- Dollar analysis: EUR/USD tests 1.07 resistance

- Dollar analysis: DXY needs to hold THIS support area

- Gold analysis: precious metal rallies to key resistance zone

Welcome to Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike.

In this edition of Technical Tuesday, we will analyse the EUR/USD, Gold and the Dollar Index.

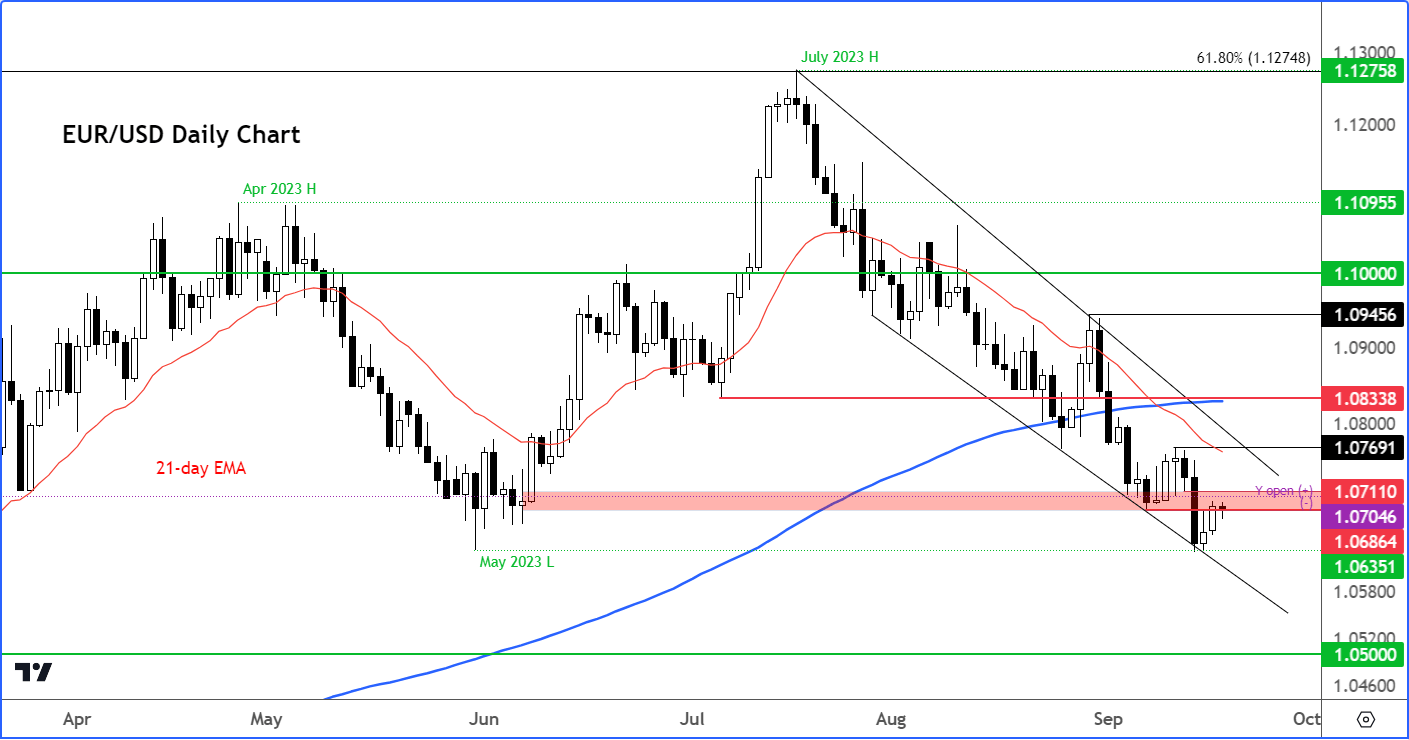

Dollar analysis: EUR/USD tests 1.07 resistance

The EUR/USD outlook remains bearish. The Fed is likely to opt for a hawkish hold on Wednesday, which could give the dollar rally fresh legs to run further. Meanwhile, the euro remains downbeat amid concerns over the Eurozone economy, and after the ECB last week said interest rates are now at ‘sufficiently restrictive levels’ to imply the hiking is now done.

The three-day recovery in the EUR/USD has not been driven by any major changes in the macro backdrop, which means there is a good chance this currency pair could resume lower from around the current levels.

If the sellers are to remain in control, then they must continue to defend broken support levels. One such area is around 1.0700, which was being tested at the time of writing. Once support, this area could turn into resistance and lead to renewed weakness for the EUR/USD.

The EUR/USD bulls meanwhile will need to see a higher high above 1.0770 to signal a possible bullish reversal.

On the downside, my main objective was the May low of 1.0635 where the EUR/USD finally got to after the ECB’s dovish rate hike on Thursday. We will now need to see acceptance below this level before we look towards 1.0500 as the possible next major downside target.

From a macro point of view, the EUR/USD outlook remains bearish. If the Fed signals fewer rate cuts in 2024 in its updated dot plot on Wednesday, this could give rise to fresh selling pressure on the EUR/USD and other major pairs. The ECB, meanwhile, seems to be done with rate hikes already. The latter is clearly worried about the path of growth more than the inflation outlook. While rising oil prices may well keep global inflation elevated, the ECB’s recent aggressive tightening is more than enough to help bring inflation back down as growth remain anaemic, as we have witnessed in recent data releases in Germany and the Eurozone.

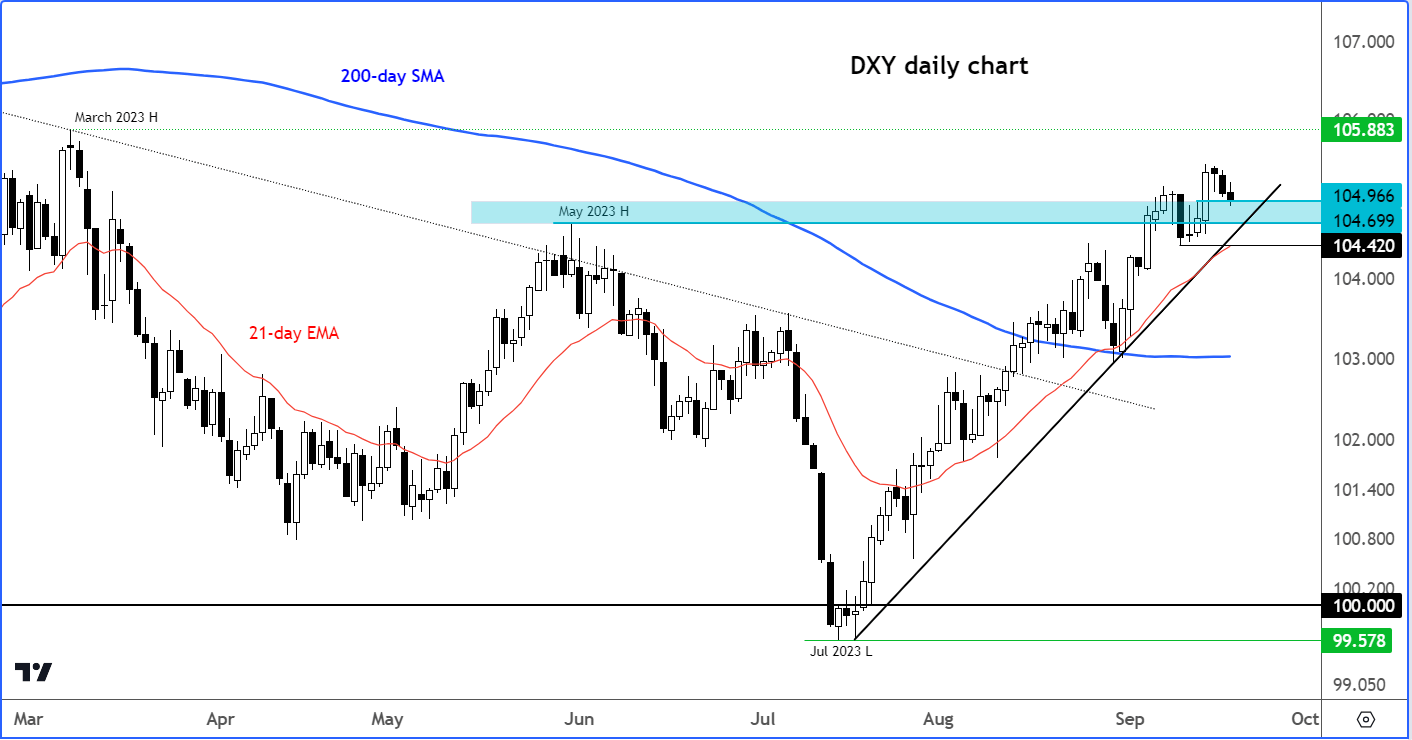

Dollar analysis: DXY needs to hold THIS support area

After rising got the 9th straight week, the dollar index (DXY) has been on the backfoot so far this week. This is hardly surprising. Traders are clearly taking some profit on their long dollar positions accumulated during this period, ahead of major risk events. The dollar has been weighed down by the likes of the Canadian dollar, which has been trending higher on the back of rising oil prices and stronger Canadian data. We have also seen a mild bounce for the EUR/USD, which is the main reason why the DXY is down – down, but not out.

The DXY was testing key support at the time of writing around the 104.70 to 1.0500 area, formerly a key resistance zone. Now that we have broken above this area, the buyers will need to show up and defend their ground if they are to maintain control. The line in the sand is at 104.42, which was last week’s low. For as long as that level remains intact, the directional bias on the DXY will remain bullish.

In the next two days, we should have a very good idea in terms of whether the dollar will be able to rise for the 10th consecutive week, or reverse. I certainly wouldn’t bet against further gains for the greenback. For one thing, US data continues to surprise to the upside, which should keep the Fed in a hawkish mode. For another, a growing number of major central banks, such as the ECB, are pausing, or about to pause, their interest rate tightening, owing to weakness in foreign data and signs of disinflation around the world.

That said, central banks in the UK, Switzerland, Sweden and Norway, as well as Turkey and Brazil, will all be making their own policy decisions this week, and all are expected to hike. The impact of these central bank decisions, apart from the BoE, on the dollar index will be limited, however, given that the DXY is heavily influenced by the EUR (57.6% weighting) and JPY (13.6%) whereas the SEK (4.2%) and CHF (3.6%) have weightings of less than 8% combined. While the GBP (11.9%) also has a big influence on the DXY, I reckon sterling is going to do what the euro did last week and drop. For we expect a dovish rate hike by the BoE this week.

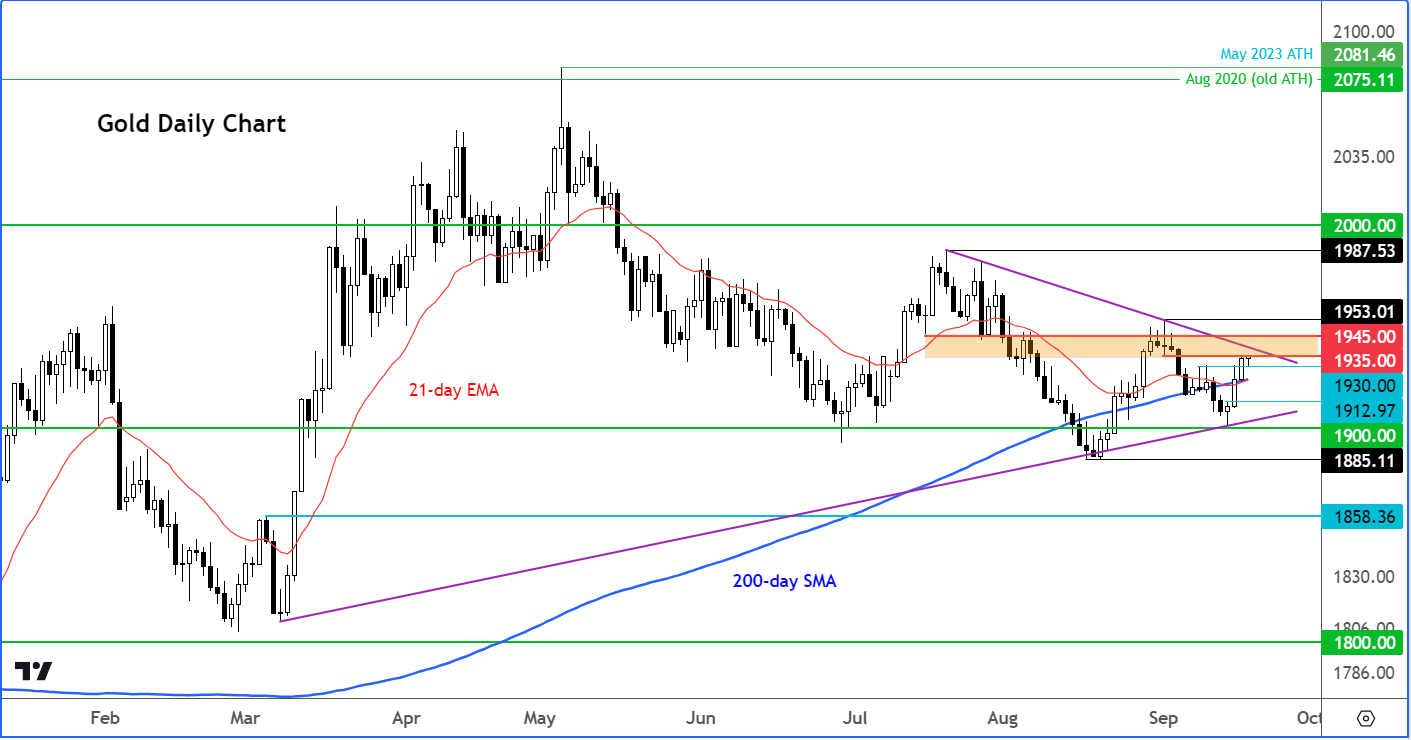

Gold analysis: precious metal rallies to key resistance zone

Gold is now up for the fourth consecutive day, building some bullish momentum heading towards the busier part of the week. Given that the gains have been made during the relatively quieter period and ahead of a key risk event – the FOMC rate decision – you always have to be careful in drawing too many conclusions. For after all, this could just be an oversold bounce. In any case, more price action is needed for confirmation. We are not convinced yet that a low has been formed.

For the opportunity cost of holding gold to fall, bond yields will need to go down and fast. Otherwise, there is a good chance the precious metal will start to head lower again from around these levels. Investors are wary of the dollar, which remains strong, albeit off its best levels. The benchmark US 10-year bond yields broke out briefly on Monday to hit levels not seen since 2007, before easing lower. The Fed’s rate decision on Wednesday, and that of several other central banks this week, could cause global bond yields to move sharply. That, in turn, could determine the direction of gold prices.

For now, gold remains inside its recent consolidation zone, testing key resistance here between $1935 to $1945. This area was previously support and resistance.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R