- Crude oil analysis: ISM manufacturing PMI miss highlights demand worries

- OPEC + fails to underpin prices

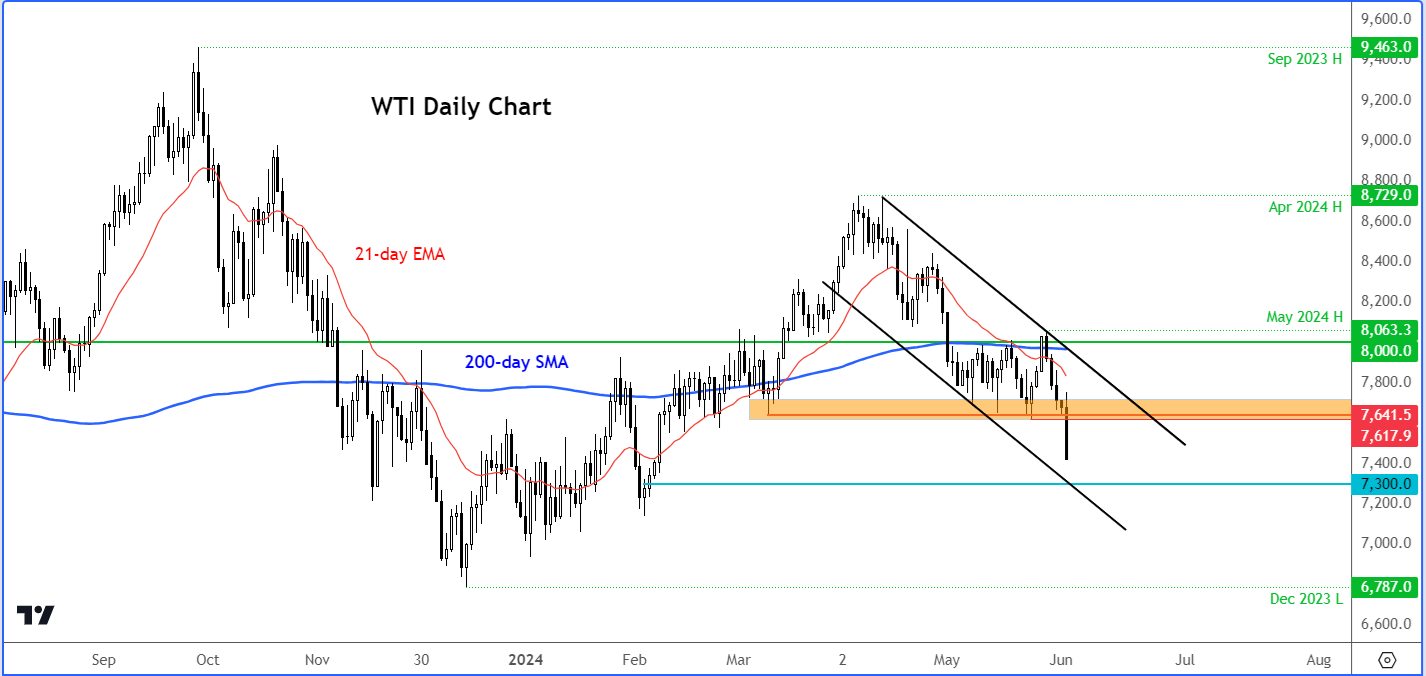

- WTI technical analysis is clearly bearish but watch out for oversold bounce

It looks like demand concerns are back on the forefront of investors' minds. Crude oil has dropped to its lowest level since February, with WTI bearing the brunt of the selling after weak US factory data intensified demand concerns, already underscored by the OPEC+ decision to extend its output cuts on Sunday. It looks like the selling was triggered by ISM manufacturing PMI data, which showed the small expansion we saw in March was just a one off. Revised data for April revealed US factory activity was in contraction and the pace of the slump deteriorated in May. What’s more, we saw construction spending fall unexpectedly by 0.2% m/m. So the crude oil analysis is not looking great for the bulls right now, but we could see an oversold bounce as prices search for support levels.

Crude oil analysis: ISM manufacturing PMI miss highlights demand worries

The weak manufacturing activity was largely thanks to sliding orders. It means that the sector’s activity contracted for the second consecutive month and the 18th time in the past 19 months. The headline PMI fell from 49.2 to 48.7, missing expectations for a rise to 49.6.

In contrast and despite a plunge in hard data in May, S&P Global's flash survey of manufacturing sentiment showed an uptick, with the final print rising from 50.0 in April to 51.3 in May.

But not many people take the latter as seriously as the former, which is why oil prices slumped once the data was revealed.

Crude oil analysis: OPEC + fails to underpin prices

The decision by the OPEC+ to extend its output cuts were factored into oil prices, hence we didn’t see much enthusiasm from the bullish camp once trading started overnight in Asia. One factor that may have contributed to the drop in oil prices, outside of demand fears, is concerns that Russia may be producing and exporting far mor oil than agreed upon. Prince Abdulaziz bin Salman, the Saudi oil minister, suggested that the process of accurately assessing the capacity of OPEC+ members had been delayed because Russia had not been able to share detailed data with the independent consultancies appointed to carry out the work. For now, the OPEC+ has pledged to keep more than 3 million barrels a day of crude off the market until the end of next year, although it will bring back curbed voluntary productions slowly this year, if permitted by macro forces and oil prices.

Crude oil technical analysis

Source: TradingView.com

The drop in oil prices have left behind a clean resistance level to watch for future references, between $76.00 to $76.50 area on WTI. This is going to be the most important resistance area to watch and for as long as prices remain below here, the bearish trend would not change even if we were to see an oversold bounce and some bullish price action at lower levels.

One area to watch for a potential bounce is around $73.00, marking the support trend of the bearish channel that has been in place since prices peaked in April. The next major support level below that is at $70.00, followed by the December low at $67.87.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R