- Crude oil analysis: WTI technical levels to watch

- Geopolitics support oil on dips

- Key risks facing oil: weaker demand and strengthening US dollar

Crude oil recovered from earlier weakness to turn slightly higher on the session. Raised geopolitical risks in the Middle East has kept oil prices in the positive territory so far this month, following a 3-month drop in Q4. WTI was again testing a major resistance hurdle around the $75 mark. So, it was too soon to say whether the gains could last, as this level has proven a tough nut to crack. There are also concerns about demand, which has limited the upside even as the OPEC+ continues its intervention by holding back supplies. Bullish traders may wish to wait for a clean breakout above $75 for confirmation. But will it fall from here instead?

Before discussing reasons why oil has been finding support and the key risks facing oil, let’s quickly take a look at the chart of WTI first.

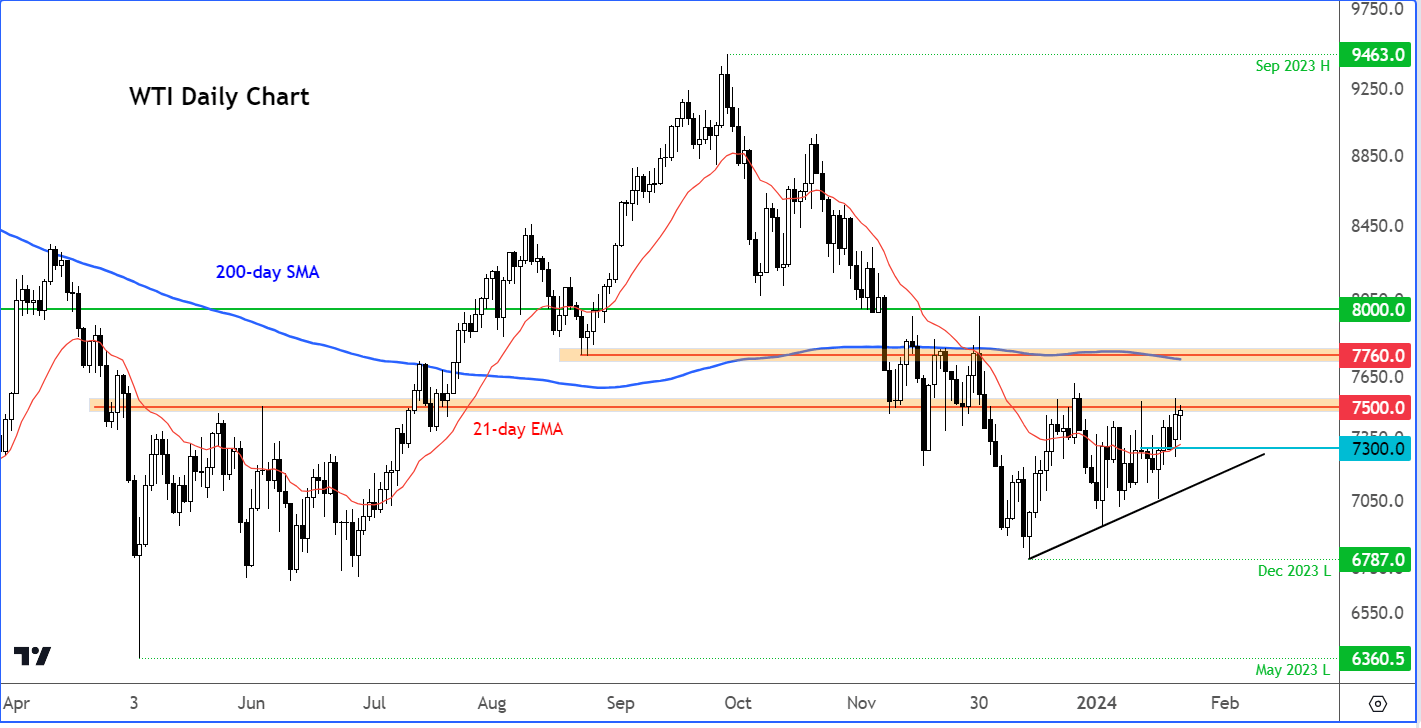

Crude oil analysis: WTI technical levels to watch

Source: TradingView.com

The fact that WTI has recent broken above its 21-day exponential moving average would appease the bulls as the US oil contract continues to knock on resistance at $75.00 from below. The lack of any bullish breakout or upside momentum is what is keeping the bears happy, for now.

Should WTI break through $75.00 cleanly, then we could see follow-up technical buying towards the next resistance and the 200-day moving average around $77.50-$77.60 area next.

However, if resistance holds at $75.00 and we see a subsequent breakdown of support around $73.00, then this will be a bearish outcome. In this potential scenario, WTI may go on to fall towards it December low of $67.87.

So, there are two potential tactical scenarios we are watching on oil. Keep a close eye on prices.

Crude oil analysis: geopolitics support oil on dips

The risks to global supplies driven by tensions and violence in the Middle East continue to provide support for oil on the dips. But we have also been in a positive risk environment, with three major US indices all breaking to fresh unchartered territories this week as the tech-fuelled rally continues. The positive risk sentiment from equity markets has also been helping to boost the appetite for other risk assets, including crude oil.

However, crude oil faces pressure from several sources…

Key risks facing oil

One of those is the dollar, which is also rising, making commodities priced in USD more expensive for foreign buyers. This is something that could potentially hurt crude oil if the greenback further extends its advance.

Another risk for crude oil is economic data, specifically the more forward-looking figures, which have pointed to subdued economic activity around the world, in particular in the manufacturing sector.

Today’s only US data release was the Richmond Fed Manufacturing index. This gave us some insights about the state of the manufacturing sector ahead of tomorrow’s official global PMIs. It printed -15 when -7 was expected and was worse than the previous reading of -11. A reading above 0 indicates improving conditions, below indicates worsening conditions. So, conditions have been worsening in the last few months in the Richmond area, which bodes ill for the wider manufacturing PMI data due for release tomorrow.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R