- DAX analysis: German index hits another record high

- Risk of correction in tech sector is increasing

- DAX technical analysis continues to point higher

The US markets will be closed on Monday in observance of Presidents’ Day, and the week ahead will not contain many important macro highlights to watch closely. But China will be back after a week-long holiday, and we will have earnings from Nvidia in mid-week to look forward to. Among the week’s data highlights, the global PMIs on Thursday could move the markets. In particular, watch those of Germany and the Eurozone, where the economic output has been below the pace of growth observed in the US. The weakness in Eurozone data did not stop the DAX from hitting repeated record highs, with nearly all mainland European indices doing rather well. But at some point, the market will have to assess the impact of weak data on earnings and consider whether they have pushed asset prices too high.

DAX analysis: German index hits another record high

On Friday, the DAX climbed to fresh unchartered territories, as investors insatiable risk appetite continued. Driving the DAX to record highs has been partly driven by speculation that the ECB is going to cut rates in the coming months. The German index has also found support from its technology constituents, with the sector surging on AI optimism in the US, lifting tech stocks across the globe.

Meanwhile, inflation within the Euro-zone has sharply fallen in recent months. From a peak of 10.6% in October 2022 to 2.8% last month. Analysts expect to see further moderation towards the 2% target this year. However, lingering risks persist: Wage growth remains high as incomes adjust to price spikes, while disruptions in Red Sea shipping pose renewed threats to supply chains. These factors have been ignored for now as the debate around when the ECB should begin lowering rates hots up.

Although nearly all ECB officials support a rate cut this year, there is disagreement on the timing. While a majority seem to prefer June or later, some are leaning towards April, and one official is not ruling out March. This divergence underscores the differing opinions on inflation trends and the outlook for Europe's sluggish economy. Against this backdrop of uncertainty with interest rates, and slow growth, the DAX may soon run out fuel.

Risk of correction in tech sector is getting higher

Wall Street was on track to close lower on Friday at the time of this writing, after indices there hit repeated record highs. But bond yields rose further, and this seemed to dampen the appetite for risk taking ahead of a long weekend. Following a hot CPI report, PPI was equally strong, printing 0.3% month over month against expectations of 0.1%, while core PPI rose 0.5% on the month, easily beating expectations of 0.1%. The PPI gains were fuelled by a sharp rise in costs of services, highlighting concerns about the sticky nature of inflation. We also saw an uptick in the UoM consumer sentiment and inflation expectations survey, with the latter rising to 3% from 2.9%. The market was therefore once again reminded that the Federal Reserve will be in no rush to cut interest rates.

Despite these signs, the US indices have hit repeated record highs. Investors have continually ignored the Fed’s consistent pushback against expectations of an early rate cut. Instead, they have chosen to concentrate on mostly stronger earnings and the AI optimism, taking advantage of the bullish momentum to drive stocks higher. But with some of the Magnificent 7 stocks reaching extremely expensive levels, there is always the danger of a correction soon. Nvidia will be the last from this group to report its results in the week ahead. With most of the optimism now in the price, a correction of some sort, should not come as major surprise in the tech sector.

DAX analysis: technical levels to watch

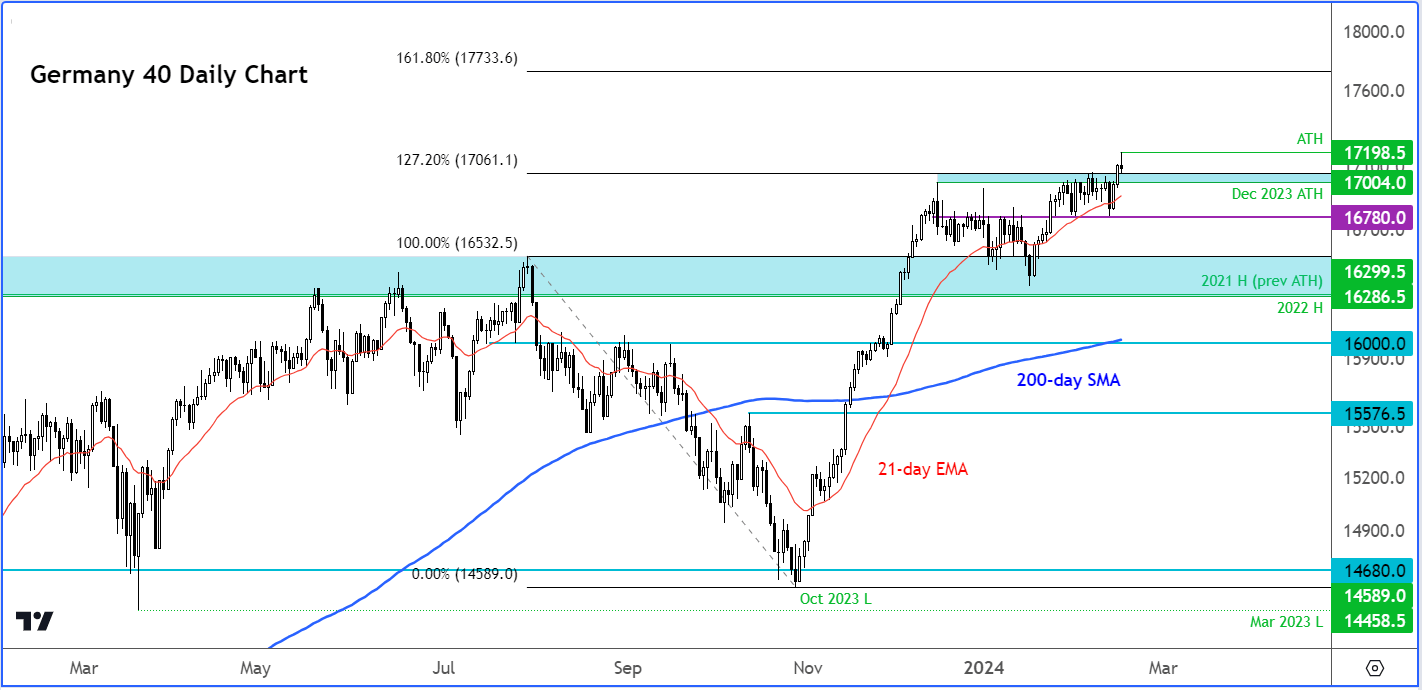

Source: TradingView.com

The DAX broke to a new record high on Friday, reaching a high so far of just under 17200. The index came off its earlier highs as US indices reacted negatively to stronger inflation data. But the DAX was still holding onto support in the range between 17000 to 17060ish. This area was previously resistance on multiple occasions, including in December. For the bullish trend to remain intact, the bulls must defend their ground here. As things stand, we will only consider bearish setups, should we see the series of higher highs and highs lows break. With that in mind, a potential move below 16780 support could be a warning sign that the bullish trend has come to an end. So far, the bears were nowhere to be seen. Let’s see if that changes in the week ahead, or we continue to power ahead. It is important to trade in the direction of the trend.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R