USD.

Outside data, central bankers on both sides of the Atlantic are queuing up to provide their insights. Of those names that stand out, Lorie Logan, Mary Daly, Loretta Mester and John Williams from the Fed deserve attention, as does Olli Rehn from the ECB. Given the strong relationship between EUR and GBP, BOE Governor Andrew Bailey could be another headline grabber.

Keep a close eye on the calendars during the week for any yet unscheduled appearances that may pop up. You can access the Federal Reserve’s event calendar here. The ECB version is found here.

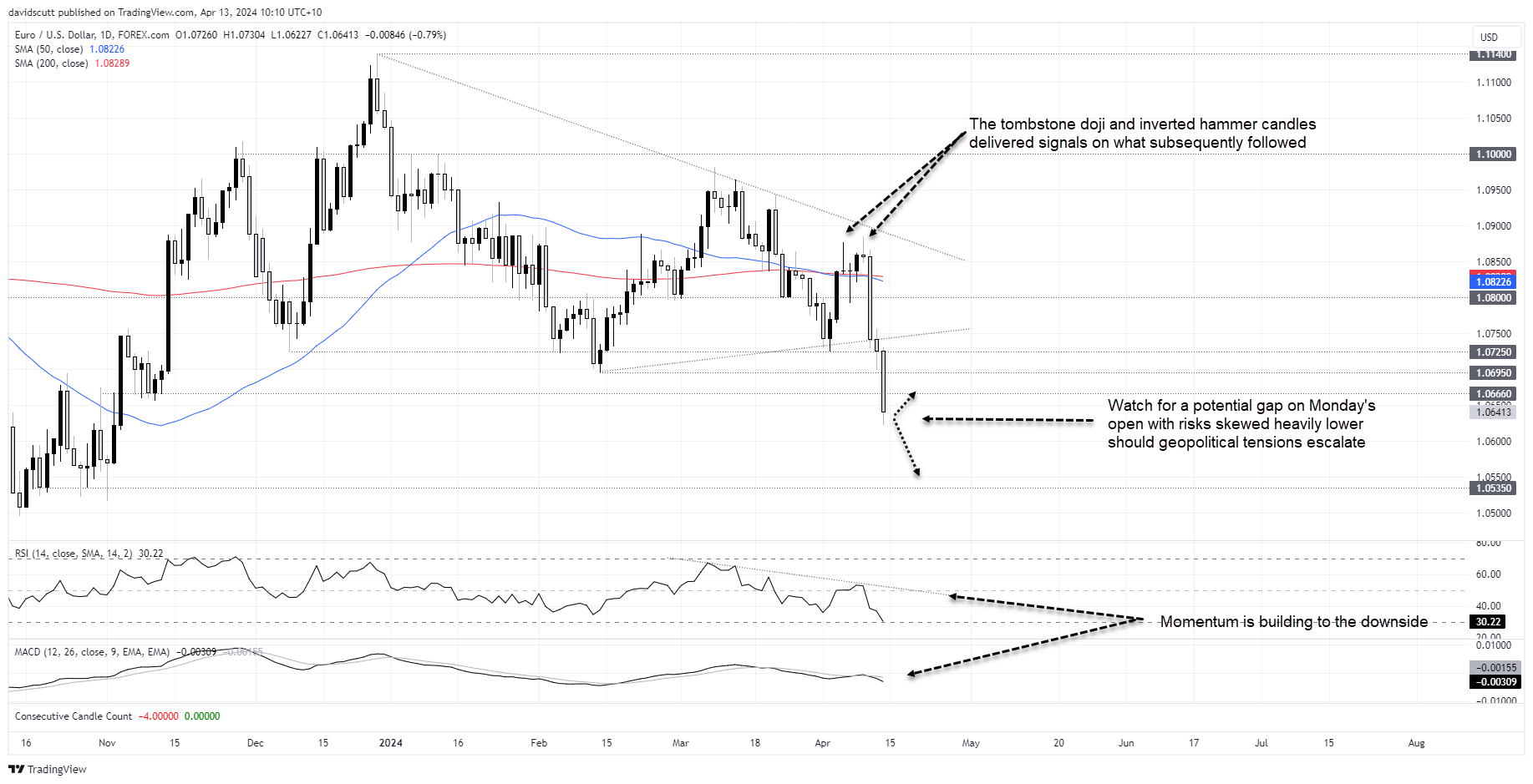

EUR/USD technical picture

EUR/USD had a shocking end to last week, breaking a series of supports following the ECB’s policy meeting to hit fresh year-to-date lows. While it’s approaching oversold levels, the case for upside is weak given the technical and fundamental backdrop, making selling rallies the preferred way to play the pair. With RSI and MACD showing strengthening downside momentum, it adds to the overall bearish picture.

The break of 1.0666 on Friday – an ominous level EUR/USD did work either side of late last year – has opened the door to a larger reversal with little visible support evident until 1.0535, a level the pair tagged on six separate occasions in October. Should the lows at 1.0450 give way, the conversation will turn to whether another flush below parity may be on the cards.

On the topside, 1.0666 is the first layer of resistance, with the former 2024 low of 1.0695 the next level after that. While unlikely to be revisited near-term, 1.0725 and 1.0800 are other topside levels to put on the radar should we see a meaningful reversal.

Geopolitics amplifies gap, volatility risk

Last Friday, traders were forced to price the risk of an imminent Iranian attack on Israel, contributing to the bearish price action into the close. Should that information prove to be accurate or incorrect, both outcomes have the potential to generate sizeable gaps upon the resumption of trade on Monday.

Traders need to be alert during this period as it may easily set the tone over the early parts of the week. Unless there’s an unlikely significant de-escalation in Middle Eastern tensions, the preferred setup remains to sell rallies.

-- Written by David Scutt

Follow David on Twitter @scutty