BTC/USD & ETH/USD Key Points

- The Fed seems set on cutting interest rates by 25bps next month, so the usually impactful US reports may be less significant with the election sucking all the proverbial air out of the room.

- Traders are increasingly confident that former President Trump will win the US Presidential election, with prediction markets pricing in 60%+ odds of a Trump victory

- Bulls may want to be cautious as long as the cryptocurrency remains below its record high near $73K (or at least the $70K handle).

Cryptoasset Market News

- Bitcoin’s hashrate hit a new all-time high above 703 EH/s.

- Avalanche launched a credit card in partnership with Visa that allows users to spend WAVAX, USDC, and sAVAX wherever Visa is accepted.

- Hedge fund manager Paul Tudor Jones announced that “All roads lead to inflation. I’m long gold. I’m long Bitcoin”

- Cryptocurrency research shop Arkham believes Telsa still holds $780M of Bitcoin and that the BTC was moved to new wallets, not exchanges.

- Microsoft announces shareholder vote on whether the company should hold Bitcoin on its balance sheet. The board recommends voting “no.”

- Ethereum founder Vitalik Buterin outlined the cryptoasset’s upcoming “Scourge” upgrade and a path to hit 100K transactions per second with rollups.

- Payment processor Stripe acquired stablecoin platform Bridge for $1.1B.

- An Alabama man was arrested in connection with the January “hack” of the SEC twitter’s account announcing the approval of spot Bitcoin ETFs.

- The WSJ reports that the FBI is investigating Tether and the Treasury Dept is considering sanctioning Tether

Macroeconomic Backdrop

It was another quieter week for global macroeconomic developments, as traders mostly looked ahead to this week’s top-tier releases (US NFP and Core PCE, UK budget, Bank of Japan meeting) and the upcoming US election. At this point, the Fed seems set on cutting interest rates by 25bps next month, so the usually impactful US reports may be less significant with the election sucking all the proverbial air out of the room.

While pre-election polls have ticked “only” a point or two toward Donald Trump, traders are increasingly confident that the former President will win, with prediction markets pricing in 60%+ odds of a Trump victory at this late stage. Barring a late “October Surprise,” it seems likely Trump will go into election night as a slight favorite, though a small polling error could have a non-linear impact on the outcome of the election itself given the tight margins in a number of key swing states.

As we noted last week, crypto traders would likely prefer to see a Trump victory, as he has been the candidate more vocally in favor of the industry. Combined with projections for a larger budget deficit under Trump (the nonpartisan Committee for a Responsible Federal Budget projects a $7.5T growth in the national debt over the next decade if Trump wins the election vs. “only” $3.5T under Kamala Harris), a Trump victory would be seen as a decided bullish for Bitcoin and the broader cryptoasset markets.

Sentiment and Flows

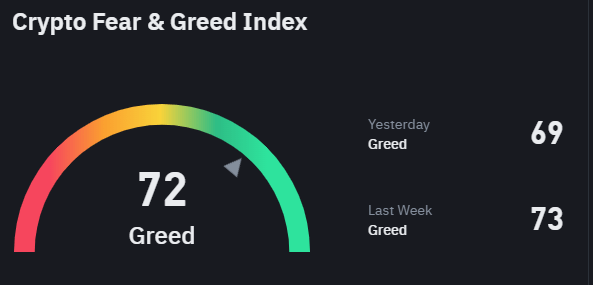

The sentiment gauge we watch most closely, the “Crypto Fear and Greed Index,” edged down to 72 last week. While not necessarily an historical extreme, this is among the highest readings for the indicator in the last six months, suggesting that a potential near-term bullish extreme may be approaching:

Source: Binance

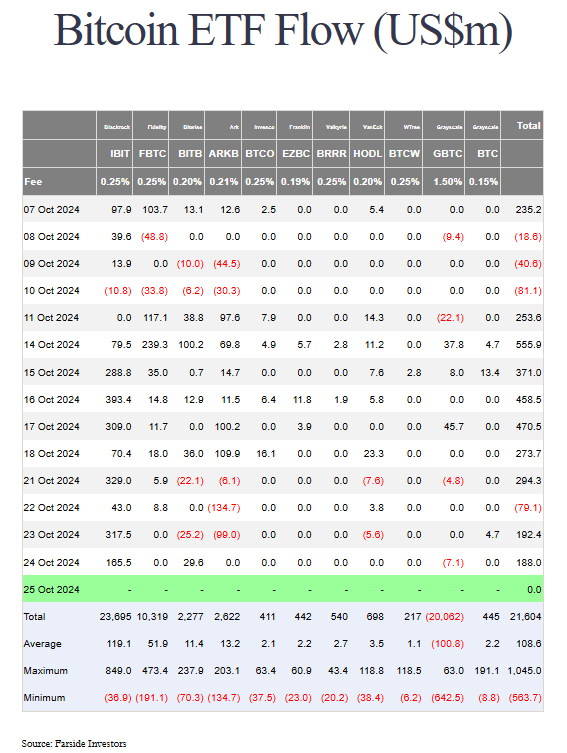

Another way of gauging sentiment, flows into exchange-based cryptoasset investment vehicles, have remained strong over the last week. As of writing before the release of Friday’s data, Bitcoin ETFs have seen stellar inflows of near $600M over the last four days. Over the long-term, inflows from “tradfi” investors provide incremental demand for Bitcoin and could help support the price.

Source: Farside Investors

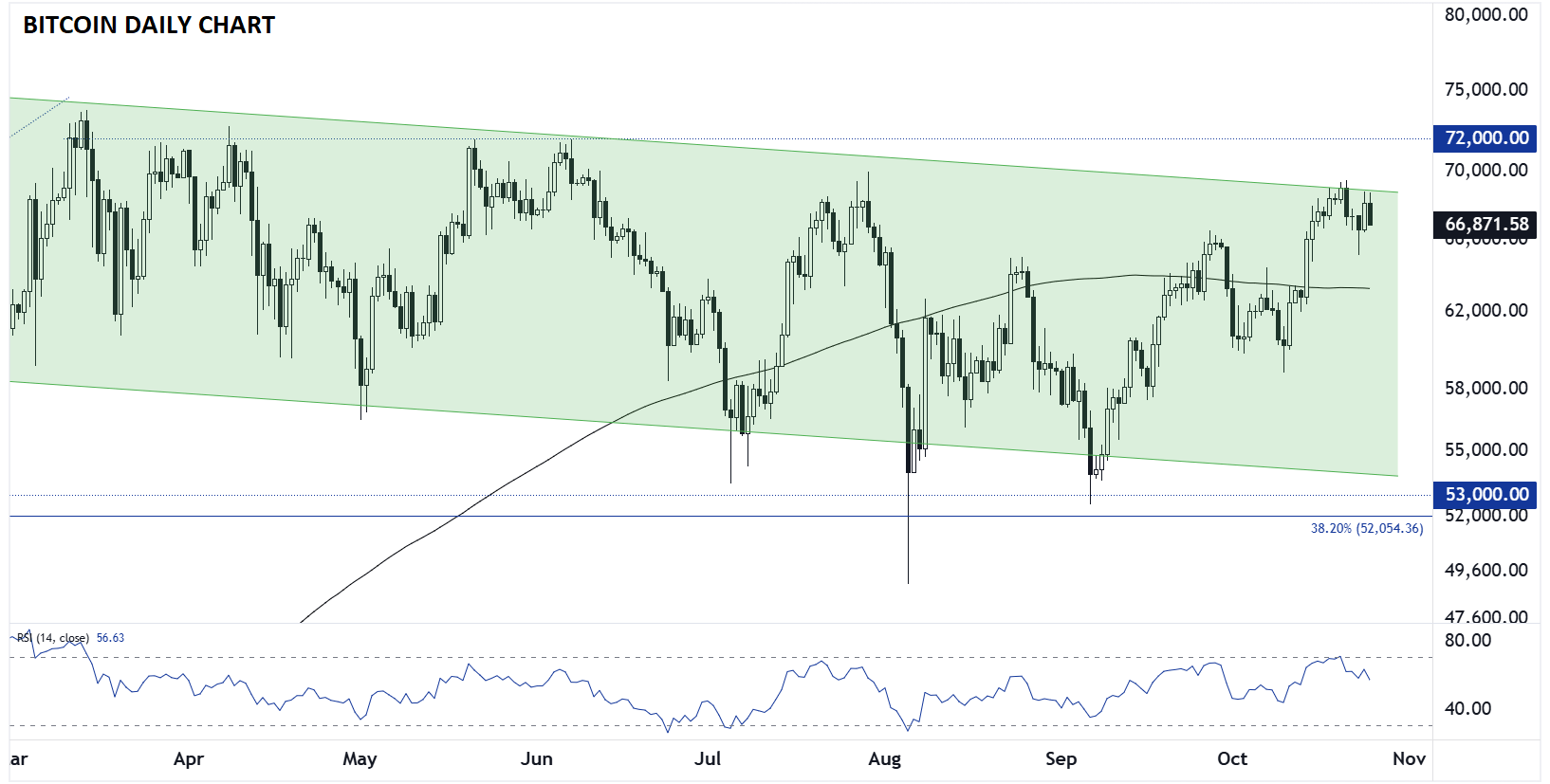

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: StoneX, TradingView

After trying to break out of the 6-month bearish channel top near $68K last week, Bitcoin bulls and bears fought to a tie over the last week. At this point, bulls may want to be cautious as long as the cryptocurrency remains below its record high near $73K (or at least the $70K handle), the technical outlook is on the verge of flipping more bullish than it’s been in weeks if not months. A reversal back into last week’s low near $65K would flip the near-term bias back in favor of the bears.

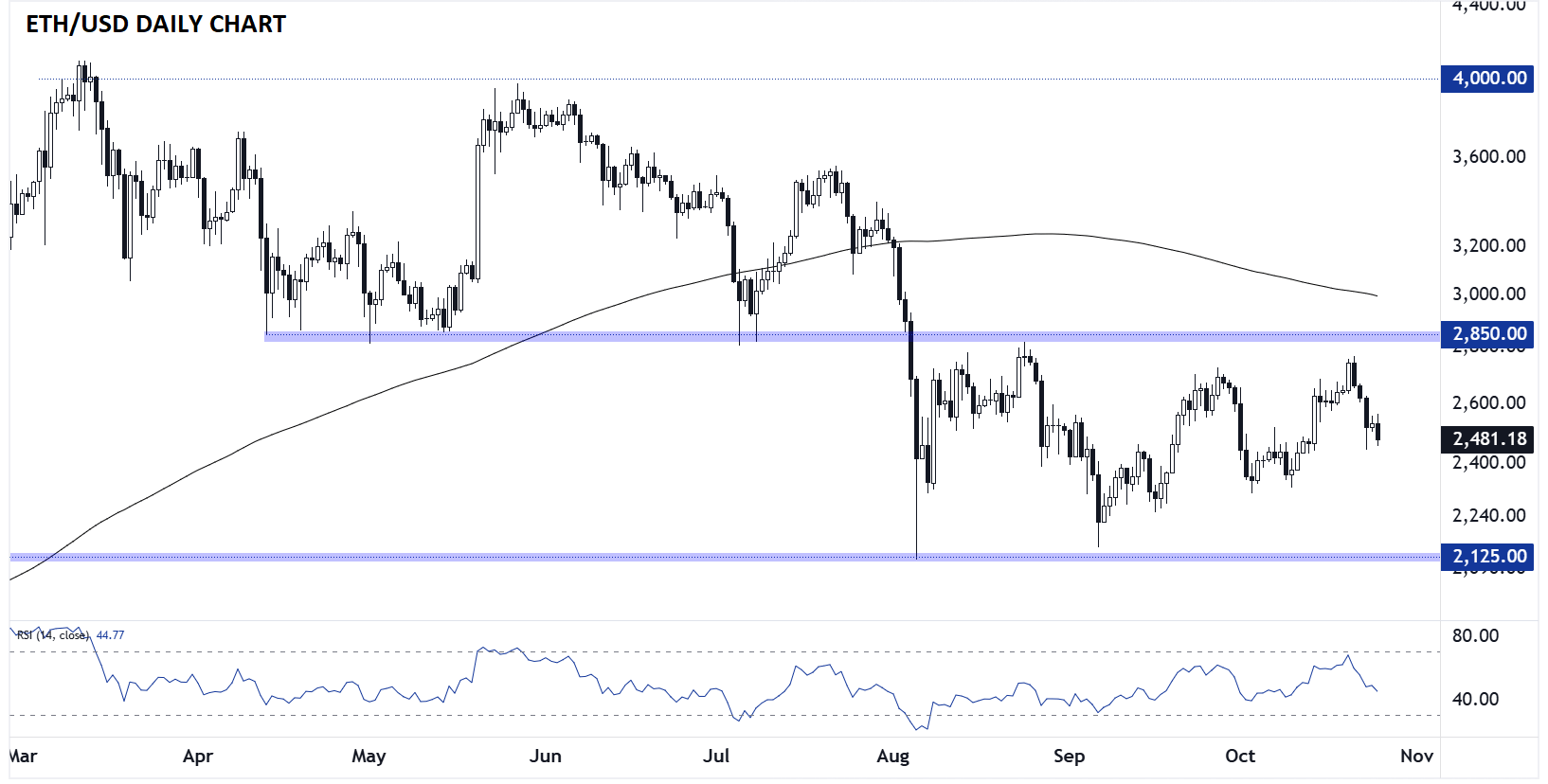

Ethereum Technical Analysis: ETH/USD Daily Chart

Source: StoneX, TradingView

As has been the case all year, Ether is underperforming its big brother, consolidating within its 3-month range between $2125 and $2850. Bulls will want to see ETH/USD regain key previous-support-turned-resistance at $2850 to paint a more bullish picture for Ether, whereas a break below $2125 support could set the stage for a continuation toward the next level of support near $1700.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos and be sure to follow Matt on Twitter: @MWellerFX