British Pound Talking Points:

- Cable was cooked this week as the USD Q4 breakout continued, driving GBP/USD down to fresh four-month-lows.

- GBP/JPY was hit on Friday after holding resistance at 198.08, breaching below the support of a symmetrical triangle and invalidating a possible bull pennant formation.

- I’ll be looking at both GBP/USD and GBP/JPY in the weekly webinar on Tuesday, and you’re welcome to join: Click here for registration information.

It was a rough week for the British Pound. In the major pair of GBP/USD that’s been somewhat of the case for Q4, so far, as an aggressive rally in the US Dollar has priced-in against most major currencies. But in GBP/JPY, there was possibility of a bullish breakout as shown by a bull pennant formation and that was dashed with a strong sell-off on Friday.

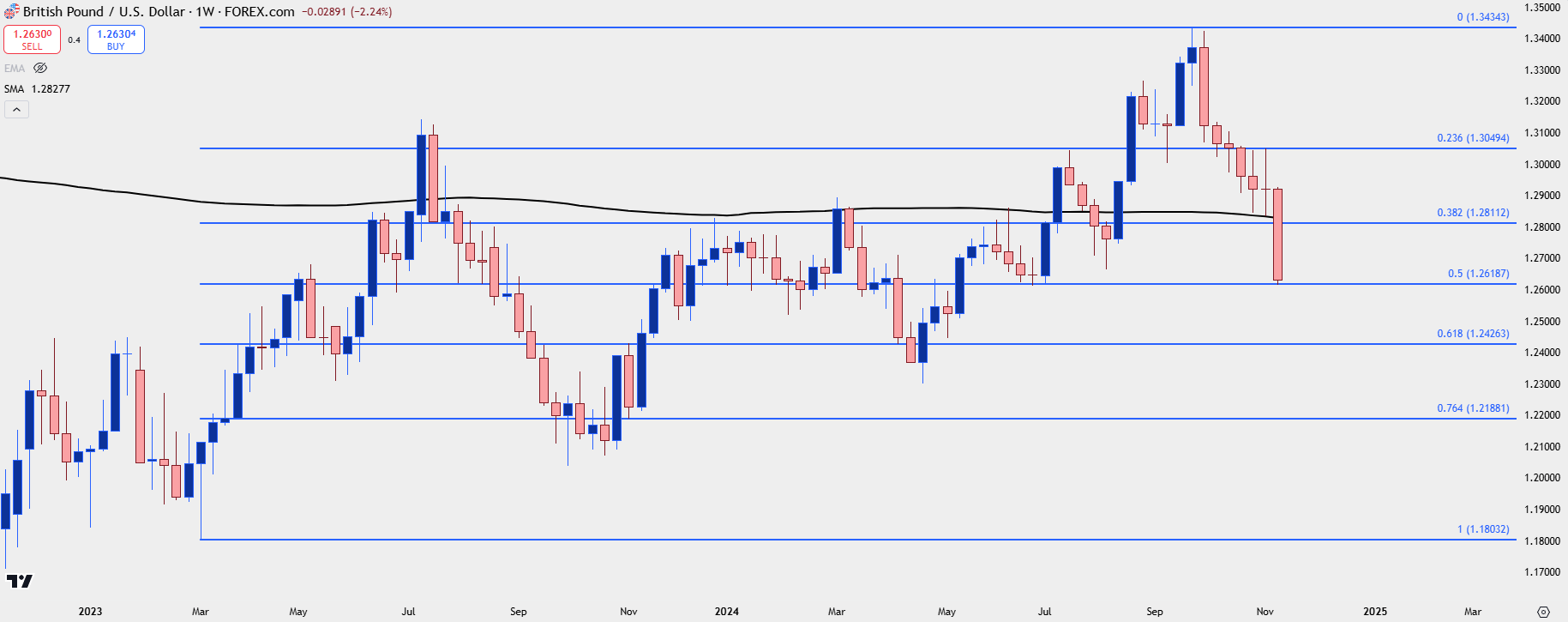

The big item from this week in the major of GBP/USD was Cable losing support at the 200-week moving average, which had previously helped to hold the lows for two weeks. The bounce from that held at a Fibonacci retracement plotted around 1.3050, which sellers defended in both cases. The challenge now is the fact that the move in DXY is already stretched by multiple accounts, with RSI overbought on the daily chart of the US Dollar and price there holding at resistance as taken from a prior gap last year.

This also shows as support in GBP/USD as taken from the 50% mark of the 2023-2024 major move which came into play in late trade on Friday.

GBP/USD Weekly Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

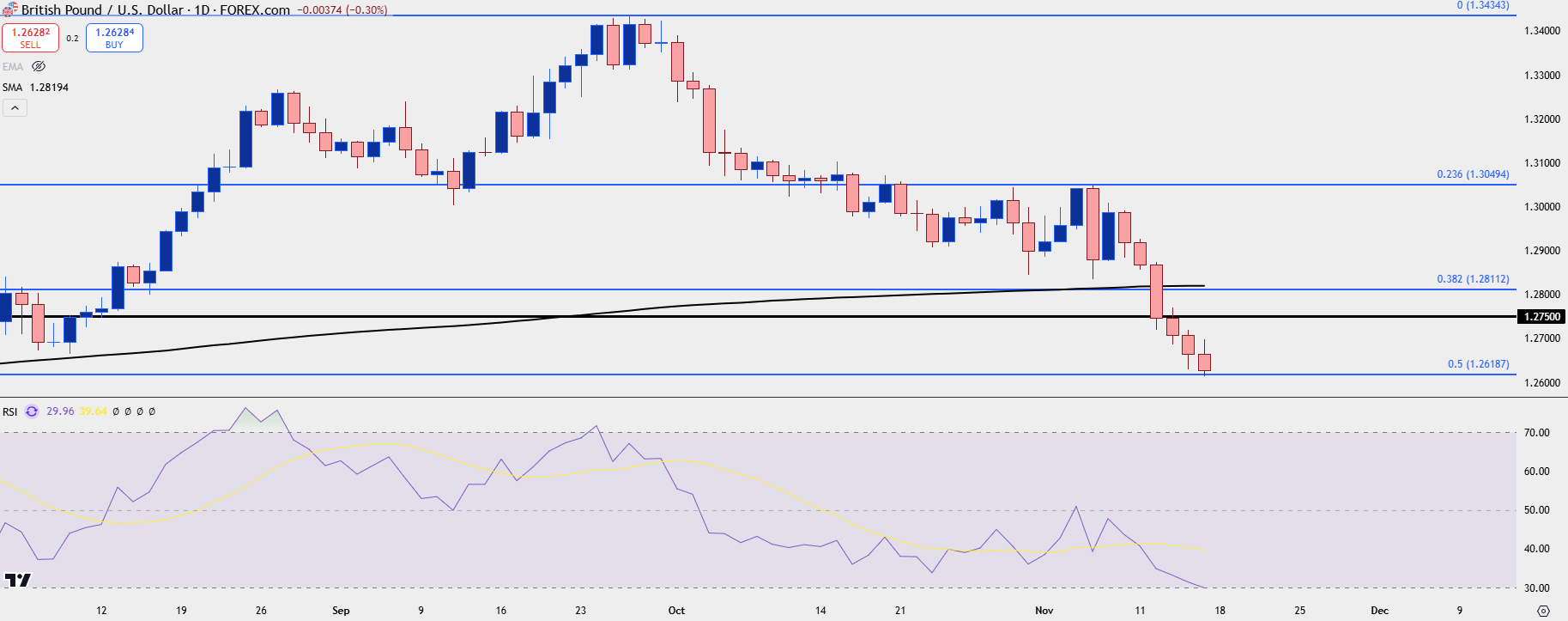

GBP/USD Daily

While GBP/USD lost support at the 200-week moving average last week, it also lost support at the 200-day moving average with the breakdown on Tuesday. But, again, the challenge here is the chasing element as daily RSI is nearing oversold territory and that goes along with the overbought reading on the daily chart of DXY.

So, for bears, a pullback could be of interest and there’s a couple of levels from which to monitor that: The 1.2811 level is particularly important as this is confluent between a Fibonacci level and the 200-day moving average. A re-test there could give some element of confidence that profit taking in the bearish trend had shown, and this would be an opportunity for bears to defend a big spot on the chart. But – if that doesn’t come into play, the psychological level of 1.2750 could similarly be of interest for bearish trend continuation if sellers can defend the level.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

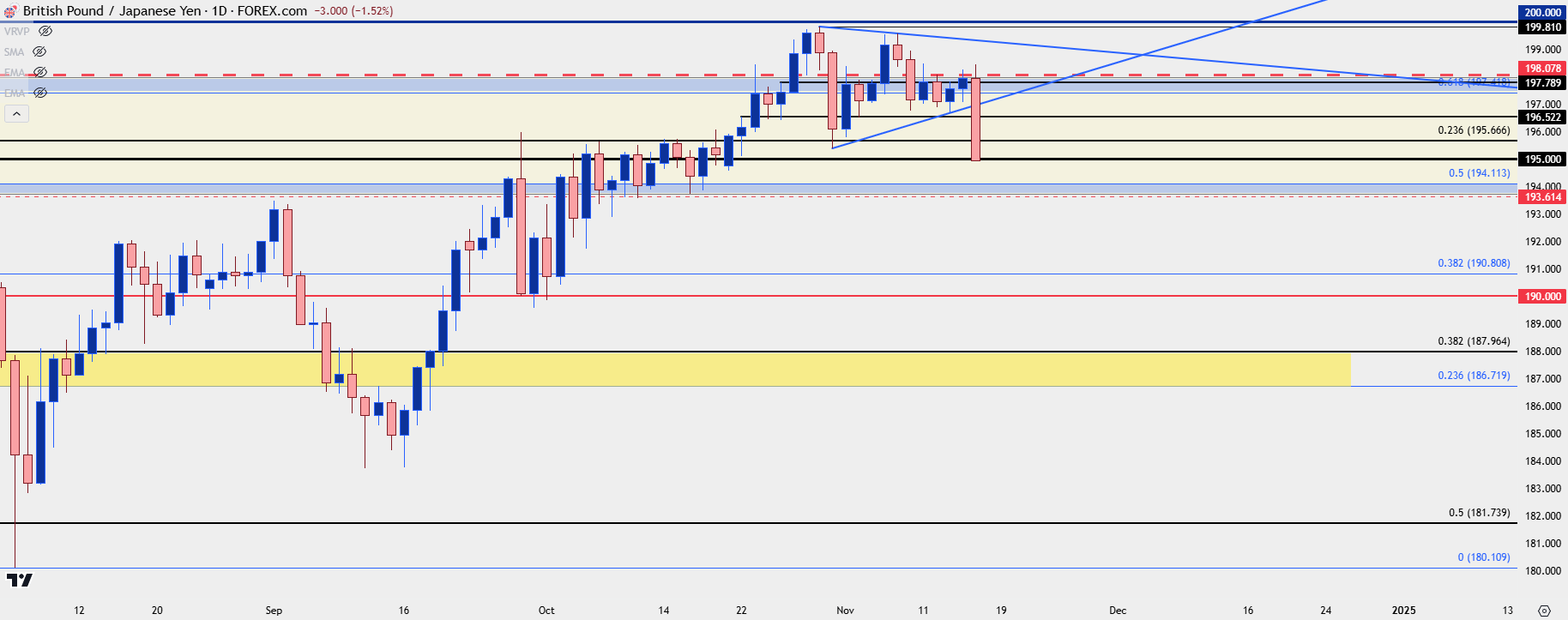

GBP/JPY

While Cable continued the Q4 sell-off, GBP/JPY displayed a greater degree of change as a previously bullish trend was very much put on its back foot on Friday. The pair was strong into the end of Q3 trade as it made a fast run at the 200.00 level, but that’s around where bulls started to show stall.

That led to a lower-high last week but that lower-high was also accompanied with a higher-low, helping to set up a symmetrical triangle formation. And when taken with the prior bullish trend, that set up a bull pennant.

But the Friday sell-off negated that, and sellers drove below prior resistance at 195.66. Similarly, that makes for a difficult move to work with as bears came on quickly, but it does set the stage for a deeper support zone from 193.61-194.11. As of this writing, with approximately four hours until the weekly close, the 195.00 level is coming in to hold the lows. And that sets up the possibility for a bounce up to resistance at prior support, of which 195.66 would be of interest, as would 196.52.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

Chart prepared by James Stanley, GBP/JPY on Tradingview

--- written by James Stanley, Senior Strategist