Key Events

- Risk of Middle East oil supply disruptions

- OPEC JMMC meeting reflects no change in policies

- US crude oil inventories hit 3-month highs

- US ISM Services PMI

- US Non-Farm Payrolls (Friday)

Middle East Supply Disruption Risks

With rising tensions in the Middle East involving over 6 countries, concerns over oil supply disruption risks have surged. As a result, oil call option volumes have spiked for October, according to CME data, as investors seek to hedge against upside risk.

US Economic Data

From a Western perspective, US economic data continues to support expectations for a 25-bps rate cut. The Non-Farm Payrolls report on Friday will be the final catalyst for the week's market direction, with oil expected to follow broader sentiment tied to rate cut expectations.

OPEC Policies

After the production cut announced in early 2024, recent OPEC meetings have been marked by weak oil prices, postponing any policy shifts toward an output hike. The latest OPEC JMMC meeting on Wednesday reflected no changes, with the next meeting scheduled for December 1st, which is expected to bring heightened oil market volatility depending on market expectations.

Technical Outlook

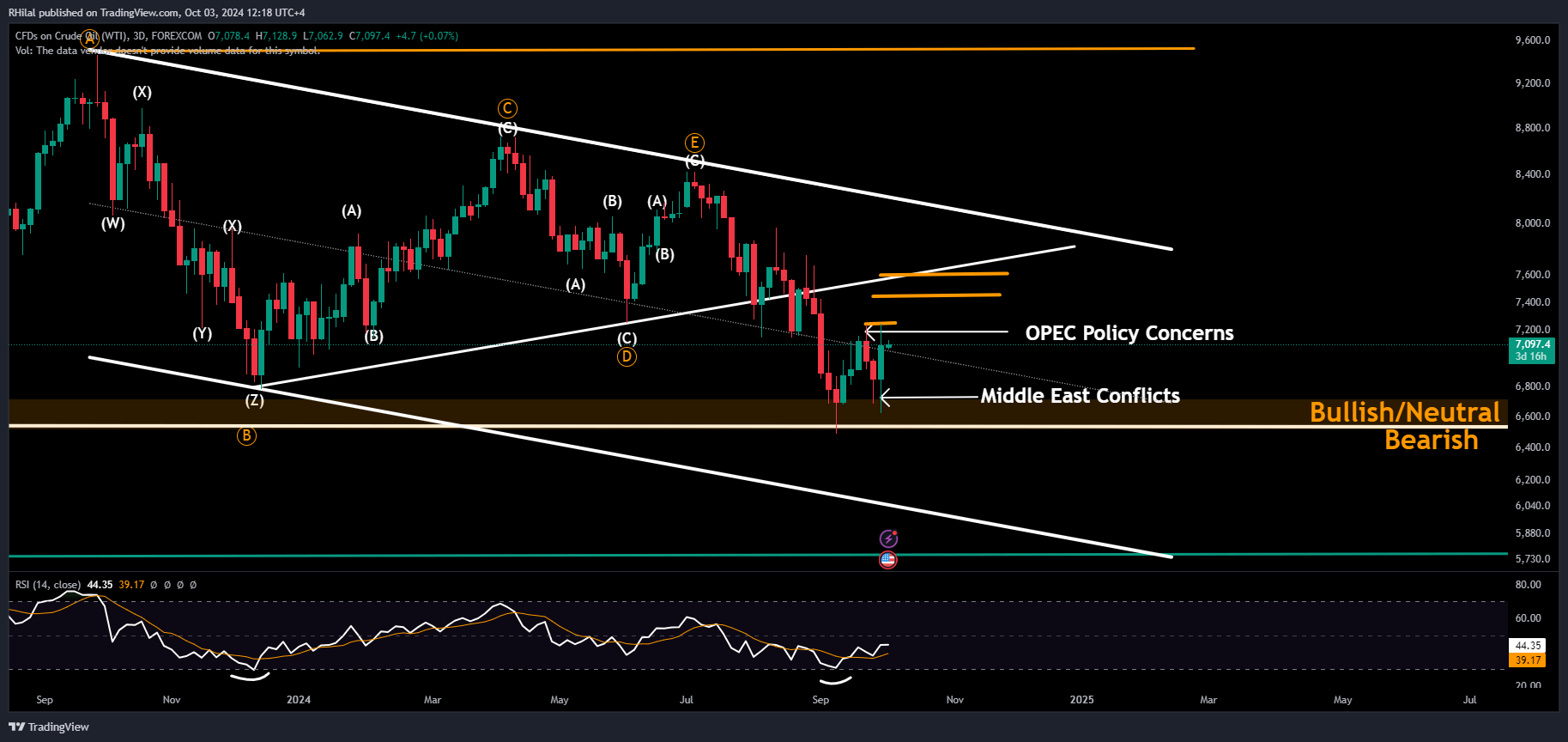

Crude Oil Analysis: 3D Time Frame – Log Scale

Source: Tradingview

Following concerns over OPEC policies, oil experienced a sharp drop from a high of $72.37 to a low of $66.30. However, escalating Middle East conflicts have driven oil prices back up to retest the $72.37 level, marking it as a key resistance before further gains toward $74 and $76. Since December 2021, oil prices have consistently rebounded from the $65-$68 support zone, with the current rebound aligning with historical patterns.

Despite the broader shift toward renewable energy and increased production supporting a longer-term bearish outlook for oil, recent price action, combined with the relative strength index (RSI) bouncing off December 2023 lows, and ongoing conflicts in the Middle East, suggest a short-term neutral to bullish outlook. The $76 level will be key in confirming a stronger bullish move.

On the downside, the $60-$58 range remains the next critical support zone if oil closes firmly below the long-standing $65-$64 support.

--- Written by Razan Hilal, CMT – on X: @Rh_waves