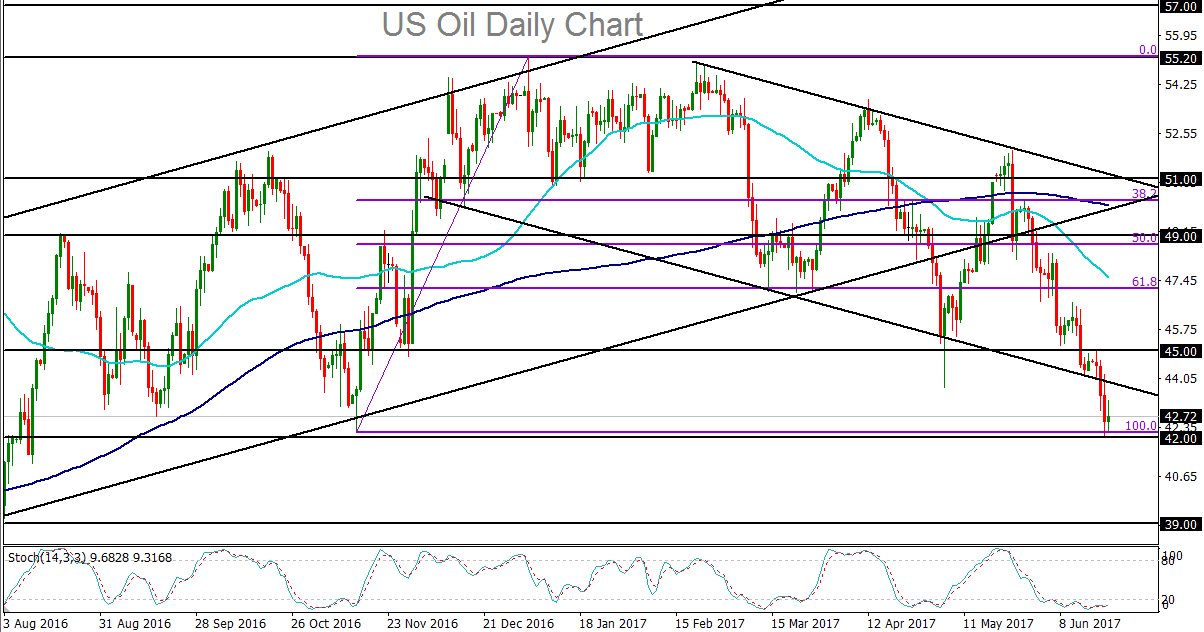

For the past month, the US crude oil benchmark, West Texas Intermediate, has been plummeting within a clearly-formed descending line, complete with short, intermittent relief rallies. After extending this sharp plunge down to key support around the $42 handle this week, Thursday saw another attempt at a modest rebound rally, which ultimately sputtered.

Though the current crude oil slide may be considered overextended by some market participants, fundamentals continue to weigh heavily on prices and are likely to persist in pushing crude oil lower. Since the highs around $55 at the beginning of the year, the price of US crude oil has followed a clear downtrend, shedding more than 20%, to hit a new 10-month low around the noted $42 support level as of Wednesday. The sharp plunge from late May has just been the latest leg to this downtrend.

This sustained drop in crude oil prices has occurred despite the OPEC-led agreement in the first half of the year to limit oil production among major OPEC and non-OPEC participants, as well as the 9-month extension to that deal that was agreed upon in May. The continued oil drop has also occurred despite a larger-than-expected draw in US crude oil inventories last week as reported by the US Energy Information Administration on Wednesday.

Ongoing concerns about prolonged global oil oversupply largely stem from increasing output by the US as well as other major oil producers like Nigeria and Libya, all of which are not participating in the OPEC-led efforts to cut production. Worries that the OPEC deal will ultimately fail in stabilizing crude oil given ramped-up output from non-participants have been a primary driving force for lower prices.

From a technical perspective, as mentioned, US crude oil has just reached down to the key $42 support level, re-testing the low from mid-November. If a strong price rebound fails to materialize, as could well be the case, this support level is likely to be broken down. In that event, the next major downside target resides significantly lower, around the $39 support level, which would re-test the lows of last August.