Canadian Dollar Technical Forecast: USD/CAD Weekly Trade Levels

- Canadian Dollar set to snaps three-week losing streak- USD/CAD marks exhaustion ahead of trend resistance

- USD/CAD now testing support at monthly open- threat remains lower while below September high

- Resistance 1.3600/05, 1.3647, 1.3753/73 (key)– Support 1.3471/93, 1.3430s, 1.3342/59

USD/CAD is poised to snap a three-week rally with the post-FOMC reversal erasing the monthly gains. The decline takes price into key support early in the week and the focus is on possible inflection off this threshold in the days ahead. Battle lines drawn on the USD/CAD weekly technical chart.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In my last Canadian Dollar Technical Forecast we noted that USD/CAD had responded to confluent technical support with the, “risk for price inflection off this zone early in the month. From a trading standpoint, rallies should be limited to the median-line IF price is heading lower on this stretch with a close below 1.3471 needed to mark downtrend resumption” USD/CAD rallied to within striking distance of the median-line before exhausting with the price unable to mark a weekly close above confluent resistance at 1.3600/05- a region defined by the February / March highs and the 52-week moving average.

The post-FOMC reaction saw USD/CAD mark a massive daily-reversal candle off the September highs with the decline now testing support at the objective September-open / 61.8% Fibonacci retracement at 1.3471/93. Note that the 2022 trendline (TL) rests just above and we’re looking for a reaction off this mark for guidance with the immediate decline vulnerable while above.

Initial resistance remains at 1.3600/05 and is backed by the monthly stretch high at 1.3647- note that this level converges on the median-line over the next few weeks and a breach / close above would be needed to suggest a more significant low was registered last month. The next major resistance zone is eyed at the 61.8% retracement of the August decline / April high-close (HC) at 1.3753/73.

A weekly-close below this support zone exposes the lower parallel (currently ~1.3430s) and the next major technical consideration is eyed at the 78.6% retracement of the December rally / 2024 low-week close (LWC) at 1.3342/59- area of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: USD/CAD failed at the yearly moving average last week with price plunging back into support at the monthly-open; looking for a reaction down here. From trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to 1.36 IF price is heading lower on this stretch with a close below 1.3471 needed to fuel the next leg.

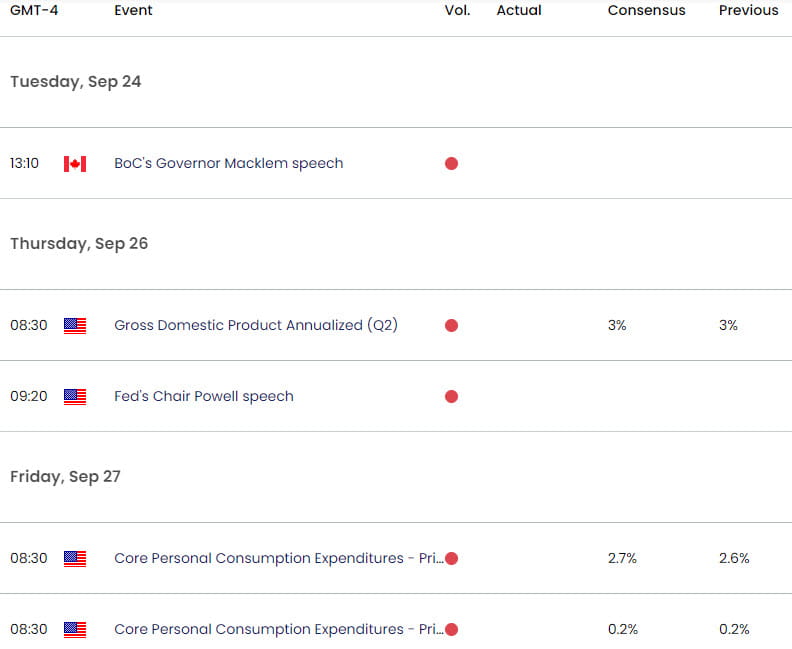

Keep in mind we get the release of key US inflation data this week with the August Personal Consumption Expenditure (PCE) on tap Friday. Watch the weekly close here for guidance.

US/ Canada Economic Data Release

--- Written by Michael Boutros, Sr Technical Strategist with City Index

Follow Michael on X @MBForex