Broadcom Q3 earnings preview

The semiconductor company will release earnings on Thursday, December 12, and it is expected to post EPS at $1.39, a 26% annual increase on revenue of $14.1 billion, up 51% compared to the same period a year earlier. Meanwhile, gross margins are expected to have improved to 76.6%, up from 74% a year earlier. The markets are likely to pay particular attention to Broadcom's semiconductor revenue, which is expected to increase 9.9% to $8.1 billion, thanks to AI revenue of $3.5 billion.

Chip stocks have benefited from strong demand amid the global race to invest in AI, with the share price trading up 53% year to date, while the Philadelphia semiconductor index trades up 20% year to date.

Some headwinds include rising geopolitical tensions between the US and China. Chinese industry bodies have said companies domestically should be more cautious of buying US chips, saying they were no longer safe, and encouraged them to look locally instead. Raising trade tensions are happening even before President-elect Donald Trump returns to the White House, where he has proposed wide-sweeping tariffs on countries, taking particular aim at China.

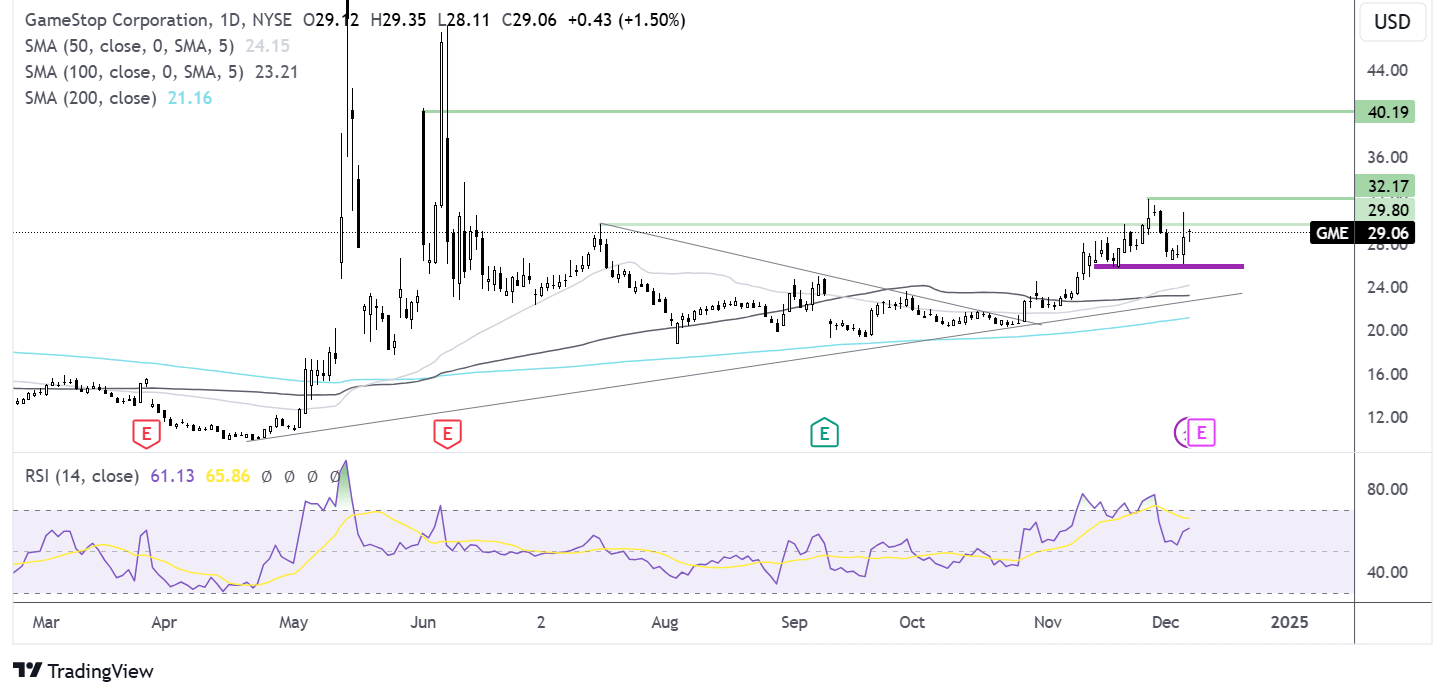

How to trade AVGO earnings?

After again running into resistance in the 184-186 zone, the AVGO share price eased lower before rebounding off the 157.50 support. The price trades above its 100 and 200 SMA and jumped above its 50 SMA on Friday.

Buyers will need to rise above the 184-186 level to create a higher high and reach record levels. 157.50 is a key support ahead of the 200 SMA at 153.00.

MARA & crypto stocks as BTC hits 100k

MARA, MicroStrategy, and other Bitcoin-related stocks will likely remain in focus again this week after the Bitcoin price shot past 100K, rising to an all-time high of 103.6k. Optimism surrounding Donald Trump's latest appointments, including Paul Atkins as SEC chair, replacing Gary Gensler, has helped boost Bitcoin. Paul Atkins has been focal, and his support of Bitcoin and the crypto sector is in sharp contrast to carry channels scrutiny of the industry over recent years.

In addition to expectations of more crypto-friendly regulation in Washington, Bitcoin ETF inflows have been strong, with the ETFs now holding more BTCs than the Satoshi wallet. This new institutional era could support Bitcoin more.

Finally, corporation purchases are also becoming a key demand-side story. MicroStrategy purchased more Bitcoin last week, taking its holding to 402,100 BTC, which is around $40 billion. MARA is the second largest corporate holder, with 22,108 Bitcoins worth around $2.17 billion, and it plans to buy more. Given the size of these holdings, the share price is influenced by the price of Bitcoin.

This week, Microsoft will also vote on whether to invest in Bitcoin, although the board has recommended against the proposal. If the proposal is agreed upon, it could legitimize BTC and boost its price.

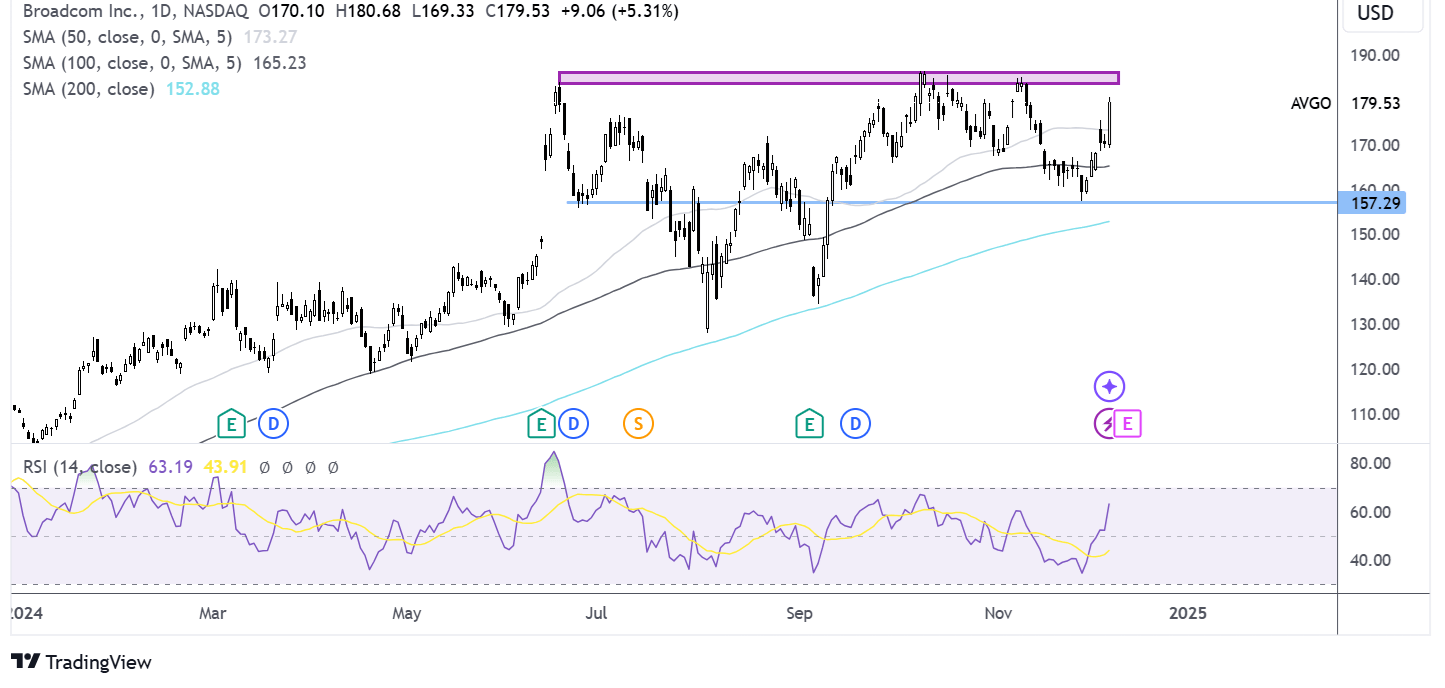

How to trade MARA?

After consolidating below the 200 SMA from August, MARA finally rose above the dynamic resistance in mid-November, rising to an 8-month high of 30.00 before easing back to consolidate around 26.00. The 50 SMA is crossing above the 200 SMA in a golden cross bullish signal, and the RSI is above 50, supporting further upside.

Buyers will look to retake 30 to extend gains to 34.00, the 2024 high.

On the downside, support can be seen at the December low of 23. The 200 SMA is at 19.40.

GameStop Q3 earnings preview

GameStop's share price jumped last week after a cryptic post from meme stock influencer Keith Gill. Gill is one of the online personas who shot to fame after bullish bets on the video game retailer sparked the trading frenzy trend several years ago. Also known as Roaring Kitty, among other aliases, Gill was a key figure in the Reddit rally of 2021, when the GME stock surged 1600%, crashing hedge funds.

Gill resurfaced on social media in 2024 after a three-year break, leading to massive excitement about the meme stock and a general resurgence of market enthusiasm. As markets trade at all-time highs, the speculative side tends to pop up and trend again.

The video game retailer's stock is 76% higher this year. Investors will ask whether the financials validate the optimism or whether this is another meme-fueled rollercoaster.

The video game retailer has faced an uphill battle due to an industry-wide shift to digital commerce, and the company's planned return to growth is facing multiple headwinds.

Q2 results showed GameStop's sales significantly declined to $789 million compared to $1.16 billion in the same period a year earlier. Meanwhile, operating expenses increased, and sales were expected to be 23% lower year over year in fiscal 2025. Following Q3 earnings, there is no expectation of a conference call or guidance.

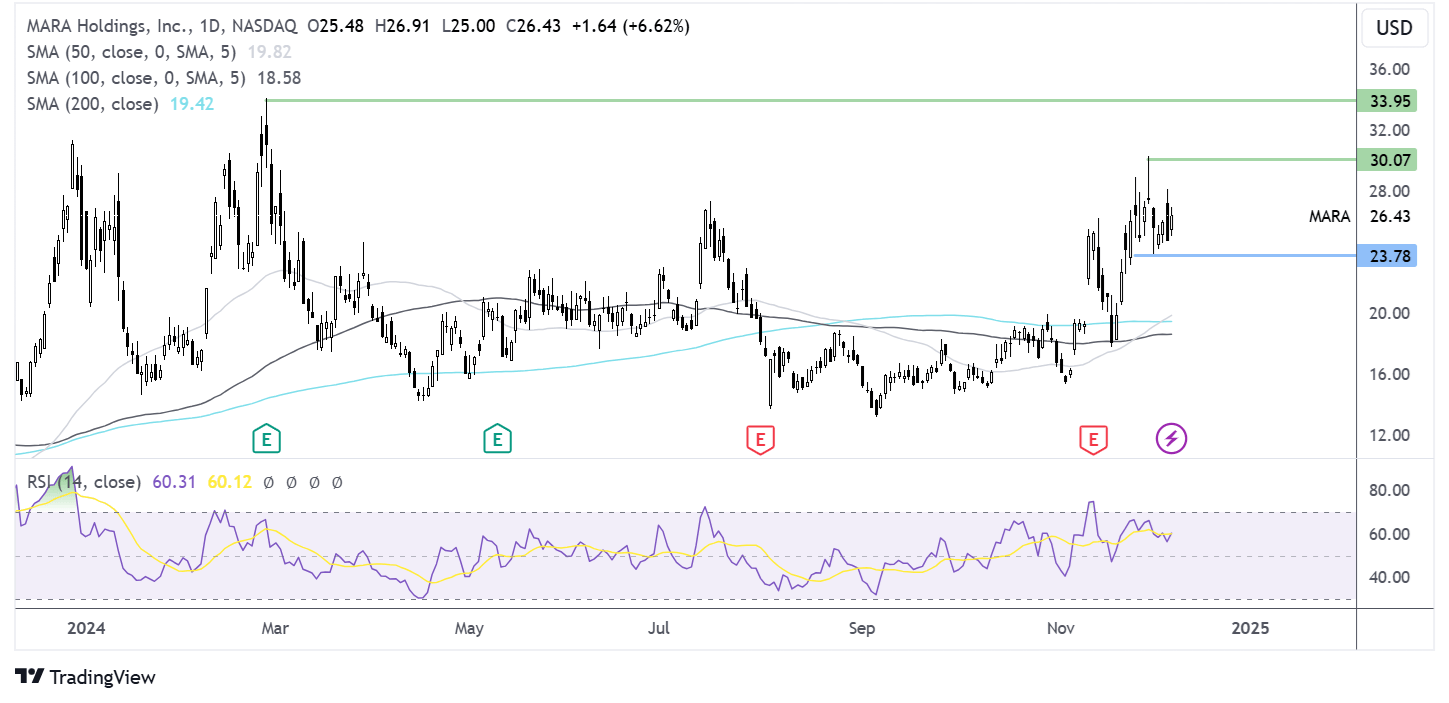

How to trade GME earnings?

After trending lower from July to October, the GME price reversed course, rallying to 32.12 in late November. The price has eased but holds above a key support zone around 25.00, which, combined with the RSI above 50, keeps buyers hopeful of further upside.

Buyers must rise above 32.10 resistance to extend gains towards a 40.00 round number and early June high.

On the downside, a break below 25 opens the door to 23, the 100 SMA, and 22.70, the rising trendline support..