On Tuesday, after market, NetApp (NTAP) is expected to report second quarter EPS of $0.73 compared to $1.09 last year on revenue of approximately $1.3 billion vs. $1.4 billion a year earlier. The Co is a leading provider of data management and storage solutions, and its current analyst consensus rating is 7 buys, 18 holds and 3 sells, according to Bloomberg.

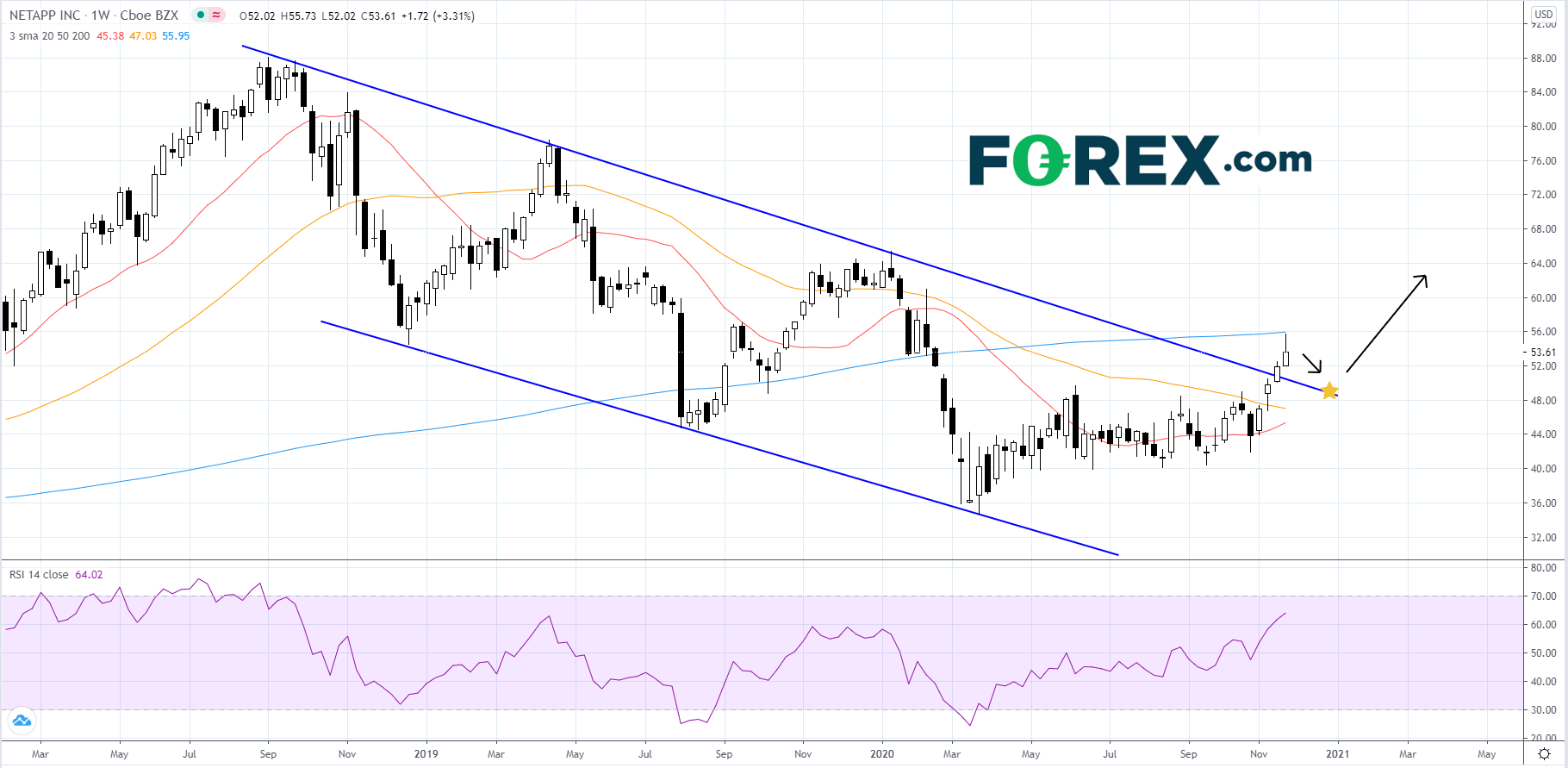

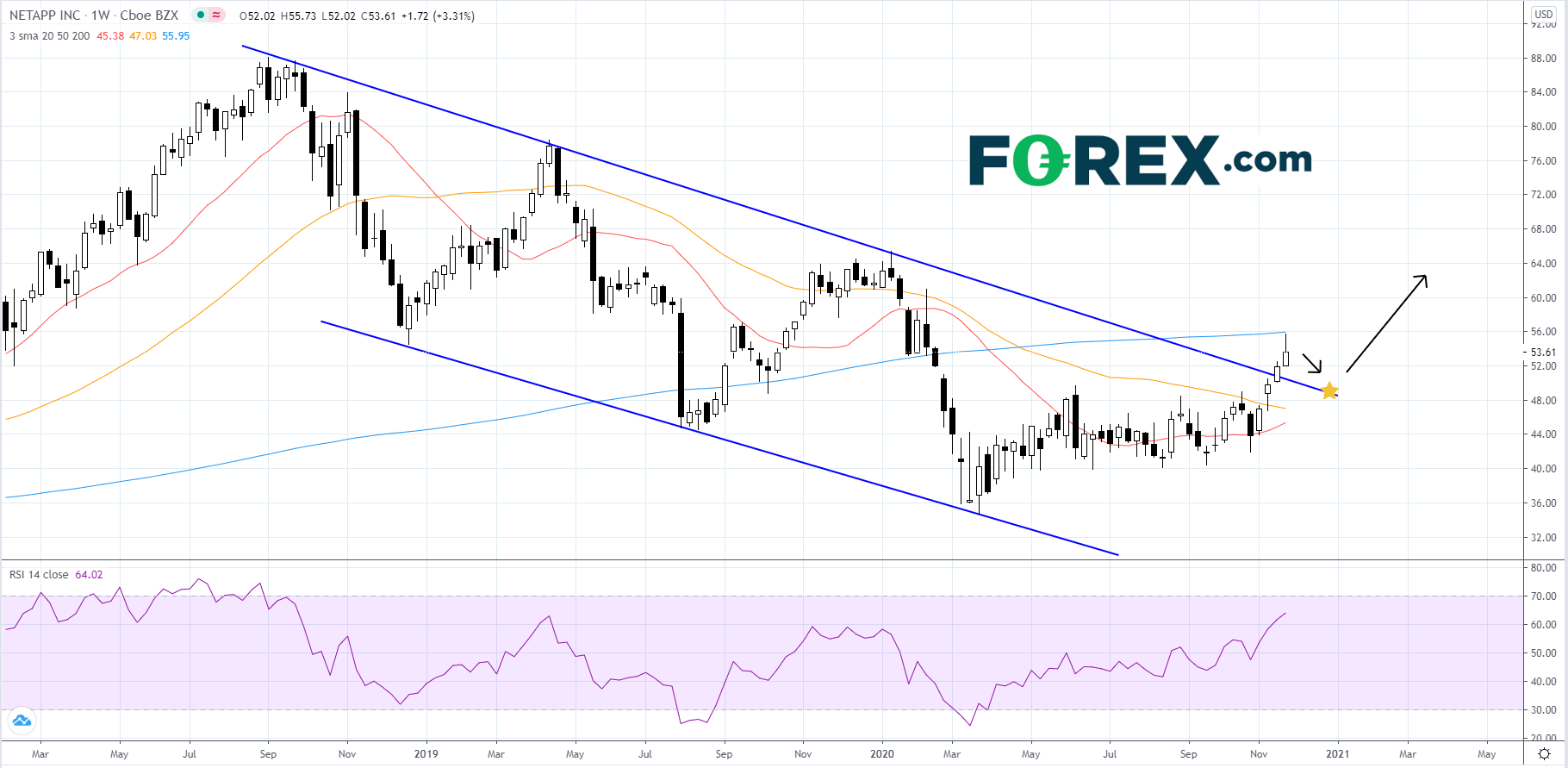

Looking at a weekly chart, NetApp's stock price recently broke out to the upside of a long-term downward channel that began to form in September of 2018. The RSI is holding over 60 and shows bullish momentum. Price appears to have used to the 200-week simple moving average (SMA) as resistance.

Source: GAIN Capital, TradingView

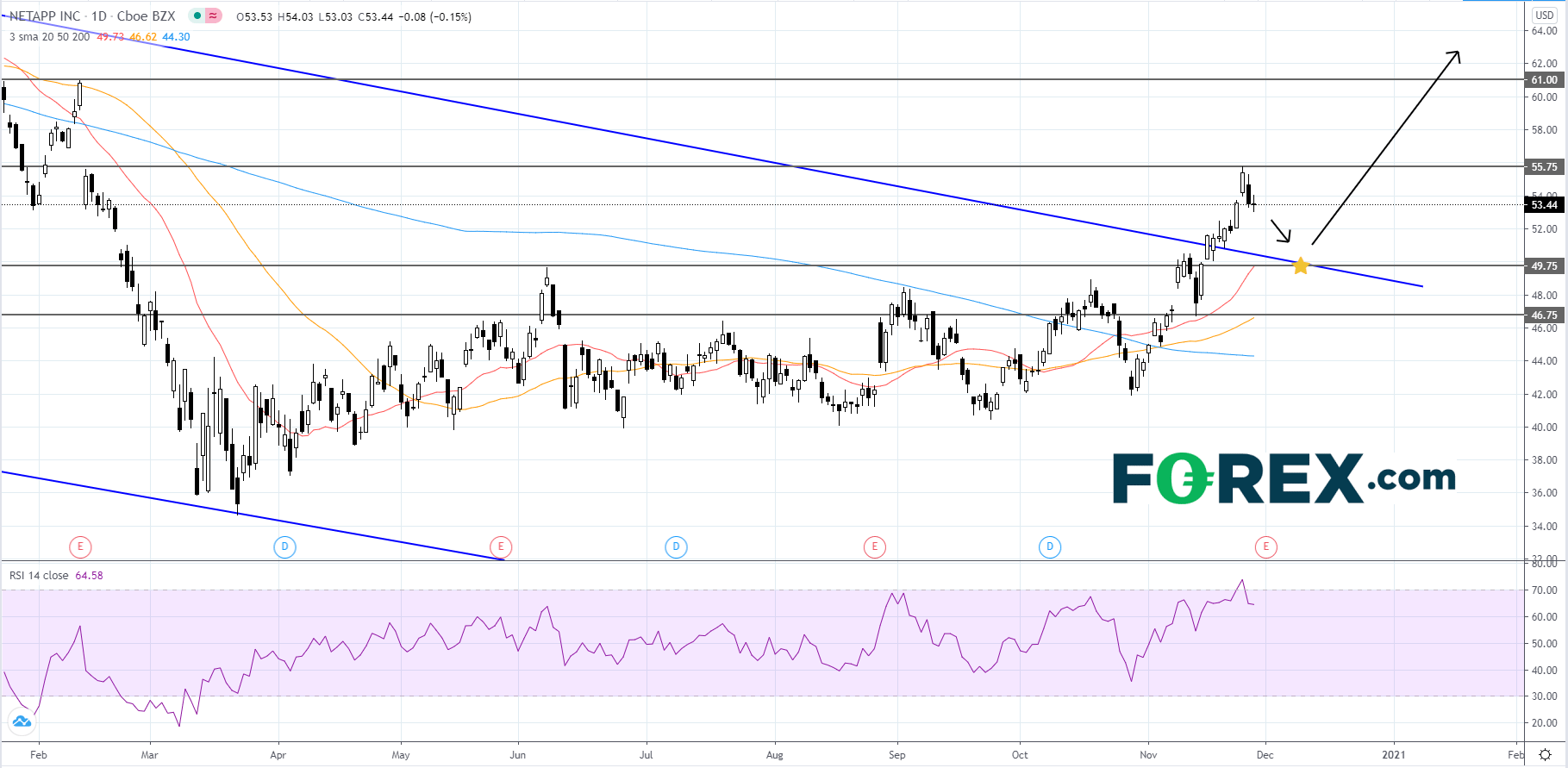

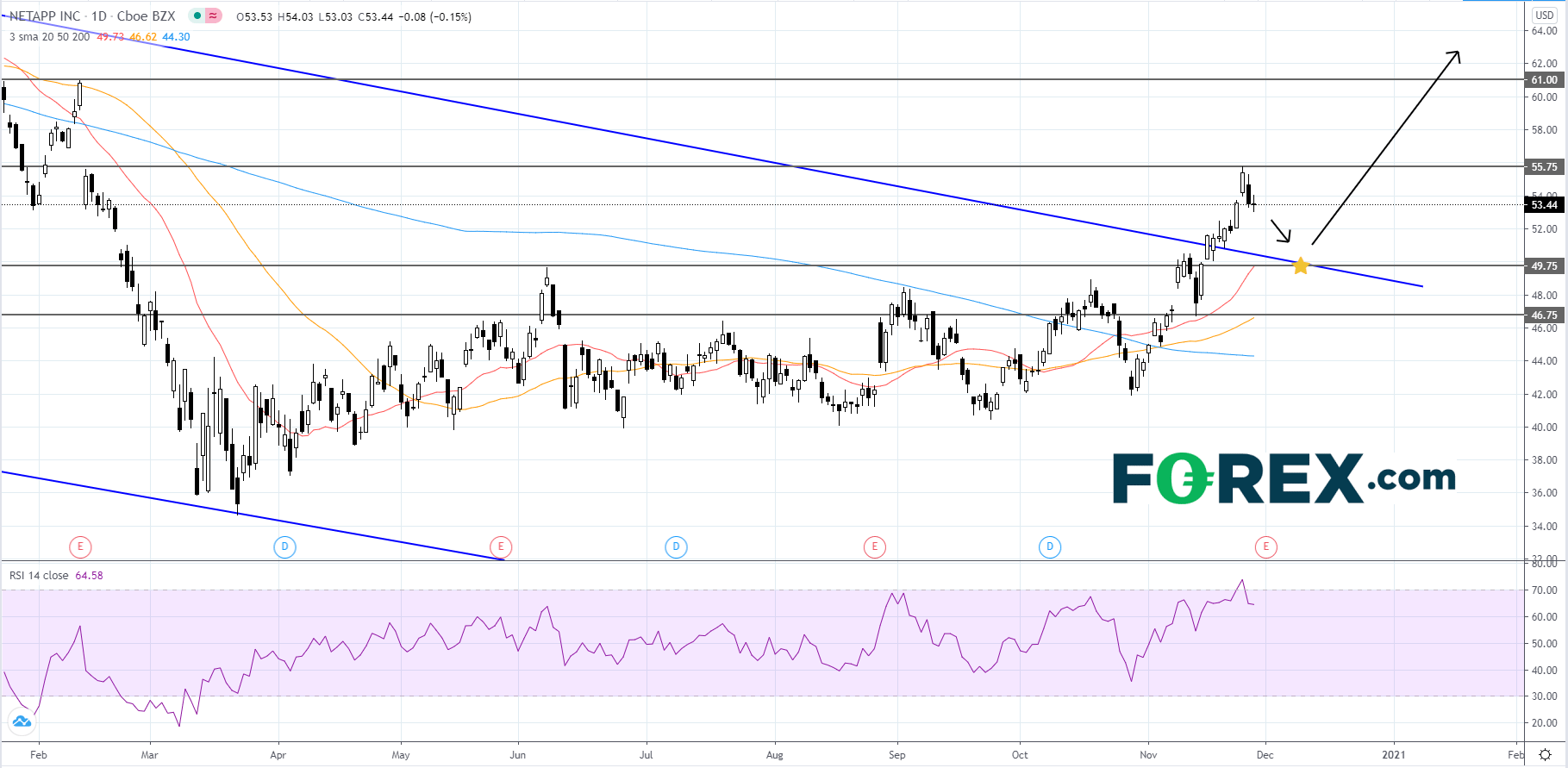

Looking at a daily chart, NetApp's stock price has been rallying since late-October, early-November and on November 16th, price broke out to the upside of the long-term bearish channel that price was declining within since September of 2018. The RSI has just retreated from overbought territory and its holding above 60. The SMAs are bullish, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. Price could possibly pull back to the upper trendline of the long-term bearish channel where it would likely find support before continuing to advance. If price can get above 55.75, then its next target would be 61.00. If price can get above 61.00, then it could continue to rise. On the other hand, if price falls below 49.75, it would be a bearish signal that could send price back to 46.75. If price is not able to find support at 46.75, then price could fall further.

Source: GAIN Capital, TradingView

Looking at a weekly chart, NetApp's stock price recently broke out to the upside of a long-term downward channel that began to form in September of 2018. The RSI is holding over 60 and shows bullish momentum. Price appears to have used to the 200-week simple moving average (SMA) as resistance.

Source: GAIN Capital, TradingView

Looking at a daily chart, NetApp's stock price has been rallying since late-October, early-November and on November 16th, price broke out to the upside of the long-term bearish channel that price was declining within since September of 2018. The RSI has just retreated from overbought territory and its holding above 60. The SMAs are bullish, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. Price could possibly pull back to the upper trendline of the long-term bearish channel where it would likely find support before continuing to advance. If price can get above 55.75, then its next target would be 61.00. If price can get above 61.00, then it could continue to rise. On the other hand, if price falls below 49.75, it would be a bearish signal that could send price back to 46.75. If price is not able to find support at 46.75, then price could fall further.

Source: GAIN Capital, TradingView

Latest market news

Today 08:00 PM

Yesterday 10:06 PM

Yesterday 07:45 PM

Yesterday 06:00 PM