British Pound Talking Points:

- GBP/USD dropped by as much as five big figures in the two weeks following the U.S. Presidential election, eventually finding support at the 1.2500 handle.

- Since that 1.2500 test, however, buyers have been pushing back and this morning has seen that strength continue into a third week.

- I’ll be looking at the pair from a few different time frames in the weekly webinar, and you’re welcome to join: Click here for registration information.

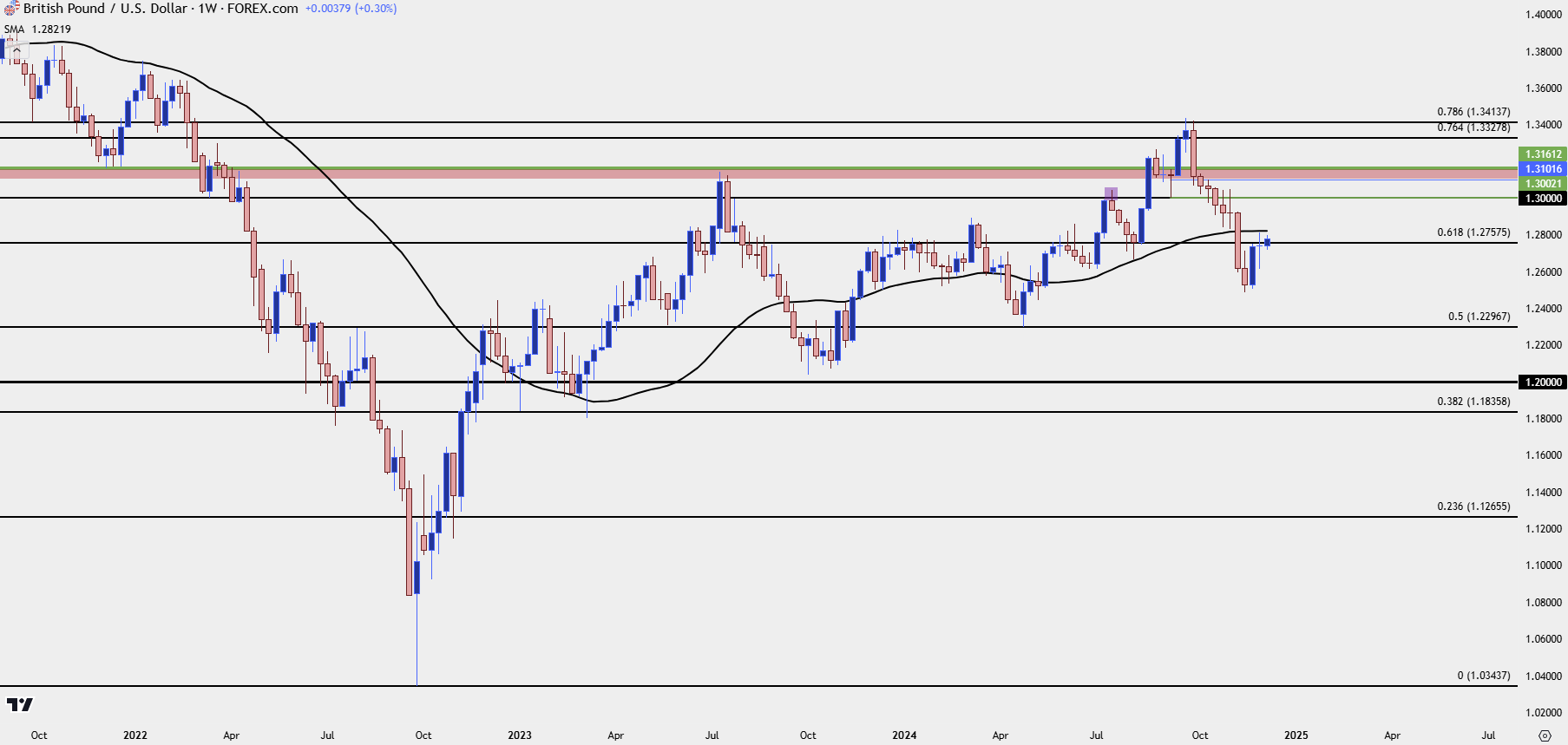

GBP/USD had a strong outing in Q3 and generally a strong 2024 until the 4th quarter showed up. The 2021-2022 major move continues to loom large for the pair as the Fibonacci retracement produced by that move have shown a couple of key inflections over the past year. The 50% mark of that major move set the low in April just inside of the 1.2300 handle. And it was the 78.6% retracement of that move helping to set the high in September and October above the 1.3400 level. That level was continually tested but bulls couldn’t leave it behind and, eventually, the sell-off showed up in a dominating eight-week sell-off that sent the pair back-below its 200-day moving average.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

GBP/USD Big Figures

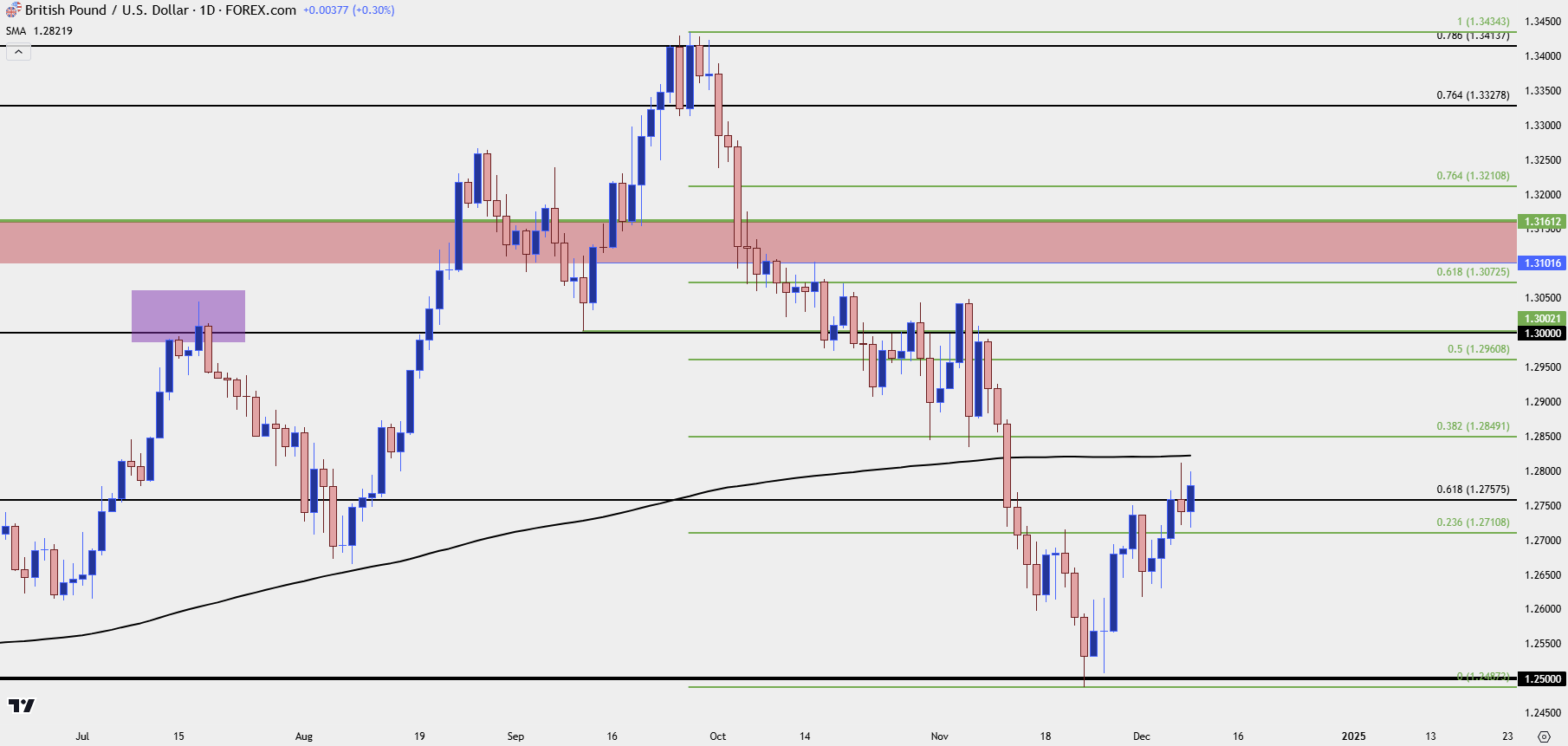

Major psychological levels have continued to play a big role in GBP/USD price action, In September, the pair saw defense of the 1.3000 handle before a 400+ pip bounce appeared, all the way until that Fibonacci level came into play to hold the highs later in the month.

Sellers saw a better fate upon the re-test of that level a month later, but the 1.2500 level came into play after that episode and that’s what helped to set the low three weeks ago. Since then, bulls have been going to work and they’re making a fast move at a re-test of the 200-day moving average.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

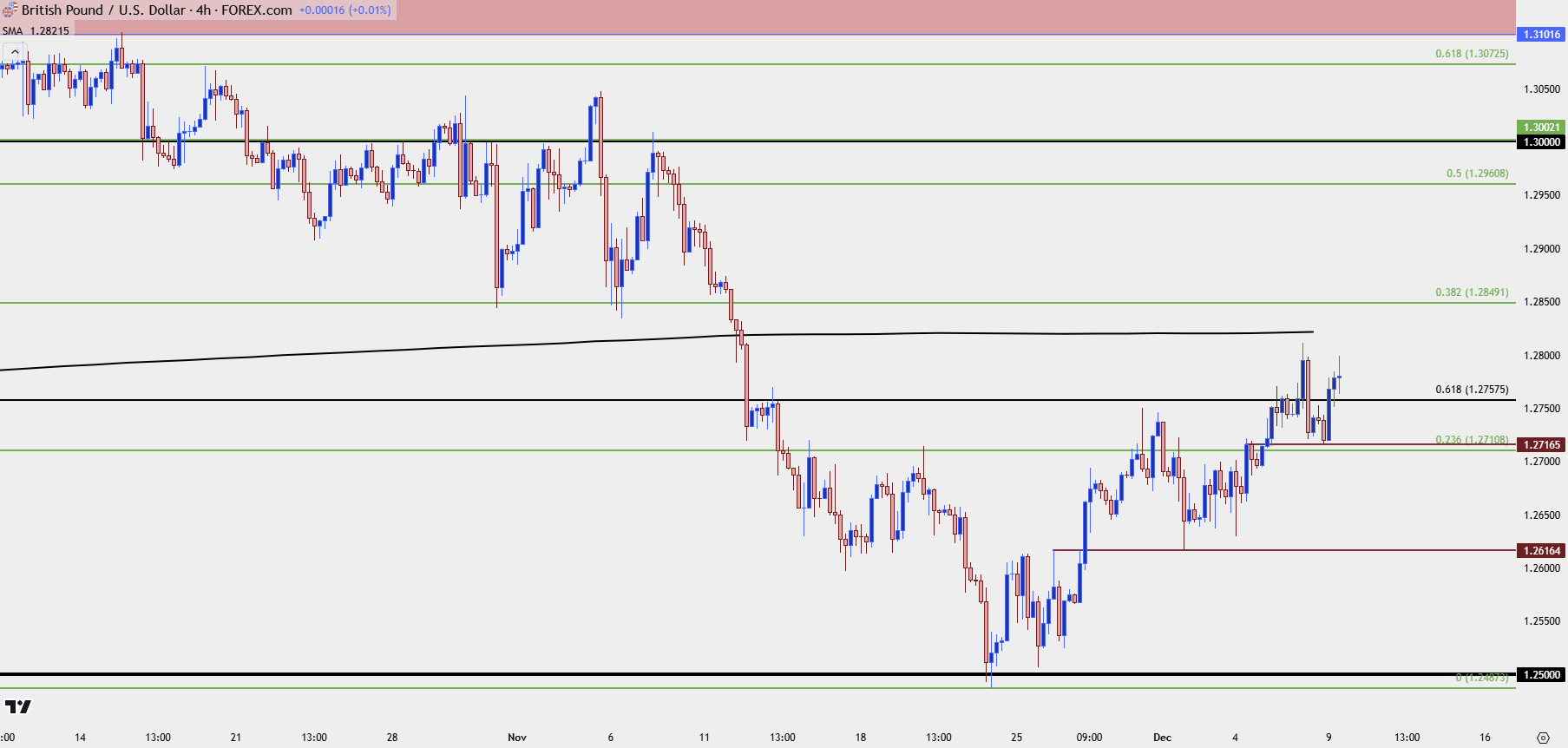

GBP/USD Four-Hour

From the shorter-term chart we can see a clear build of higher-highs and lows. Last week saw a hold of support at prior resistance, around the 1.2616 level, which then led to a fresh higher-high on Friday morning ahead of the release of NFPs in the U.S. That pullback has so far held another higher-low, around 100 pips above last week’s higher low with the more recent version showing around 1.2717.

The next major objective overhead would be re-test of the 200-day moving average, after which the 38.2% retracement of the pullback move shows at 1.2850. If bulls can force the move-higher, the 50% mark of the sell-off plots just below the 1.3000 level, at 1.2961.

GBP/USD Four-Hour Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

--- written by James Stanley, Senior Strategist