EUR/USD made a major breakdown on Tuesday as the US dollar surged on increasingly higher expectations of a Federal Reserve interest rate hike before year-end as well as increasingly lower prospects for a victory by Donald Trump in the early November US presidential elections. At the same time that the dollar has been boosted, the euro showed some pronounced weakness on Tuesday, falling not only against the dollar, but also against the yen, while rising against the even more pressured British pound.

Major upcoming events that will very likely affect EUR/USD begin this week with Wednesday’s minutes from September’s FOMC meeting, in which interest rates were kept unchanged but three dissenting votes upset the typically more united policy-setting group. As it currently stands, expectations for a December rate hike are running high, with the market’s view of the probability of such a hike still hovering just below 70%. A series of US economic data releases at the end of this week, including retail sales, the producer price index (PPI), and consumer sentiment, could also help shape expectations and dollar movement going forward.

Shifting to Europe, next week holds the long-awaited October policy meeting of the European Central Bank (ECB). Dovish pronouncements from the ECB as the central bank continues to implement its substantial quantitative easing measures have long weighed on the euro. Any further dovishness from the ECB next week could lead to significantly further euro downside, especially against the Fed-driven strength of the dollar.

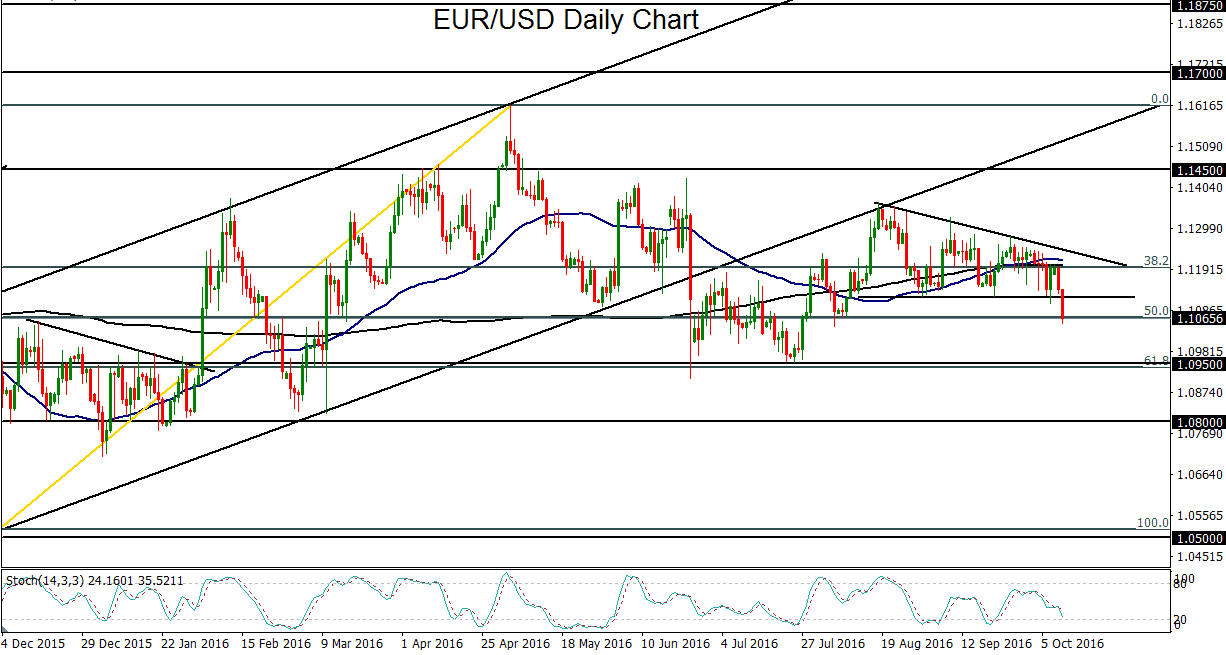

Up until Tuesday, EUR/USD had been consolidating in a tightening range, forming a common triangle chart pattern, since mid-August. The lower boundary of this triangle was just above the 1.1100 support level. Tuesday’s breakdown has clearly broken the nearly-2-month consolidation pattern without showing signs of becoming technically oversold. This suggests that further potential losses may be in store for EUR/USD, depending substantially upon the abovementioned risk events from the FOMC minutes and ECB meeting. With sustained follow-through on the current breakdown, major downside targets are currently at the key 1.0950 and 1.0800 support levels.

Major upcoming events that will very likely affect EUR/USD begin this week with Wednesday’s minutes from September’s FOMC meeting, in which interest rates were kept unchanged but three dissenting votes upset the typically more united policy-setting group. As it currently stands, expectations for a December rate hike are running high, with the market’s view of the probability of such a hike still hovering just below 70%. A series of US economic data releases at the end of this week, including retail sales, the producer price index (PPI), and consumer sentiment, could also help shape expectations and dollar movement going forward.

Shifting to Europe, next week holds the long-awaited October policy meeting of the European Central Bank (ECB). Dovish pronouncements from the ECB as the central bank continues to implement its substantial quantitative easing measures have long weighed on the euro. Any further dovishness from the ECB next week could lead to significantly further euro downside, especially against the Fed-driven strength of the dollar.

Up until Tuesday, EUR/USD had been consolidating in a tightening range, forming a common triangle chart pattern, since mid-August. The lower boundary of this triangle was just above the 1.1100 support level. Tuesday’s breakdown has clearly broken the nearly-2-month consolidation pattern without showing signs of becoming technically oversold. This suggests that further potential losses may be in store for EUR/USD, depending substantially upon the abovementioned risk events from the FOMC minutes and ECB meeting. With sustained follow-through on the current breakdown, major downside targets are currently at the key 1.0950 and 1.0800 support levels.

Latest market news

Today 04:00 PM

Today 09:11 AM