DAX rises as consumer confidence improves and earnings roll in

- GFK consumer confidence improves to -18.3 from -21

- Adidas rises after solid results

- DAX looks towards 20k

The DAX and its European peers are heading higher after overnight gains on Wall Street as investors digest the latest earnings and improve German consumer sentiment.

GfK consumer confidence improved more than expected to -18.3, up from -21 and ahead of forecasts of -20.5, marking its highest level since April 2022. Wage growth and easing inflation are boosting confidence. However, recession worries persist as the German government forecasts a 0.2% GDP contraction this year.

Still, the market remained positive amid upbeat earnings. Adidas is rising after posting strong underlying growth in Greater China in the third quarter, while sales in North America, excluding the Yeezy collection, also rose on increasing brand momentum.

Looking ahead, attention will turn to the US, JOLTS job openings, and consumer confidence data. Stronger-than-expected data could lower Fed rate cut expectations for the December meeting, putting pressure on stock.

US earnings are also in focus, with Alphabet, McDonald's, and Visa among big names announcing results.

Meanwhile, the US elections are drawing closer, with Trump gaining ground in the polls. Still, the uncertainty surrounding the election could prevent stocks from reaching record highs.

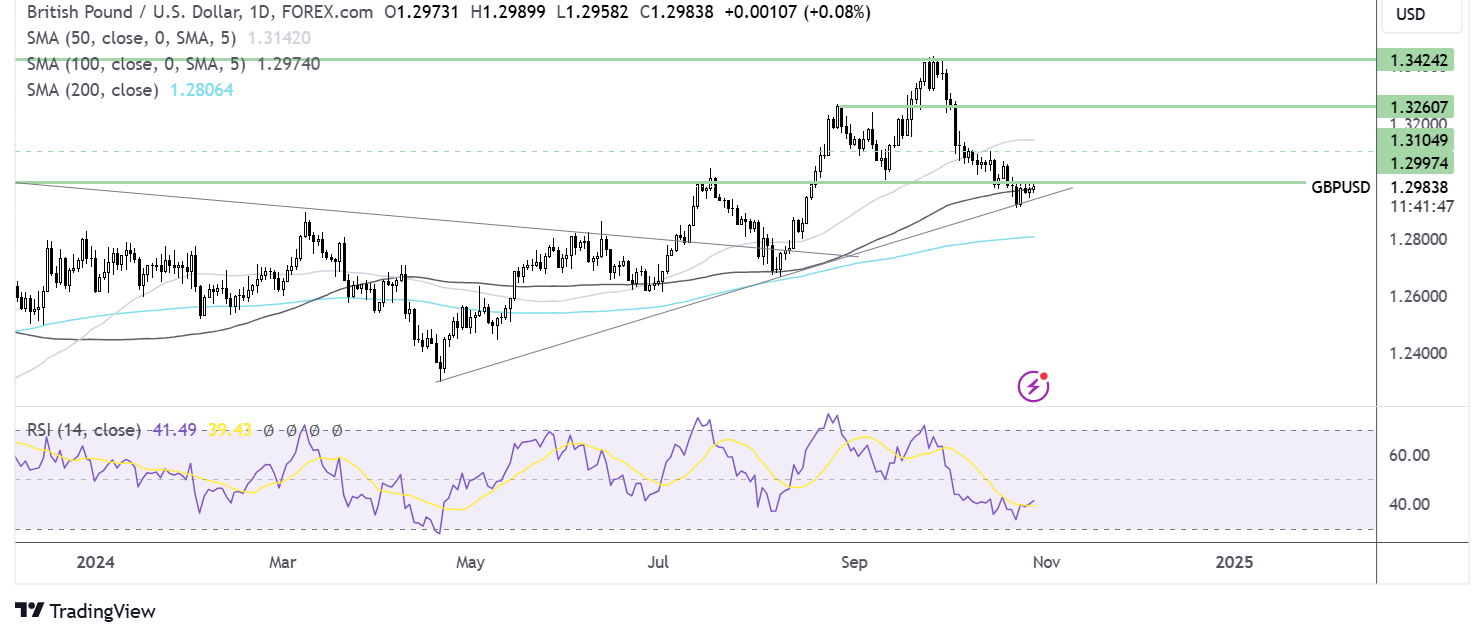

DAX forecast – technical analysis

The DAX has recovered from its 17k August low, forming a series of higher highs and lower lows. This, combined with the RSI above 50, keeps buyers hopeful of further upside.

Buyers will look to rise above 19,680 to fresh all-time highs towards 20k and beyond.

Support can be seen at 19.3k, last week’s low. Below here, 19k, the October low, comes into focus.

GBP/USD holds steady ahead of tomorrow's budget

- Budget could bring tax hikes, spending cuts & changes to the Golden Rules

- This could be deflationary, helping the BoE to cut rates

- US JOLTS job openings & consumer confidence is due

- GBP/USD holds steady below 1.30

The pound is little changed in cautious trade ahead of the labour government's budget tomorrow, where Rachel Reeves is looking to plug a £22 billion black hole in public sector finances. Reeves is looking to apply a combination of tax hikes, spending cuts, and changes to the golden rules to achieve this while also attempting to implement measures to boost UK economic growth. Reeves will be walking a fine line, where she will want to avoid the mistakes of Liz Truss two years earlier, whose Budget sent the pound to its lowest level in decades.

Tax hikes are considered deflationary and could aid the Bank of England's rate-cutting cycle, which would pressure the pound. Any growth measures implemented are likely to be longer-term, so they are unlikely to boost sterling.

Meanwhile, the US dollar is rising, hovering around a three-month high on expectations that the Federal Reserve will adopt a more gradual pace to rate cuts following a series of stronger-than-expected U.S. economic data.

This week, the US economic calendar is packed with GDP, core PCE, and nonfarm payrolls, which will provide more clues about the future path of Fed rate cuts.

Today, the focus is on U.S. consumer confidence, which is expected to improve in October, and jolts job openings, which are expected to decrease modestly.

Meanwhile, the US elections are also in focus and supporting the US dollar. The market is increasingly expecting a Trump victory. Trump's policies are inflationary, which could mean the Fed will be even more gradual with its rate cuts.

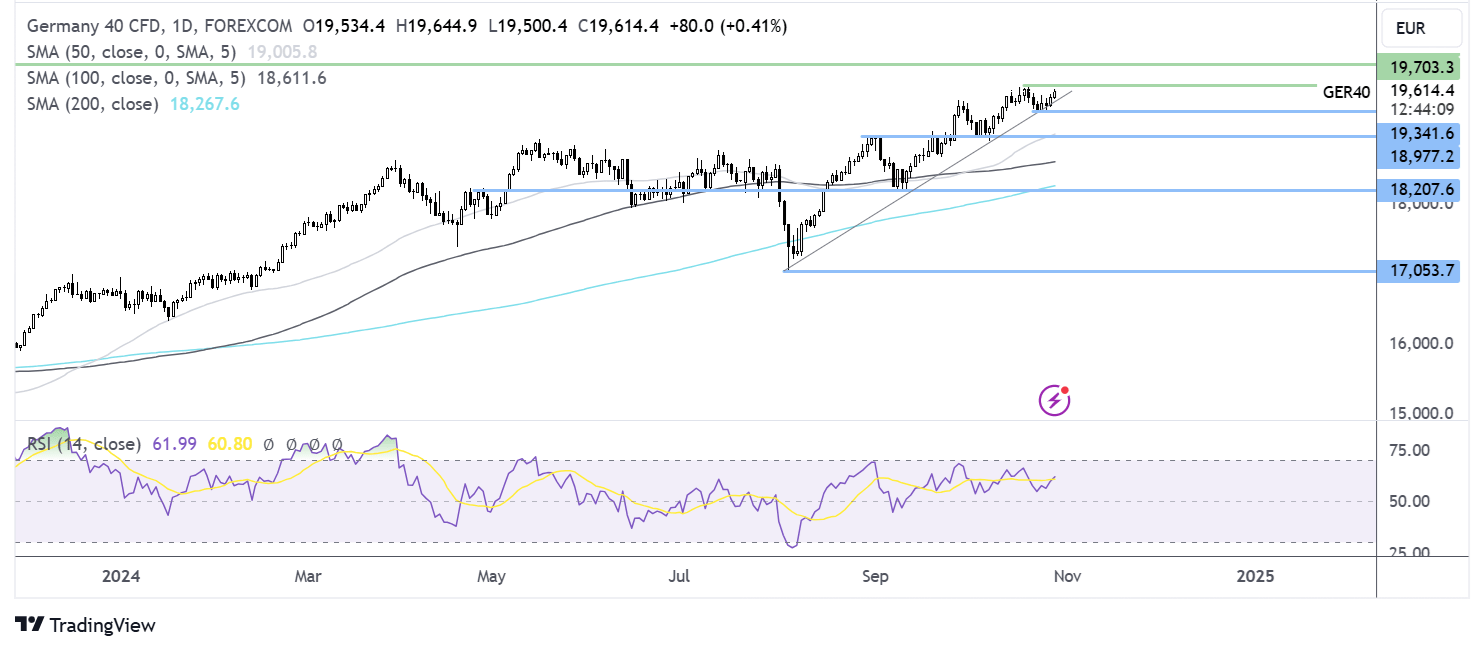

GBP/USD forecast – technical analysis

GBP/USD fell from 1.3420 resistance, dropping below 1.30 before finding support at 1.29, the rising trendline support dating back to May. The price has edged higher and is holding steady around 1.2974.

Sellers, supported by the RSI below 50, will look to take out 1.29 to expose the 200 SMA at 1.28.

Should the rising trendline support continue to hold, buyers will look to rise above 1.30 to negate the downtrend and look towards gains at 1.31.