British Pound Outlook: GBP/USD

GBP/USD slipped to a fresh monthly low (1.3022) after struggling to hold above the 50-Day SMA (1.3107), but lack of momentum to test the September low (1.3002) may keep the exchange rate within a defined range.

British Pound Forecast: GBP/USD Susceptible to Test of September Low

GBP/USD may no longer track the positive slope in the moving average as the Bank of England (BoE) shows a greater willingness to further unwind its restrictive policy, and data prints coming out of the UK may sway the central bank plans to ‘decide the appropriate degree of monetary policy restrictiveness at each meeting.’

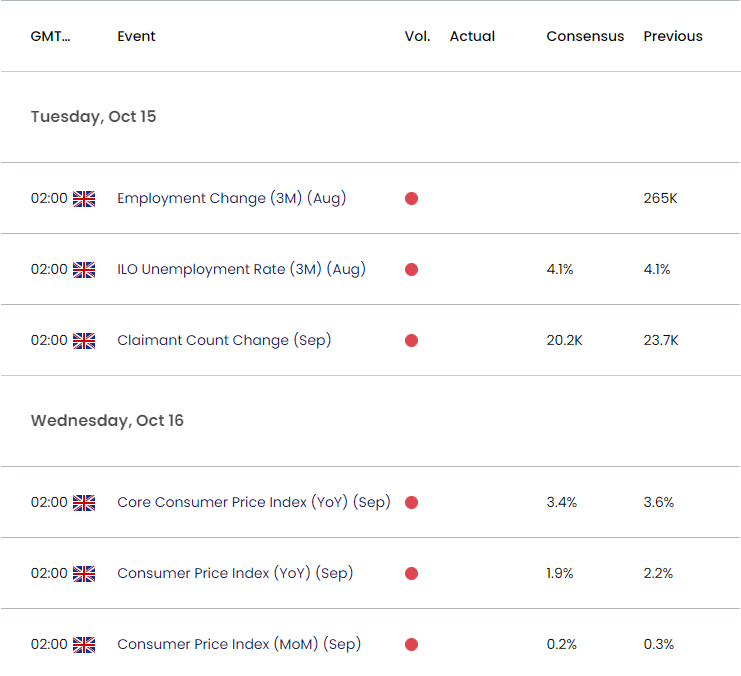

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register HereUK Economic Calendar

Even though the UK Unemployment Report is expected to hold steady at 4.1% during the three-months through August, the update to the Consumer Price Index (CPI) is anticipated to show both the headline and core rate of inflation narrowing in September.

Signs of slowing price growth may drag on the British Pound as it puts pressure on the BoE to achieve a neutral policy sooner rather than later, but a higher-than-expected CPI print may curb the recent weakness in GBP/USD as ‘monetary policy would need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term had dissipated further.’

With that said, GBP/USD may trade within a defined range ahead of the next BoE meeting on November 7 should it defend the September low (1.3002), but the exchange rate may struggle to retain the advance from August low (1.2665) as it no longer holds above the 50-Day SMA (1.3107).

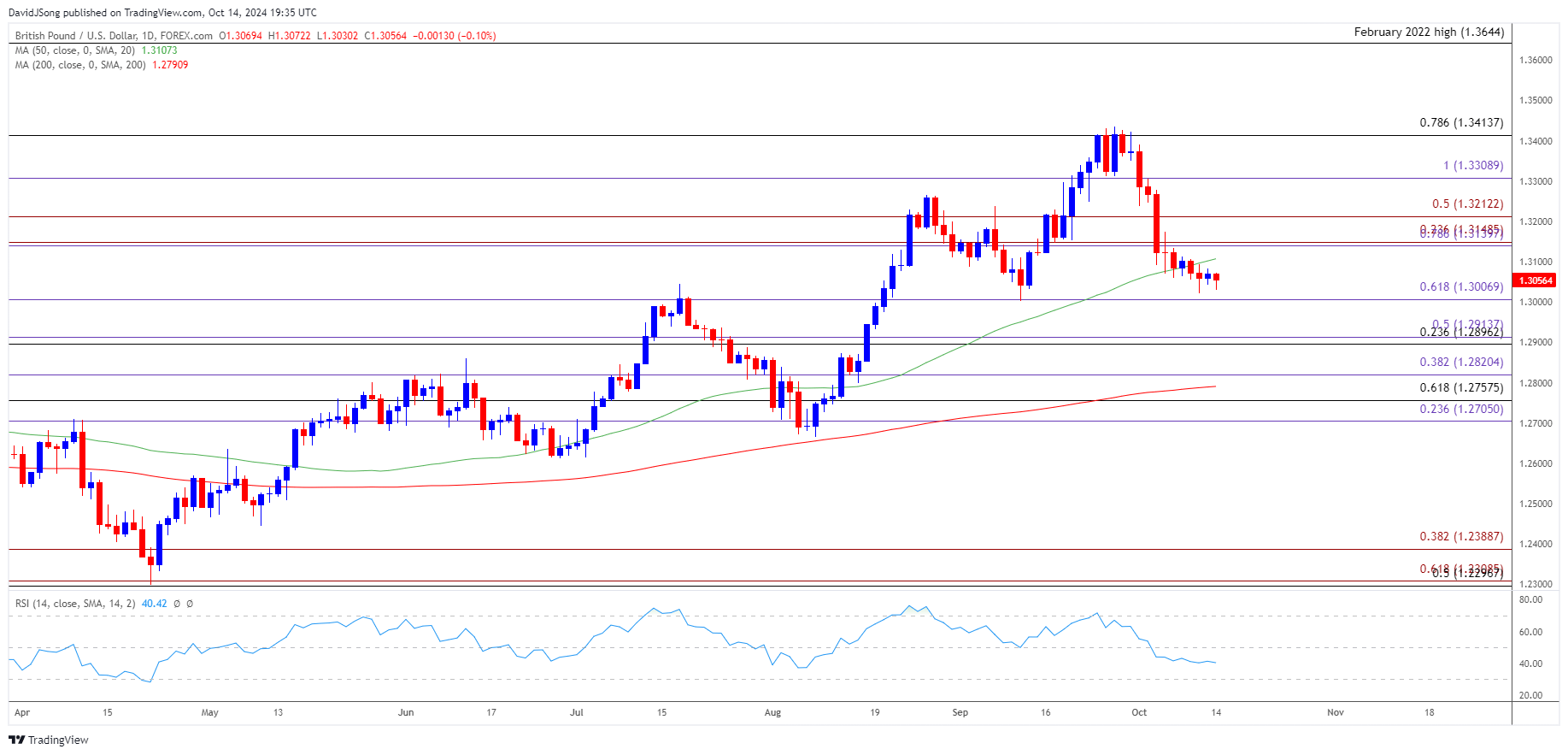

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD may continue to trade to fresh monthly lows as it trades below the 50-Day SMA (1.3107) for the first time since August, with a break/close below 1.3010 (61.8% Fibonacci extension) opening up the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region.

- Next area of interest comes in around 1.2820 (38.2% Fibonacci extension) but GBP/USD may attempt to retrace the decline from the start of the monthly should it continue to hold above the September low (1.3002).

- Need a break/close above the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) zone to bring 1.3210 (50% Fibonacci extension) back on the radar, with the next region of interest coming in around 1.3310 (100% Fibonacci extension).

Additional Market Outlooks

EUR/USD Outlook Hinges on ECB Interest Rate Decision

Gold Price Forecast: Bullion Breaks Out of Bull Flag Formation

USD/CAD Rally Pushes RSI Up Against Overbought Zone

Australian Dollar Forecast: AUD/USD Bearish Price Series Persists

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong